PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846337

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846337

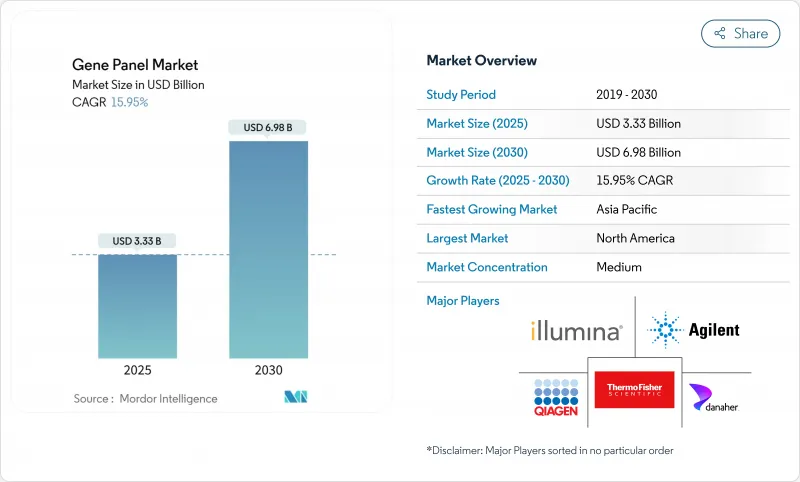

Gene Panel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The gene panel market stands at USD 3.33 billion in 2025 and is projected to reach USD 6.98 billion by 2030, advancing at a 15.95% CAGR.

Growing clinical adoption, expanding payer coverage, and AI-enabled interpretation technologies underpin this rapid scale-up. Larger commercial laboratories adopt multi-cancer and pharmacogenomic panels as bundled services, spurring reagent demand and repeat testing volumes. Payer acceptance widens following the Centers for Medicare & Medicaid Services (CMS) National Coverage Determination 90.2 and parallel private-insurer guidelines, easing the reimbursement barrier for high-complexity assays . At the same time, global population-scale sequencing initiatives and newborn screening pilots broaden the addressable test universe. Competitive intensity increases as full-stack providers knit sequencing platforms, informatics, and clinical reporting into single-vendor solutions, accelerating consolidation within the gene panel market.

Global Gene Panel Market Trends and Insights

Accelerating Oncology-Focused Clinical Adoption Through NGS Reimbursement Expansion

Expanded payer coverage transforms oncology testing economics and speeds the shift from sequential single-gene assays to comprehensive panels. CMS Local Coverage Determination L37810 now covers advanced solid tumors, while Blue Cross Blue Shield networks codify medical-necessity criteria such as pre-test counseling and relevant family histories. Value-based care reimbursement aligns with upfront genomic profiling because early molecular stratification reduces downstream chemotherapy failures. Community oncology practices adopt panel testing as standard of care, shortening diagnostic odysseys and boosting targeted-therapy utilization. Laboratories leverage this demand spike by bundling tissue and blood-based assays, thereby enlarging the total order value per patient. The resulting volume gains reinforce economies of scale and lower the unit cost curve across the gene panel market.

AI-Powered Interpretation Tools Slashing VUS Rates and Turnaround Times

Artificial-intelligence engines digest millions of prior case variants and real-world outcomes, converting raw NGS data into concise clinical reports within hours. Invitae's Clinical Variant Modeling lowered variants of uncertain significance by 24% for Lynch syndrome genes across 4 million samples . QIAGEN's QCI Interpret now handles 850,000 cases annually, delivering batch-level interpretation for high-throughput laboratories . Early deployments show 30-50% reductions in report-generation labor and meaningful acceleration of patient management decisions. Academic consortia such as AI-MARRVEL demonstrate 98% precision in rare-disease variant classification, doubling diagnostic yields over traditional curation workflows. As AI models continue to learn from federated clinical repositories, algorithmic interpretation becomes a must-have differentiator across the gene panel market.

Escalating Bioinformatics Workforce Shortage

Clinical labs confront a tight supply of accredited variant scientists as test complexity rises. Training pipelines lag behind job growth, with only 20 U.S. molecular genetics fellowship slots graduating annually. AI tools offset routine interpretation, but oversight roles still require certified professionals, creating bottlenecks in high-volume centers. African initiatives under H3Africa demonstrate similar gaps, prompting distance-learning programs for local researchers. Until broad upskilling closes the gap, turnaround-time gains from sequencing hardware will be capped, moderating expansion of the gene panel market.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Prevalence of Multi-Gene Pharmacogenomic Labels in FDA Approvals

- Wider Integration Into Newborn and Carrier Screening Programs

- Data Sovereignty and Cross-Border Transfer Restrictions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Testing Services revenue is on track for a 16.77% CAGR through 2030, reflecting laboratories' pivot from kit sales toward bundled sequencing-plus-interpretation offerings. The gene panel market size for Testing Services is projected to climb as reimbursement and clinician familiarity encourage send-out testing. Multi-gene oncology panels anchor referral volumes, enabling labs to amortize infrastructure and cross-sell pharmacogenomic screening.

Test Kits remain foundational, holding 65.45% revenue share in 2024 because hospitals still value in-house control over sample flows. Yet as CLIA-certified labs like Labcorp integrate Invitae's oncology assets, they gain the scale to undercut hospital lab costs while guaranteeing 10-day turnaround for complex cases. Bioinformatics-only subscriptions-classified in the Others segment-grow as laboratories license AI pipelines such as QIAGEN QCI Interpret to process legacy FASTQ files, opening an asset-light entry path for regional players.

Amplicon-based methods generated 62.34% of total revenue, underpinned by rapid PCR amplification workflows suited to FFPE tissue and liquid biopsy applications. Nevertheless, hybridization capture systems will deliver a 16.71% CAGR to 2030, increasing their contribution as laboratories prioritize even coverage over speed for comprehensive genomic profiling.

The gene panel market share held by amplicon platforms erodes gradually because hybrid capture demonstrates lower GC-bias and superior detection of copy-number variants in high-throughput oncology testing. Vendors like Roche and QIAGEN commercialize ready-to-run capture panels for circulating tumor DNA, allowing community labs to deploy liquid biopsy with minimal validation. Enzymatic DNA synthesis, while nascent, promises longer oligo length and greener chemistry, setting the stage for custom panel manufacturing at scale and further reshaping technique preferences.

The Gene Panel Market is Segmented by Products & Services (Test Kits, Testing Services, Others), Technique (Amplicon-Based, Hybridization Capture, Others), Application (Cancer Risk Assessment, Pharmacogenetics, and More), End User (Hospitals and Clinics, Diagnostic Laboratories, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 42.45% of global revenue in 2024, buoyed by CMS coverage under National Coverage Determination 90.2 and private-payer parity laws. U.S. reference labs roll out tumor-agnostic panels paired with real-time prescription decision support, capturing recurrent monitoring orders. Canada trials pan-province pharmacogenomic reimbursement frameworks to mitigate adverse drug events, while Mexico's national genomics consortium negotiates cross-border sample logistics and shared variant databases.

Asia-Pacific is the fastest growing geography with a 16.87% CAGR to 2030. China's newborn sequencing pilots span more than 20 provincial hospitals, demonstrating cost per sample under USD 150 by pooling barcoded libraries. India's GenomeIndia project seeds regional testing hubs and incentivizes private labs to meet a projected 12-million sample backlog by 2030. South Korea's Welfare Genome Project links lifestyle coaching apps to sequencing results, increasing test completion rates and post-test engagement. Meanwhile, Japan's national insurance funds 2 comprehensive cancer panels per patient lifetime, though rural access disparities persist due to specialist concentration in metropolitan centers.

Europe posts steady adoption as the European Health Data Space clarifies secondary-use rights, albeit at the cost of stricter cross-border transfer compliance. Germany funnels de-identified genomic data into federally managed trusted research environments, catalyzing AI model training partnerships with health-tech start-ups. Switzerland mirrors Japanese reimbursement breadth but contends with patient-awareness gaps in non-urban cantons. Middle East and Africa remain latency markets; however, H3Africa builds local sequencing core facilities and distance-learning programs that nurture the talent base necessary for long-run gene panel market expansion.

- Illumina

- Thermo Fisher Scientific

- Agilent Technologies

- QIAGEN

- Roche

- Danaher

- BGI

- Eurofins

- Novogene Co.

- Guardant Health

- Invitae

- Myriad Genetics

- Color Genomics

- Twist Bioscience

- ArcherDX (Invitae)

- Sophia Genetics

- Personalis Inc.

- Helix OpCo

- Geneseeq Technology

- GENEWIZ (Azenta)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating oncology-focused clinical adoption (NGS reimbursement expansion, 2025-2027)

- 4.2.2 Increasing prevalence of multi-gene pharmacogenomic labels in FDA approvals

- 4.2.3 Wider integration into newborn & carrier screening programs (post-2026 policy shifts)

- 4.2.4 AI-powered interpretation tools slashing VUS rates and turnaround times

- 4.2.5 Surge in custom gene-panel design demand from decentralized sequencing labs

- 4.2.6 Untapped demand from population-scale genomic initiatives

- 4.3 Market Restraints

- 4.3.1 Escalating bio-informatics workforce shortage

- 4.3.2 Data-sovereignty & cross-border transfer restrictions

- 4.3.3 Payer push-back on large hereditary panels with limited clinical utility

- 4.3.4 Supply-chain fragility for oligo/reagent-grade enzymes

- 4.4 Regulatory Landscape

- 4.5 Porters Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Products and Services

- 5.1.1 Test Kits

- 5.1.2 Testing Services

- 5.1.3 Others

- 5.2 By Technique

- 5.2.1 Amplicon-Based

- 5.2.2 Hybridization Capture

- 5.2.3 Others

- 5.3 By Application

- 5.3.1 Cancer Risk Assessment

- 5.3.2 Pharmacogenetics

- 5.3.3 Congenital & Rare Disorders Diagnosis

- 5.3.4 Carrier Screening

- 5.3.5 Others

- 5.4 By End User

- 5.4.1 Hospitals and Clinics

- 5.4.2 Diagnostic Laboratories

- 5.4.3 Pharmaceutical & Biotech Companies

- 5.4.4 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Illumina Inc.

- 6.3.2 Thermo Fisher Scientific

- 6.3.3 Agilent Technologies Inc.

- 6.3.4 QIAGEN

- 6.3.5 F. Hoffmann-La Roche AG

- 6.3.6 Danaher Corporation

- 6.3.7 BGI Group

- 6.3.8 Eurofins Scientific

- 6.3.9 Novogene Co.

- 6.3.10 Guardant Health

- 6.3.11 Invitae Corporation

- 6.3.12 Myriad Genetics

- 6.3.13 Color Genomics

- 6.3.14 Twist Bioscience

- 6.3.15 ArcherDX (Invitae)

- 6.3.16 Sophia Genetics

- 6.3.17 Personalis Inc.

- 6.3.18 Helix OpCo

- 6.3.19 Geneseeq Technology

- 6.3.20 GENEWIZ (Azenta)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessmen