PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846331

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846331

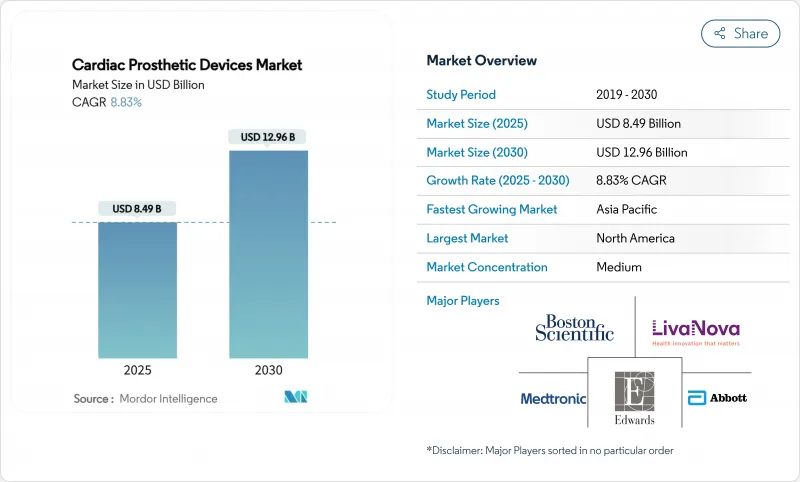

Cardiac Prosthetic Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The cardiac prosthetic devices market size reached USD 8.49 billion in 2025 and is forecast to expand to USD 12.96 billion by 2030, registering an 8.83% CAGR during the period.

Rising life expectancy, expanding indications for transcatheter procedures, and continuous device miniaturization collectively underpin this steady advance. Manufacturers are capitalizing on the rapid uptake of catheter-based aortic and mitral valve replacements, which enable treatment of elderly or high-risk patients who previously lacked surgical options . At the same time, remote monitoring software embedded in next-generation pacemakers is unlocking subscription-type revenues for device makers while reducing follow-up burdens on cardiology clinics. Competitive pressure is intensifying around pulsed-field ablation platforms that promise shorter treatment times and fewer complications, forcing incumbents to accelerate R&D road-maps. Finally, hospitals and ambulatory centers alike are benefiting from payer support for same-day discharge, a policy trend that amplifies procedure volumes without proportionally raising facility overheads.

Global Cardiac Prosthetic Devices Market Trends and Insights

Rise in prevalence of cardiac diseases & ageing population

Cardiovascular disease incidence climbs steeply after age 65, and the share of citizens in that age bracket now exceeds 17% in the United States, 21% in Japan and 20% across Western Europe. Higher life expectancy therefore enlarges the pool of patients living long enough to develop severe aortic stenosis, atrial fibrillation or heart failure that necessitate implant therapy. Longer survivorship also raises clinical expectations for device longevity, which pushes vendors to engineer valves that can last decades without re-operation. Geriatric patients tend to favor minimally-invasive therapies that shorten hospital stays, reinforcing demand for transcatheter solutions. Together these demographic forces are expanding procedure volumes as well as unit prices, supporting sustained revenue growth for the cardiac prosthetic devices market.

Rapid adoption of minimally-invasive TAVR procedures

Rapid adoption of minimally-invasive TAVR proceduresTranscatheter aortic valve replacement (TAVR) has shifted from a high-risk niche therapy to a mainstream option endorsed for low-risk patients after robust five-year data confirmed comparable survival versus open surgery. Hospitals gain operational efficiencies because typical length of stay falls below two days, freeing capacity in crowded cardiac wards. Valve-in-valve techniques further widen the addressable pool by treating degenerated bioprostheses without sternotomy, a capability especially valued by elderly patients. Next-generation platforms now feature enlarged commissural alignment and easier coronary access, ensuring future percutaneous coronary interventions remain feasible. As payer policies increasingly reimburse TAVR outside tertiary centers, procedure counts accelerate, amplifying the positive impact on the cardiac prosthetic devices market CAGR.

Stringent multi-region regulatory approvals

The European Medical Device Regulation (MDR) enforces clinical-evidence requirements that roughly triple the documentation burden relative to the former CE-mark process, adding 18-24 months to typical approval timelines and inflating pre-market costs by USD 12 million per high-risk device according to company filings . Simultaneously, the U.S. FDA's requirement for long-term post-approval studies places ongoing resource demands on manufacturers. Smaller innovators struggle to finance these obligations, leading several to out-license promising technologies or exit the field entirely. Multinational players can absorb the expense, but the longer path to revenue delays return on R&D spending, marginally dampening the CAGR of the cardiac prosthetic devices market during the forecast window.

Other drivers and restraints analyzed in the detailed report include:

- Continuous technology upgrades in leadless & MRI-safe pacemakers

- Favourable reimbursement pathways in US, EU & Japan

- High procedure & device cost, limited access in LMICs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Heart valves contributed 9.56% CAGR through 2030, outpacing every other category even though pacemakers retained a 60.61% cardiac prosthetic devices market share in 2024. TAVR, TMVR and emerging transcatheter tricuspid systems have expanded the treatable patient pool while commanding high average selling prices that lift overall revenue. Hospitals prize the rapid recovery dynamics of these implants, and patients value the avoidance of sternotomy, fueling sustained double-digit annual procedure growth. Pacemaker sales remain resilient due to the sheer size of the bradyarrhythmia population, yet their mature status and pricing compression restrain segment expansion. The others segment, including ventricular assist devices, continues to receive breakthrough-device designations, suggesting a long-term upswing that could diversify revenue beyond the core rhythm-management base, but near-term contribution remains modest.

Second-generation tissue valves integrating anti-calcification chemistry now capture share from mechanical valves, especially in patients aged 50-65 who prefer to avoid lifelong anticoagulation. Simultaneously, leadless pacemakers with AI-enabled analytics are carving a premium sub-segment even within a plateauing category. The combined effect is a gradual tilt of the product mix toward higher-margin, technology-rich solutions that sustain the broader cardiac prosthetic devices market growth trajectory.

The Cardiac Prosthetic Devices Market Report is Segmented by Product Type (Heart Valves, Pacemakers, Others), Material (Metal Alloys, Biological Tissue, Polymeric and Hybrid), End User (Hospitals, Specialty Clinics, Ambulatory Surgical Centres, Others), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America leads global revenue, accounting for 41.29% in 2024 as Medicare broadened TAVR coverage to low-risk cohorts and approved ambulatory billing codes. The presence of vast clinical-trial networks facilitates first-in-human studies, often granting U.S. facilities 12-18-month lead time over international peers in new-technology adoption. Regulatory programs such as the FDA Breakthrough Device pathway shorten time-to-market for transformative platforms, further cementing the region's leadership. Yet margin compression is inevitable as value-based purchasing agreements and bundled payments expand; leading manufacturers hedge by bundling digital services and extended warranties into pricing proposals to preserve ASPs.

Asia-Pacific is the fastest climber at 9.91% CAGR, supported by governmental push to modernize tertiary care and a burgeoning middle class able to self-pay for advanced interventions. Chinese Centers for Excellence grants subsidize the capital expenditure for hybrid operating suites, unlocking latent demand. Japan's revised reimbursement schedule recognizes AI-driven remote monitoring codes, creating recurring revenue that stabilizes vendor cash flows. Although per-patient spend is lower than in North America, population scale compensates, and local manufacturing partnerships reduce import tariffs, improving affordability.

Europe demonstrates steady mid-single-digit expansion as universal-payer models shield procedure volumes from economic volatility. Germany's DRG system rewards shorter length of stay, directly benefiting transcatheter approaches. The MDR imposes up-front costs but enhances patient confidence in device safety, indirectly supporting adoption. Meanwhile, the United Kingdom's Medicines & Healthcare products Regulatory Agency is piloting an expedited review for implantables post-Brexit, offering an alternate fast-track to market for companies willing to invest in localized evidence generation. Collectively, these regional dynamics shape a balanced growth mosaic that underpins the upward trajectory of the cardiac prosthetic devices market.

- Abbott Laboratories

- Medtronic

- Edward Lifesciences

- Boston Scientific

- LivaNova

- BIOTRONIK

- Lepu Medical

- Meril Life Sciences

- Colibri Heart Valve

- Siemens Healthineers

- Venus Medtech

- On-X Life Technologies

- SynCardia Systems

- Foldax Inc.

- CryoLife (Artivion)

- Terumo

- Getinge

- W. L. Gore & Associates

- MicroPort

- Shockwave Medical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in prevalence of cardiac diseases & ageing population

- 4.2.2 Rapid adoption of minimally-invasive TAVR procedures

- 4.2.3 Continuous technology upgrades in lead-less & MRI-safe pacemakers

- 4.2.4 Favourable reimbursement pathways in US, EU & Japan

- 4.2.5 AI-driven remote programming & monitoring of pacemakers

- 4.2.6 Polymeric RESILIA-like valves extending durability beyond 25 yrs

- 4.3 Market Restraints

- 4.3.1 Stringent multi-region regulatory approvals

- 4.3.2 High procedure & device cost, limited access in LMICs

- 4.3.3 Dependency on bovine & porcine tissue supply chains

- 4.3.4 Catheter-based ablation therapies delaying implant need

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Heart Valves

- 5.1.1.1 Mechanical Valves

- 5.1.1.2 Tissue Valves

- 5.1.1.3 Transcatheter Valves

- 5.1.2 Pacemakers

- 5.1.2.1 Leaded

- 5.1.2.2 Leadless

- 5.1.3 Others

- 5.1.1 Heart Valves

- 5.2 By Material

- 5.2.1 Metal Alloys

- 5.2.2 Biological Tissue

- 5.2.3 Polymeric and Hybrid

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Specilaty Clinics

- 5.3.3 Ambulatory Surgical Centres

- 5.3.4 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 Medtronic plc

- 6.3.3 Edwards Lifesciences Corporation

- 6.3.4 Boston Scientific Corporation

- 6.3.5 LivaNova PLC

- 6.3.6 Biotronik SE & Co. KG

- 6.3.7 Lepu Medical Technology

- 6.3.8 Meril Life Sciences

- 6.3.9 Colibri Heart Valve

- 6.3.10 Siemens Healthineers

- 6.3.11 Venus Medtech

- 6.3.12 On-X Life Technologies

- 6.3.13 SynCardia Systems

- 6.3.14 Foldax Inc.

- 6.3.15 CryoLife (Artivion)

- 6.3.16 Terumo Corporation

- 6.3.17 Getinge AB

- 6.3.18 W. L. Gore & Associates

- 6.3.19 MicroPort Scientific

- 6.3.20 Shockwave Medical

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment