PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906928

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906928

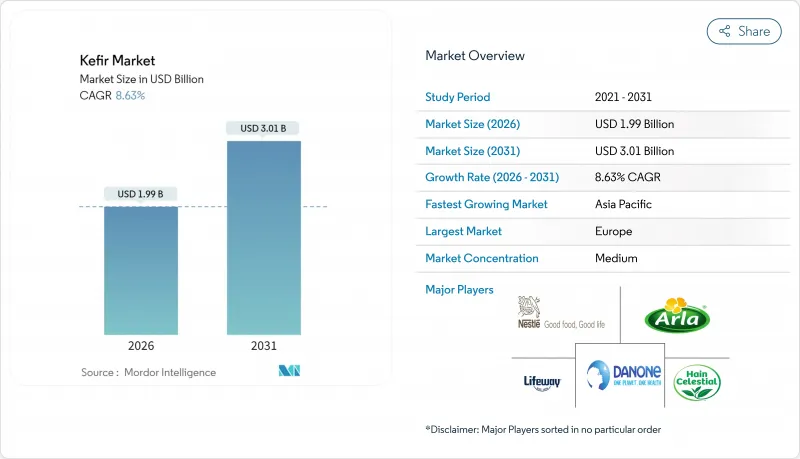

Kefir - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The kefir market was valued at USD 1.83 billion in 2025 and estimated to grow from USD 1.99 billion in 2026 to reach USD 3.01 billion by 2031, at a CAGR of 8.63% during the forecast period (2026-2031).

Rising clinical evidence supporting kefir's superior gut-health benefits over many commercial probiotic supplements continues to shift consumer preference toward naturally fermented products, while the United States Food and Drug Administration's 2024 qualified health-claim decision for yogurt has created a halo effect across the wider fermented dairy aisle, including kefir. Europe retains the highest regional demand, supported by long-standing consumption habits and a favorable regulatory climate, whereas Asia-Pacific is expanding fastest on the back of rapid urbanization and increasing awareness of digestive wellness. Conventional formulations dominate volume sales, yet premium organic, flavored, and plant-based variants capture consumers seeking clean-label, low-sugar, and lactose-free options, driving above-average growth in these sub-segments. Within distribution, supermarkets remain pivotal, but cafes and wellness-focused food service outlets are redefining trial exposure and brand storytelling through experiential formats.

Global Kefir Market Trends and Insights

Rising Consumer Focus on Gut Health Boosts Kefir Demand

Dairy kefir contains a diverse range of beneficial microorganisms and bioactive compounds that improve gut microbiota composition and digestive health more effectively than probiotic yogurt and inulin-rich diets. The fermented dairy product's proven effectiveness in managing type 2 diabetes and cardiovascular diseases has increased its consumption among older consumers. Companies have successfully educated consumers about these health benefits through marketing campaigns and product labeling, which has driven market demand. Growing awareness of gut health benefits and digestive wellness among younger consumers has also expanded the market for premium kefir products, including organic and flavored variants.

Growing Popularity of Probiotic-Rich Functional Foods

The growing consumer awareness of probiotics and increased adoption of functional foods are expanding market opportunities, especially in plant-based probiotic products. The Food and Agriculture Organization's (FAO) proposed global probiotic guidelines, covering more than 200 countries, aim to standardize quality requirements and enhance international trade . Advancements in manufacturing processes, including improved strain selection and fermentation techniques, enable producers to maintain probiotic counts above 20 billion CFUs per serving, which is higher than traditional yogurt products. Kefir's positioning as a functional food allows for premium pricing while addressing health benefits, including digestive health and immune system support.

Competition From Kombucha and Yogurt-Based Beverages

The competitive landscape shows kombucha gaining market share as a non-dairy probiotic beverage appealing to younger consumers, while yogurt-based drinks maintain their position through established consumer preferences and production efficiencies. In the online retail segment, kefir faces strong competition from kombucha brands that demonstrate stronger digital marketing and subscription-based sales models. As consumers find it challenging to differentiate between probiotic claims across products, kefir manufacturers must increase investment in consumer education and scientific validation to maintain premium pricing. The market competition now includes new product categories, such as Wonder Veggies' planned launch of probiotic fresh produce, which may lead to further market segmentation. To maintain market position, kefir producers must highlight their core advantages, including diverse probiotic strains and traditional fermentation processes, while developing new products that incorporate popular flavors from other beverage categories.

Other drivers and restraints analyzed in the detailed report include:

- Innovation In Flavors of Kefir Attracts Wider Demographics

- Celebrity and Influencer Endorsements Boost Kefir's Image

- Higher Cost Compared to Regular Dairy Products

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Conventional kefir products held 70.84% of the market share in 2025, while the organic kefir segment is expected to grow at a CAGR of 10.54% through 2031, driven by increasing consumer preference for clean-label and premium products. While conventional kefir continues to benefit from well-established supply chains and mainstream consumer promotions, it faces growth challenges as health-conscious buyers increasingly choose organic alternatives. Manufacturers have invested in improving their fermentation control methods to maintain consistent probiotic content without using synthetic stabilizers, a key requirement for organic certification. Several companies have found a middle ground by incorporating organic milk into standard processing methods, helping them manage costs while maintaining market credibility.

The evolving market landscape requires companies to build strong organic supply chain capabilities and develop certification expertise to remain competitive. Forward-thinking organic producers are distinguishing themselves by implementing automated milking systems and renewable energy solutions at the farm level, while adding value through non-GMO feed and grass-fed certifications. In response, conventional manufacturers are maintaining their market position by developing fortified product lines enriched with vitamin D, calcium, and collagen, particularly appealing to price-sensitive consumer segments.

The kefir market shows a clear consumer preference for flavored options, which currently command a 63.45% market share in 2025. This dominance reflects successful efforts by manufacturers to diversify their product offerings and make kefir more appealing to mainstream consumers. Meanwhile, non-flavored variants are experiencing notable growth, with a projected 9.69% CAGR through 2031, as consumers increasingly seek pure, minimally processed options. Lifeway's launch of 10 organic flavors, including innovative combinations like Taro Ube Latte and Pistachio Rose Vanilla, demonstrates how companies are actively responding to diverse consumer preferences, while non-flavored kefir continues to attract health-focused consumers who value its versatility in smoothies and cooking applications.

Market analysis reveals distinct regional patterns in flavor preferences, with tropical and Asian-inspired varieties performing particularly well in culturally diverse markets, while traditional berry and vanilla options maintain their appeal in established markets. Companies are responding to health-conscious consumer demands by developing reduced-sugar formulations that incorporate natural sweetening alternatives, ensuring that taste quality remains high while maintaining the product's probiotic benefits.

The Kefir Market Report is Segmented by Form (Organic, and Conventional), by Flavor (Flavored Kefir, and Non-Flavored Kefir), by Product Type (Milk Kefir, and Water Kefir), by Distribution Channel (Off-Trade, and On-Trade), by Packaging Type (Bottles, and Pouches), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

European consumers have embraced kefir products, giving the region a commanding 30.92% share of global consumption in 2025. This strong market position stems from generations of familiarity with fermented dairy products, supported by well-established distribution networks across Germany, United Kingdom, and France. Major food companies like Danone are capitalizing on this cultural acceptance by expanding their kefir offerings through new Activia product lines. While the region benefits from comprehensive regulatory frameworks that uphold probiotic health claims and quality standards, the varying interpretations of probiotic terminology and marketing regulations among Eurpean Union member states continue to present operational challenges .

Consumer behavior in Asia-Pacific is rapidly evolving, driving an impressive 9.66% CAGR through 2031 in the kefir market. The region's transformation is particularly evident in Japan, where consumers are increasingly choosing lactic acid beverages over traditional vegetable juices. This shift reflects broader regional trends of urbanization, rising disposable incomes, and growing health consciousness, making Asia-Pacific the most dynamic market for functional food products.

North America maintains its market strength through companies like Lifeway Foods, which dominates the United States kefir category. The region's innovation-friendly regulatory environment, featuring FDA qualified health claims and GRAS approvals for probiotic strains, continues to support product development. Meanwhile, the Middle East and Africa and South America show promise as emerging markets, driven by expanding middle-class populations and increasing health awareness. However, success in these regions requires carefully balanced strategies that address both infrastructure limitations and price sensitivity while maintaining product quality.

- Danone S.A.

- Lifeway Foods, Inc.

- Nestle S.A.

- The Hain Celestial Group, Inc.

- Green Valley Creamery

- Arla Foods AMBA

- Maple Hill Creamery, LLC

- Springfield Creamery, Inc.

- Biotiful Dairy Ltd

- Brookford Farm

- Nourish Kefir

- Babushka Kefir

- Valio Eesti AS

- Chobani, LLC

- Suta? Sut Urunleri A.?.

- Les Produits de Marque Liberte Inc.

- Emmi AG (Redwood Hill Farm & Creamery)

- Straus Family Creamery

- Kefir Lab Inc

- Kalona SuperNatural

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Consumer Focus on Gut Health Boosts Kefir Demand

- 4.2.2 Growing Popularity of Probiotic-Rich Functional Foods

- 4.2.3 Innovation In Flavors of Kefir Attracts Wider Demographics

- 4.2.4 Celebrity And Influencer Endorsements Boost Kefir's Image

- 4.2.5 Demand for Clean-Label and Minimally Processed Beverages

- 4.2.6 Inclusion of Kefir in Weight Management and Detox Diets

- 4.3 Market Restraints

- 4.3.1 Competition From Kombucha and Yogurt-Based Beverages

- 4.3.2 Higher Cost Compared to Regular Dairy Products

- 4.3.3 High Added-Sugar Perception Among Health-Conscious Consumers

- 4.3.4 Limited Shelf-Life for Water-Kefir In Tropical Markets

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Buyers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Form

- 5.1.1 Organic

- 5.1.2 Conventional

- 5.2 By Flavor

- 5.2.1 Flavored Kefir

- 5.2.2 Non-flavored Kefir

- 5.3 By Product Type

- 5.3.1 Milk Kefir

- 5.3.2 Water Kefir

- 5.4 By Distribution Channel

- 5.4.1 Off-Trade

- 5.4.1.1 Supermarkets/Hypermarkets

- 5.4.1.2 Convenience Stores

- 5.4.1.3 Online Retail Stores

- 5.4.1.4 Other Retail Channels

- 5.4.2 On-Trade

- 5.4.1 Off-Trade

- 5.5 By Packaging Type

- 5.5.1 Bottles

- 5.5.2 Pouches

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 France

- 5.6.2.3 United Kingdom

- 5.6.2.4 Spain

- 5.6.2.5 Netherlands

- 5.6.2.6 Italy

- 5.6.2.7 Sweden

- 5.6.2.8 Poland

- 5.6.2.9 Belgium

- 5.6.2.10 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Indonesia

- 5.6.3.7 Thailand

- 5.6.3.8 Singapore

- 5.6.3.9 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Chile

- 5.6.4.4 Colombia

- 5.6.4.5 Peru

- 5.6.4.6 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 South Africa

- 5.6.5.3 Nigeria

- 5.6.5.4 Saudi Arabia

- 5.6.5.5 Egypt

- 5.6.5.6 Morocco

- 5.6.5.7 Turkey

- 5.6.5.8 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Danone S.A.

- 6.4.2 Lifeway Foods, Inc.

- 6.4.3 Nestle S.A.

- 6.4.4 The Hain Celestial Group, Inc.

- 6.4.5 Green Valley Creamery

- 6.4.6 Arla Foods AMBA

- 6.4.7 Maple Hill Creamery, LLC

- 6.4.8 Springfield Creamery, Inc.

- 6.4.9 Biotiful Dairy Ltd

- 6.4.10 Brookford Farm

- 6.4.11 Nourish Kefir

- 6.4.12 Babushka Kefir

- 6.4.13 Valio Eesti AS

- 6.4.14 Chobani, LLC

- 6.4.15 Suta? Sut Urunleri A.?.

- 6.4.16 Les Produits de Marque Liberte Inc.

- 6.4.17 Emmi AG (Redwood Hill Farm & Creamery)

- 6.4.18 Straus Family Creamery

- 6.4.19 Kefir Lab Inc

- 6.4.20 Kalona SuperNatural

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK