PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846341

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846341

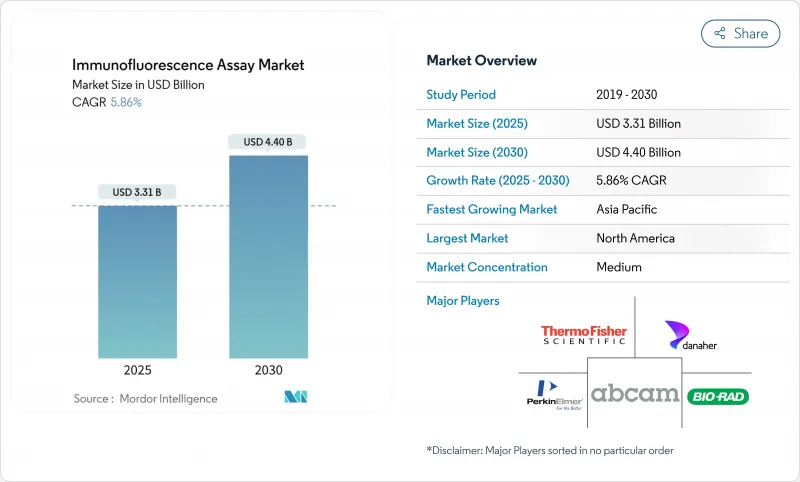

Immunofluorescence Assay - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Immunofluorescence Assay Market size is estimated at USD 3.31 billion in 2025, and is expected to reach USD 4.40 billion by 2030, at a CAGR of 5.86% during the forecast period (2025-2030).

Growth reflects the migration from manual fluorescence microscopy to AI-enabled digital pathology systems that streamline image analysis and raise diagnostic precision. Expansion is reinforced by the wider use of companion diagnostics in precision medicine, continued infectious-disease surveillance, and investment in microfluidic point-of-care platforms suited to resource-limited settings. Capital equipment upgrades toward automated instruments, together with large hospital groups adopting standardized laboratory-developed test protocols, further propel the immunofluorescence assay market. However, cost pressure from advanced microscopes and tightened disposal rules on PFAS-based fluorophores temper near-term adoption.

Global Immunofluorescence Assay Market Trends and Insights

Rising Incidence of Cancer and Infectious Diseases

Cancer prevalence and lingering infectious-disease burdens elevate demand for multiplex immunofluorescence platforms that detect tumor markers and pathogens in the same run. Multi-cancer early-detection tests demonstrating 95.4% accuracy showcase the value of high-sensitivity fluorescence imaging in population screening. Parallel advances in tuberculosis point-of-care assays adapted from COVID-19 workflows highlight how existing test infrastructure can be repurposed to serve broader disease-monitoring programs. This dual-utility profile underpins the growth momentum observed across the immunofluorescence assay market.

Expanding Governmental and NGO Funding

Targeted grants and health-system modernization schemes accelerate platform rollouts, notably portable fluorescence readers that function in decentralized settings. The European Medicines Agency's backing of novel tuberculosis diagnostics underscores a public-sector push for rapid, high-specificity tests. In the United States, the FDA estimates USD 3.51 billion annualized benefits tied to standardized laboratory-developed test oversight, encouraging labs to adopt compliant automated instruments. Such funding channels directly influence purchase decisions in the immunofluorescence assay market.

Availability of Alternative High-Throughput Assay Formats

Next-generation sequencing and label-free multiphoton imaging now deliver higher multiplexing and quantitative rigor, siphoning projects that would traditionally rely on immunofluorescence. Microfluidic biosensors that work directly with body fluids further tighten competition by trimming sample volume and turnaround time. Single-cell analysis technologies are providing unprecedented insights into cellular heterogeneity and disease mechanisms, offering research capabilities that complement but may eventually supersede certain immunofluorescence applications. The integration of artificial intelligence with these alternative platforms is accelerating their adoption by reducing technical complexity and improving diagnostic accuracy, creating sustained competitive pressure on immunofluorescence market growth.

Other drivers and restraints analyzed in the detailed report include:

- Growing Use of Companion Diagnostics and Precision Medicine

- Multiplex Spatial-Omics IF Platforms in Drug Discovery

- High Capital Cost of Advanced Fluorescence Microscopes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, reagents and kits generated 62.23% of revenue, yet instrument sales are rising fastest at 6.95% CAGR as labs pivot to automation. Platform providers couple hardware with image-analysis software in subscription bundles, smoothing cash-flow hurdles and nurturing multi-year service contracts. Upgradable spectral-flow cytometers and remote-monitored slide stainers exemplify how modular designs stretch asset lifecycles and speed return on investment.

Accessory purchases scale proportionally, covering slide loaders, calibration beads, and barcode scanners. As AI modules demand consistent illumination and precise stage control, buyers increasingly treat high-resolution objectives and environmental enclosures as integral parts of platform modernization. This ecosystem view anchors long-range procurement plans across the immunofluorescence assay market.

Indirect techniques kept 65.63% share in 2024 thanks to established autoimmune protocols, yet direct immunofluorescence exhibits stronger appetite from oncology programs requiring rapid single-step staining. Adoption climbs as pathologists value shorter assay cycles when guiding intraoperative decisions. Rising HER2-low breast-cancer testing illustrates how direct conjugates support quantitative thresholding without amplification artifacts.

Indirect methods retain importance for broad screens such as antinuclear antibody panels, leveraging HEp-2 substrates to visualize multiple autoantibody classes concurrently. Their cost-effectiveness and existing reimbursement codes ensure continued dominance in routine labs. Still, the immunofluorescence assay market anticipates incremental share migration to direct formats where turnaround and specificity trump batch economy.

The Immunofluorescence Assay Market Report is Segmented by Product (Reagents and Kits, Instruments, Accessories), Immunofluorescence Type (Indirect Immunofluorescence, Direct Immunofluorescence), Application (Cancer Diagnostics and Research, and More), End User (Hospital and Reference Laboratories, and More), and Geography (North America, Europe, and More. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 40.02% of global revenue in 2024, benefiting from large installed bases of automated slide scanners and a supportive FDA pathway that clarifies quality-system expectations. High per-capita healthcare spending enables faster replacement cycles, and tax incentives for capital investment reduce adoption risk for mid-sized hospitals. Corporate activity, such as Thermo Fisher Scientific's USD 3.1 billion purchase of Olink, consolidates platform portfolios and widens menu offerings, reinforcing regional leadership.

Europe follows closely, aided by stringent but predictable IVDR frameworks that encourage harmonized performance claims. The immunofluorescence assay market size for the region benefits from cross-border reimbursement pacts and Horizon Europe research funding that underwrites large biomarker consortia. Extended IVDR transition deadlines give SMEs breathing room to complete conformity assessments without halting product availability.

Asia-Pacific is the fastest-growing territory at 7.26% CAGR through 2030. China's domestic champions, such as Autobio Diagnostics, scale high-volume analyzer production, lowering cost-per-test and expanding access in county-level hospitals. India sees indigenous firms like Meril Diagnostics tailoring microfluidic fluorescence cartridges for endemic infections, supporting double-digit rural market growth. Government-sponsored health-insurance schemes further unlock demand for decentralized diagnostics, propelling the immunofluorescence assay market across Southeast Asia.

- Abcam

- Thermo Fisher Scientific

- Danaher (Leica Biosystems & Molecular Devices)

- Bio-Rad Laboratories

- Merck

- Becton Dickinson (BD)

- PerkinElmer

- Cell Signaling Technology

- Enzo Life Sciences

- Werfen (Inova Diagnostics)

- Sino Biological

- Agilent Technologies (Dako)

- Roche

- Bio-Techne (R&D Systems)

- GeneTex

- Rockland Immunochemicals

- Miltenyi Biotec

- Olympus Corporation (Evident)

- Zeiss Microscopy

- Genscript Biotech

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Incidence of Cancer and Infectious Diseases

- 4.2.2 Expanding Governmental and NGO Funding

- 4.2.3 Growing Use of Companion Diagnostics and Precision Medicine

- 4.2.4 Multiplex Spatial-Omics IF Platforms in Drug Discovery

- 4.2.5 AI-Enabled Digital Pathology Driving Decentralized IF Adoption

- 4.2.6 Microfluidic Point-Of-Care IF Kits in Emerging Markets

- 4.3 Market Restraints

- 4.3.1 Availability Of Alternative High-Throughput Assay Formats

- 4.3.2 High Capital Cost of Advanced Fluorescence Microscopes

- 4.3.3 Photobleaching & Inter-Lab Variability Hurting Trial Reproducibility

- 4.3.4 Environmental Rules on Fluorophore/PFAS Waste

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Reagents and Kits

- 5.1.2 Instruments

- 5.1.3 Accessories

- 5.2 By Immunofluorescence Type

- 5.2.1 Indirect Immunofluorescence

- 5.2.2 Direct Immunofluorescence

- 5.3 By Application

- 5.3.1 Cancer Diagnostics and Research

- 5.3.2 Infectious Disease Testing

- 5.3.3 Autoimmune Disease Testing

- 5.3.4 Others

- 5.4 By End User

- 5.4.1 Hospital and Reference Laboratories

- 5.4.2 Pharmaceutical and Biotechnology Companies

- 5.4.3 Academic and Research Institutes

- 5.4.4 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abcam

- 6.3.2 Thermo Fisher Scientific Inc.

- 6.3.3 Danaher (Leica Biosystems & Molecular Devices)

- 6.3.4 Bio-Rad Laboratories

- 6.3.5 Merck KGaA (Millipore Sigma)

- 6.3.6 Becton Dickinson (BD)

- 6.3.7 PerkinElmer

- 6.3.8 Cell Signaling Technology

- 6.3.9 Enzo Life Sciences

- 6.3.10 Werfen (Inova Diagnostics)

- 6.3.11 Sino Biological

- 6.3.12 Agilent Technologies (Dako)

- 6.3.13 Roche Diagnostics

- 6.3.14 Bio-Techne (R&D Systems)

- 6.3.15 GeneTex

- 6.3.16 Rockland Immunochemicals

- 6.3.17 Miltenyi Biotec

- 6.3.18 Olympus Corporation (Evident)

- 6.3.19 Zeiss Microscopy

- 6.3.20 Genscript Biotech

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment