PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846336

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846336

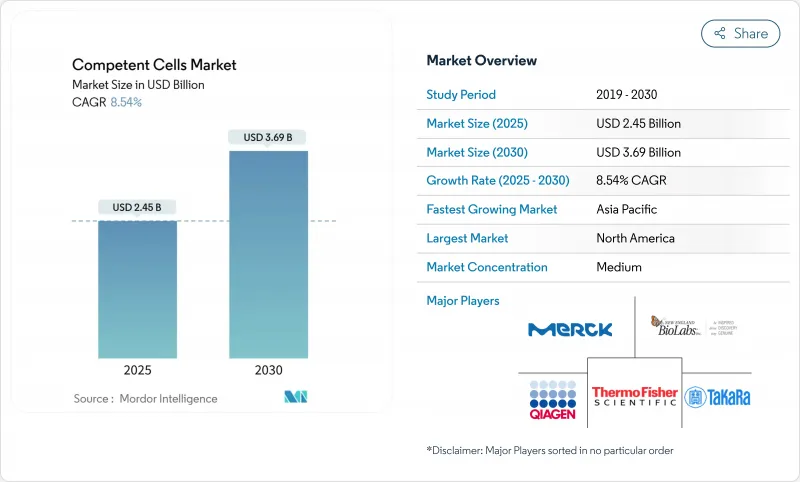

Competent Cells - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The competent cells market stood at USD 2.45 billion in 2025 and is forecast to climb to USD 3.69 billion by 2030, advancing at an 8.54% CAGR over the period.

Increasing reliance on synthetic biology, gene-editing platforms, and automated bioprocessing pipelines positions competent cells as a foundational reagent class. Growth is reinforced by the 28.3% CAGR expansion of the global synthetic biology sector, which directly amplifies demand for ultra-high-efficiency transformation systems that can handle large plasmid constructs. Parallel investments in CRISPR-Cas9 therapeutics, government-funded biofoundries, and continuous advances in cell-free protein synthesis broaden the scope of applications that require tailored competent cell formats. As laboratories transition from manual bench procedures to fully automated high-throughput environments, suppliers with automation-friendly packaging and validated strain performance gain a strategic edge in the competent cells market.

Global Competent Cells Market Trends and Insights

Commercial demand and academic or government support

Government-backed infrastructure programs have locked in multiyear reagent spending, giving the competent cells market predictable baseline volumes. The National Science Foundation's USD 75 million allocation to five biofoundries equips institutions with permanent, high-capacity facilities that must stock standardized competent cell lots for automated workflows . The National Institutes of Health adds a focused USD 2 million annual stream for genome-editing therapeutics, stimulating uptake of ultra-high-efficiency strains suitable for CRISPR pipelines . Policy testimony before the U.S.-China Economic and Security Review Commission projects that the bio-economy could underpin 60% of global economic inputs by mid-century, underscoring continued public financing that favors long-term reagent demand.

Expanding biologics and recombinant protein pipelines

Contract development and manufacturing organizations (CDMOs) are scaling to meet a biologics pipeline that rose from USD 19.89 billion in 2023 toward USD 31.92 billion by 2032. As upstream cell line development often dictates downstream yields, manufacturers specify high-titer competent cells capable of supporting complex plasmid expression constructs. Asimov's CHO Edge platform guarantees >= 5 g/L monoclonal antibody titers, signaling an industry shift toward predictable strain performance that relies on consistent transformation efficiency for template plasmids. Cell-free expression systems taken to 4,500 L scale by Sutro Biopharma further widen the addressable market for specialized competent cells tuned for in vitro protein synthesis.

High R&D and production costs

A single biopharmaceutical approval carries a median USD 2.3 billion development price tag, which forces sponsors to eliminate inefficiencies across every reagent class. For monoclonal antibodies, capture chromatography alone can swallow 25% of total cost of goods; upstream strain choice therefore receives intense scrutiny. Stable producer cell lines that cut GMP-grade plasmid demand from four to one provide clear evidence of the economic leverage tied to competent cell design. These economics place margin pressure on smaller vendors that cannot amortize development costs across global volumes.

Other drivers and restraints analyzed in the detailed report include:

- Adoption of high-throughput automation-friendly formats

- Rising CRISPR gene-editing workflows

- Cold-chain fragility in emerging nations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Chemically prepared strains contributed 65.65% revenue in 2024, supported by cost-efficient manufacturing and straightforward calcium chloride protocols that suit teaching laboratories with limited capital equipment. Standard products deliver 1 X 106 cfu/µg efficiency sufficient for routine molecular cloning, preserving the strong volume base of the competent cells market. Electrocompetent formats, however, post the quickest 9.21% CAGR, driven by automated electroporation platforms that need consistent sub-microliter aliquots. For ultra-demanding CRISPR pipelines, leading electrocompetent offerings certify efficiencies above 5 X 10⁹ cfu/µg, which outpaces the ceiling of most chemical counterparts. The competent cells market size for electrocompetent products is forecast to add USD 650 million through 2030 as labs automate transformation steps to match robotic liquid handling throughput.

