PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846338

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846338

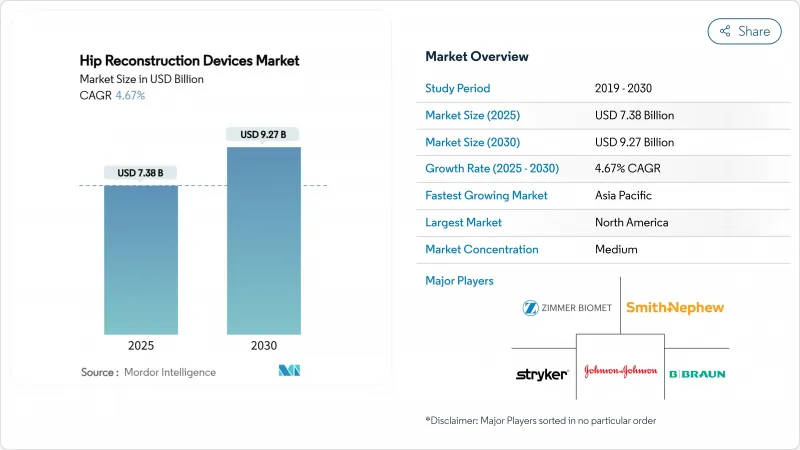

Hip Reconstruction Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Hip Reconstruction Devices Market size is estimated at USD 7.38 billion in 2025, and is expected to reach USD 9.27 billion by 2030, at a CAGR of 4.67% during the forecast period (2025-2030).

Healthy procedure volumes, an aging population, and improved surgical eligibility from GLP-1 weight-loss therapy together lift demand, while cementless fixation and dual-mobility implants capture share through demonstrable outcome gains. Hospitals remain the dominant point of care, yet ambulatory surgical centers (ASCs) are scaling quickly as payers move complex orthopedic procedures to outpatient settings. North America preserves leadership on the back of high implant penetration and early robotic adoption, whereas Asia Pacific outpaces all regions as health-system investments and procurement reforms narrow affordability gaps. Moderate market concentration spurs a steady cadence of acquisitions, and digital surgery platforms create new competitive moats around data and workflow integration.

Global Hip Reconstruction Devices Market Trends and Insights

Rising Incidence of Hip Fractures & Osteoarthritis

Demographic aging intensifies the clinical burden: Asia alone is projected to record 6.3 million hip fractures and incur USD 130 billion in related costs by 2050. The intersection of higher case complexity and better peri-operative optimization is elevating demand for both primary and revision Hip Reconstruction Devices market solutions. Advanced implants with dislocation-resistant designs and enhanced surface coatings increasingly suit patients with multiple comorbidities. Socio-economic development paradoxically elevates need as longer life expectancy exposes populations to degenerative musculoskeletal disease, reinforcing the Hip Reconstruction Devices market growth trajectory in both mature and emerging health systems.

Expanding Geriatric Population

Norway expects hip-fracture incidence to soar 91% in women and 131% in men by 2050 despite constant rates, highlighting the demographic swell facing affluent nations. Globally, nearly half of post-menopausal women are projected to suffer a musculoskeletal disorder by 2045, further widening the Hip Reconstruction Devices market's addressable base. The baby-boomer cohort is entering peak joint-replacement age, a dynamic that simultaneously raises volumes and pushes device makers toward longer-lasting bearings. Revision procedures, already trending up, gain further momentum as earlier-generation implants reach end-of-life, driving uptake of modular and bespoke revision components. Health-system planners respond with expanded surgical capacity and geriatric-orthopedic protocols, fuelling sustained Hip Reconstruction Devices market demand over the long term.

High Procedure & Implant Costs

In 2024, Medicare reimbursed USD 12,553 per THA 5.5% above 2019 levels while China's centralized procurement halved implant prices, demonstrating stark cost asymmetry. Limited GLP-1 drug coverage, affecting nearly two-thirds of eligible patients, further constrains surgical access in obesity-linked osteoarthritis. Elevated index-procedure costs magnify downstream burdens from complications such as periprosthetic infection, pressuring hospitals to prioritize value-based contracts. Device firms counter with additive-manufactured stems and streamlined instrument trays that compress sterilization and logistics expenses. Yet constrained public-sector budgets in emerging markets continue to temper Hip Reconstruction Devices market penetration, especially for premium implants.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Uptake of Minimally-Invasive & Robotic THA

- Shift Toward Outpatient & ASC Settings

- Stringent EU-MDR & FDA Recall Risk

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Primary devices generated the largest revenue slice, representing 41.18% of 2024 hip reconstruction devices market share. Rising surgical volumes among aging yet active cohorts enhance preference for highly cross-linked polyethylene liners and advanced ceramic heads that extend implant longevity. Dual-mobility systems, while smaller today, are accelerating at a 7.41% CAGR to 2030, driven by superior dislocation resistance, especially in high-risk or revision patients. OXINIUM oxide-infused alloy heads achieved 94.1% survivorship at 20 years, translating into 35% fewer revisions versus conventional metal-on-polyethylene pairings. Partial devices preserve a role in hemiarthroplasty for frail femoral-neck-fracture patients, though comparative studies increasingly favor total hip with dual mobility on functional scores. Hip resurfacing retains niche appeal for young athletes due to bone-conserving benefits but faces narrowed indications following metal-ion surveillance.

Additive manufacturing and AI-based templating are enabling bespoke implant geometries, shrinking inventory and optimizing bone preservation. Modular neck-stem constructs cater to complex anatomies yet remain under scrutiny after past corrosion-related recalls. Revision-specific cages and augments see steady uptake as first-generation patients outlive implants, enlarging the hip reconstruction devices market size for revision solutions by the end of the decade. Competitive intensity hinges on differentiated surface treatments, advanced bearing couples, and digital planning workflows.

The Hip Reconstruction Devices Market Report is Segmented by Product Type (Primary Hip Reconstruction Devices, Partial Hip Reconstruction Devices, Revision Devices, and More), Fixation Type (Cementless, Cemented, Hybrid, Others), End User (Hospitals, Orthopedic Clinics, and More), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 43.84% of 2024 Hip Reconstruction Devices market revenue, supported by more than 450,000 total-hip arthroplasties annually, mature reimbursement coverage, and early robotic penetration. Cementless stems constitute the standard of care, and dual-mobility adoption is expanding rapidly to curb instability complications. Regulatory vigilance remains elevated, as highlighted by the 2024 Zimmer Biomet recall, yet the depth of clinical data and surgeon familiarity preserves overall momentum.

Europe, although exposed to EU-MDR cost overheads, maintains high per-capita procedure rates and sophisticated revision capabilities. National joint registries fuel evidence-based purchasing, channeling demand toward implants with robust survivorship trajectories. Outpatient migration lags the United States but is accelerating in Scandinavia and the United Kingdom as payers prioritize day-case efficiency.

Asia Pacific is the fastest-growing region, advancing at a 5.39% CAGR thanks to expanding insurance coverage and aging demographics. China's national volume-based procurement strategy trimmed total-hip implant prices by 50%, unlocking significant latent demand while pressuring supplier margins. Japan and South Korea demonstrate high robotic-surgery uptake, whereas India sees proliferation of mid-tier domestic manufacturers producing cost-optimized cementless stems. The Hip Reconstruction Devices market share in this region is set to widen further as tertiary hospitals scale capacity and clinical-outcome reporting improves.

South America and the Middle East & Africa collectively still represent a modest fraction of the Hip Reconstruction Devices market, yet their long-term potential grows with health-system investment and surgeon training exchanges. Colombia, for example, is projected to perform 13,902 hip replacements by 2050, mirroring broader regional orthopedic expansion. Import tariffs and currency volatility remain headwinds, prompting global vendors to weigh localized assembly or strategic partnerships to secure price competitiveness.

- Zimmer Biomet

- Johnson & Johnson

- Stryker

- Smiths Group

- B. Braun (Aesculap)

- MicroPort Orthopedics

- Exactech

- Waldemar Link

- LimaCorporate

- Surgival

- Hip Innovation Technology

- JointMedica

- Corin Group

- DJO Global

- Wright Medical (Tornier)

- Medacta

- Arthrex

- United Orthopedic Corp.

- Conformis

- OrthAlign

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Incidence of Hip Fractures & Osteoarthritis

- 4.2.2 Expanding Geriatric Population

- 4.2.3 Rapid Uptake of Minimally-Invasive & Robotic THA

- 4.2.4 Shift Toward Outpatient & ASC Settings

- 4.2.5 Ai-Driven Surgical Planning & Patient-Specific Implants

- 4.2.6 GLP-1-Induced Obesity Decline Expanding Surgical Eligibility

- 4.3 Market Restraints

- 4.3.1 High Procedure & Implant Costs

- 4.3.2 Stringent EU-MDR & FDA Recall Risk

- 4.3.3 Reimbursement Cuts Causing Implant Shortages

- 4.3.4 Potential Demand Dampening from Weight-Loss Drugs

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Primary Hip Reconstruction Devices

- 5.1.2 Partial Hip Reconstruction Devices

- 5.1.3 Revision Devices

- 5.1.4 Hip Resurfacing Devices

- 5.1.5 Dual-mobility Systems

- 5.1.6 Modular Neck/Stem Components

- 5.1.7 Other Products

- 5.2 By Fixation Type

- 5.2.1 Cementless

- 5.2.2 Cemented

- 5.2.3 Hybrid

- 5.2.4 Others

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Orthopedic Clinics

- 5.3.3 Ambulatory Surgical Centers

- 5.3.4 Specialized Joint-Replacement Centers

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Zimmer Biomet

- 6.3.2 Johnson & Johnson (DePuy Synthes)

- 6.3.3 Stryker

- 6.3.4 Smith & Nephew

- 6.3.5 B. Braun (Aesculap)

- 6.3.6 MicroPort Orthopedics

- 6.3.7 Exactech

- 6.3.8 Waldemar Link

- 6.3.9 LimaCorporate

- 6.3.10 Surgival

- 6.3.11 Hip Innovation Technology

- 6.3.12 JointMedica

- 6.3.13 Corin Group

- 6.3.14 DJO Global

- 6.3.15 Wright Medical (Tornier)

- 6.3.16 Medacta

- 6.3.17 Arthrex

- 6.3.18 United Orthopedic Corp.

- 6.3.19 Conformis

- 6.3.20 OrthAlign

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment