PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906871

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906871

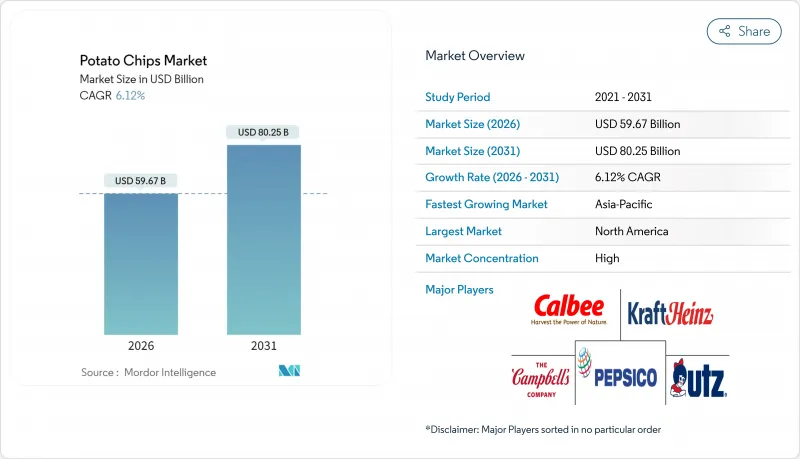

Potato Chips - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The potato chips market is expected to grow from USD 56.23 billion in 2025 to USD 59.67 billion in 2026 and is forecast to reach USD 80.25 billion by 2031 at 6.12% CAGR over 2026-2031.

The market demonstrates stability despite inflation and increasing consumer demand for premium and healthier snack alternatives. The growth is primarily driven by rising disposable incomes, urbanization, changing snacking habits, and the convenience of ready-to-eat foods. Additionally, manufacturers' focus on product innovation, including new flavors and healthier variants, along with expanding distribution networks, particularly in emerging markets, supports market expansion. The rapid growth of e-commerce platforms and modern retail formats further accelerates market penetration. Market growth is also influenced by increasing snacking frequency among millennials and Gen Z consumers, product premiumization, and the introduction of regional flavors to cater to local taste preferences.

Global Potato Chips Market Trends and Insights

Increasing Consumer Demand for Convenient Snacks

The global potato chips market is experiencing growth primarily due to rising consumer demand for convenient and ready-to-eat snacks. The acceleration of urbanization and increasingly fast-paced lifestyles, especially among working professionals, students, and younger demographics, has transformed snacking habits. Potato chips meet these evolving consumer needs by being portable, shelf-stable, and available across various price points. The product requires no preparation while offering familiar tastes and diverse flavors. According to the International Food Information Council (IFIC) in 2024, 60% of United States respondents snack once or twice daily, while 14% snack three or more times per day . These statistics demonstrate how snacking has evolved from an occasional activity to an integral part of daily dietary patterns. This trend extends globally, where consumers actively choose convenient snacks instead of traditional meals.

Innovation in Flavors and Packaging

Flavor innovation has become the key differentiator in the potato-based snacks market, with increased product development activities. The "swicy" flavor combination has gained significant popularity among younger consumers, prompting manufacturers to diversify their product portfolios. Lay's "Do Us A Flavor" contest, offering a USD 1 million prize, exemplifies how consumer participation generates innovative flavor concepts while enhancing brand loyalty. Companies are also focusing on packaging innovations to meet sustainability goals and comply with regulations, as demonstrated by Frito-Lay's commitment to achieve 100% recyclable or compostable packaging by 2025. This combined emphasis on flavor development and sustainable packaging helps companies maintain competitive advantages while meeting consumer demands for new taste experiences and environmental consciousness. The market shows strong demand from younger consumers, particularly millennials, who show a preference for salty snacks, especially potato chips. In Germany, according to IfD Allensbach, 16.49 million people purchased salty snacks in 2024 .

Stringent Food Safety and Labeling Regulations

The regulatory landscape in major markets is becoming more stringent, particularly with the FDA's proposed front-of-package nutrition labeling requirements. These regulations necessitate substantial investments in product reformulation and packaging updates. The Food and Drug Administration (FDA) proposal requires clear labeling of saturated fat, sodium, and added sugars content, which may influence consumer purchasing patterns for traditional chip products. Additionally, the European Union's packaging waste regulations require manufacturers to transition to recyclable materials, despite their higher costs and technical limitations. These regulatory requirements place a heavier burden on smaller manufacturers who have limited resources for compliance measures, which may lead to increased market consolidation. The legal dispute involving Campbell Soup's Kettle Brand and its "air frying" claims demonstrates how regulatory compliance issues can result in legal challenges and increased business risks.

Other drivers and restraints analyzed in the detailed report include:

- Westernization of Food Consumption Patterns

- Aggressive Marketing and Branding by Key Players

- Fluctuating Raw Material Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fried potato chips command a substantial 67.75% share of the global market in 2025, reflecting their enduring popularity among consumers. The segment's success stems from manufacturers delivering the classic crunch and taste that consumers seek while continuously introducing innovative flavors and packaging designs. Kettle Studio has strengthened this trend by launching Air-Fried Chips in April 2025, offering consumers a product with 50% less oil content. Urban consumers particularly drive sales through frequent purchases at convenience stores and vending machines, making fried chips a consistently popular snack choice across different retail channels.

The baked potato chips segment demonstrates remarkable growth potential, advancing at a 6.98% CAGR through 2031. Health-conscious consumers actively choose baked chips as their preferred snacking option, appreciating the reduced fat content and nutritional benefits. Manufacturers respond to this demand by developing diverse product lines that cater to specific regional taste preferences. Pringles exemplifies this market adaptation with its April 2025 introduction of Baked Potato Chips in 7-Layer Dip flavor, combining cheese, onion, and sour cream flavors to create a unique taste profile. This innovation in the baked segment shows how manufacturers successfully balance health considerations with flavor expectations.