Innovation within chemical methods continues. Escherichia coli BW25113, a recA+ strain, achieves 100-fold improvements in transformation over XL1-Blue MRF' using an optimized chemical protocol, and records 440- to 1,267-fold boosts in cloning success for large plasmids. Such performance erodes the traditional efficiency gap with electroporation and appeals to institutes lacking electroporators. The competent cells market therefore balances the entrenched cost advantage of chemical formats with the rising performance and automation appeal of electrocompetent lines.

The Competent Cells Market Report is Segmented by Type (Chemically Competent Cells, Electrocompetent Cells), Application (Protein Expression, Cloning & Sub-Cloning, Mutagenesis, Others), End User (Biopharmaceutical Companies, Academic and Research Institutes, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America anchors 42.31% of 2024 revenue owing to deep life-science capital pools, robust regulatory clarity, and a dense network of GMP facilities. Thermo Fisher Scientific's pledge to invest USD 2 billion across 64 manufacturing sites in 37 states secures local bioprocessing capacity that guarantees large call-offs for premium competent cell lots. FDA guidance on cell-substrate characterization further standardizes quality benchmarks, reducing lot rejection risk and favoring domestic suppliers with traceable supply chains. The competent cells market size in North America is projected to surpass USD 1.6 billion by 2030 as CRISPR therapeutics enter late-phase trials.

Asia-Pacific is the growth engine, advancing at 9.43% CAGR through 2030. Japan aims to triple its biotechnology output to 15 trillion yen by 2030, supporting local venture rounds that finance platform strains customized for mammalian and bacterial workflows. China's pivot toward Southeast Asian manufacturing corridors hedges against geopolitical headwinds, linking 600 million potential patients to lower-cost biologics factories. India's biologics roadmap targets USD 12 billion value by 2025, and policy incentives for biosimilars energize local CDMOs that procure automation-ready competent cells at scale.

Europe sustains steady uptake through entrenched pharmaceutical hubs in Germany, Ireland, and Switzerland. The Hovione-iBET venture ViSync Technologies demonstrates how contract formulators team with academic institutes to solve stability and delivery hurdles for complex biologics. EMA guidelines on advanced therapy medicinal products align with FDA standards, facilitating trans-Atlantic supplier qualification. EU-funded Horizon projects encourage university participation in industrial biomanufacturing, lifting baseline demand for research-grade competent cells. Collectively, regional cooperation keeps the competent cells market in Europe on a balanced trajectory despite slower underlying population growth.

- Thermo Fisher Scientific

- Merck

- New England Biolabs

- Agilent Technologies

- Takara Bio

- Promega

- Zymo Research

- Avantor

- Intact Genomics

- Scarab Genomics

- Lucigen

- Genscript

- Tonbo Biosciences

- Enzynomics

- NZYTech

- QIAGEN

- Bio-Rad Laboratories

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Commercial Demand & Continuous Academic/Government Support

- 4.2.2 Expanding Biologics & Recombinant Protein Pipelines

- 4.2.3 Adoption Of High-Throughput Automation-Friendly Formats

- 4.2.4 Rising CRISPR Gene-Editing Workflows Needing Ultra-High Efficiency Cells

- 4.2.5 Growth Of Synthetic Biology & Cell-Free Systems

- 4.2.6 Regional Capacity-Building Funds for Life-Science Manufacturing

- 4.3 Market Restraints

- 4.3.1 High R&D And Production Costs

- 4.3.2 Market Consolidation & Difficult Entry for Start-Ups

- 4.3.3 Cold-Chain Fragility in Emerging Nations

- 4.3.4 Shift Toward Synthetic Gene Circuits That Bypass Transformation

- 4.4 Regulatory Landscape

- 4.5 Porters Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Cell Type

- 5.1.1 Chemically Competent Cells

- 5.1.2 Electrocompetent Cells

- 5.2 By Application

- 5.2.1 Protein Expression

- 5.2.2 Cloning & Sub-cloning

- 5.2.3 Mutagenesis

- 5.2.4 Others

- 5.3 By End User

- 5.3.1 Biopharmaceutical Companies

- 5.3.2 Contract Research/Manufacturing Organizations (CROs/CDMOs)

- 5.3.3 Academic and Research Institutes

- 5.3.4 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global overview, Market overview, Core Segments, Financials, Strategic Info, Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Thermo Fisher Scientific

- 6.3.2 Merck KGaA

- 6.3.3 New England Biolabs

- 6.3.4 Agilent Technologies

- 6.3.5 Takara Bio

- 6.3.6 Promega Corporation

- 6.3.7 Zymo Research

- 6.3.8 Avantor

- 6.3.9 Intact Genomics

- 6.3.10 Scarab Genomics

- 6.3.11 Lucigen

- 6.3.12 GenScript

- 6.3.13 Tonbo Biosciences

- 6.3.14 Enzynomics

- 6.3.15 NZYTech

- 6.3.16 Qiagen

- 6.3.17 Bio-Rad Laboratories

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment