PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846321

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846321

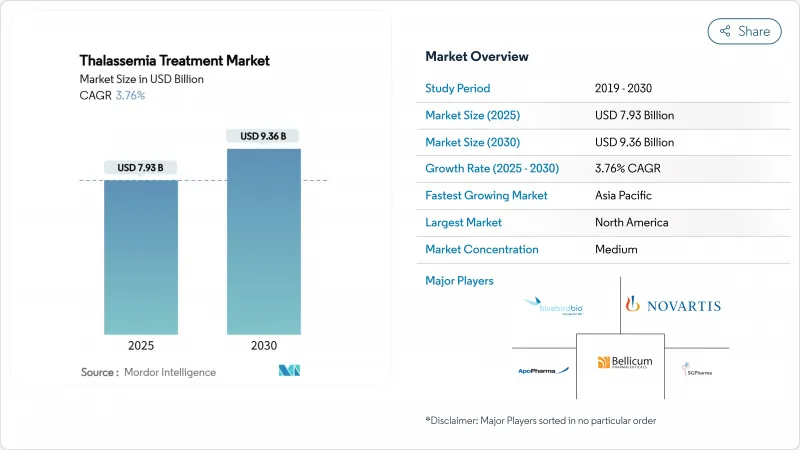

Thalassemia Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The thalassemia treatment market size stood at USD 7.93 billion in 2025 and is forecast to reach USD 9.36 billion by 2030, reflecting a 3.76% CAGR.

The thalassemia treatment market continues moving from supportive care to curative gene-editing solutions following the landmark approvals of CASGEVY and ZYNTEGLO in major economies FDA. Consistent demand from roughly 300,000 patients worldwide who live with severe forms of the disorder underpins revenue stability, even as curative options begin to narrow, transfusion volumes BDgene. Novel therapies, AI-enabled diagnostics and specialty clinic infrastructure are reshaping how payers, providers and manufacturers allocate resources inside the thalassemia treatment market. Investor confidence remains high, as illustrated by Carlyle and SK Capital's purchase agreement for Bluebird Bio that hinges on ambitious USD 600 million sales milestones by 2027 Bluebird Bio. At the same time, access and affordability pressures-especially the USD 2.2 million list price for gene therapy-temper near-term adoption, forcing health systems to weigh large up-front payments against USD 5.4 million lifetime costs of conventional care HemaSphere.

Global Thalassemia Treatment Market Trends and Insights

Rising Prevalence of Thalassemia

China hosts 47.48 million carriers and reports more than 20,000 affected births every year.Comprehensive genetic screening uncovers additional undiagnosed cases and keeps the thalassemia treatment market expanding. Comparable patterns emerge in the Philippines, where 69.22% of tested individuals are positive, and alpha thalassemia dominates 65.77% of those in. High carrier frequencies of roughly 5% for alpha and 4% for beta thalassemia in southern China demand robust treatment capacity. In the Mediterranean, incidence varies widely-36.8 cases per 100,000 in southern countries versus 15.9 per 100,000 farther north, HAL Science. Together, these epidemiological realities secure long-run volume for every major therapy class.

Increasing Awareness & Screening Programmes

Newborn initiatives deliver earlier diagnoses and reshape patient funnels into the thalassemia treatment market. Saudi Arabia screened 5,715 babies and flagged 25.7% as positive, increasing the number of eligible patients for counseling and therapy. Denmark's 16-year run saw diagnostic exams rise fivefold and yielded 5,142 trait and 136 intermediate/major confirmations. Iowa's two-decade data set proves hemoglobinopathy screening's maturing relevance. The WHO's prevention-first playbook reduced incidence across Cyprus, Greece, and Italy, showing that screening and prenatal counseling complement rather than diminish downstream therapy demand.

High Cost of Curative Therapies

A list price of USD 2.2 million per gene-therapy infusion challenges immediate affordability. Conventional management costs USD 5.4 million spread across decades, yet budgeting models struggle with a single-year outlay. Bluebird Bio's slow uptake and resulting USD 3.00 per-share buyout confirm how financing hurdles hinder adoption. Payers demand rigorous health-economic dossiers, pushing manufacturers toward installment plans or outcome-based contracts that remain nascent in most regions.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Approvals of Advanced Gene Therapies

- Inclusion of Thalassemia in Newborn Genomic Panels

- Limited Voluntary Blood-Donor Pools

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The thalassemia treatment market size for the gene-therapy segment is forecast to expand at 13.3% CAGR, reflecting its capacity to end lifelong transfusion needs in 91% of treated patients. Blood transfusions still account for a 60.3% slice of the thalassemia treatment market, underscoring their indispensability for those not yet eligible for curative solutions. Combination iron chelation reduced serum ferritin by 34.99% after one year, maintaining relevance for transfusion-dependent patients. Stem-cell transplantation delivers 85-90% thalassemia-free survival for low-risk profiles at UCSF but remains limited by donor compatibility. Luspatercept yielded >=33% transfusion reduction in 21% of BELIEVE trial participants Reblozyl Pro, positioning it as a bridge therapy. Folic-acid supplementation improves hemoglobin and bone-pain scores in beta thalassemia minor, Evidence-Based Practice, though its role in major disease remains supplementary. Collectively, these modalities coexist, but the momentum clearly favors gene-editing platforms that redefine the risk-benefit equation for payers and patients.

Demand for sustainability is reinforced by manufacturing capacity expansion at nine authorized CASGEVY centers. Yet the thalassemia treatment market size attributed to transfusions will contract gradually as curative uptake rises. Iron chelation manufacturers, led by Novartis and Apotex, are therefore launching adherence-enhancing formulations to defend revenue. Transition dynamics, along with luspatercept's proven quality-of-life gains, signal an ecosystem in flux rather than immediate displacement of legacy options.

The Thalassemia Treatment Market is Segmented by Treatment Type (Blood Transfusions, Iron Chelation Therapy, Luspatercept & Erythroid-Maturation Agents, and More), Disease Type (Alpha Thalassemia and Beta Thalassemia), End User (Hospitals, Specialty Clinics, Academic & Research Institutes, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific's 48.5% share of the thalassemia treatment market stems from endemic carrier rates and improved funding for diagnostics. China alone lifts demand through 47.48 million carriers and an expanding network of treatment centers UCSF. The thalassemia treatment market size in Asia Pacific is projected to widen as provincial reimbursements now cover parts of gene-therapy cost for eligible children. Middle East & Africa, though smaller, posts the fastest 7.3% CAGR thanks to Saudi Arabia's high newborn positivity and public-health commitment HemaSphere. Regional insurers increasingly authorise luspatercept as an intermediate measure, bridging systemic capacity gaps.

Europe benefits from decades of prevention, yet still harbors concentrated patient pools in Italy, Greece and Cyprus where screening reduced incidence but not existing caseloads HAL Science. The United States accelerates adoption following January 2024 FDA approvals, with insurers evaluating outcomes-based instalments for curative products AABB. Latin America and parts of South Asia remain under-diagnosed; as awareness grows, newly identified patients will enlarge the global thalassemia treatment market.

Healthcare expenditure disparities create unequal access, but technology transfer initiatives, long-term loan financing and donor-supported infrastructure programs intend to narrow the gap. The geography mix therefore sustains a two-speed market: advanced economies drive premium gene-therapy revenue while emerging regions continue anchoring transfusion and iron-chelation volumes.

- Novartis

- Bluebird Bio

- CSL Vifor

- Pfizer

- Merck & Co. (Acceleron)

- Ionis Pharmaceuticals

- Chiesi Farmaceutici

- Vertex Pharmaceuticals

- CRISPR Therapeutic

- Editas Medicine

- Sangamo Therapeutics

- Bellicum Pharmaceuticals

- Agios Pharmaceuticals

- Kiadis Pharma

- ApoPharma Inc.

- SG Pharma Pvt Ltd

- Zydus Lifesciences

- Incyte

- Gamida Cell

- Intellia Therapeutics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence Of Thalassemia

- 4.2.2 Increasing Awareness & Screening Programmes

- 4.2.3 Regulatory Approvals Of Advanced Gene Therapies

- 4.2.4 Inclusion Of Thalassemia In Newborn Genomic Panels

- 4.2.5 Low-Cost Oral Iron Chelators Improving Adherence

- 4.2.6 AI-Driven Blood-Match Algorithms Lowering Allo-Immunisation

- 4.3 Market Restraints

- 4.3.1 High Cost Of Curative Therapies

- 4.3.2 Limited Voluntary Blood-Donor Pools

- 4.3.3 Vector-Manufacturing Capacity Bottlenecks

- 4.3.4 Regulatory Uncertainty For Genome-Edited Therapies

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Treatment Type

- 5.1.1 Blood Transfusions

- 5.1.2 Iron Chelation Therapy

- 5.1.3 Gene Therapy

- 5.1.4 Haematopoietic Stem-Cell Transplantation

- 5.1.5 Luspatercept & Erythroid-maturation Agents

- 5.1.6 Folic Acid & supportive supplements

- 5.1.7 Others

- 5.2 By Disease Type

- 5.2.1 Alpha thalassemia

- 5.2.2 Beta thalassemia

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Specialty Clinics

- 5.3.3 Academic & Research Institutes

- 5.3.4 Home-care settings

- 5.3.5 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global-level overview, Market-level overview, Core segments, Financials, Strategic information, Market rank/share, Products & Services, Recent developments)

- 6.3.1 Novartis AG

- 6.3.2 Bluebird Bio

- 6.3.3 CSL Vifor

- 6.3.4 Pfizer Inc.

- 6.3.5 Merck & Co. (Acceleron)

- 6.3.6 Ionis Pharmaceuticals

- 6.3.7 Chiesi Farmaceutici

- 6.3.8 Vertex Pharmaceuticals

- 6.3.9 CRISPR Therapeutics

- 6.3.10 Editas Medicine

- 6.3.11 Sangamo Therapeutics

- 6.3.12 Bellicum Pharmaceuticals

- 6.3.13 Agios Pharmaceuticals

- 6.3.14 Kiadis Pharma

- 6.3.15 ApoPharma Inc.

- 6.3.16 SG Pharma Pvt Ltd

- 6.3.17 Zydus Lifesciences

- 6.3.18 Incyte Corporation

- 6.3.19 Gamida Cell

- 6.3.20 Intellia Therapeutics

7 Market Opportunities & Future Outlook

- 7.1 White-space & unmet-need assessment