Flavored chips maintain a 64.10% market share in 2025 with a consistent 6.58% CAGR, indicating sustained consumer demand for diversified taste offerings beyond conventional plain and salted varieties. The global flavor portfolio of Lay's, incorporating Tzatziki, Masala, and Honey Butter variants, demonstrates the market differentiation potential of international taste profiles. The convergence of sweet and spicy flavor combinations has established substantial market presence among younger consumer segments, contributing to increased revenue generation for PepsiCo's Flamin' Hot product range.

Plain and salted chips retain their market presence as cost-effective options and culinary ingredients, although their growth trajectory remains below that of flavored alternatives. Manufacturing entities are expanding their innovation focus beyond conventional taste development to incorporate functional attributes, implementing protein fortification and nutrient enhancement to establish premium price positioning. Time-limited product releases, exemplified by Utz's lemonade-flavored chips in collaboration with Alex's Lemonade Stand Foundation, illustrate the integration of flavor innovation with strategic marketing objectives and corporate social initiatives.

The Potato Chips Market Report is Segmented by Product Type (Baked and Fried), Flavor (Plain/Salted and Flavored), Packaging Type (Single Serve and Family/Bulk Packs), Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, and More), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America holds a dominant 35.20% market share in 2025, despite experiencing market maturation that constrains growth compared to developing regions. The implementation of Food and Drug Administration (FDA) front-of-package nutrition labeling requirements will impact market dynamics by emphasizing nutritional content differences between products . The region's advanced supply chain infrastructure enables product innovation and premium offerings, while companies increase investments in automation and AI to optimize operational costs. Growing health awareness drives demand for nutritious alternatives, creating market opportunities for organic and baked products that support premium pricing in a mature market.

The Asia-Pacific region exhibits a 6.85% CAGR through 2031, establishing its position as the fastest-growing market. This growth is attributed to the transformation of food consumption patterns toward Western preferences and the substantial increase in disposable incomes across China, India, and Southeast Asian economies. The transformation in consumer behavior regarding snack foods as meal alternatives and social consumption items continues to drive market expansion. This growth trajectory presents opportunities for global brands to implement localization strategies and enables regional enterprises to capitalize on their comprehensive understanding of cultural preferences and distribution networks.

Europe demonstrates consistent growth, underpinned by comprehensive regulatory frameworks that establish international standards for food safety and environmental compliance. South America and the Middle East and Africa represent significant growth opportunities through continued economic development and urbanization, although market progression faces impediments from political and economic instability. Regional market success necessitates a comprehensive understanding of distinct taste preferences, distribution infrastructure capabilities, and diverse regulatory requirements.

List of Companies Covered in this Report:

- PepsiCo Inc.

- Calbee Inc.

- The Campbell's Company

- Utz Brands Inc.

- The Kraft Heinz Company

- Mars, Incorporated (Pringles)

- ITC Limited

- The Lorenz Bahlsen Snack-World GmbH & Co KG

- Herr Foods Inc.

- Burts Snacks Ltd.

- Great Lakes Potato Chip Co

- KP Snacks Limited

- Orkla ASA

- Shearer's Foods, LLC

- Grupo Bimbo, SAB de CV

- Haldiram's India Pvt Ltd

- Balaji Wafers Pvt. Ltd.

- Oriental Food Industries Sdn. Bhd.

- Zweifel Pomy-Chips AG

- Ira Middleswarth & Son, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Consumer Demand for Convenient Snacks

- 4.2.2 Innovation in Flavors and Packaging

- 4.2.3 Westernization of Food Consumption Patterns

- 4.2.4 Aggressive Marketing and Branding by Key Players

- 4.2.5 Introduction of Healthier Product Variants

- 4.2.6 Cultural Significance and Popularity of Potato Chips

- 4.3 Market Restraints

- 4.3.1 Stringent Food Safety and Labeling Regulations

- 4.3.2 Fluctuating Raw Material Prices

- 4.3.3 Rising Health Concerns Among Consumers

- 4.3.4 Environmental Impact and Packaging Waste

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Baked

- 5.1.2 Fried

- 5.2 By Flavor

- 5.2.1 Plain/Salted

- 5.2.2 Flavored

- 5.3 By Packaging Type

- 5.3.1 Single Serve

- 5.3.2 Family/Bulk Packs

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Convenience Stores

- 5.4.3 Online Retail Stores

- 5.4.4 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 PepsiCo Inc.

- 6.4.2 Calbee Inc.

- 6.4.3 The Campbell's Company

- 6.4.4 Utz Brands Inc.

- 6.4.5 The Kraft Heinz Company

- 6.4.6 Mars, Incorporated (Pringles)

- 6.4.7 ITC Limited

- 6.4.8 The Lorenz Bahlsen Snack-World GmbH & Co KG

- 6.4.9 Herr Foods Inc.

- 6.4.10 Burts Snacks Ltd.

- 6.4.11 Great Lakes Potato Chip Co

- 6.4.12 KP Snacks Limited

- 6.4.13 Orkla ASA

- 6.4.14 Shearer's Foods, LLC

- 6.4.15 Grupo Bimbo, SAB de CV

- 6.4.16 Haldiram's India Pvt Ltd

- 6.4.17 Balaji Wafers Pvt. Ltd.

- 6.4.18 Oriental Food Industries Sdn. Bhd.

- 6.4.19 Zweifel Pomy-Chips AG

- 6.4.20 Ira Middleswarth & Son, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK