PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846319

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846319

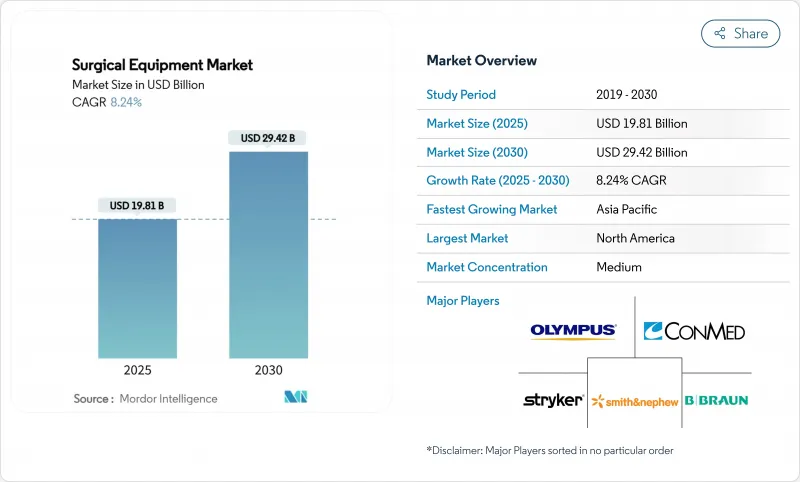

Surgical Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Surgical Equipment Market size is estimated at USD 19.81 billion in 2025, and is expected to reach USD 29.42 billion by 2030, at a CAGR of 8.24% during the forecast period (2025-2030).

Rising procedure volumes strengthen the outlook, rapid uptake of minimally invasive techniques, and the growing presence of ambulatory surgical centers (ASCs). Powered and electrosurgical devices are set to lead product growth as clinicians seek instruments that cut, seal, and coagulate tissue in a single step. Asia-Pacific is on course to record the fastest regional expansion, reflecting capacity build-outs in China and India alongside steadily rising surgical volumes. Competitive intensity is growing as niche innovators challenge established brands with compact, workflow-specific systems designed for outpatient settings. Capital constraints in hospitals and ASCs are nudging suppliers toward flexible financing and per-procedure pricing, reshaping purchasing dynamics across the surgical equipment market.

Global Surgical Equipment Market Trends and Insights

Rising Surgical Procedure Volumes Driven by Aging & Chronic-Disease Prevalence

Procedure counts continue to climb, with roughly 235 million major operations performed each year. Orthopedic, cardiovascular, and oncology surgeries account for much of the incremental volume as global populations age and the burden of chronic disease rises. Manufacturers are responding by tailoring instruments to high-volume specialties rather than offering broad, general-purpose sets, improving throughput and reducing waste. Orthopedic procedures are growing 7.2% annually, spurring demand for powered saws, drills, and navigation aids. Cardiovascular interventions are advancing 5.8% per year, prompting investment in hybrid operating rooms that combine imaging and minimally invasive capabilities. The net effect is a sustained need for reliable, procedure-specific systems that can withstand heavy daily utilization.

Rising Number of Road and Other Accidents

Road-traffic injuries and workplace trauma continue to elevate demand for fracture fixation hardware, portable imaging, and navigation systems that enable rapid intervention in emergency settings. Beyond traditional plates and screws, trauma surgeons now seek integrated platforms capable of guiding screw placement in real time, shortening operative windows, and limiting repeat surgeries. Device makers have carved out a dedicated trauma segment within orthopedics, with growth outpacing general orthopedic equipment as hospitals expand major-injury centers and stock trauma-ready kits.

High Capital and Maintenance Costs of Advanced Surgical Systems

A top-tier robotic platform can cost more than USD 2 million, with annual service contracts adding 10-15%. Smaller hospitals and ASCs often defer purchases or seek pay-per-use models that link expenses to utilization. Leasing, profit-sharing, and risk-pooling agreements are gradually easing barriers, yet capital-intense systems remain concentrated in large academic centers.

Other drivers and restraints analyzed in the detailed report include:

- Accelerated Shift Toward Minimally Invasive & Robotic-Assisted Surgeries

- Growth of Ambulatory Surgical Centers and Outpatient Care Models

- Stringent Regulatory Approval & Compliance Requirements

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sutures, staplers, and other closure devices held 38.24% of the surgical equipment market share in 2024, underlining their universal role across specialties. Barbed sutures that eliminate knot-tying have shaved an average 1 minute 43 seconds off cesarean section closure times, demonstrating workflow value. Johnson & Johnson's ECHELON ENDOPATH Staple Line Reinforcement illustrates how biomaterial advances can protect tissue and reduce leaks.

Powered and electrosurgical systems are projected to expand at an 8.57% CAGR through 2030. Instruments such as Medtronic's LigaSure Maryland jaw blend cutting and vessel-sealing, cutting operative steps, and collateral damage. Retractors, handheld forceps, and surgical power tools remain essential staples, but the frontier lies in integrated consoles that merge energy, imaging, and smoke evacuation, streamlining the sterile field. The surgical equipment market size for powered devices is likely to gain further momentum as outpatient centers adopt multifunction towers for space efficiency.

The Surgical Equipment Market Report is Segmented by Product (Handheld Surgical Instruments, Powered & Electrosurgical Devices, Sutures, and More), Application (Orthopedic & Trauma, Cardiovascular & Thoracic, and More), End User (Hospitals, Ambulatory Surgical Centers, and More), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 35.54% of 2024 revenue, driven by favorable reimbursement and early adoption of robotic and AI-enabled systems. Hospitals are under cost pressure, but ASCs are flourishing, reflecting payer incentives and patient preference for same-day procedures. Ongoing capital modernization delays have increased the average equipment life cycle, pushing providers toward service contracts and rental models. Nonetheless, U.S. and Canadian centers remain the proving ground for next-generation robotic and digital-surgery suites.

Europe presents a broad landscape anchored by robust public health systems. Germany, France, and the United Kingdom spearhead uptake of minimally invasive platforms. New Medical Device Regulations strengthen post-market oversight, raising compliance costs yet bolstering patient safety. Southern and Eastern European markets, upgrading legacy infrastructure, represent catch-up growth pockets where mid-priced, versatile instruments gain favor.

Asia-Pacific is the fastest-growing zone, advancing at an 8.83% CAGR through 2030. China is now the second-largest buyer of robotic theaters, supported by domestic manufacturers who tailor designs to local budgets. Japan leads in procedure volumes per capita, while India targets 15% annual device adoption via tax incentives and streamlined approvals. Southeast Asian nations are adding surgical suites in provincial hubs, fueling demand for turnkey, bundled equipment packages that include on-site training and service warranties.

The Middle East & Africa and South America offer long-range potential as governments allocate larger health budgets to surgical infrastructure. Private-sector hospital chains in Brazil and the Gulf Cooperation Council are early adopters of robotic systems, setting benchmarks that public facilities strive to match.

- Medtronic

- Johnson & Johnson

- Stryker

- B. Braun

- Olympus

- Boston Scientific

- Smiths Group

- Zimmer Biomet

- Conmed

- Intuitive Surgical

- Siemens Healthineers

- 3M

- Frankenman International Ltd.

- Meril Life Science

- Teleflex

- Karl Storz

- Arthrex

- Alcon

- Steris plc

- Surgical Holdings Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Surgical Procedure Volumes Driven by Aging & Chronic-disease Prevalence

- 4.2.2 Rising Number of Road and Other Accidents

- 4.2.3 Accelerated Shift Toward Minimally Invasive & Robotic-assisted Surgeries

- 4.2.4 Growth of Ambulatory Surgical Centers and Outpatient Care Models

- 4.2.5 Increasing Adoption of Disposable & Single-use Instruments

- 4.2.6 Expanding Healthcare Infrastructure & Capital Expenditure in Emerging Economies

- 4.3 Market Restraints

- 4.3.1 High Capital and Maintenance Costs of Advanced Surgical Systems

- 4.3.2 Stringent Regulatory Approval & Compliance Requirements

- 4.3.3 Shortage of Skilled Surgical Workforce Limiting Technology Uptake

- 4.3.4 Budget Constraints Delaying Equipment Upgrades

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product

- 5.1.1 Handheld Surgical Instruments

- 5.1.1.1 Forceps & Graspers

- 5.1.1.2 Scalpels & Blades

- 5.1.1.3 Retractors & Dilators

- 5.1.2 Powered & Electrosurgical Devices

- 5.1.2.1 High-frequency Electrosurgery Units

- 5.1.2.2 Ultrasonic & Plasma Energy Systems

- 5.1.2.3 Surgical Power Tools

- 5.1.3 Sutures, Staplers & Wound Closure

- 5.1.3.1 Absorbable Sutures

- 5.1.3.2 Non-absorbable Sutures

- 5.1.3.3 Manual Staplers

- 5.1.3.4 Sealants & Tissue Adhesives

- 5.1.3.5 Others

- 5.1.1 Handheld Surgical Instruments

- 5.2 By Application

- 5.2.1 Orthopedic & Trauma

- 5.2.2 Cardiovascular & Thoracic

- 5.2.3 Obstetrics & Gynecology

- 5.2.4 Neurosurgery & Spine

- 5.2.5 Plastic, Cosmetic & Burn Reconstruction

- 5.2.6 Gastrointestinal & Bariatric

- 5.2.7 Other Surgeries

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Specialty Clinics & Physician Offices

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Medtronic

- 6.3.2 Johnson & Johnson (Ethicon)

- 6.3.3 Stryker Corporation

- 6.3.4 B. Braun Melsungen AG

- 6.3.5 Olympus Corporation

- 6.3.6 Boston Scientific Corporation

- 6.3.7 Smith & Nephew plc

- 6.3.8 Zimmer Biomet Holdings Inc.

- 6.3.9 CONMED Corporation

- 6.3.10 Intuitive Surgical Inc.

- 6.3.11 Siemens Healthineers AG

- 6.3.12 3M

- 6.3.13 Frankenman International Ltd.

- 6.3.14 Meril Life Sciences Pvt. Ltd.

- 6.3.15 Teleflex Incorporated

- 6.3.16 Karl Storz SE & Co. KG

- 6.3.17 Arthrex Inc.

- 6.3.18 Alcon Inc.

- 6.3.19 Steris plc

- 6.3.20 Surgical Holdings Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment