PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846328

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846328

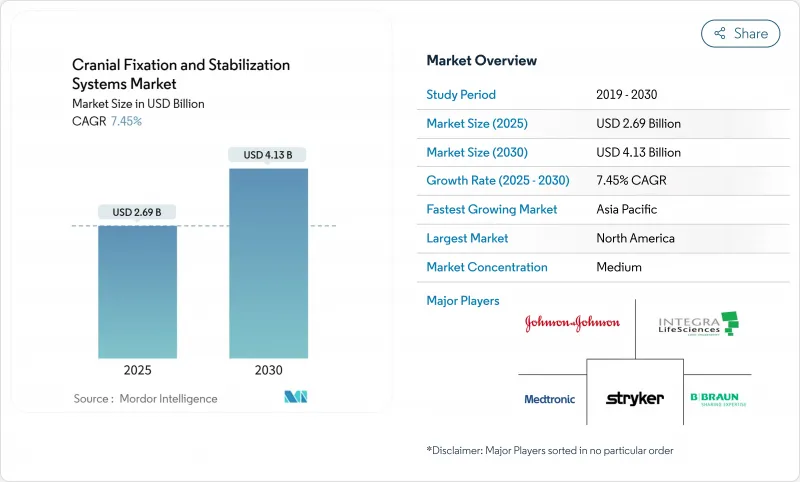

Cranial Fixation And Stabilization Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The cranial fixation and stabilization systems market stands at USD 2.69 billion in 2025 and is forecast to climb to USD 4.13 billion by 2030, reflecting a 7.45% CAGR.

Demographic aging, the steady rise in traumatic brain injuries, and the push toward minimally invasive neurosurgery underpin this trajectory. Three-dimensional printing now supplies patient-specific implants that reduce theater time, while mixed-reality navigation shortens trajectory planning by 2.1 times and preserves sub-millimetric accuracy. Ambulatory surgical centers (ASCs) fuel incremental demand as 11,555 facilities in the United States pivot toward outpatient neurosurgery. Lightweight, single-use headrest kits matched to ASC workflows are gaining traction. Meanwhile, titanium supply volatility and post-operative MRI artifacts temper enthusiasm for metal implants, opening a lane for resorbable polymers and magnesium alloys that sidestep revision surgery and imaging limitations.

Global Cranial Fixation And Stabilization Systems Market Trends and Insights

Rising Incidence of Traumatic Brain Injuries & Neurosurgical Procedures

Global traumatic brain injury (TBI) admissions hover near 235,000 in the United States alone each year, pushing hospitals to expand decompressive craniectomy capacity. Mortality disparities-38.0% in developing regions versus 25.2% in developed markets-swell the surgical backlog. Early cranioplasty within three months cuts operative time and blood loss, reinforcing demand for durable fixation plates that tolerate staged interventions. Medicare beneficiaries average 9.6-day stays for cranial surgery, underscoring the economic burden of complications.

Growing Adoption of Resorbable Fixation Materials

Biodegradable plates avert second operations, a critical advantage when payers tighten reimbursement. PLLA-magnesium composites now achieve 190 MPa bending strength with 150 kJ/m2 impact resistance. Nano-MgO additives buffer acidic by-products, promoting osteoblast proliferation. ZK60 magnesium alloy, coated in poly-l-lactic acid, preserves >300 MPa tensile strength and fully resorbs in 12 weeks, though swift degradation can trigger wound dehiscence. Pediatric craniosynostosis repair particularly benefits, as molybdenum systems show biocompatibility without impacting skull growth. Regulatory hurdles remain, yet long-term healthcare savings and patient comfort sustain momentum.

High Cost of Neurosurgical Procedures & Advanced Implants

Average inpatient charges of USD 30,746 for cranial surgery strain public payers, while in-hospital mortality of 10.9% among seniors amplifies scrutiny of device value. Premium implants widen access gaps; reimbursement codes often lag technology, forcing hospitals to absorb costs. Training, advanced imaging, and longer theater times add layers of expense. Emerging economies face stark choices between legacy plates and next-generation polymer systems. Manufacturers counter by bundling navigation hardware and disposables under risk-sharing contracts.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Geriatric Population with Neurological Disorders

- Rapid Uptake of 3-D-Printed, Patient-Specific Cranial Implants

- Shortage of Skilled Neurosurgeons in Emerging Economies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cranial fixation systems retained 58.56% of the cranial fixation and stabilization systems market in 2024 on the strength of titanium plates, screws, and mesh. Innovative three-pin skull clamps now distribute force more evenly, reducing penetration asymmetries. Table-mounted frames integrate with optical trackers so surgeons finalize trajectories 2.1 times faster. The cranial fixation and stabilization systems market size for fixation hardware is projected to advance steadily through 2030 as hospitals refresh legacy inventories.

Stabilization systems, including modular horseshoe headrests and disposable ASC kits, post an 8.34% CAGR. Mixed-reality overlays allow sub-millimetric verification of head orientation, crucial for endoscopic resections. ASCs value single-use frames that bypass reprocessing, improving turnover. Integration with motorized patient tables further boosts demand by automating positional adjustments.

Non-resorbable titanium commanded 72.35% of the cranial fixation and stabilization systems market share in 2024. MRI artifact concerns and titanium price indices hitting 190.106 complicate procurement. The cranial fixation and stabilization systems market size for titanium hardware grows but at a slower clip as hospitals hedge with hybrid options.

Resorbable polymers climb at 8.95% CAGR, propelled by PLLA/PLGA blends buffered with nano-MgO. Pediatric units lead adoption because implants dissolve as skulls expand. Magnesium alloys show promise yet require controlled corrosion to avoid inflammatory sequelae. PEEK finds niche use where radiolucency is critical, though premium cost tempers uptake outside complex reconstructions.

The Cranial Fixation and Stabilization Systems Market is Segmented by Product Type (Cranial Fixation System, Cranial Stabilization Systems), Material Type (Resorbable Fixation Systems, Nonresorbable Fixation Systems and More), and by End User (Hospitals, and More), by Indication (Traumatic Brain Injury, and More), Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 41.23% of the cranial fixation and stabilization systems market in 2024 owing to advanced surgical capacity and a supportive reimbursement climate. Average cranial admissions span 9.6 days with notable ICU utilization, highlighting economic value in devices that reduce complications. The ASC boom channels outpatient demand, while FDA guidance gives clarity for personalized implants.

Asia-Pacific posts an 11.07% CAGR, the fastest worldwide. Rising healthcare investment in China and India, coupled with workforce upskilling, widens access. Indonesia's neurosurgeon count remains low relative to population, but cross-border training initiatives are narrowing gaps. Vietnam's Cho Ray Hospital now conducts 1,000 craniotomies annually, marking the region's shift from trauma-only caseloads to elective procedures.

Europe reflects a mature yet opportunity-rich market. Germany, the United Kingdom, and France anchor R&D activity, while peripheral nations modernize theater suites. Regulatory convergence through the Medical Device Regulation harmonizes approval pathways, thus smoothing cross-border device adoption. Aging populations magnify demand for implants optimized for osteoporotic bone

- Integra LifeSciences

- Stryker

- Johnson & Johnson

- Medtronic

- B. Braun (Aesculap)

- Zimmer Biomet

- KLS Martin Group

- MicroPort

- Pro Med Instruments

- Micromar Ind.

- OsteoMed

- evonos GmbH

- Neos Surgery

- Renishaw plc

- Xillix Technologies

- Nexus CMF

- Surgalign (RTI Surgical)

- Acumed

- Evonik (Vestakeep PEEK)

- OrthoPediatrics Neuro

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising incidence of traumatic brain injuries & neurosurgical procedures

- 4.2.2 Growing adoption of resorbable fixation materials

- 4.2.3 Expansion of geriatric population with neurological disorders

- 4.2.4 Rapid uptake of 3-D-printed, patient-specific cranial implants

- 4.2.5 Integration of intra-operative navigation with skull clamp systems

- 4.2.6 Shift toward lightweight, single-use headrest kits in ASC settings

- 4.3 Market Restraints

- 4.3.1 High cost of neurosurgical procedures & advanced implants

- 4.3.2 Shortage of skilled neurosurgeons in emerging economies

- 4.3.3 Regulatory scrutiny over titanium-particle MRI artefacts

- 4.3.4 Price volatility tied to aerospace-grade titanium powders

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Cranial Fixation Systems

- 5.1.1.1 Plates

- 5.1.1.2 Screws

- 5.1.1.3 Meshes

- 5.1.1.4 Fastening Clamps (Skull Clamps, Horseshoe Headrests, 3-Pin Holders)

- 5.1.1.5 Accessories & Adaptors

- 5.1.2 Cranial Stabilization Systems

- 5.1.2.1 Table-Mounted Head Clamps

- 5.1.2.2 Horseshoe Headrests

- 5.1.2.3 Arms & Base Units

- 5.1.2.4 Positioning Pillows & Pads

- 5.1.1 Cranial Fixation Systems

- 5.2 By Material

- 5.2.1 Non-Resorbable Metals (Titanium, PEEK, Others)

- 5.2.2 Resorbable Polymers (PLLA/PLGA)

- 5.2.3 Magnesium Alloys

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Specialized Neurosurgery Centers

- 5.4 By Indication

- 5.4.1 Traumatic Brain Injury

- 5.4.2 Tumor Surgery

- 5.4.3 Vascular & Aneurysm Procedures

- 5.4.4 Hydrocephalus & CSF Disorders

- 5.4.5 Reconstruction & Deformity Correction

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Integra LifeSciences

- 6.3.2 Stryker Corporation

- 6.3.3 DePuy Synthes (Johnson & Johnson)

- 6.3.4 Medtronic plc

- 6.3.5 B. Braun (Aesculap)

- 6.3.6 Zimmer Biomet

- 6.3.7 KLS Martin Group

- 6.3.8 MicroPort Scientific

- 6.3.9 Pro Med Instruments

- 6.3.10 Micromar Ind.

- 6.3.11 OsteoMed

- 6.3.12 evonos GmbH

- 6.3.13 Neos Surgery

- 6.3.14 Renishaw plc

- 6.3.15 Xillix Technologies

- 6.3.16 Nexus CMF

- 6.3.17 Surgalign (RTI Surgical)

- 6.3.18 Acumed LLC

- 6.3.19 Evonik (Vestakeep PEEK)

- 6.3.20 OrthoPediatrics Neuro

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment