PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846333

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846333

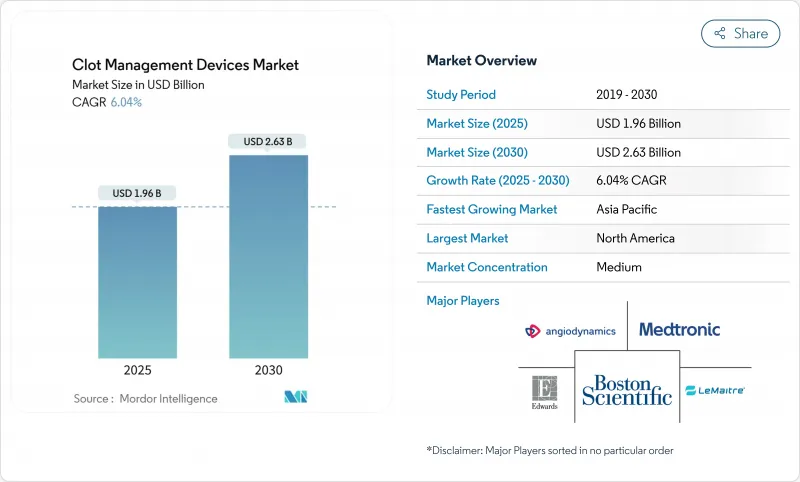

Clot Management Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Clot Management Devices Market size is estimated at USD 1.96 billion in 2025, and is expected to reach USD 2.63 billion by 2030, at a CAGR of 6.04% during the forecast period (2025-2030).

The current expansion rests on the mounting global cardiovascular burden, the steady rise of ischemic and thrombotic events, and a marked pivot toward outpatient, minimally invasive vascular interventions. Demographic pressure from aging societies, coupled with lifestyle-related risk factors such as obesity and hypertension, keeps procedure volumes on an upward trajectory. Technology pipelines that integrate advanced mechanical designs, artificial intelligence-guided imaging, and high-precision navigation reinforce demand by improving procedural success rates and safety profiles. Simultaneously, payer reform in key markets is widening reimbursement coverage for mechanical thrombectomy, easing the financial pathway for providers to adopt next-generation systems. These factors collectively position the clot management devices market for durable mid-single-digit growth through the decade.

Global Clot Management Devices Market Trends and Insights

Rising Prevalence of Cardiovascular & Neurovascular Diseases

Escalating incidences of stroke and myocardial infarction represent the most powerful catalyst for the clot management devices market. Global stroke cases are projected to rise to 21.43 million by 2050, a surge that will swell demand for safe, effective thrombectomy solutions. In Europe, ischemic strokes already account for 85% of all stroke events, sustaining adoption of advanced retriever technology. Metabolic risks compound the challenge: United States diabetes prevalence is forecast to climb from 16.3% to 26.8% by 2050, raising thrombotic complexity in day-to-day practice. Lower-middle-income countries highlight unmet needs, recording 77.93% recanalization rates with existing systems despite resource limitations. Current devices resolve barely one out of two tough clots, opening the door for platforms like Stanford University's milli-spinner, which achieves near-90% efficacy on difficult occlusions.

Expanding Geriatric Population Base

Population aging reshapes procedure volumes and device requirements. While age-standardized mortality from ischemic heart disease is falling in affluent nations, absolute patient counts are rising due to demographic momentum. Frailty, comorbidities, and elevated bleeding risk push providers toward highly controllable mechanical systems rather than systemic thrombolysis. FLASH registry data reinforce this preference: mechanical thrombectomy in intermediate-high-risk pulmonary embolism delivered 0.3% all-cause mortality at 48 hours. Device makers now engineer slimmer catheters and advanced steering tools to navigate calcified, tortuous vessels commonly found in older adults.

Stringent FDA & CE Clinical-Evidence Requirements

Regulators now demand expansive safety datasets, lengthening development cycles and raising costs for novel systems. Europe's new Medical Device Regulation strengthens post-market surveillance but has strained notified-body capacity, prolonging approvals. Temporary sales pauses-such as Johnson & Johnson MedTech's Varipulse catheter in early 2025 demonstrate how quickly regulatory concerns can derail commercialization. In the United States, the FDA placed viscoelastic coagulation analyzers into Class II with special controls in May 2025, underscoring stricter oversight even for adjunct technologies. Large-scale studies, including the EXCELLENT registry with 997 patients across 34 sites, have become the minimum evidence bar for neurovascular devices.

Other drivers and restraints analyzed in the detailed report include:

- Growing Preference for Minimally Invasive Procedures & Shorter LOS

- Increasing Reimbursement Coverage for Mechanical Thrombectomy

- Litigation Risk Tied to Long-Term IVC-Filter Complications

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Mechanical and percutaneous thrombectomy systems commanded 36.87% of the clot management devices market share in 2024 and remain the workhorse solutions across neurovascular, coronary, and peripheral territories. Their versatility, combined with rapid technical iteration, makes them a central pillar of provider inventories. The clot management devices market continues to benefit from platforms offering higher aspiration power, improved clot-capture baskets, and integrated imaging that elevates first-pass success. The EXCELLENT registry confirmed first-pass recanalization of 64.5% and final rates of 94.5% for EMBOTRAP devices, supporting broader guideline endorsement Stroke. Neurovascular embolectomy and thrombectomy devices are set to grow 8.59% annually through 2030, lifted by rising stroke volumes and efficacy data that surpass pharmacologic therapies. Academic-industry partnerships, such as Stanford's milli-spinner achieving 95% clot-volume reduction, exemplify how step-change engineering will keep the segment on an upward trajectory.

Second-tier categories hold niche, yet stable, positions. Catheter-directed thrombolysis devices remain vital for massive pulmonary embolism and complex deep-vein thrombosis when purely mechanical options are insufficient. Embolectomy balloon catheters address small-caliber, lesion-specific indications, while IVC filters experience usage decay amid safety concerns and observer scrutiny. Nevertheless, the clot management devices market retains opportunities for value-priced retrieval filters designed for rapid extraction, provided long-term complication profiles improve. Across products, AI-augmented guidance software continues to gain traction, promising real-time visualization of clot characteristics and optimized device deployment.

The Clot Management Devices Market is Segmented by Product (Embolectomy Balloon Catheters, Catheter-Directed Thrombolysis Devices, Mechanical/Percutaneous Thrombectomy Devices, Inferior Vena Cava (IVC) Filters, and More), End User (Hospitals, Ambulatory Surgical Centers, Specialty Clinics), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America remained the leading revenue contributor, capturing 45.84% of the clot management devices market in 2024. Robust reimbursement, widespread primary-stroke-center certification, and a mature network of ambulatory facilities underpin usage levels that outpace other regions. CMS pass-through approvals for devices such as Medtronic's Symplicity Spyral catheter further strengthen the adoption pipeline. Nevertheless, legal exposures in the IVC filter segment create an undercurrent of caution among manufacturers, potentially curbing near-term innovation in filter design.

Europe delivers the second-largest share and records healthy mid-single-digit expansion. Despite implementation bottlenecks, the enhanced European MDR fosters improved traceability and data transparency, which are expected to stabilize clinician confidence over time. Reimbursement for embolic-protection and thrombectomy varies among the 11 scrutinized EU states, yet overall payment coverage is trending upward. High-quality clinical infrastructures illustrated by the 34-site EXCELLENT registry accelerate multicenter validations and post-market studies that feed national funding decisions.

Asia-Pacific is the fastest-growing region at a projected 7.04% CAGR for 2025-2030. Rising cardiovascular incidence, improving insurance penetration, and large-scale hospital modernization drive equipment uptake. Emerging economies show the starkest need-capacity gap: lower-middle-income settings demonstrated 77.93% recanalization despite limited resources, indicating sizable latent demand once procedural financing improves. Multinationals collaborate with domestic distributors and deploy mobile training labs to speed clinician adoption, while local manufacturers expand R&D to address price-sensitive segments. These factors make Asia-Pacific the primary geographic engine for incremental clot management devices market revenue over the next five years.

- Medtronic

- Boston Scientific

- Penumbra

- Stryker

- Terumo

- Edward Lifesciences

- Teleflex

- Johnson & Johnson

- LeMaitre Vascular

- AngioDynamics

- Inari Medical

- Cook Group

- Cardinal Health

- iVascular S.L.U

- Strub Medical

- Abbott Laboratories

- Terumo

- Beckton Dickinson

- Thrombolex Inc.

- Penumbra (Indigo)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Cardiovascular & Neurovascular Diseases

- 4.2.2 Expanding Geriatric Population Base

- 4.2.3 Growing Preference for Minimally-Invasive Procedures & Shorter LOS

- 4.2.4 Increasing Reimbursement Coverage for Mechanical Thrombectomy

- 4.2.5 Ai-Enabled Clot Imaging & Navigation Tools Broadening Addressable Sites

- 4.2.6 Rapid Adoption of Outpatient Thrombectomy Suites in ASC Settings

- 4.3 Market Restraints

- 4.3.1 Stringent FDA & CE Clinical-Evidence Requirements

- 4.3.2 Competition from Pharmacological Anticoagulants & Thrombolytics

- 4.3.3 High Device Cost Pressures Amid Bundled-Payment Models

- 4.3.4 Litigation Risk Tied to Long-Term IVC-Filter Complications

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product

- 5.1.1 Embolectomy Balloon Catheters

- 5.1.2 Catheter-Directed Thrombolysis Devices

- 5.1.3 Mechanical/Percutaneous Thrombectomy Devices

- 5.1.4 Inferior Vena Cava (IVC) Filters

- 5.1.5 Neurovascular Embolectomy/Thrombectomy Devices

- 5.2 By End User

- 5.2.1 Hospitals

- 5.2.2 Ambulatory Surgical Centers

- 5.2.3 Specialty Clinics

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East & Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East & Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Medtronic

- 6.3.2 Boston Scientific Corporation

- 6.3.3 Penumbra Inc.

- 6.3.4 Stryker Corporation

- 6.3.5 Terumo Corporation

- 6.3.6 Edwards Lifesciences

- 6.3.7 Teleflex Incorporated

- 6.3.8 Johnson & Johnson

- 6.3.9 LeMaitre Vascular Inc.

- 6.3.10 AngioDynamics, Inc.

- 6.3.11 Inari Medical

- 6.3.12 Cook Group Incorporated

- 6.3.13 Cardinal Health

- 6.3.14 iVascular S.L.U

- 6.3.15 Strub Medical GmbH & Co. KG

- 6.3.16 Abbott Laboratories

- 6.3.17 Terumo Aortic

- 6.3.18 BD (Becton, Dickinson and Company)

- 6.3.19 Thrombolex Inc.

- 6.3.20 Penumbra (Indigo)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment