PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846324

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846324

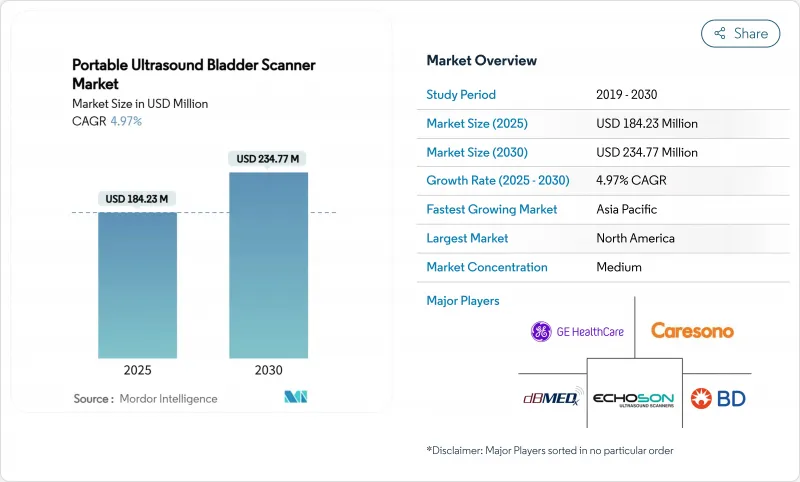

Portable Ultrasound Bladder Scanner - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Portable Ultrasound Bladder Scanner Market size is estimated at USD 184.23 million in 2025, and is expected to reach USD 234.77 million by 2030, at a CAGR of 4.97% during the forecast period (2025-2030).

This growth continues even as the technology matures and competition intensifies. Aging populations, miniaturization of ultrasound components and favorable reimbursement updates sustain demand, while regulatory complexity and operator-training gaps temper adoption. Market leaders are responding with AI-enabled automation, portfolio expansion and targeted solutions for long-term care, home-care and ambulatory environments. Alongside these drivers, the market is witnessing sharper segmentation dynamics and geographic expansion. Competition features global imaging giants and agile start-ups; both groups are embedding AI to improve accuracy and cut scan time. The single biggest barrier is the persistent shortage of trained users, partly offset by AI tools that automate image capture and interpretation.

Global Portable Ultrasound Bladder Scanner Market Trends and Insights

Ageing Population Surge Elevating Demand for Bladder-Volume Monitoring

The number of people aged 65 years and older is climbing at an unprecedented pace, escalating incidence of benign prostatic hyperplasia and related urinary complications. Scientific Reports highlighted 112.5 million BPH cases globally in 2024, with highest prevalence in Eastern Europe, Central Latin America and Andean Latin America. Medicare data further indicate urinary incontinence in 11.2% of beneficiaries, rising to 20.6% in skilled nursing facilities. These demographics elevate routine bladder-volume monitoring, making a compelling clinical and economic case for the portable ultrasound bladder scanner market.

Healthcare Shift Toward Non-Invasive Point-of-Care Diagnostics

Clinical protocols now prioritize infection reduction, patient comfort and rapid decision-making. A 2024 acute-stroke study showed UTIs falling to 4.0% after portable bladder ultrasound adoption, while length-of-stay dropped simultaneously. Medicare's 2025 Physician Fee Schedule introduced telehealth and caregiver-training codes that encourage remote diagnosis tools. These reforms directly support accelerated uptake in home-care and community settings.

Shortage of Skilled Operators for Ultrasound Interpretation

Formal ultrasound training remains limited across primary-care and long-term care facilities. Although AI features such as automated bladder outlining cut learning curves, these tools still require integration spending and user confidence. Smaller providers hesitate to invest without immediate reimbursement certainty.

Other drivers and restraints analyzed in the detailed report include:

- Continuous Innovation in Portable & Handheld Ultrasound Platforms

- Growing Adoption of POCUS in Emergency, Critical-Care & Primary Settings

- Variable Reimbursement & Coding Frameworks Across Regions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

3D scanners held 62.43% of 2024 revenue within the portable ultrasound bladder scanner market. Their volumetric precision suits complex anatomy, including prolapse cases where catheterization error risk is high. Nonetheless, 2D scanners are scaling at 8.78% CAGR during 2025-2030 as algorithmic upgrades tighten accuracy bands. Memory-efficient segmentation now runs on lower-cost processors, driving down average selling prices and widening addressable demand. Procurement teams increasingly compare price-performance ratios rather than absolute accuracy, allowing 2D to penetrate resource-constrained settings. The portable ultrasound bladder scanner market size for 2D systems is therefore projected to expand faster than for 3D, though the latter retains hospital preference for high-acuity wards.

Advances in handheld form factors compound the 2D opportunity. Integrated AI makes capturing orthogonal views less operator-dependent, while Wi-Fi connectivity streamlines record transfer. Leading 3D vendors respond by bundling software licenses and extended warranties. Resulting competition improves total cost of ownership for all scanner types, sustaining double-digit shipment growth across emerging economies.

The Portable Ultrasound Bladder Scanner Market is Segmented by Type (2D Portable Ultrasound Bladder Scanner, 3D Portable Ultrasound Bladder Scanner), Device Type (Handheld Portable, Mobile-Cart, Bench-Top), End-User (Hospitals & Clinics, Diagnostic Imaging Centers, and More), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America leads with 39.81% 2024 revenue in the portable ultrasound bladder scanner market, powered by Medicare beneficiaries' high urinary-incontinence prevalence and supportive device coding. FDA down-classification has shortened time-to-market, fostering quicker portfolio refreshes. Canada trails the United States yet follows similar adoption trajectories, whereas Mexico's private hospitals spearhead demand within Latin America.

Europe ranks second. Germany posts the highest unit volumes, driven by multi-facility nursing home adoption where indwelling catheter prevalence reached 13.4%. The United Kingdom and France follow, leveraging national health priorities that target hospital-acquired infection reduction. Southern Europe accelerates as aging demographics stretch public healthcare budgets, elevating interest in cost-effective bladder monitoring.

Asia-Pacific delivers the swiftest growth at 9.69% CAGR. China benefits from state investments in primary clinics and the world's largest elderly cohort. Domestic vendors supply affordable scanners, but multinationals retain premium hospital tiers. Japan's super-aged society drives high per-capita utilization, while India's growing middle class catalyzes urban uptake. Strategic acquisitions, such as Samsung Medison's AI push, further stimulate the regional portable ultrasound bladder scanner market.

Middle East & Africa and South America show steady but uneven progress. GCC states' hospital modernizations include bladder-scanner deployments, yet rural access lags. Brazil and Argentina dominate South American sales within private urban networks. Urban-rural divides therefore shape localized marketing tactics and after-sales footprints.

- Verathon

- GE Healthcare Technologies Inc.

- LABORIE Medical Technologies Corp.

- dBMEDx

- Caresono Technology Co., Ltd.

- Vitacon US LLC

- EchoNous (Signostics Inc.)

- Sonostar Technologies

- Beckton Dickinson

- Wuhan Tianyi Electronic

- MCube Technology Co., Ltd.

- SRS Medical Systems Inc.

- Echo-Son SA

- Butterfly Network, Inc.

- Clarius Mobile Health Corp.

- SonoScape Medical Corp.

- Vave Health

- Mindray Bio-Medical Electronics Co., Ltd.

- Koninklijke Philips

- Meike Co., Ltd. (CubeScan)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ageing Population Surge Elevating Demand for Bladder-Volume Monitoring

- 4.2.2 Healthcare Shift Toward Non-Invasive Point-of-Care Diagnostics

- 4.2.3 Continuous Innovation in Portable & Handheld Ultrasound Platforms

- 4.2.4 Growing Adoption of POCUS in Emergency, Critical-Care & Primary Settings

- 4.2.5 Rising Prevalence of Urological Disorders

- 4.2.6 Integration of AI & Smart Imaging Technologies

- 4.3 Market Restraints

- 4.3.1 Shortage of Skilled Operators for Ultrasound Interpretation

- 4.3.2 Variable Reimbursement & Coding Frameworks Across Regions

- 4.3.3 Complex Regulatory Approval Processes

- 4.3.4 Limited Accuracy in Complex Cases

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Scanner Type

- 5.1.1 2D Portable Ultrasound Bladder Scanner

- 5.1.2 3D Portable Ultrasound Bladder Scanner

- 5.2 By Device Type

- 5.2.1 Handheld Portable

- 5.2.2 Mobile-Cart

- 5.2.3 Bench-top

- 5.3 By End User

- 5.3.1 Hospitals & Clinics

- 5.3.2 Diagnostic Imaging Centers

- 5.3.3 Ambulatory Surgical Centers

- 5.3.4 Home-Care & Long-Term Care Facilities

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Verathon Inc.

- 6.3.2 GE Healthcare Technologies Inc.

- 6.3.3 LABORIE Medical Technologies Corp.

- 6.3.4 dBMEDx Inc.

- 6.3.5 Caresono Technology Co., Ltd.

- 6.3.6 Vitacon US LLC

- 6.3.7 EchoNous (Signostics Inc.)

- 6.3.8 Sonostar Technologies Co., Limited

- 6.3.9 Becton, Dickinson and Company

- 6.3.10 Wuhan Tianyi Electronic Co., Ltd.

- 6.3.11 MCube Technology Co., Ltd.

- 6.3.12 SRS Medical Systems Inc.

- 6.3.13 Echo-Son SA

- 6.3.14 Butterfly Network, Inc.

- 6.3.15 Clarius Mobile Health Corp.

- 6.3.16 SonoScape Medical Corp.

- 6.3.17 Vave Health

- 6.3.18 Mindray Bio-Medical Electronics Co., Ltd.

- 6.3.19 Koninklijke Philips N.V. (Philips Healthcare)

- 6.3.20 Meike Co., Ltd. (CubeScan)

7 Market Opportunities & Future Outlook