PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846327

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846327

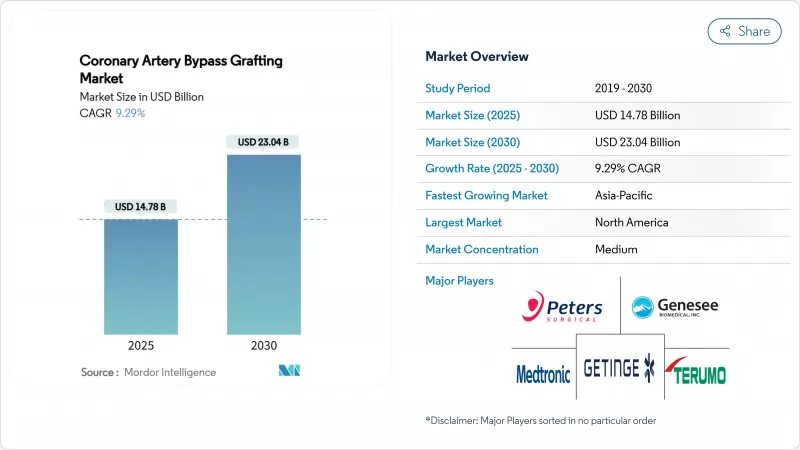

Coronary Artery Bypass Grafting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global coronary artery bypass grafting market is valued at USD 14.78 billion in 2025 and is projected to reach USD 23.04 billion by 2030, advancing at a 9.29% CAGR during the forecast period.

Steady momentum comes from widening coronary artery disease incidence in aging populations, rapid adoption of hybrid revascularization strategies, and routine use of AI-guided robotic systems that shorten procedure time while improving graft accuracy. Growing preference for minimally invasive approaches encourages hospitals to invest in next-generation visualization tools, while demographic expansion in middle-income economies opens new patient pools for advanced cardiac surgery. At the same time, favorable reimbursement pilots in North America and Europe offset capital cost pressures, ensuring continued device upgrades and procedure volume growth. Competitive rivalry intensifies as incumbents acquire vascular intervention assets, while innovators bring tissue-engineered grafts and predictive analytics to market.

Global Coronary Artery Bypass Grafting Market Trends and Insights

Rising Prevalence of CAD & Stroke

Global cardiovascular burden rises as lifestyle risk factors and population aging converge, driving continuous demand for surgical revascularization. The number of Americans living with coronary artery disease is expected to reach 8.5 million by 2030, reinforcing procedure pipelines in high-volume centers.Asia-Pacific registers earlier onset of multivessel disease, making bypass surgery preferable to complex PCI in many younger patients. A higher incidence of diffuse lesions and smaller vessel diameters further tilts therapy choice toward complete surgical revascularization. This patient mix pushes hospitals to retain robust CABG capacity even as catheter-based solutions expand.

Technological Advances in Grafts & Robotics

Robotic platforms such as the da Vinci system show 30-day mortality near 1.2% and sternotomy conversion below 5%, confirming safety in minimally invasive coronary procedures. Artificial intelligence enhances coronary mapping and intra-operative navigation, supporting surgeons during complex off-pump harvests. Tissue-engineered conduits move toward commercial reality, with Humacyte planning first-in-human trials of acellular small-diameter grafts for CABG in 2025. Together, these innovations widen the addressable patient base by lowering morbidity and shortening hospital stays.

Shift Toward PCI & TAVI

Recent trials show competitive outcomes for PCI in selected left main disease, and transcatheter aortic valve replacement combined with PCI offers a fully catheter-based alternative for dual pathology patients. Yet long-term registries still favor CABG for complex multivessel disease, diabetes, and impaired ventricular function because of lower repeat revascularization and infarction rates. As device iterations improve stent deliverability and durability, interventional cardiology will continue drawing cases from surgical suites, particularly where comorbidity risk is moderate.

Other drivers and restraints analyzed in the detailed report include:

- Favourable Reimbursement in Key Markets

- Hybrid Revascularization Programmes in ASCs

- High Capex & Procedural Cost

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

On-pump surgery generated the highest revenue in 2024, reflecting 61.33% of the coronary artery bypass grafting market. Reliable cardiopulmonary bypass techniques and surgeon familiarity keep demand steady in complex anatomies and redo cases. Nevertheless, hybrid techniques led technology growth at 12.73% CAGR as hospitals combine minimally invasive grafting with PCI to balance durability and recovery speed. The coronary artery bypass grafting market size for hybrid procedures is projected to climb sharply through 2030 as evidence shows comparable freedom from major adverse events over a decade.

Robot-assisted harvest enables bilateral internal mammary artery use through a single port, improving long-term patency without widening the incision. Off-pump surgery remains valuable in high-risk patients with calcified aortas where bypass manipulation elevates stroke risk. Taken together, these options allow surgeons to tailor therapy to anatomy, comorbidity, and institutional resources, enhancing procedural outcomes while sustaining overall coronary artery bypass grafting market growth.

