PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846350

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846350

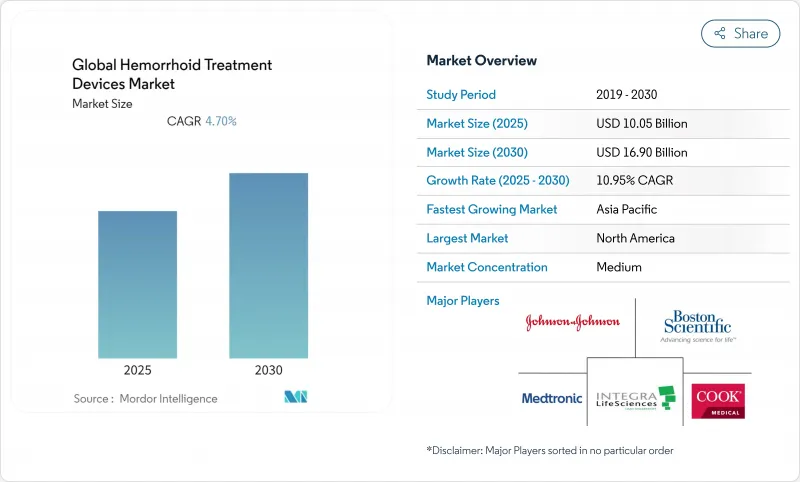

Global Hemorrhoid Treatment Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The hemorrhoid treatment devices market size stands at USD 1.20 billion in 2025 and is forecast to reach USD 2.45 billion by 2030, advancing at a 4.88% CAGR during the period.

Growth is fuelled by aging populations, a global swing toward outpatient care, and quick adoption of minimally invasive technologies that shorten recovery time and lower overall treatment costs. AI-guided endoscopy, Doppler-guided ligation, and laser hemorrhoidoplasty are widening the therapeutic toolbox, allowing physicians to intervene earlier, reduce postoperative pain, and improve long-term outcomes. Healthcare payers increasingly reimburse outpatient procedures, so providers are prioritizing ambulatory surgical centers that can deliver standardized, high-volume treatment at lower cost without compromising safety or efficacy. Established manufacturers, meanwhile, are concentrating on technology differentiation, sustainability, and single-use designs that align with infection-control policies and environmental directives.

Global Hemorrhoid Treatment Devices Market Trends and Insights

Rising prevalence of symptomatic hemorrhoids

Nearly 10 million Americans sought care for symptomatic hemorrhoids in 2024, representing about 5% of the adult population. Incidence rises sharply after age 50, so demographic aging guarantees a sustained patient pool. Sedentary work patterns, high-fat diets, and increasing obesity intensify symptom severity, especially in urban centers where advanced treatment is readily accessible. As emerging economies age and adopt similar lifestyles, epidemiological curves in those regions are expected to track those of developed markets. Together, these factors underpin a broad and predictable demand base that supports continued expansion of the hemorrhoid treatment devices market

Preference for minimally invasive outpatient procedures

Payers and patients alike prefer procedures that shorten recovery and avoid overnight admission. Medicare reimburses key hemorrhoid ligation codes, making outpatient treatment financially attractive for providers. Laser hemorrhoidoplasty patients in a 2024 case series reported no pain or bleeding by day 4, highlighting faster convalescence compared with open surgery. Ambulatory surgical centers combine specialized staff with high-throughput workflows, so they capture a growing share of volume. Collectively, these trends accelerate migration away from inpatient settings and reinforce steady demand for advanced devices.

Limited reimbursement in developing markets

In many emerging economies, insurance budgets prioritize communicable diseases and maternal health, so hemorrhoid interventions are often paid out-of-pocket. The high ticket price of Doppler-guided or laser systems places them out of reach for lower-income patients, leading to a two-tiered market where affluent urban citizens access advanced care while rural populations rely on conservative management. This gap dampens overall installed-base growth, slows training uptake among clinicians, and tempers the long-run CAGR of the hemorrhoid treatment devices market.

Other drivers and restraints analyzed in the detailed report include:

- Technological advances (Doppler-guided ligation, AI endoscopy)

- Healthcare expenditure growth in Asia-Pacific

- OTC topical products delaying device adoption

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Rubber band ligators remained the volume leader with 42.32% of the 2024 hemorrhoid treatment devices market share, reflecting decades-long clinical familiarity, low unit cost, and minimal capital requirements. Doppler-guided ligation systems, however, are on a faster growth arc, posting a 6.46% CAGR to 2030 as surgeons migrate to real-time vessel localization that curbs recurrence. The THD Revolution platform exemplifies this shift with integrated imaging, intuitive controls, and sterility-optimized accessories. Infrared coagulators and sclerotherapy injectors maintain relevance for grades I and II disease, where tissue sparing is paramount. Bipolar probes supply targeted thermal energy for select patient groups, whereas cryotherapy devices find niche application in districts where disposables remain cost prohibitive. As sustainability rules tighten, producers are exploring bio-polymer housings and single-use kits that balance infection control with environmental impact. Such design innovations are expected to preserve the value proposition of entry-level ligators while nudging the category into higher-margin territory.

The Report Covers Global Hemorrhoids Treatment Market Size & Share. The Market is Segmented by Product Type (Band Ligators, Bipolar Probes, Laser Probes, Cryotherapy Devices, Infrared Coagulators, Sclerotherapy Injectors, and Others), and Geography (North America, Europe, Asia-Pacific, The Middle East and Africa, and South America). The Value is Provided in (USD Million) for the Above Segments.

Geography Analysis

North America held the leading 42.23% revenue share in 2024, supported by Medicare coverage for CPT codes 46221, 46945, and 46946, which pay providers an average of USD 400 per procedure. Strong hospital infrastructure, widespread availability of high-definition endoscopy, and fast-track FDA pathways for Class II ligators underpin the region's dominance.

Asia-Pacific is the fastest-growing geography with a 7.93% CAGR forecast to 2030. China streamlined its device registration framework in 2024, reducing average review cycles and increasing post-market surveillance, which boosts foreign and domestic investment. India's marketing conduct code formalized promotional standards, rewarding multinational producers that maintain rigorous compliance. Olympus recorded 32% year-over-year gains in North America, while reporting strong therapeutic endoscopy demand in Asia, confirming the cross-regional transferability of GI platforms. Urbanizing populations, rising disposable income, and heightened health awareness combine to create sustained momentum for advanced hemorrhoid interventions.

Europe represents a mature yet resilient market. Strict infection-control mandates and environmental directives encourage single-use device adoption, pushing manufacturers to redesign ligators with recyclable bio-polymers. Reimbursement structures vary, yet most national payers now cover Doppler-guided procedures for higher-grade disease, underpinning steady replacement cycles. South America and the Middle East & Africa remain emerging segments: limited reimbursement and fewer trained proctologists cap uptake outside major cities, although rising employer-sponsored insurance and public-sector infrastructure projects are gradually widening access to device-based care.

- Boston Scientific

- Medtronic

- Johnson & Johnson

- Cook Group

- Olympus

- Teleflex

- Conmed

- CooperSurgical (Wallace)

- A.M.I. Agency for Medical Innovations

- Lohmann & Rauscher

- Sklar Surgical Instruments

- Sterylab

- Privi Medical

- The Cooper Companies

- Integra LifeSciences

- Smiths Group

- Hologic

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of symptomatic hemorrhoids

- 4.2.2 Preference for minimally-invasive outpatient procedures

- 4.2.3 Technological advances (e.g., Doppler-guided ligation)

- 4.2.4 Healthcare expenditure growth in Asia-Pacific

- 4.2.5 Regulatory push for single-use ligators (infection control)

- 4.2.6 AI-guided endoscopy enabling earlier intervention

- 4.3 Market Restraints

- 4.3.1 Limited reimbursement in developing markets

- 4.3.2 OTC topical products delaying device adoption

- 4.3.3 Shortage of colorectal surgeons in rural settings

- 4.3.4 Sustainability pressure on disposable plastics

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, 2024-2030)

- 5.1 By Product Type

- 5.1.1 Rubber Band Ligators

- 5.1.2 Infrared Coagulators

- 5.1.3 Sclerotherapy Injectors

- 5.1.4 Bipolar Probes

- 5.1.5 Cryotherapy Devices

- 5.1.6 Doppler-Guided Ligation Systems

- 5.2 By Procedure Setting

- 5.2.1 Endoscopic Ligations

- 5.2.2 Non-Endoscopic (Outpatient) Procedures

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Specialty Clinics

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 GCC

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Boston Scientific

- 6.3.2 Medtronic

- 6.3.3 Johnson & Johnson (Ethicon)

- 6.3.4 Cook Medical

- 6.3.5 Olympus Corporation

- 6.3.6 Teleflex Incorporated

- 6.3.7 ConMed Corporation

- 6.3.8 CooperSurgical (Wallace)

- 6.3.9 A.M.I. Agency for Medical Innovations

- 6.3.10 Lohmann & Rauscher

- 6.3.11 Sklar Surgical Instruments

- 6.3.12 Sterylab

- 6.3.13 Privi Medical

- 6.3.14 The Cooper Companies Inc

- 6.3.15 Integra LifeSciences

- 6.3.16 Smith & Nephew plc

- 6.3.17 Hologic, Inc

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment