PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846330

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846330

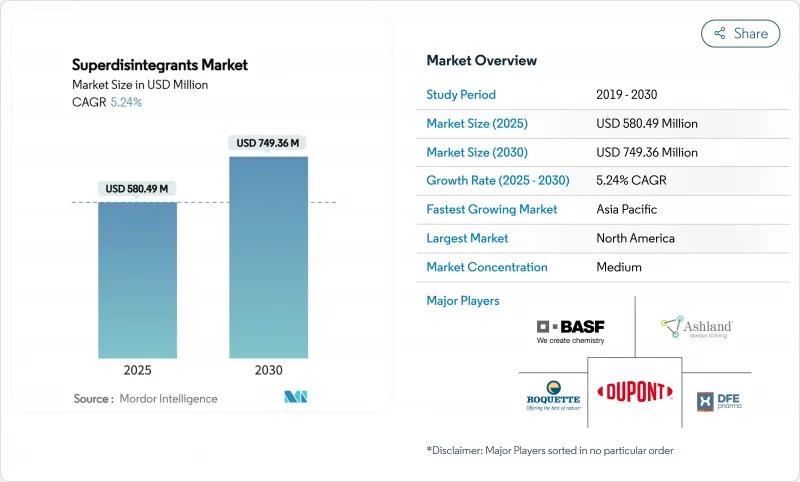

Superdisintegrants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The superdisintegrants market size is valued at USD 580.49 million in 2025 and is forecast to reach USD 749.36 million by 2030, reflecting a 5.24% CAGR that outpaces broader pharmaceutical excipient averages.

Patient-centric drug-delivery priorities, a sharp rise in orally disintegrating tablets for aging and pediatric users, and regulatory streamlining in the United States and Europe are the principal engines of growth. Fast-dissolving dosage approvals now move through an expedited route after the Food and Drug Administration's June 2025 draft administrative order, removing a key procedural hurdle . Manufacturers are pivoting toward sustainability as synthetic polymer scrutiny intensifies, even while synthetic grades retain technical dominance. Consolidation-most notably Roquette's USD 2.85 billion agreement to acquire IFF Pharma Solutions-signals a market in which scale, global compliance systems, and local supply chains are decisive strategic assets.

Global Superdisintegrants Market Trends and Insights

Rising adoption of orally disintegrating tablets (ODTs)

Expanding clinical proof of improved adherence and faster onset is propelling ODT uptake, bolstering the superdisintegrants market. Intraoral drug-delivery spending rose from USD 36 billion in 2023 to a projected USD 55 billion by 2030, reflecting a 4.88% CAGR that sharply eclipses conventional tablets . Neurological agents, notably sublingual levodopa, show greater pharmacokinetic predictability than standard oral solids, reinforcing demand for high-performance crospovidone and sodium starch glycolate grades . Quality-by-Design toolkits now produce tablets that disintegrate in under 10 seconds without compromising mechanical strength. Collectively, these advances place superdisintegrants at the heart of next-generation dosage design.

Expanding geriatric & pediatric patient pools

The proportion of people aged >= 65 years climbs steadily across Asia-Pacific and Europe, while almost one-third of global births occur in nations modernizing pediatric formularies. Swallowing impairment affects 15% of the population; tablet dimension research shows handling difficulty spikes when combined length and width touch 13.3 mm, validating the commercial logic of ODTs. Clean-label products such as CompactCel DIS permit 1-5% inclusion levels, matching synthetic speed while meeting excipient transparency mandates. Proposed single-unit ODT packaging rules from the FDA further protect young and frail users. These demographic realities ensure steady long-run tailwinds for the superdisintegrants market.

Stringent quality & pharmacopoeial compliance demands

Parallel but non-identical monographs in the USP, Ph. Eur., and JP compel multi-spec product lines, soaring analytical costs, and overlapping audits. Nitrosamine vigilance has forced low-peroxide crospovidone grades such as Polyplasdone LN, necessitating fresh stability protocols and capital-intensive testing equipment. Smaller producers find these hurdles prohibitive, driving consolidation and elevating barriers to entry.

Other drivers and restraints analyzed in the detailed report include:

- Growth in R&D pipelines for patient-centric solid dosage

- Regulatory support for fast-dissolving formulations

- Raw-material price volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Synthetic grades retained a commanding 63.34% of the superdisintegrants market share in 2024, reflecting reliable performance and established compliance files that multinational drug makers lean on for high-throughput lines. Commercial benchmarks such as crospovidone frequently achieve <30 second dissolution at 2-5% loadings, supporting direct-compression throughput above 300,000 tablets per hour. Yet sustainability audits, petrochemical cost movements, and consumer preference accelerators are steering formulators toward plant-derived options. Natural alternatives are projected to climb at a 6.12% CAGR, narrowing the gap but not eclipsing synthetics through 2030. Advanced sago starch glycolates now meet USP substitution thresholds, underscoring material science gains that underpin this upswing. The superdisintegrants market therefore exhibits a dual-track dynamic: legacy synthetic volumes sustain core revenue while natural portfolios carve new lanes in pediatric, nutraceutical, and clean-label drugs.

The synthetic franchise nevertheless innovates. Ultra-low peroxide and nitrosamine-controlled grades shore up compatibility with sensitive oncology actives. Co-processed excipients pairing crospovidone with mannitol or silicified microcrystalline cellulose further speed wet-granulation lines. Suppliers with backward integration into vinyl monomer plants mitigate cost volatility and protect margin by selling functional-blend systems instead of single excipients, reinforcing pricing resilience within the superdisintegrants market.

The Superdisintegrants Market Report is Segmented by Product Type (Natural Superdisintegrants, Synthetic Superdisintegrants, Others), Formulation (Tablets, Capsules, Others), Therapeutic Area (Neurological Diseases, Gastrointestinal Diseases, Cardiovascular Diseases, Oncology, Respiratory Diseases, Others), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America, home to stringent cGMP enforcement and extensive R&D spend, captured 39.89% of 2024 sales. Mature formulators value validated supply chains: the FDA's site inspection cadence and high biopharma investment underpin predictable volume call-offs that safeguard incumbents. While growth steadies near the market average, premium formulations and high-margin controlled substances keep revenue dense.

Asia-Pacific shows pronounced dynamism. Regional modernization, local excipient declarations, and medical-device influx together propel a 6.34% regional CAGR. India's label mandate and growing share of DMFs strengthen transparency, allowing verified suppliers to differentiate. Chinese policy changes sparked geographic supply diversification, fertilizing new plants in Vietnam, Indonesia, and South Korea. Healthcare outlays in ASEAN stand to pass USD 138 billion by 2027, embedding structural pull for the superdisintegrants market.

Europe remains technologically advanced yet regulated under sustainability imperatives. Corporate Sustainability Reporting Directive metrics guide excipient procurement toward biodegradable options, boosting natural superdisintegrants adoption. The European Pharmacopoeia formally defines fast-dissolve performance windows; hence, European buyers gravitate toward grades with dossier-ready Particle-Size Distribution and Residual-Solvent certificates. Supply-chain continuity remains solid, yet incremental demand migrates Eastward as local formulations proliferate.

- BASF

- Ashland Global

- DuPont

- Roquette Freres

- DFE Pharma

- JRS Pharma

- Asahi Kasei Corp.

- Merck

- Corel Pharma Chem

- SPI Pharma

- Avantor

- Mingtai Chemical

- Colorcon

- Lubrizol Life Science

- IFF (FMC)

- Maple Biotech

- Gattefosse

- Qufu Tianli Pharma

- Hunan Yuantong Pharmaceutical

- Zhejiang Fiberon

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising adoption of orally disintegrating tablets (ODTs)

- 4.2.2 Expanding geriatric & pediatric patient pools

- 4.2.3 Growth in R&D pipelines for patient-centric solid dosage

- 4.2.4 Regulatory support for fast-dissolving formulations

- 4.2.5 3-D printed dosage forms embedding superdisintegrants

- 4.2.6 Localization of supply chains in emerging markets

- 4.3 Market Restraints

- 4.3.1 Stringent quality & pharmacopoeial compliance demands

- 4.3.2 Raw-material price volatility

- 4.3.3 Substitution by alternative drug-delivery formats

- 4.3.4 Sustainability pressure on synthetic polymers

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Natural Superdisintegrants

- 5.1.2 Synthetic Superdisintegrants

- 5.1.2.1 Modified Starch

- 5.1.2.2 Modified Cellulose

- 5.1.2.3 Crospovidone

- 5.1.2.4 Calcium Silicates

- 5.1.2.5 Ion-Exchange Resins

- 5.1.3 Others

- 5.2 By Formulation

- 5.2.1 Tablets

- 5.2.2 Capsules

- 5.2.3 Others

- 5.3 By Therapeutic Area

- 5.3.1 Neurological Diseases

- 5.3.2 Gastrointestinal Diseases

- 5.3.3 Cardiovascular Diseases

- 5.3.4 Oncology

- 5.3.5 Respiratory Diseases

- 5.3.6 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 BASF SE

- 6.3.2 Ashland Global Holdings Inc.

- 6.3.3 DuPont

- 6.3.4 Roquette Freres

- 6.3.5 DFE Pharma

- 6.3.6 JRS Pharma

- 6.3.7 Asahi Kasei Corp.

- 6.3.8 Merck KGaA

- 6.3.9 Corel Pharma Chem

- 6.3.10 SPI Pharma

- 6.3.11 Avantor

- 6.3.12 Mingtai Chemical

- 6.3.13 Colorcon

- 6.3.14 Lubrizol Life Science

- 6.3.15 IFF (FMC)

- 6.3.16 Maple Biotech

- 6.3.17 Gattefosse

- 6.3.18 Qufu Tianli Pharma

- 6.3.19 Hunan Yuantong Pharmaceutical

- 6.3.20 Zhejiang Fiberon

7 Market Opportunities & Future Outlook

- 7.1 White-space & unmet-need assessment