PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848020

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848020

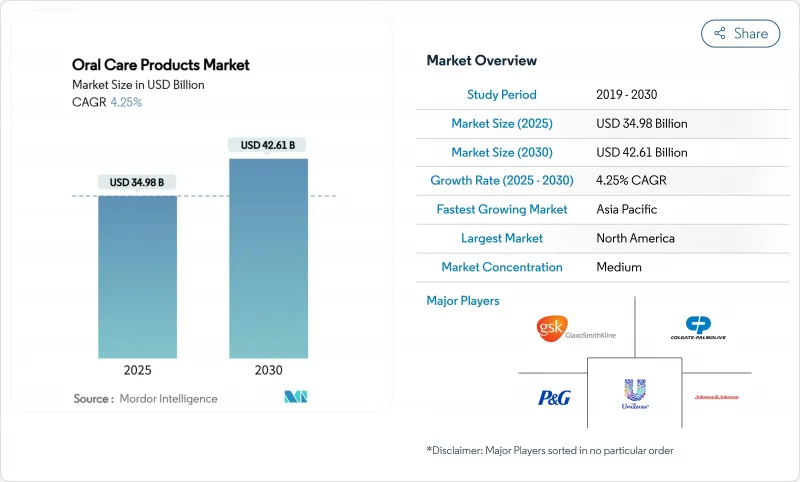

Oral Care Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The oral care products market size registers USD 34.98 billion in 2025 and is forecast to reach USD 42.61 billion by 2030, reflecting a steady 4.25% CAGR over 2025-2030.

Mature demand in North America and Western Europe combines with rising penetration in Asia-Pacific, the Middle East, and parts of Latin America to uphold volume growth. Household focus on preventive health, public-sector awareness drives, and regular new-product launches keep branded toothpaste, mouthwash, and interdental accessories on shopping lists even as shelf prices nudge upward. Meanwhile, reformulation linked to stricter ingredient oversight-especially whitening opacifiers-extends the innovation cycle and differentiates premium offerings. Digital sales channels and subscription programs increase purchase frequency, provide real-time shopper insights, and compress the idea-to-shelf interval, allowing nimble brands to address granular consumer segments faster than legacy retail models.

Global Oral Care Products Market Trends and Insights

Escalating Global Prevalence of Dental Caries and Periodontal Diseases

Worldwide, more than 3.5 billion people currently live with at least one untreated oral condition. Dental caries in permanent teeth remains the most widespread disorder, while severe periodontitis is projected to affect 1.1 billion individuals by 2050. The aggregate economic burden-direct costs near USD 387 billion and indirect productivity losses about USD 323 billion-drives governments to embed preventive care within universal-coverage programs. In emerging economies, this policy push overlaps with rapid urbanization and rising disposable incomes, propelling consistent consumption of fluoride-enriched pastes, antimicrobial rinses, and interdental cleaning aids. Manufacturers are tailoring ingredient blends to address biofilm management, enamel reinforcement, and sensitivity relief, thereby reinforcing value across price tiers while aligning with the WHO Global Oral Health Action Plan 2023-2030.

Rapid Expansion of E-Commerce and Direct-to-Consumer Models

Digitally native routes are redrawing the oral care products market landscape. First-party data collected from D2C storefronts reveals brushing frequency, flavor preferences, and refill patterns in real time, enabling brands to run agile A/B tests and launch limited-edition variants within weeks. Subscription bundles for toothpaste and electric brush heads reduce stock-out risk and nurture predictable revenue streams. In North America, online share of premium electric toothbrushes doubled between 2024 and 2025, supported by buy-now-pay-later financing and doorstep replacement programs. European e-pharmacies promote specialist rinses for gum care, while Southeast Asian live-stream platforms pair influencer demonstrations with flash discounts to tap rural demand pockets. Traditional retailers respond by building click-and-collect services and tightening last-mile partnerships to sustain relevance.

Regulatory Push-Back on Titanium Dioxide Whitening Agents

The European Court's 2025 opinion backing titanium dioxide's carcinogenic classification pushes manufacturers to fast-track blanc fixe, hydroxyapatite, and blue-cove optical-brightener alternatives4. Reformulation costs spike because substitutes can run 15-20% higher per kilogram than TiO2. Multinationals aim for universal "titanium-dioxide-free" bases to avoid dual-SKU complexity, yet must tailor flavor, abrasive texture, and regional compliance labels. Early adopters gain a safety halo among ingredient-conscious shoppers, but short-term margin compression persists until scale economies temper input cost premiums.

Other drivers and restraints analyzed in the detailed report include:

- Rising Consumer Shift from Treatment-Centric to Preventive & Cosmetic Oral Health

- Antibiotic-Free Herbal Formulation Momentum in India & the GCC

- Supply-Chain Volatility of Sorbitol & Silica Driving Cost Pressures

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Toothpaste remained the bedrock of everyday routines and commanded 34.8% oral care products market share in 2024, benefiting from universal penetration and high purchase frequency. The category's innovation cadence accelerates as brands incorporate stannous fluoride, nano-hydroxyapatite, or arginine complexes for multi-problem relief. Meanwhile, mouthwash/rinses post the fastest growth at a 5.7% CAGR. Consumers increasingly integrate antiseptic rinses into twice-daily regimens, boosting dwell time across oral-health conversations. Alcohol-free formulas and specialized gum-care variants address sensitivity or orthodontic needs. Celebrity-backed launches and social-media tutorials further normalize mouthwash use, especially among millennials seeking comprehensive plaque control.

Electric toothbrushes continue to raise the technology bar through AI-enabled pressure sensors, gamified apps, and flexible-neck brush heads. While manual brushes still dominate unit volumes in value-driven economies, entry-level battery models priced under USD 25 entice first-time upgraders. Interdental accessories-floss, picks, water-flossers-record double-digit volume gains as professional guidelines spotlight interdental cleaning. Whitening strips, LED tray devices, and remineralizing pens anchor the cosmetic sub-segment, offering at-home solutions at one-third the cost of in-clinic treatments. Cross-selling bundles-paste + strip + brush-lift basket size and deepen brand stickiness.

The Oral Care Products Market Report is Segmented by Product Type (Toothpastes, Toothbrushes & Accessories, and More), Distribution Channel (Hypermarkets & Supermarkets, and More), End-User (Adults, Children (0-12 Yrs), and Geriatric (60 Yrs +)), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific leads the oral care products market with a 32.4% share in 2024 and is expected to rise at a 5.89% CAGR. Expanding middle-class ranks across China, India, Indonesia, and Vietnam underpin higher per-capita spend. Government campaigns distribute fluoride varnish in rural schools, while urban consumers pivot to premium accessory categories such as water-flossers and probiotic lozenges. Chinese online festivals spur record sales peaks for whitening strips, and Indian pharmacy chains showcase herbal-fluoride hybrids as safer daily options.

North America represents a mature but innovation-oriented cluster. US shoppers adopt connected electric brushes linked to smartphone dashboards that award compliance points redeemable for refill discounts. Retailers refine shelf planograms monthly using AI analytics of loyalty data, making rapid assortment rotation standard practice. Canada observes rising preference for titanium-dioxide-free whitening, favoring blue covarine or hydroxyapatite formulations.

Europe sustains robust penetration levels, aided by state-subsidized dental visits in several countries. Ingredient regulation remains stringent; French authorities already require microplastic-free abrasives in rinse-off products. Central-Eastern European markets witness growing modern-trade formats where value multipacks appeal to cost-sensitive shoppers. Brexit-related customs frictions prompt some brands to relocate United Kingdom warehouses close to EU ports to maintain delivery certainty.

The Middle East and Africa exhibit above-average growth trajectories. GCC states spotlight oral health in national wellness roadmaps; pharmacy chains in Saudi Arabia promote halal-certified rinses and single-use floss picks. Kenyan and Nigerian startups leverage mobile-money ecosystems to deliver subscription toothpaste bundles, broadening outreach in logistics-challenged geographies.

Latin America maintains steady double-digit volume in whitening accessories, especially in Brazil where aesthetic dentistry holds cultural significance. Inflation volatility in Argentina shifts consumer preference toward bundle packs that lower per-unit expenditure but sustain brand presence. Long-haul supply routes from Asia face shipping-container cost spikes, nudging local contract manufacturing in Mexico and Colombia.

- Colgate-Palmolive Company

- Procter & Gamble

- Unilever PLC

- Johnson & Johnson (Kenvue)

- GlaxoSmithKline

- Church & Dwight

- Koninklijke Philips

- Panasonic Holdings Corp.

- Sunstar Suisse

- Lion

- Dabur India Ltd.

- Himalaya

- Henkel AG (Theramed)

- GC Corporation

- Dentsply Sirona

- Straumann Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating Global Prevalence of Dental Caries and Periodontal Diseases

- 4.2.2 Rapid Expansion of E-Commerce and Direct-To-Consumer Models

- 4.2.3 Rising Consumer Shift from Treatment-Centric to Preventive & Cosmetic Oral Health

- 4.2.4 Antibiotic-free Herbal Formulation Momentum in India & GCC

- 4.2.5 Government-backed Fluoridation Programs

- 4.2.6 Smart Electric Toothbrush Adoption in High-income Economies

- 4.3 Market Restraints

- 4.3.1 Regulatory Push-back on Titanium Dioxide Whitening Agents

- 4.3.2 Supply-Chain Volatility of Sorbitol & Silica Driving Cost Pressures

- 4.3.3 Counterfeit Electric Brush Heads on Chinese E-commerce Platforms

- 4.3.4 Limited Insurance Coverage for Preventive Dental Products

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Toothpastes

- 5.1.1.1 Pastes

- 5.1.1.2 Gels

- 5.1.1.3 Powders

- 5.1.1.4 Polishes

- 5.1.2 Toothbrushes & Accessories

- 5.1.2.1 Manual

- 5.1.2.2 Power (Oscillating, Sonic, Ultrasonic)

- 5.1.2.3 Battery-powered Toothbrushes

- 5.1.2.4 Replacement Toothbrush Heads

- 5.1.3 Mouthwashes/ Rinses

- 5.1.3.1 Non-medicated Mouthwashes

- 5.1.3.2 Medicated Mouthwashes

- 5.1.4 Dental Accessories/ Ancillaries

- 5.1.4.1 Dental Flosses

- 5.1.4.2 Breath Fresheners

- 5.1.4.3 Cosmetic Dental Whitening Products

- 5.1.4.4 Dental Water Jets

- 5.1.5 Dental Products

- 5.1.5.1 Fixatives

- 5.1.5.2 Other Denture Products

- 5.1.6 Dental Prosthesis Cleaning Solutions

- 5.1.1 Toothpastes

- 5.2 By Distribution Channel

- 5.2.1 Hypermarkets & Supermarkets

- 5.2.2 Pharmacies & Drug Stores

- 5.2.3 Online Retail (e-commerce & DTC)

- 5.3 By End-User

- 5.3.1 Adults

- 5.3.2 Children (0-12 yrs)

- 5.3.3 Geriatric (60 yrs +)

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle-East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 Colgate-Palmolive Company

- 6.4.2 Procter & Gamble Co.

- 6.4.3 Unilever PLC

- 6.4.4 Johnson & Johnson (Kenvue)

- 6.4.5 GlaxoSmithKline

- 6.4.6 Church & Dwight Co. Inc.

- 6.4.7 Koninklijke Philips N.V.

- 6.4.8 Panasonic Holdings Corp.

- 6.4.9 Sunstar Suisse SA

- 6.4.10 Lion Corporation

- 6.4.11 Dabur India Ltd.

- 6.4.12 Himalaya Wellness Company

- 6.4.13 Henkel AG (Theramed)

- 6.4.14 GC Corporation

- 6.4.15 Dentsply Sirona Inc.

- 6.4.16 Straumann Group

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment