PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846352

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846352

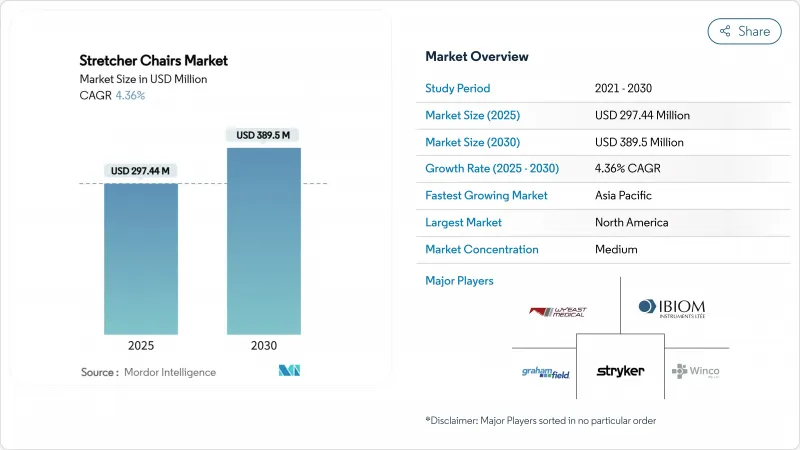

Stretcher Chairs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The medical stretcher chairs market is valued at USD 297.44 million in 2025 and is forecast to reach USD 389.50 million by 2030, expanding at a 4.36% CAGR.

This steady progression reflects health-system priorities that blend patient-centric mobility, caregiver ergonomics, and tightening regulatory mandates. Accelerating ambulatory surgical center (ASC) growth, wider adoption of "no-lift" hospital policies, and technology upgrades in actuation systems all reinforce demand. Powered variants gain traction as facilities quantify reductions in musculoskeletal injuries, while bariatric-capable models command premium pricing amid rising obesity prevalence. At the same time, manufacturers navigate stricter FDA quality system amendments taking effect in 2026 and variable Medicare reimbursement that can prolong purchase cycles. The overall momentum positions the medical stretcher chairs market to benefit from both demographic shifts and health-facility modernization programs.

Global Stretcher Chairs Market Trends and Insights

Rise in Geriatric Population

The proportion of individuals aged 65 and older is climbing sharply, a demographic transition that elevates day-to-day mobility demands across hospitals, outpatient centers, and long-term-care sites. Facilities respond by specifying stretcher chairs with low transfer heights, integrated vital-sign monitoring, and cushioning that minimizes pressure-injury risk. Compliance imperatives also intensify: updated U.S. Access Board equipment rules require 17-inch transfer heights so most wheelchair users can self-transfer, a standard that accelerates adoption of height-adjustable powered models. For vendors, the aging trend secures multi-year demand visibility and reinforces the medical stretcher chairs market's orientation toward ergonomic innovations that improve dignity and throughput.

Expansion of Ambulatory Surgical Centers

ASCs are expanding by 16.2% from 2023-2027, supported by Medicare site-neutral payments and relaxed certificate-of-need statutes. High patient-turnover environments favor stretcher chairs with rapid cleaning surfaces and modular accessories that align with same-day surgery workflows. Equipment capable of seamless imaging integration and lateral tilting further shortens room cycles. The resulting procurement wave positions ASCs as the fastest-growing customer group within the medical stretcher chairs market, prompting manufacturers to tailor service packages and training modules to specialized outpatient requirements.

High Capital Cost of Powered Chairs

Powered stretcher chairs cost roughly 3-5 times more than manual units, challenging budgets of small clinics and facilities in emerging economies. Although reductions in injury claims can offset purchase expense, many administrators must still stage acquisitions over multiple fiscal cycles or shift toward leasing. Vendors counter hesitation by bundling preventative-maintenance contracts and extended batteries that lower lifetime service calls. Over the near term, however, capital intensity will temper conversion speed and carve price-sensitive niches inside the broader medical stretcher chairs market.

Other drivers and restraints analyzed in the detailed report include:

- Hospital "No-Lift" Safety Initiatives

- Demand for Bariatric-Capable Chairs

- Limited Reimbursement Policies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Manual units accounted for 52.34% of the medical stretcher chairs market in 2024 thanks to cost advantages and minimal training needs. Powered models, however, are accelerating at a 5.26% CAGR as facilities prioritize caregiver safety and compliance metrics. This migration is reflected in the medical stretcher chairs market size for powered variants, which is projected to expand faster than any other product category through 2030. Early conversions often begin in emergency departments and surgical suites, but replacement cycles are now spreading to imaging wings and outpatient clinics.

Powered designs integrate joystick steering, battery health indicators, and usage analytics that feed directly into hospital asset-management systems. Their higher upfront price is counterbalanced by fewer worker compensation claims and shorter transfer times, reinforcing total-cost propositions. Manufacturers are also introducing hybrid systems that allow manual fallback during battery depletion, reducing risk perception among procurement teams. Collectively, these dynamics underpin a gradual yet durable shift that will redefine product-mix composition inside the medical stretcher chairs market.

Hydraulic platforms held 43.48% of the medical stretcher chairs market share in 2024 due to proven load-bearing reliability and smooth motion. Electric motor systems, though, are expanding at a 5.12% CAGR, propelled by precision positioning, lower energy usage, and seamless integration with digital infrastructures. Facilities seeking data-rich maintenance programs opt for electric actuators because onboard sensors feed real-time diagnostics to central dashboards.

Electromechanical research indicates 35-50% energy savings compared with hydraulics, a benefit aligned with hospital sustainability goals. Battery advances also mitigate prior concerns over duty cycles. Hybrid configurations, pairing hydraulic lifting with electric tilting, gain popularity in bariatric contexts where fail-safe margin remains paramount. As a result, the medical stretcher chairs market size for electric solutions is expected to close the gap on hydraulics during the forecast period, although both technologies will coexist to address varying acuity and budget tiers.

The Stretcher Chairs Market is Segmented by Product Type (Powered Stretcher Chairs, Manual Stretcher Chairs, Others), by Actuation Technology (Electric Motor, Hydraulic, and More), by End User (Hospitals, Ambulatory Surgical Centers, Specialty Clinics, and More), by Distribution Channel (Direct Institutional Sales, Medical Supply Distributors, Online / E-Commerce), by Geography (North America, Europe, Asia-Pacific, and More).

Geography Analysis

North America led with 41.18% share of the medical stretcher chairs market in 2024. Uptake is driven by OSHA-backed safety mandates, Medicare payment incentives favoring ASCs, and the 2024 CDC Safe Patient Handling framework that standardizes mobility protocols. Hospitals invest heavily in powered solutions to meet state "no-lift" laws, whereas bariatric models gain prominence amid obesity rates exceeding 40%. Robust aftermarket service networks and established capital-budget cycles sustain recurring demand even as capital scrutiny intensifies.

Asia-Pacific is poised for the fastest 6.28% CAGR through 2030, buoyed by healthcare infrastructure projects in China, India, and Southeast Asia. Government insurance expansions broaden equipment budgets, while private operators add high-acuity specialty centers that specify advanced mobility solutions. Local manufacturing clusters reduce component costs, but regional buyers still import premium actuators and control modules. Harmonization of ASEAN medical device regulations lowers entry barriers for multinational suppliers, amplifying competitive depth within the regional medical stretcher chairs market.

Europe maintains steady adoption on the back of aging demographics, unified MDR compliance, and national initiatives that reward ergonomic upgrades in long-term care. Hospitals prioritize stretcher chairs certified to EN 60601-2-52 bed safety standards, while procurement frameworks in the United Kingdom and Nordic countries increasingly apply lifecycle carbon-footprint scoring. Brexit-related customs checks have elongated lead times for U.K. buyers, nudging some toward regional sourcing strategies. Sustainability metrics combined with stringent worker-safety regulations underpin a consistent, if slower, contribution to overall medical stretcher chairs market expansion.

- Stryker

- GF Health Products, Inc.

- Winco Mfg LLC (Champion Manufacturing Inc.)

- Wy'East Medical

- IBIOM Instruments Ltee

- Productos Metalicos del Bages (Promeba)

- NovyMed International

- UFSK-International OSYS

- LINET Group

- Drive DeVilbiss Healthcare (Medical Depot, Inc. )

- Invacare

- Ferno-Washington

- TransMotion Medical

- Midmark

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increase in number of accidents & trauma

- 4.2.2 Rise in geriatric population

- 4.2.3 Expansion of ambulatory surgical centers

- 4.2.4 Hospital "no-lift" safety initiatives

- 4.2.5 Integration with imaging-table systems

- 4.2.6 Demand for bariatric-capable chairs

- 4.3 Market Restraints

- 4.3.1 High capital cost of powered chairs

- 4.3.2 Limited reimbursement policies

- 4.3.3 Regulatory delays for imaging compliance

- 4.3.4 Supply-chain gaps in high-load actuators

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Powered Stretcher Chairs

- 5.1.2 Manual Stretcher Chairs

- 5.1.3 Others

- 5.2 By Actuation Technology

- 5.2.1 Electric Motor

- 5.2.2 Hydraulic

- 5.2.3 Pneumatic

- 5.2.4 Mechanical

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Specialty Clinics

- 5.3.4 Home-Care Settings

- 5.3.5 Others

- 5.4 By Distribution Channel

- 5.4.1 Direct Institutional Sales

- 5.4.2 Medical Supply Distributors

- 5.4.3 Online / E-commerce

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Stryker Corporation

- 6.3.2 GF Health Products, Inc.

- 6.3.3 Winco Mfg LLC (Champion Manufacturing Inc.)

- 6.3.4 Wy'East Medical

- 6.3.5 IBIOM Instruments Ltee

- 6.3.6 Productos Metalicos del Bages (Promeba)

- 6.3.7 NovyMed International

- 6.3.8 UFSK-International OSYS

- 6.3.9 LINET Group SE

- 6.3.10 Drive DeVilbiss Healthcare (Medical Depot, Inc. )

- 6.3.11 Invacare Corporation

- 6.3.12 Ferno-Washington

- 6.3.13 TransMotion Medical

- 6.3.14 Midmark Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment