PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846344

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846344

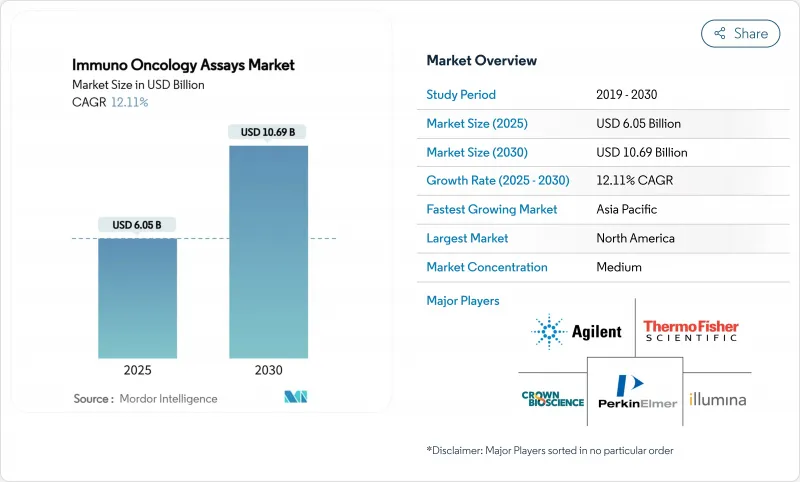

Immuno Oncology Assays - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The immuno Oncology assays market stands at USD 6.05 billion in 2025 and is forecast to reach USD 10.69 billion by 2030, reflecting a healthy 12.11% CAGR.

Rising global cancer incidence, steady regulatory support for companion diagnostics, and accelerating adoption of spatial biology platforms combine to spur demand for sophisticated immune profiling tests. Growing pharma-diagnostic partnerships shorten validation timelines and expand test menus, while artificial intelligence (AI) integration strengthens assay accuracy and throughput. North America maintains leadership through favorable reimbursement, but Asia-Pacific records the fastest uptake as healthcare infrastructure matures and clinical trial activity rises. Competitive strategies increasingly hinge on multi-omics integration and real-world evidence generation, positioning agile technology providers to capture sizeable share in community oncology settings.

Global Immuno Oncology Assays Market Trends and Insights

Expanding Adoption of Immune-Checkpoint Inhibitors

Immune-checkpoint inhibitors reshape the therapeutic landscape, prompting wider deployment of companion tests that gauge PD-L1 status, tumor mutational burden, and microsatellite stability. Multiple FDA approvals in 2025, such as tislelizumab plus chemotherapy for esophageal squamous cell carcinoma and pembrolizumab-trastuzumab for HER2-positive gastric cancer, emphasise the need for robust predictive assays. The Society for Immunotherapy of Cancer lists biomarker panels that now guide routine clinical decision-making. Spatial omics platforms further refine response prediction, enabling multidimensional tumour micro-environment analysis that elevates assay specificity.

AI-Driven Multiplex Spatial Profiling Boosting Biomarker Discovery

Coupling AI with spatial biology technology uncovers cellular interactions previously hidden by conventional approaches. The Garvan Institute's AAnet tool exemplifies this progress by differentiating five tumour-resident cell types to inform therapeutic strategies. Commercial systems such as the Hyperion XTi Imaging Mass Cytometer visualise 40+ markers simultaneously without autofluorescence noise, fostering deeper biomarker pipelines. Research in Molecular Cancer confirms that high-resolution 3D histology enhances understanding of tumour heterogeneity, accelerating assay innovation.

High Assay Costs & Complex Reimbursement Pathways

Sharp increases in Medicare claim denial rates for NGS-from 16.8% to 27.4% in 2025-illustrate tightening US payer scrutiny. Capital investment exceeding USD 500,000 for full spatial-profiling setups further limits diffusion in community settings. Health technology assessments in Europe add 12-18 months to launch timelines, increasing financial risk for smaller developers. Consequently, price-tiering strategies become essential to sustain uptake in cost-sensitive regions.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Approvals of Companion Dx Assays (PD-1/PD-L1, TMB)

- Pharma-Dx Co-Development Partnerships Accelerating Test Menus

- Stringent Multi-Jurisdiction Regulatory Validation Demands

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Reagents & Antibodies captured 40.12% of the immuno-oncology assays market in 2024, evidencing the consumable-heavy nature of immune testing workflows. Hospital and reference laboratories turn to validated antibody panels to meet SITC-endorsed biomarker requirements. Instruments enjoy steady demand as labs upgrade to imaging-mass-cytometry platforms capable of 40-plus marker detection.

Software & Analytics, projected to post a 12.67% CAGR through 2030, benefits from AI modules that automate cell-phenotype mapping and cloud-based data sharing. The Garvan Institute's AAnet and similar solutions lower analysis times, creating new revenue streams for digital pathology vendors. This software upsurge diversifies revenue composition within the immuno-oncology assays market.

Next-Generation Sequencing retained 37.67% share of the immuno-oncology assays market in 2024, remaining indispensable for broad mutational scans. High-depth panel sequencing supports tumour mutational burden calculation, directly guiding checkpoint inhibitor use.

Multiplex Spatial Profiling, forecast to grow at 12.71% CAGR, permits single-cell resolution mapping of protein and RNA markers within intact tissues. Illumina's whole-transcriptome spatial platform highlights this shift toward context-rich analytics. Immunoassay, PCR, and flow cytometry modalities maintain complementary roles for targeted or high-throughput applications, collectively sustaining technology diversity inside the immuno-oncology assays market.

The Global Immuno-Oncology Assays Market Report is Segmented by Product (Reagents & Antibodies, Instruments, and More), Technology (Immunoassay, PCR, and More), Assay Type (CDx, Ldts, RUO), Indication (Lung, Colorectal, Melanoma, Breast, Other Cancers), Sample Type (Tissue, Liquid Biopsy), and Geography (North America, Europe, Asia-Pacific, MEA, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 42.34% of 2024 global revenue through favourable reimbursement, early AI adoption, and dense networks of comprehensive cancer centres. Medicare's evolving coverage for NGS diagnostics still poses short-term reimbursement uncertainty, but strong private-payer frameworks keep overall growth intact.

Europe maintains balanced progress as health technology assessments verify clinical benefit before wide rollout. EMA's approval of agents such as tislelizumab shows regional commitment to immunotherapeutic expansion. Although multiple national approval layers can delay diagnostics launches, streamlined EU IVDR-compliant pathways promise to shorten time-to-market after 2026.

Asia-Pacific leads growth at a 12.86% CAGR as China deploys national cancer screening programs and Japan subsidises genomic testing. Emerging precision-medicine hubs in India and South Korea further stimulate demand. Simplified regulatory fast-tracks for innovative devices improve access, giving international suppliers a sizeable addressable base in the immuno-oncology assays market.

Middle East & Africa witnesses incremental uptake as Gulf states invest in oncology centres of excellence and procure multiplex platforms. South America records steady progress, led by Brazil's public-private oncology partnerships and Argentina's inclusion of genomic testing in national guidelines. Varying reimbursement coverage still restricts volume but long-term incidence trends underpin latent demand.

- Agilent Technologies

- Thermo Fisher Scientific

- Illumina

- PerkinElmer

- Roche

- Merck

- HTG Molecular Diagnostics

- Crown Bioscience

- InSphero

- QIAGEN

- Bio-Rad Laboratories

- NanoString Technologies

- ArcherDx (Invitae)

- Adaptive Biotechnologies

- Sysmex

- Oxford Nanopore Tech.

- Guardant Health

- NeoGenomics

- Foundation Medicine

- Danaher (Leica-Cytiva)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Sustained rise in Global Cancer Incidence

- 4.2.2 Expanding Adoption of Immune-checkpoint Inhibitors

- 4.2.3 Regulatory Approvals of Companion Dx Assays (PD-1/PD-L1, TMB)

- 4.2.4 Pharma-Dx Co-development Partnerships Accelerating Test Menus

- 4.2.5 AI-driven Multiplex Spatial Profiling Boosting Biomarker Discovery

- 4.2.6 Decentralised Liquid-biopsy Testing in Community Oncology

- 4.3 Market Restraints

- 4.3.1 High Assay Costs & Complex Reimbursement Pathways

- 4.3.2 Stringent Multi-jurisdiction Regulatory Validation Demands

- 4.3.3 Scarcity of Well-annotated Matched Tumour/normal Biobanks

- 4.3.4 Lack of Global Standardisation in Multiplex Assay Protocols

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value-USD)

- 5.1 By Product

- 5.1.1 Reagents & Antibodies

- 5.1.2 Instruments

- 5.1.3 Software & Analytics

- 5.1.4 Consumables & Accessories

- 5.2 By Technology

- 5.2.1 Immunoassay (ELISA, CLIA)

- 5.2.2 Polymerase Chain Reaction (PCR/qPCR/ddPCR)

- 5.2.3 Next-Generation Sequencing (NGS)

- 5.2.4 Flow Cytometry

- 5.2.5 Multiplex Spatial Profiling (mIF, IMC, DSP)

- 5.3 By Assay Type

- 5.3.1 Companion Diagnostic (CDx) Assays

- 5.3.2 Laboratory-Developed Tests (LDTs)

- 5.3.3 Research-Use-Only (RUO) Panels

- 5.4 By Indication

- 5.4.1 Lung Cancer

- 5.4.2 Colorectal Cancer

- 5.4.3 Melanoma

- 5.4.4 Breast Cancer

- 5.4.5 Other Cancers

- 5.5 By Sample Type

- 5.5.1 Tissue Biopsy

- 5.5.2 Liquid Biopsy (Blood, Plasma, cfDNA)

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)}

- 6.3.1 Agilent Technologies

- 6.3.2 Thermo Fisher Scientific

- 6.3.3 Illumina

- 6.3.4 PerkinElmer

- 6.3.5 Roche

- 6.3.6 Merck KGaA

- 6.3.7 HTG Molecular Diagnostics

- 6.3.8 Crown Bioscience

- 6.3.9 InSphero

- 6.3.10 Qiagen

- 6.3.11 Bio-Rad Laboratories

- 6.3.12 NanoString Technologies

- 6.3.13 ArcherDx (Invitae)

- 6.3.14 Adaptive Biotechnologies

- 6.3.15 Sysmex

- 6.3.16 Oxford Nanopore Tech.

- 6.3.17 Guardant Health

- 6.3.18 NeoGenomics

- 6.3.19 Foundation Medicine

- 6.3.20 Danaher (Leica-Cytiva)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment