PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848018

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848018

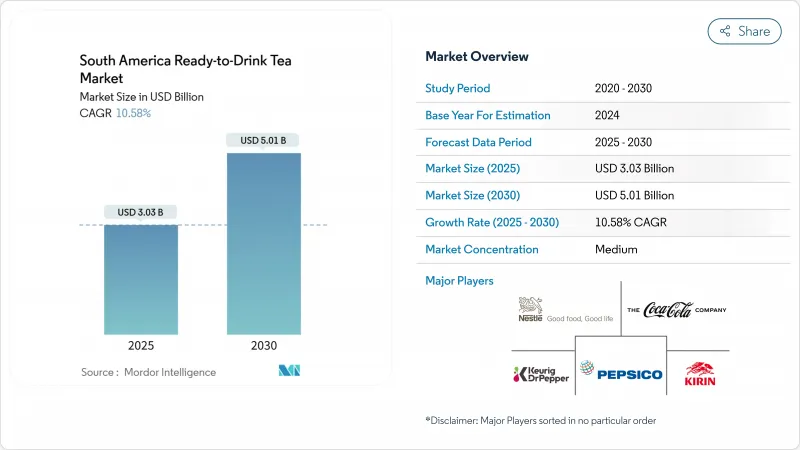

South America Ready-to-Drink Tea - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The South American ready-to-drink (RTD) tea market size is estimated to be USD 3.03 billion in 2025 and is forecast to reach USD 5.01 billion by 2030, reflecting a CAGR of 10.58%.

The market is experiencing significant growth, driven by increasing consumer demand for beverages with lower sugar content, broader distribution through modern trade channels, and ongoing product innovation. Urban professionals with hectic schedules are increasingly replacing carbonated soft drinks with RTD teas that offer both convenience and functional benefits. Additionally, premium RTD tea lines that emphasize their antioxidant properties are contributing to higher profit margins for brands. Sustainability initiatives are also playing a key role, as companies transition to lightweight aluminum and recycled-content PET packaging. This shift not only aligns with environmental goals but also enhances brand credibility, allowing for the justification of price premiums. Furthermore, the rise of digital retail platforms and direct-to-consumer models is expanding market accessibility, particularly for niche botanical blends that are not yet widely available in physical retail stores.

South America Ready-to-Drink Tea Market Trends and Insights

Rising Demand for Low-Sugar Refreshments Amid Obesity Concerns in The Region

The escalating obesity rates across South America are fundamentally reshaping beverage consumption patterns, with RTD tea emerging as a primary beneficiary of the shift away from high-sugar carbonated drinks. The World Obesity Federation projects that by 2044, 48% of Brazilian adults will face obesity, while another 27% will live with overweight . This growing health concern has prompted significant changes in consumer behavior, particularly as awareness about the health risks associated with excessive sugar consumption increases. The Pan American Health Organization (PAHO) actively promotes sugar reduction initiatives across the region, further encouraging consumers to seek healthier alternatives. Urban professionals aged 25-40 are driving this shift, opting for lower-sugar beverages 2.7 times more than previous generations, as they prioritize health and wellness in their daily choices. Public health campaigns, changing consumer preferences, and innovative product development are collectively propelling the growth of low-sugar RTD tea variants. Manufacturers are leveraging premium positioning to manage higher ingredient costs while maintaining their profit margins, ensuring that these healthier options remain accessible and appealing to the growing health-conscious demographic.

Expansion of Hybrid Tea-Fruit RTD Lineups Targeting Millennials

The market is growing rapidly, driven by increasing demand for hybrid tea-fruit beverages among millennials. This health-conscious demographic has pushed manufacturers to expand their product portfolios. The Food and Agriculture Organization (FAO) reports steady growth in tea consumption across South America, with a preference for flavored and functional beverages. The Brazilian Tea Association highlights the rising popularity of hybrid tea-fruit RTD products due to their health benefits and convenience. Government initiatives are further supporting this trend. For example, Chile's Ministry of Health has enforced sugar reduction regulations, spurring the development of low-sugar hybrid tea-fruit RTD options. Similarly, Argentina's National Institute of Yerba Mate (INYM) reports increased production of yerba mate-based RTD beverages, often infused with fruit flavors to appeal to millennials. These shifts reflect growing consumer demand for beverages that balance taste and health benefits, positioning hybrid tea-fruit RTD products as a key driver in the South American RTD tea market. The World Health Organization (WHO) has also emphasized reducing sugar intake to combat obesity, prompting manufacturers to innovate with natural sweeteners and functional ingredients like antioxidants and vitamins. The hybrid tea-fruit RTD segment is expected to play a pivotal role in driving the South America RTD tea market during the forecast period.

Intensifying Competition from RTD Coffee & Functional Beverages

The market faces significant restraint due to the intensifying competition from RTD coffee and functional beverages. These alternatives are gaining popularity among consumers due to their perceived health benefits, convenience, and innovative flavors. Functional beverages, in particular, are attracting health-conscious consumers by offering added nutrients, vitamins, and other functional ingredients. Similarly, RTD coffee is becoming a preferred choice for its energy-boosting properties and wide variety of options, including cold brews and specialty flavors. The increasing availability of these products in retail outlets, supermarkets, and online platforms further amplifies their reach and appeal, making it challenging for RTD tea to maintain its market share. Additionally, aggressive marketing strategies and promotional campaigns by RTD coffee and functional beverage brands are drawing consumer attention, creating a competitive environment. This growing competition is compelling RTD tea manufacturers to innovate and differentiate their offerings by introducing unique flavors, organic options, and health-focused formulations to retain and expand their consumer base. However, the challenge remains significant as the preference for RTD coffee and functional beverages continues to rise, driven by evolving consumer lifestyles and preferences.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward Sustainable PET & Aluminum Packaging Driving Premiumization

- Health-Conscious Consumers Inclined Towards Low-Calorie, Antioxidant-Rich Beverages, Boosts Demand for RTD Tea

- Inconsistent Cold Chain Infrastructure Challenges the Distribution and Shelf-Life of RTD Tea Products

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, black tea maintained its position as the most popular choice in South America's ready-to-drink (RTD) tea market, holding a significant 45.12% market share. Its widespread appeal comes from its versatility, as it pairs well with a variety of sweeteners and fruit flavors, making it a favorite among a broad range of consumers. Herbal tea, while currently occupying a smaller portion of the market, is growing at a much faster pace, with a projected compound annual growth rate (CAGR) of 10.56%. This rapid growth is largely driven by younger consumers who are actively seeking healthier beverage options. Many of these consumers are looking for alternatives to caffeine and are drawn to herbal teas for their functional benefits, such as promoting relaxation or boosting immunity. Green tea holds a middle position in the market, benefiting from its long-standing reputation as a healthy beverage rich in antioxidants. This health-focused image continues to attract consumers who are mindful of their well-being.

On the other hand, Oolong and White teas cater to smaller, niche audiences. Despite their limited production volumes, these teas are able to sustain higher price points due to their premium positioning and unique flavor profiles. One of the most notable trends in the South American RTD tea market is the rapid growth of the herbal tea segment. While its sales volumes have not yet reached the levels of black tea, the segment is expected to add significant value to the market. This growth highlights the increasing consumer interest in beverages that offer both health benefits and unique flavors, positioning herbal tea as a key driver of future market expansion.

In 2024, sweetened ready-to-drink (RTD) tea holds an 80.23% market share, reflecting a strong cultural preference for sweet flavors and a shift from carbonated soft drinks. This dominance is driven by consumer demand for sweetened beverages, supported by extensive product availability, aggressive marketing, and innovation within the sweetened segment. The transition to sweetened RTD tea also aligns with a broader trend toward perceived healthier alternatives. Meanwhile, the unsweetened segment is gaining traction, with a projected 13.34% CAGR from 2025 to 2030, fueled by rising health awareness and global trends favoring reduced sugar intake.

Manufacturers in the sweetened category are adapting by introducing reduced-sugar variants to bridge the gap for consumers transitioning from full-sugar products. These strategies aim to retain a broad consumer base while addressing health concerns. Natural sweeteners like stevia, monk fruit, and erythritol are also gaining prominence, enabling brands to balance sweetness with health-conscious demands. The unsweetened segment's growth is particularly evident in premium markets and among affluent consumers, highlighting a link between income, education, and preference for unsweetened options. This segmentation allows manufacturers to implement price-tier strategies, capturing diverse consumer groups while aligning with the shift toward healthier choices.

The South America Ready-To-Drink Tea Market is Segmented by Type (Black Tea, Herbal Tea and More), Ingredient (Conventional and Organic), Category (Sweetened and Unsweetened), Packaging (Bottles, Cans, and Others), Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- The Coca-Cola Company

- PepsiCo, Inc

- Keurig Dr Pepper Inc.

- AriZona Beverages USA LLC

- Ito En, Ltd.

- Nestle S.A.

- Danone S.A.

- Unilever PLC

- Kirin Holdings Co., Ltd.

- Monster Beverage Corporation

- Ajinomoto Co., Inc.

- Suntory Beverage & Food Ltd.

- Grupo Aje

- Organique Energeticos Naturais Ltda.

- Bigelow Tea Company

- Suntory Beverage & Food Ltd.

- Compania de Alimentos Fargo SA

- Mega Alimentos S.A.

- Tata Consumer Products Limited

- Santa Catarina Alimentos Ltda

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Low-Sugar Refreshments Amid Obesity Concerns inThe Region

- 4.2.2 Expansion of Hybrid Tea-Fruit RTD Lineups Targeting Millennials

- 4.2.3 Shift Toward Sustainable PET & Aluminum Packaging Driving Premiumization

- 4.2.4 Health-Conscious Consumers Inclined Towards Low-Calorie, Antioxidant-Rich Beverages, Boosts Demand for RTD Tea.

- 4.2.5 Surging Popularity of Natural and Herbal Ingredients Propel The Demand For Functional RTD Teas.

- 4.2.6 Shift Toward Natural and Organic Products Driving Market Growth

- 4.3 Market Restraints

- 4.3.1 Intensifying Competition from RTD Coffee & Functional Beverages

- 4.3.2 Inconsistent Cold Chain Infrastructure Challenges the Distribution and Shelf-Life of RTD Tea Products.

- 4.3.3 High Import Tariffs on Specialty Tea Extracts Elevating Production Costs

- 4.3.4 High Costs Compared to Traditional Beverages Limiting Market Growth

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Black Tea

- 5.1.2 Green Tea

- 5.1.3 Herbal Tea

- 5.1.4 Fruit & Flavored Tea

- 5.1.5 Oolong Tea

- 5.1.6 Decaffeinated Tea

- 5.1.7 Others

- 5.2 By Category

- 5.2.1 Sweetened

- 5.2.2 Unsweetened

- 5.3 By Packaging

- 5.3.1 Bottles

- 5.3.2 Cans

- 5.3.3 Others

- 5.4 By Ingredient Source

- 5.4.1 Conventional

- 5.4.2 Organic

- 5.5 By Distribution Channel

- 5.5.1 Supermarkets & Hypermarkets

- 5.5.2 Convinience/Grocery Stores

- 5.5.3 Online Retail Stores

- 5.5.4 Other Distribution Channels

- 5.6 By Geography

- 5.6.1 Brazil

- 5.6.2 Argentina

- 5.6.3 Chile

- 5.6.4 Colombia

- 5.6.5 Peru

- 5.6.6 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 The Coca-Cola Company

- 6.4.2 PepsiCo, Inc

- 6.4.3 Keurig Dr Pepper Inc.

- 6.4.4 AriZona Beverages USA LLC

- 6.4.5 Ito En, Ltd.

- 6.4.6 Nestle S.A.

- 6.4.7 Danone S.A.

- 6.4.8 Unilever PLC

- 6.4.9 Kirin Holdings Co., Ltd.

- 6.4.10 Monster Beverage Corporation

- 6.4.11 Ajinomoto Co., Inc.

- 6.4.12 Suntory Beverage & Food Ltd.

- 6.4.13 Grupo Aje

- 6.4.14 Organique Energeticos Naturais Ltda.

- 6.4.15 Bigelow Tea Company

- 6.4.16 Suntory Beverage & Food Ltd.

- 6.4.17 Compania de Alimentos Fargo SA

- 6.4.18 Mega Alimentos S.A.

- 6.4.19 Tata Consumer Products Limited

- 6.4.20 Santa Catarina Alimentos Ltda

7 Market Opportunities and Future Outlook