PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846348

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846348

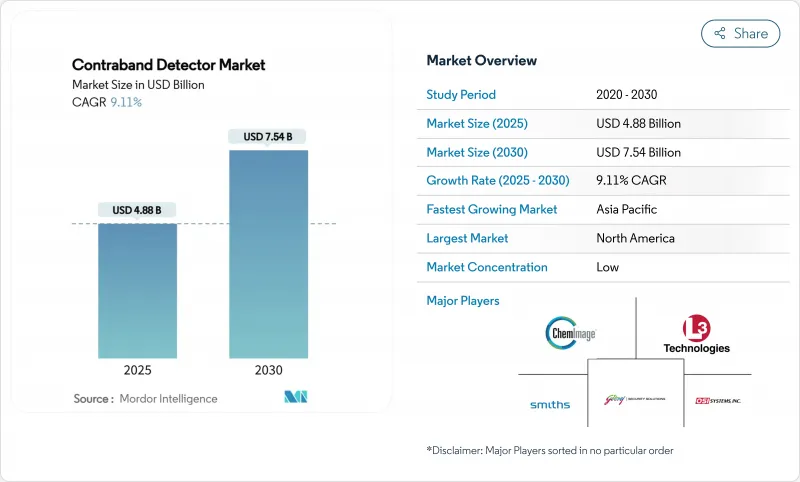

Contraband Detector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Contraband Detector Market size is estimated at USD 4.88 billion in 2025, and is expected to reach USD 7.54 billion by 2030, at a CAGR of 9.11% during the forecast period (2025-2030).

Equipment upgrades are propelled by regulatory deadlines for air-cargo screening, the surge in synthetic opioid trafficking, and national infrastructure programs that modernize airports, seaports, and land borders. Budgeted investments including the Transportation Security Administration's USD 89.6 million for new checkpoint property screening systems and USD 9.3 million for credential-authentication units demonstrate institutional commitment to next-generation capabilities. Suppliers capture predictable demand by offering modular platforms that integrate AI-enabled analytics, lower false-alarm rates, and support interoperability with existing command-and-control frameworks. At the same time, supply-chain friction in semiconductors and rising component costs compress margins, encouraging vendors to emphasize software, services, and threat-library subscriptions to defend profitability.

Global Contraband Detector Market Trends and Insights

Mandated Air-Cargo Screening Deadlines Drive Technology Upgrades

Regulatory compliance deadlines in the United States and European Union compel airport operators to refresh detection fleets ahead of standard replacement cycles. The European Commission's reinstatement of liquid-carry limitations for C3 scanners in September 2024 forced hubs to operate dual screening lanes, increasing demand for high-speed computed-tomography (CT) lanes that preserve throughput without sacrificing detection depth. Munich Airport's CT rollout in Terminal 2 exceeded USD 150,000 per unit and showcases the capital intensity airports are willing to absorb to ensure compliance. Airports Council International Europe criticized frequent regulatory reversals, arguing that uncertainty depresses ROI on early technology adoption, yet major hubs such as Frankfurt are pressing forward with AI-powered scanners that sustain passenger throughput while meeting evolving standards.

Synthetic Opioid Trafficking Intensifies Detection Technology Demands

International parcel networks remain the preferred channel for fentanyl traffickers, pressuring customs agencies to procure molecular-level detection capabilities. Customs and Border Protection's recent USD 16.86 million contract for AI-enhanced X-ray algorithms targets fentanyl identification inside unopened parcels. DHS's Rapid Technologies for Drug Interdiction program pursues non-intrusive techniques to analyze chemical signatures without opening packages, alleviating throughput constraints. Industry suppliers such as Smiths Detection responded with the SDX 10060 XDi X-ray diffraction system, which analyzes molecular lattices to improve narcotics accuracy. Together, these actions shift procurement preferences toward detectors capable of real-time chemical analysis integrated with AI analytics.

High Total Cost of Ownership Constrains Advanced System Adoption

CT and neutron-activation platforms require specialized shielding and ongoing operator certification, pushing life-cycle costs beyond the reach of smaller ports. RAND analysis shows supply-chain uncertainty and tariffs inflate semiconductor costs, delaying production runs and pushing acquisition budgets above initial estimates. Airports Council International Europe cites cases where airports paid substantial premiums for advanced scanners, only to face new usage restrictions that obscure payback periods. Consequently, developing markets often defer upgrades, limiting global penetration of neutron-based solutions despite their superior performance against shielded nuclear materials.

Other drivers and restraints analyzed in the detailed report include:

- Infrastructure Modernization Programs Accelerate Border Technology Adoption

- E-commerce Growth Exposes 3PL Security Vulnerabilities

- Government Budget Constraints Create Procurement Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Transmission X-ray technology retained 37% revenue in 2024, anchoring the contraband detector market through its installed base and cost-efficient upgrades. In contrast, terahertz imaging is set for a 10.2% CAGR, bolstered by passive systems that detect metallic and non-metallic threats without ionizing radiation. The European Space Agency reports its THz cameras now operate in 18 countries, spotting concealed weapons up to 10 meters away. Computed-tomography lanes continue to replace legacy 2-D scanners at airports, driving service revenue from algorithm updates. Neutron activation remains niche, constrained by shielding costs, but remains irreplaceable for shielded nuclear-material detection.

Terahertz's momentum stems from academia-to-industry spinouts. For instance, Cambridge Terahertz commercialized MIT research into radar-style THz imaging that produces 3-D point clouds, expanding opportunities in high-footfall venues. AI overlay drives adoption of millimeter-wave personnel scanners in corrections and event venues, minimizing privacy concerns through automatic anomaly visualization rather than raw body images. Trace detection based on ion-mobility spectrometry persists in parcel-screening operations, merging with AI classification to prioritize manual swabs. Vendors thus position multitechnology suites under a single UI, reinforcing replacement-cycle lock-in.

Fixed portals and gantry units anchored 68% of 2024 revenue, but portable devices are outperforming with a 9.8% CAGR as agencies seek rapid deployment for pop-up checkpoints and ad hoc border missions. Missouri's Department of Corrections deployed Tek 84 Intercept full-body scanners costing roughly USD 150,000 each to curb contraband flow in prisons. DHS is piloting handheld millimeter-wave wands to reduce pat-downs at stadium entrances, exploiting AI to highlight anomalies directly on device displays. Interoperability guidelines from U.S. Customs and Border Protection require that portable units feed event logs to central security information management platforms, driving software-defined architectures.

AI-enabled pattern recognition further tilts cost-benefit calculations toward portable gear by reducing operator training hours. Field agents can upload threat images to shared cloud libraries, ensuring consistent detection across dispersed sites. As a result, manufacturers bundle ruggedized tablets, cellular connectivity, and software-as-a-service licenses into multiyear agreements that smooth revenue beyond initial hardware sales.

The Contraband Detector Market Report is Segmented by Detector Technology (X-Ray Backscatter, Transmission X-Ray, and More), Mobility (Fixed, Portable/Handheld), Screening Target (Drugs/Narcotics, Explosives, Weapons, and More), End-User (Airports, Seaports, Law Enforcement, and More), Sales Channel (New Equipment Sales, Aftermarket/Service), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 38% of global revenue in 2024, benefitting from structured procurement and well-funded federal mandates. TSA installed 2,000 credential-authentication units and 267 CT lanes across domestic checkpoints, solidifying its status as lead adopter and reference customer. Yet supply-chain constraints and budget-resolution delays occasionally stall rollouts, prompting program offices to favor modular upgrades that extend existing assets.

Europe follows close behind on the strength of harmonized aviation security codes and the Common Evaluation Process framework for equipment approval. Nevertheless, abrupt regulatory reversals such as the 2024 decision to reinstate liquid restrictions erode operator confidence and may slow adoption of costly scanners. Frontex seizures at EU external borders underline the need for advanced cargo solutions, while privacy concerns in rail networks drive demand for non-ionizing modalities.

Asia-Pacific constitutes the fastest-growing region at a 10.2% CAGR. Trade-facilitation corridors and cross-border e-commerce volumes motivate customs agencies to digitize risk management. China's Smart Customs program feeds 260 billion data records into AI engines that guide real-time inspections, shrinking clearance times and boosting detection yields. Singapore's homeland-security agency recently trialed hyperspectral imaging to elevate threat discrimination at checkpoints. Varying standards across the region encourage suppliers to package configurable software layers that tailor workflows to national doctrines without costly hardware redesigns.

- Smiths Group plc (Smiths Detection)

- OSI Systems Inc. (Rapiscan and ASandE)

- L3Harris Technologies Inc. (Security and Detection)

- Nuctech Company Ltd.

- CEIA SpA

- Metrasens Inc.

- ChemImage Corporation

- Adani Systems Inc.

- Berkeley Varitronics Systems Inc.

- Godrej Security Solutions

- Magal Security Systems Ltd.

- Teledyne IAC

- Leidos Holdings Inc.

- Westminster Group plc

- Astrophysics Inc.

- Novatec Metrix

- Viken Detection

- Gilardoni S.p.A.

- Shenzhen Safeway Inspection System Ltd.

- Securetec AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mandated Air Cargo Screening Deadlines in U.S. and EU

- 4.2.2 Surge in Synthetic Opioid Trafficking via International Mail and Parcels

- 4.2.3 Modernization of Land Border Crossings under Infrastructure Programs

- 4.2.4 Rapid Growth of E-commerce Returns Creating 3PL Security Gaps

- 4.2.5 Adoption of AI-Enabled Image Analytics Reducing False Alarms

- 4.2.6 Expansion of Legal Cannabis Increasing Cash-Sniffing Needs at Airports

- 4.3 Market Restraints

- 4.3.1 High Total Cost of Ownership of CT and Neutron Systems in Developing Ports

- 4.3.2 Privacy and Radiation Exposure Concerns in EU Rail Deployments

- 4.3.3 Government Budget Freezes Causing Unpredictable Procurement Cycles

- 4.3.4 Shortage of Skilled Operators Deterring Retail Adoption

- 4.4 Regulatory and Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Investment Outlook

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Detector Technology

- 5.1.1 X-ray Backscatter

- 5.1.2 Transmission X-ray

- 5.1.3 Computed Tomography (CT) Scanners

- 5.1.4 Terahertz Imaging

- 5.1.5 Millimeter-Wave Systems

- 5.1.6 Trace Detection (IMS, MS)

- 5.1.7 Neutron Activation Analysis

- 5.2 By Mobility

- 5.2.1 Fixed

- 5.2.2 Portable / Handheld

- 5.3 By Screening Target

- 5.3.1 Drugs / Narcotics

- 5.3.2 Explosives

- 5.3.3 Weapons and Ammunition

- 5.3.4 Currency

- 5.3.5 Other Contraband

- 5.4 By End-user

- 5.4.1 Airports

- 5.4.2 Seaports and Land Border Crossings

- 5.4.3 Law Enforcement and Prisons

- 5.4.4 Public Transportation Hubs (Train, Metro, Bus)

- 5.4.5 Retail and Commercial Facilities (Logistics, Warehousing)

- 5.4.6 Government and Critical Infrastructure Sites

- 5.4.7 Others

- 5.5 By Sales Channel

- 5.5.1 New Equipment Sales

- 5.5.2 Aftermarket and Service

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Nordics

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Southeast Asia

- 5.6.4.6 Australia

- 5.6.4.7 New Zealand

- 5.6.4.8 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 GCC

- 5.6.5.1.2 Turkey

- 5.6.5.1.3 Israel

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Smiths Group plc (Smiths Detection)

- 6.4.2 OSI Systems Inc. (Rapiscan and ASandE)

- 6.4.3 L3Harris Technologies Inc. (Security and Detection)

- 6.4.4 Nuctech Company Ltd.

- 6.4.5 CEIA SpA

- 6.4.6 Metrasens Inc.

- 6.4.7 ChemImage Corporation

- 6.4.8 Adani Systems Inc.

- 6.4.9 Berkeley Varitronics Systems Inc.

- 6.4.10 Godrej Security Solutions

- 6.4.11 Magal Security Systems Ltd.

- 6.4.12 Teledyne IAC

- 6.4.13 Leidos Holdings Inc.

- 6.4.14 Westminster Group plc

- 6.4.15 Astrophysics Inc.

- 6.4.16 Novatec Metrix

- 6.4.17 Viken Detection

- 6.4.18 Gilardoni S.p.A.

- 6.4.19 Shenzhen Safeway Inspection System Ltd.

- 6.4.20 Securetec AG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment