PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848024

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848024

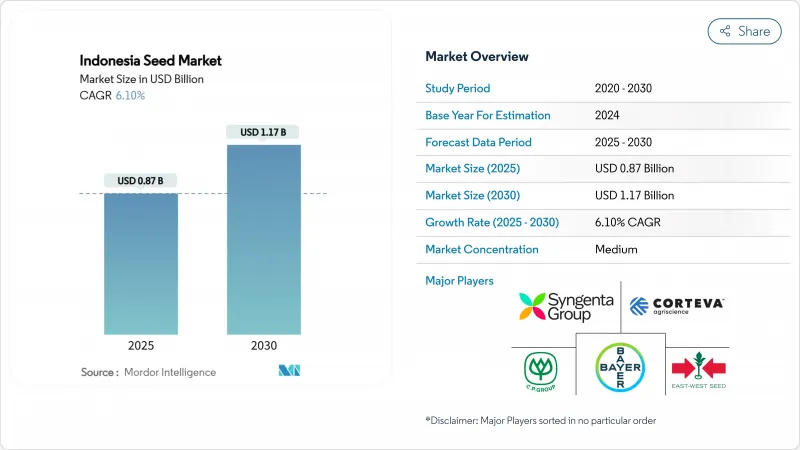

Indonesia Seed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Indonesia seed market size is USD 0.87 billion in 2025 and is projected to reach USD 1.17 billion by 2030, growing at a CAGR of 6.1% during the forecast period.

Farmers are adopting certified and hybrid seed varieties to protect crop yields against weather fluctuations, soil salinity, and pest infestations. In January 2024, the Indonesian government allocated IDR 124.4 trillion (USD 7.6 billion) for seed subsidies to reduce input costs for small-scale farmers and enhance food security. Digital agriculture solutions are accelerating the transition from farmer-saved seeds to branded products with enhanced traceability. Changes in urban food consumption patterns increase demand for diverse vegetable seeds, while national rice self-sufficiency targets maintain strong demand for field crop seeds. While the market remains moderately consolidated, agricultural technology companies are transforming seed distribution through contract farming programs and mobile-based advisory services.

Indonesia Seed Market Trends and Insights

Government Subsidy Programs for Certified Seeds

Indonesia's food security strategy focuses on procuring certified rice seeds for extensive cultivation areas annually. The government implements price ceilings to reduce financial risks for smallholder farmers and encourage them to switch from saved seeds to certified varieties. The SNI 8211:2023 standard requires strict genetic purity standards, enabling compliant seed producers to set higher prices. While this regulatory framework reduces profit margins for informal vendors, it provides scale advantages to companies that can fulfill large institutional orders. Distributors with effective traceability systems receive faster payments and more frequent orders, which increases service standards in the Indonesian seed market.

Expansion of Hybrid-rice Acreage

Hybrid rice plays a key role in Indonesia's UPSUS yield-enhancement program, which aims to increase productivity compared to previous seasons. Local doubled-haploid varieties, developed specifically for tropical daylight patterns, show better performance than imported varieties. Provincial governments provide comprehensive packages including fertilizer, certified seed, and crop insurance to encourage adoption by making hybrid rice more economically feasible for farmers despite higher upfront costs. The requirement to purchase new hybrid seeds each season creates steady revenue for suppliers, supporting the growth and development of Indonesia's formal seed market.

Limited GM Seed Multiplication Capacity

Indonesia's biosafety review has approved only three GM crop events, with certified multiplication sites concentrated in Java. The lengthy approval processes for GM corn and soybean require significant working capital, which impedes market expansion. These regulatory delays increase costs, limiting smallholder farmers' access to biotech seeds and reducing market demand. The low adoption rate prevents farmers from realizing the productivity benefits of biotech traits. The Indonesian seed market's growth in genetically modified crops remains constrained by complex regulations and limited infrastructure, creating a disconnect between available technology and farmer accessibility across the country.

Other drivers and restraints analyzed in the detailed report include:

- Urban Middle-class Demand for Fresh Vegetables

- Demand for Climate-resilient Varieties

- Counterfeit Seed Circulation via Fragmented Channels

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Row crops generated 68% of the Indonesia seed market size in 2024, primarily driven by extensive cultivation of rice, corn, and soybeans under government support programs. Rice cultivation covered over 8.1 million hectares, supported by guaranteed floor prices that encourage farmers to purchase certified seeds. The feed industry's annual demand of 15 million metric tons of corn maintains consistent seed demand across rain-fed and irrigated farming systems. In the soybean segment, domestic seed suppliers focus on developing higher-protein varieties to compete against imports under the USD 4.5 billion bilateral trade agreement. Groundnut cultivation remains concentrated in East Java's sandy soils, where drought-resistant varieties demonstrate superior performance compared to other legumes.

The vegetable seed segment projects a 7.5% CAGR through 2030, despite smaller cultivation areas. Chili, tomato, and leafy green crops provide quick returns for peri-urban farmers supplying supermarkets and e-commerce platforms. East-West Seed utilizes its global research and development network to develop varieties adapted to Indonesia's humid conditions, focusing on extended shelf life and reduced post-harvest losses. The development of specialty hybrids meeting export standards for Singapore and Malaysia markets commands higher prices compared to staple crops, improving overall market margins while complementing the high-volume row crop segment.

The Indonesia Seed Market Report is Segmented by Crop Type (Row Crops Including Rice, Maize, Soybean, Groundnut, and More, and Vegetables Including Chilli, Onion, Cabbage, Tomato, and More), and Product Type (Non-GM/Hybrid Seeds, GM Seeds, and Varietal Seeds). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Bayer AG

- Syngenta Group

- UPL Limited (Advanta Seeds International)

- Charoen Pokphand Group (PT. BISI International Tbk)

- East West Group (East-West Seeds)

- Corteva Agriscience

- Asian Hybrid Seed Technologies, Inc.

- Java Seed Indonesia

- Rijk Zwaan Zaadteelt en Zaadhandel B.V.

- Sakata Seed Corporation

- PT. Benih Citra Asia (BCA)

- PT. Agri Makmur Pertiwi

- PT Shriram Seed Indonesia (DCM Shriram Ltd.)

- Known-You Seed Co. Ltd

- Bejo Zaden B.V.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government Subsidy Programs for Certified Seeds

- 4.2.2 Expansion of Hybrid-rice Acreage

- 4.2.3 Urban Middle-class Demand for Fresh Vegetables

- 4.2.4 Precision Phenotyping Adoption by Local Breeders

- 4.2.5 Demand for Climate-resilient Varieties

- 4.2.6 Contract-farming Seed Supply Models from Agri-tech Start-ups

- 4.3 Market Restraints

- 4.3.1 Limited GM Seed Multiplication Capacity

- 4.3.2 Counterfeit Seed Circulation via Fragmented Channels

- 4.3.3 Royalty-collection Uncertainty for Plant-Variety Protection

- 4.3.4 Coastal Soil Salinity Lowering Germination Rates

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Crop Type

- 5.1.1 Row Crops

- 5.1.1.1 Rice

- 5.1.1.2 Maize

- 5.1.1.3 Soybean

- 5.1.1.4 Groundnut

- 5.1.1.5 Other Row Crops

- 5.1.2 Vegetables

- 5.1.2.1 Chilli

- 5.1.2.2 Onion

- 5.1.2.3 Cabbage

- 5.1.2.4 Tomato

- 5.1.2.5 Other Vegetables

- 5.1.1 Row Crops

- 5.2 By Product Type

- 5.2.1 Non-GM/Hybrid Seeds

- 5.2.2 GM Seeds

- 5.2.3 Varietal Seeds

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Bayer AG

- 6.4.2 Syngenta Group

- 6.4.3 UPL Limited (Advanta Seeds International)

- 6.4.4 Charoen Pokphand Group (PT. BISI International Tbk)

- 6.4.5 East West Group (East-West Seeds)

- 6.4.6 Corteva Agriscience

- 6.4.7 Asian Hybrid Seed Technologies, Inc.

- 6.4.8 Java Seed Indonesia

- 6.4.9 Rijk Zwaan Zaadteelt en Zaadhandel B.V.

- 6.4.10 Sakata Seed Corporation

- 6.4.11 PT. Benih Citra Asia (BCA)

- 6.4.12 PT. Agri Makmur Pertiwi

- 6.4.13 PT Shriram Seed Indonesia (DCM Shriram Ltd.)

- 6.4.14 Known-You Seed Co. Ltd

- 6.4.15 Bejo Zaden B.V.

7 Market Opportunities and Future Outlook