The Coronary Artery Bypass Grafting Market Report is Segmented by Technology (Off-Pump CABG, On-Pump CABG, and More), Products and Services (Conduits & Grafts [Saphenous-Vein Grafts and More], Retractors & Stabilisers, Heart-lung Machines and More), End Users (Tertiary-Care Hospitals, Cardiology Clinics, and More), and Geography (North America, Europe and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 33.77% of global revenue in 2024, supported by technology leadership, established cardiac surgery programs, and bundled payment pilots that reward quality outcomes. Early uptake of robotic systems and AI-guided imaging reinforces procedure efficiency, while strong capital budgets sustain rapid refresh cycles. Medicare coding changes that pay for AI risk profiling tools further encourage procedure funnel growth, keeping the coronary artery bypass grafting market dynamic across the United States and Canada.

Europe shows steady expansion despite Medical Device Regulation compliance challenges that lengthen approval timelines for novel robotic components. Cross-border training networks and government cardiac centers upgrade perfusion equipment and mapping software to maintain clinical parity with North American peers. Scandinavian countries pilot value-based procurement contracts that bundle grafts, disposables, and service agreements, protecting margins while securing supply chain stability.

Asia-Pacific is forecast to post the fastest 12.20% CAGR through 2030 as rising disposable income and donor-funded surgical training programs broaden access to advanced revascularization. India attracts international patients with procedure costs 50-80% lower than Western averages, supporting medical tourism growth inside the coronary artery bypass grafting market. China partners with neighboring Cambodia to screen millions for congenital heart disease, highlighting regional commitment to cardiovascular care. Middle East and Africa plus South America continue upgrading centers with international assistance, though capital investment limitations and supply chain delays moderate near-term procedure volumes.

- Medtronic

- Getinge

- Terumo Corp.

- Edward Lifesciences

- Johnson & Johnson (Ethicon/Cordis)

- Abbott Laboratories

- Boston Scientific

- LivaNova plc

- W. L. Gore & Associates

- B. Braun

- Stryker

- Karl Storz

- Teleflex

- Scanlan International

- Genesee Biomedical

- Peters Surgical

- Zimmer Biomet

- Dextera Surgical

- CardioMedical GmbH

- Novare Surgical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence Of CAD & Stroke

- 4.2.2 Technological Advances In Grafts & Robotics

- 4.2.3 Favourable Reimbursement In Key Markets

- 4.2.4 Hybrid Revascularisation Programmes In ASCs

- 4.2.5 AI-Guided Intra-Operative Imaging Adoption

- 4.2.6 Donor-Funded Cardiac-Surgery Training In LMICs

- 4.3 Market Restraints

- 4.3.1 Shift Toward PCI & TAVI

- 4.3.2 High Capex & Procedural Cost

- 4.3.3 Tissue-Sourcing Regulatory Disruptions

- 4.3.4 Post-Covid Scheduling Bias To Pci

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Technology

- 5.1.1 Off-pump CABG

- 5.1.2 On-pump CABG

- 5.1.3 Minimally-invasive/Robot-assisted CABG

- 5.1.4 Hybrid Coronary Revascularisation

- 5.2 By Product & Service

- 5.2.1 Conduits & Grafts

- 5.2.1.1 Saphenous-vein grafts (SVG)

- 5.2.1.2 Internal thoracic/ITA grafts

- 5.2.1.3 Radial-artery grafts

- 5.2.1.4 Synthetic & drug-eluting grafts

- 5.2.2 Retractors & Stabilisers

- 5.2.3 Heart-lung Machines

- 5.2.4 Surgical Instruments & Sutures

- 5.2.5 Intra-operative Imaging & Navigation

- 5.2.6 Services (CABG Centres of Excellence)

- 5.2.1 Conduits & Grafts

- 5.3 By End-user

- 5.3.1 Tertiary-care Hospitals

- 5.3.2 Cardiology / Cardiothoracic Clinics

- 5.3.3 Ambulatory Surgical Centres

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Medtronic plc

- 6.3.2 Getinge AB

- 6.3.3 Terumo Corp.

- 6.3.4 Edwards Lifesciences

- 6.3.5 Johnson & Johnson (Ethicon/Cordis)

- 6.3.6 Abbott Laboratories

- 6.3.7 Boston Scientific

- 6.3.8 LivaNova plc

- 6.3.9 W. L. Gore & Associates

- 6.3.10 B. Braun Melsungen

- 6.3.11 Stryker Corp.

- 6.3.12 Karl Storz SE & Co. KG

- 6.3.13 Teleflex Inc.

- 6.3.14 Scanlan International

- 6.3.15 Genesee Biomedical

- 6.3.16 Peter Surgical

- 6.3.17 Zimmer Biomet

- 6.3.18 Dextera Surgical

- 6.3.19 CardioMedical GmbH

- 6.3.20 Novare Surgical

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment