PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846339

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846339

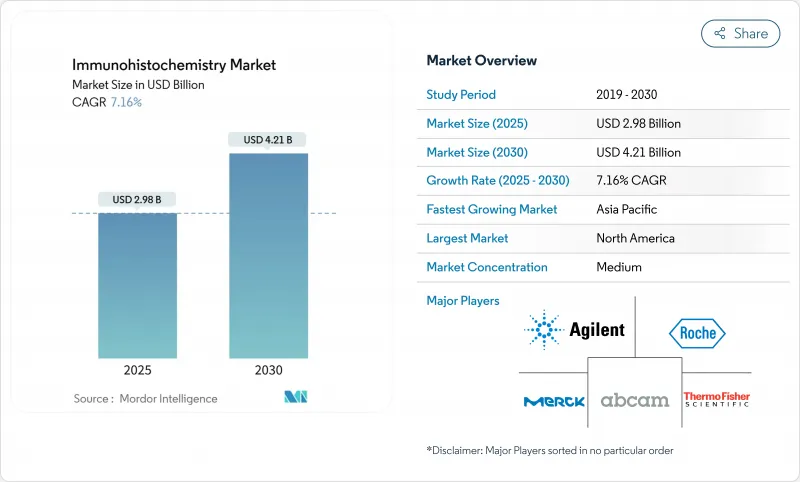

Immunohistochemistry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global immunohistochemistry market is valued at USD 2.98 billion in 2025 and is forecast to reach USD 4.21 billion in 2030, advancing at a 7.16% CAGR.

Growth is supported by rising cancer prevalence, broader use of companion diagnostics, and rapid adoption of AI-enabled multiplex staining workflows that shorten turnaround times while improving diagnostic precision . Increasing digital pathology integration, deeper penetration of automated slide stainers in middle-income laboratories, and mounting investments in drug discovery outsourcing add further momentum. At the same time, the FDA's re-classification of immunohistochemistry assays as medical devices raises compliance costs yet favors large manufacturers that already operate globally certified quality systems. Geographic demand gradually shifts to Asia-Pacific, where expanding oncology infrastructure and manufacturing capacity complement unmet diagnostic needs. Consolidation among suppliers-illustrated by the 2024 Danaher-Abcam deal-signals a competitive emphasis on end-to-end reagent, instrument, and software portfolios.

Global Immunohistochemistry Market Trends and Insights

Rising Prevalence of Cancer

Surging cancer incidence sustains high demand for immunohistochemistry market tests that clarify tumor biology with single-cell resolution . Multiplex staining reveals immune-tumor interactions, guiding checkpoint inhibitor therapy selection. Companion diagnostics broaden treatment eligibility: the FDA cleared HER2-ultralow testing, and zanidatamab's biliary tract indication relies on robust HER2 staining. Rare cancer use cases, such as pemphigus diagnosis via direct immunofluorescence replacement, further expand the immunohistochemistry market .

Ageing Population & Chronic Disease Burden

Longer life expectancy multiplies chronic comorbidities, driving case volumes that stretch existing histopathology capacity. Fewer than 14 pathologists per million population globally and escalating workloads (over 4,000 cases annually in many regions) increase reliance on automation. Hospital laboratories request 20% more immunohistochemistry tests than a decade earlier, while only one-third of clinical sites have implemented digital pathology due to capital constraints. This gap accelerates adoption of AI-enabled slide scanners that standardize staining intensity and scoring, improving throughput without lowering quality.

High Cost of Premium Antibodies & Detection Kits

Two-thirds of commercially available antibodies fail basic specificity tests, forcing labs to run costly in-house validations that inflate per-test expenditure. The YCharOS review of 1,000 antibodies pegged unreproducibility losses at up to USD 1.8 billion annually in the United States alone. Median list prices for monoclonal therapeutics remain between USD 15,624 and USD 143,833, reflecting manufacturing scale limitations despite process improvements. Medicare's Local Coverage Determinations (in force since July 2024) now require rigorous medical-necessity documentation for immunohistochemistry stains, crimping reimbursement for extended panels.

Other drivers and restraints analyzed in the detailed report include:

- Advancements in Multiplex & AI-Assisted Workflows

- Expansion of Companion-Diagnostic Approvals

- Scarcity of Skilled Histopathologists in Low-Income Regions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The antibodies subsegment still anchors 42.23% of immunohistochemistry market share in 2024, confirming its foundational role in every assay run. Software, however, is advancing at an 8.02% CAGR as laboratories migrate to cloud-hosted image analytics that enable multi-institutional algorithm deployment. Roche's VENTANA DP 200 slide scanner integrated with navify Digital Pathology illustrates a seamless pathway from staining through AI scoring. The antibodies category itself evolves: primary monoclonal clones gain validation transparency, while multiplex-ready secondary antibodies amplify low-abundance targets. Equipment upgrades parallel these shifts; automated stainers reduce manual errors and free skilled labor for interpretation tasks. As open-source tools such as QuPath and HistoQC improve image standardization, laboratories in mid-income countries adopt digital platforms more swiftly, reinforcing software's strategic importance across the immunohistochemistry market.

In kits and reagents, companion diagnostic approvals influence purchasing decisions because oncologists require strict lot-to-lot reproducibility. Slide scanners and tissue microarrayers converge to support high-throughput translational research. Manufacturers respond with quality-assured reagent bundles to ease compliance under the FDA's device re-classification rule. This interplay secures software's elevation from ancillary tool to core revenue contributor, setting the stage for double-digit growth through 2030 in the immunohistochemistry market.

Diagnostics retained 61.44% of immunohistochemistry market size in 2024, mirroring routine oncology workflows across hospitals. Yet drug discovery and testing climbs fastest at an 8.14% CAGR as pharmaceutical sponsors externalize tissue analysis to contract research organizations. ICON plc exemplifies this pivot, offering custom immunohistochemistry assay development on Ventana Benchmark ULTRA platforms within CAP-licensed labs. Outsourcing benefits from immunohistochemistry market economies of scale: centralized sites process thousands of slides daily and deploy AI to flag outliers, reducing cycle time for biomarker qualification.

Beyond oncology, tissue-based assays inform infectious disease and autoimmune research. Spatial omics couples immunohistochemistry with high-plex RNA mapping, affording multi-omic context that accelerates target discovery. Laboratory automation and algorithm-driven scoring boost reproducibility, assuring sponsors of data integrity. As regulatory agencies emphasize tissue evidence in drug approval packages, contract labs expand capacity, reinforcing the segment's momentum throughout the forecast period.

The Immunohistochemistry Market Report is Segmented by Product (Antibodies [Primary Antibodies, Secondary Antibodies], Equipment, and More), Application (Diagnostics, Drug Discovery and Testing), End-User (Hospitals and Diagnostic Centres, and More), Detection Method (Direct, Indirect), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commands 41.45% of 2024 revenue, buoyed by established reimbursement, early AI deployment, and frequent companion diagnostic approvals. However, laboratories must absorb compliance spending of USD 566 million-3.56 billion under the FDA's 2024 laboratory-developed test rule, prompting strategic partnerships with larger IVD manufacturers. Digital pathology adoption, currently 33% of clinical sites, is expected to accelerate as capital budgets migrate toward image management platforms that unlock remote sub-specialist reads.

Asia-Pacific exhibits the highest growth at 8.21% CAGR, driven by rising oncology incidence, expanding biomanufacturing capacity, and public hospital upgrades. China and India channel stimulus funds into cancer centers outfitted with automated slide stainers, though workforce shortages remain acute. Pathologist density in Pakistan stands at one per 450,000 people, restraining the speed of advanced immunohistochemistry market adoption. Investment in AI-enabled scoring tools offers partial mitigation, allowing less-experienced staff to triage simple cases.

Europe grows steadily on the back of CE-IVDR alignment and expanding precision medicine rollouts. Germany and France lead in digital platform deployments, while Southern and Eastern states lag due to reimbursement gaps: Bulgaria restricts coverage to limited breast malignancy markers, shifting costs to patients. Regional quality programs such as NordiQC boosted biomarker pass rates from 71% in 2017 to 79% in 2021, underscoring a continental push toward assay standardization.

- Roche

- Agilent Technologies

- Thermo Fisher Scientific

- Danaher Corp. (Leica Biosystems)

- Merck

- Abcam

- Bio-Rad Laboratories

- PerkinElmer

- Cell Signaling Technology

- Bio SB

- Sakura Finetek Japan Co.

- Biocare Medical

- Enzo Biochem

- Lunaphore Technologies SA

- Vector Laboratories

- 3DHistech

- Fluidigm (Standard BioTools)

- Qritive Pte Ltd.

- Miltenyi Biotec

- Genemed Biotechnologies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Cancer

- 4.2.2 Ageing Population & Chronic Disease Burden

- 4.2.3 Advancements In Multiplex & AI-Assisted IHC Workflows

- 4.2.4 Expansion Of Companion-Diagnostic Approvals for Targeted Oncology Drugs

- 4.2.5 Growth Of Tissue-Based Biomarker Discovery in Pharma Outsourcing

- 4.2.6 Accessibility Of Low-Cost Automated Slide Stainers in Emerging Labs

- 4.3 Market Restraints

- 4.3.1 High Cost of Premium Antibodies & Detection Kits

- 4.3.2 Scarcity Of Skilled Histopathologists in Low-Income Regions

- 4.3.3 Reimbursement Gaps for Advanced IHC Panels

- 4.3.4 Supply-Chain Fragility for Critical Reagents

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porters Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Antibodies

- 5.1.1.1 Primary Antibodies

- 5.1.1.2 Secondary Antibodies

- 5.1.2 Equipment

- 5.1.2.1 Automated Slide Stainers

- 5.1.2.2 Tissue Microarrayers

- 5.1.2.3 Slide Scanners

- 5.1.2.4 Others

- 5.1.3 Kits and Reagents

- 5.1.4 Software

- 5.1.1 Antibodies

- 5.2 By Application

- 5.2.1 Diagnostics

- 5.2.1.1 Cancer

- 5.2.1.2 Infectious Diseases

- 5.2.1.3 Auto-immune Diseases

- 5.2.1.4 Others

- 5.2.2 Drug Discovery and Testing

- 5.2.1 Diagnostics

- 5.3 By End-User

- 5.3.1 Hospitals and Diagnostic Centres

- 5.3.2 Academic and Research Institutes

- 5.3.3 Contract Research Organizations

- 5.3.4 Others

- 5.4 By Detection Method

- 5.4.1 Direct

- 5.4.2 Indirect

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 F. Hoffmann-La Roche AG

- 6.3.2 Agilent Technologies Inc.

- 6.3.3 Thermo Fisher Scientific Inc.

- 6.3.4 Danaher Corp. (Leica Biosystems)

- 6.3.5 Merck KGaA

- 6.3.6 Abcam plc

- 6.3.7 Bio-Rad Laboratories Inc.

- 6.3.8 PerkinElmer Inc.

- 6.3.9 Cell Signaling Technology Inc.

- 6.3.10 Bio SB Inc.

- 6.3.11 Sakura Finetek Japan Co.

- 6.3.12 Biocare Medical LLC

- 6.3.13 Enzo Life Sciences Inc.

- 6.3.14 Lunaphore Technologies SA

- 6.3.15 Vector Laboratories Inc.

- 6.3.16 3DHISTECH Ltd.

- 6.3.17 Fluidigm (Standard BioTools)

- 6.3.18 Qritive Pte Ltd.

- 6.3.19 Miltenyi Biotec

- 6.3.20 Genemed Biotechnologies Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment