PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848035

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848035

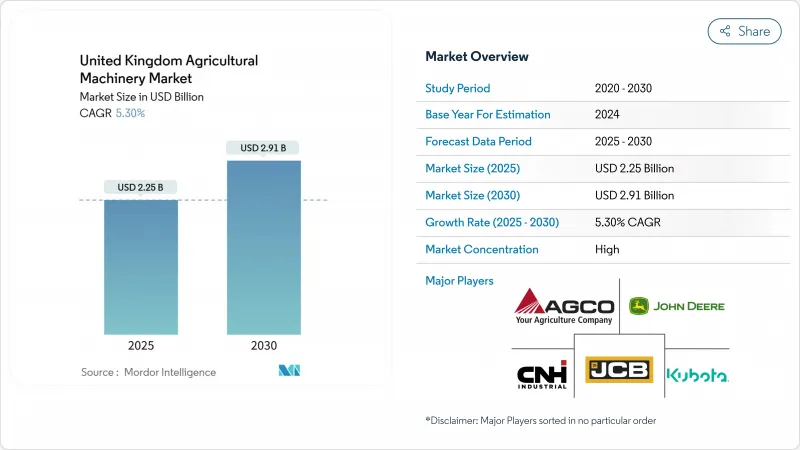

United Kingdom Agricultural Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The United Kingdom agricultural machinery market size stands at USD 2.25 billion in 2025 and is projected to advance to USD 2.91 billion by 2030, delivering a steady 5.3% CAGR during the forecast period.

This upward trajectory underscores the sector's resilience amid post-Brexit regulation, persistent labor shortages, and accelerating on-farm automation. Over the next five years, equipment purchases will be buoyed by the Farming Equipment and Technology Fund, a GBP 50 million (USD 63 million) grant program that directly offsets capital costs for productivity-enhancing machinery. Demand is also influenced by the Clean Power 2030 Action Plan, which channels investment toward low-emission electric and hydrogen tractors that help farms meet the national net-zero target for 2030. Meanwhile, the Expansion of agri-robotics testbeds, supported by the Smart Machines Strategy 2035, is fostering rapid prototype adoption and attracting technology partnerships across research clusters.

United Kingdom Agricultural Machinery Market Trends and Insights

Shortage of labor accelerating mechanization

More than 40% of British farms report an insufficient workforce, a figure that has intensified capital outlays toward autonomous and semi-autonomous machinery capable of substituting manual labor. Seasonal-worker visas have been extended to 45,000 positions through 2029, yet government policy is simultaneously investing GBP 50 million (USD 63 million) in automation to reduce long-term reliance on migrant labor. Fieldwork Robotics' raspberry-picking system exemplifies how continuous operation and human-comparable throughput shift return-on-investment calculations in favor of robotics. As labor costs rise, specification requirements move toward equipment that can work longer hours with limited oversight, reinforcing demand across the United Kingdom agricultural machinery market.

Government grant schemes and tax relief on farm machinery

The Farming Equipment and Technology Fund awards between GBP 1,000 and GBP 25,000 (USD 1,250 to USD 31,250) per applicant, while the Improving Farm Productivity program finances up to GBP 500,000 (USD 625,000) for robotics and precision systems. Each funded item must remain in use for five years, providing equipment suppliers with predictable demand cycles. Grant scoring frameworks prioritize carbon reduction and animal welfare metrics, steering purchases toward sensor-rich implements, autonomous guidance, and low-compaction solutions. These incentives directly lift overall equipment turnover within the United Kingdom agricultural machinery market, especially for small and mid-sized farms that historically delayed high-ticket investments.

High upfront and maintenance costs

The Institute of Chartered Accountants in England and Wales notes that large producers are delaying equipment purchases despite healthy cash flows, reflecting rising unit prices and tighter financing. AGCO Corporation's Q1 2025 revenue fell 30%, a signal that cost-sensitive buyers are pruning capital budgets. Maintenance burdens compound the hurdle modern combines and tractors require proprietary diagnostic software, cloud subscriptions, and specialized technicians. Even with grant offsets, many small operations find lifecycle costs prohibitive, trimming projected expansion of the United Kingdom agricultural machinery market.

Other drivers and restraints analyzed in the detailed report include:

- Regenerative-farming incentives driving low-compaction equipment demand

- Net-Zero electrification mandates catalyzing electric tractor purchases

- Cybersecurity and data privacy risks in connected machinery

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Tractors accounted for a 55.2% share of the United Kingdom agricultural machinery market in 2024. Segment expansion remains tethered to replacement cycles and horsepower upgrades, with autonomous and telematics integration becoming default specifications. Within tractors, models under 100 horsepower dominate volume, yet high-horsepower units above 150 horsepower capture disproportionate revenue due to their premium pricing and full-stack technology. Deere & Company's majority share highlights the importance of integrated guidance, connectivity, and after-sales networks that lower the total cost of ownership across the United Kingdom agricultural machinery market.

Irrigation equipment posted an 8.2% CAGR outlook through 2030, the strongest among all categories, and a direct response to unpredictable rainfall and tightening abstraction permits. Pivot systems coupled with soil-moisture sensors help farms align with the Environment Agency's water-management directives, while drip technology gains traction in high-value horticulture. Precision irrigation supports regenerative objectives by reducing runoff and input waste, underscoring how climate volatility drives product diversification within the United Kingdom agricultural machinery market size framework. Harvesters, forage machinery, and tillage implements also report steady demand, but their growth trails irrigation as water stewardship rises on farm agendas.

The United Kingdom Agricultural Machinery Market Report is Segmented by Machinery Type (Tractor, Equipment, Irrigation Machinery, Harvesting Machinery, Haying and Forage Machinery, and Other Machinery Types). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Deere & Company

- CNH Industrial N.V.

- AGCO Corporation

- Kubota Corporation

- Claas KGaA mbH

- J.C. Bamford Excavators Ltd.

- Kuhn Group (Bucher Industries AG)

- SDF Group S.p.A.

- Bernard Krone Holding SE & Co. KG

- Horsch Maschinen GmbH

- Amazone-Werke H. Dreyer SE & Co. KG

- GRIMME Landmaschinenfabrik GmbH & Co. KG

- LEMKEN GmbH & Co. KG

- Vaderstad Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shortage of labor accelerating mechanization

- 4.2.2 Government grant schemes and tax relief on farm machinery

- 4.2.3 Demand for precision agriculture and digitalization

- 4.2.4 Regenerative-farming incentives driving low-compaction equipment demand

- 4.2.5 Expansion of agri-robotics testbeds boosting prototype uptake

- 4.2.6 Net-Zero electrification mandates catalyzing electric tractor purchases

- 4.3 Market Restraints

- 4.3.1 High upfront and maintenance costs

- 4.3.2 Cybersecurity and data privacy risks in connected machinery

- 4.3.3 Rural grid-capacity limits slowing electric-equipment adoption

- 4.3.4 Post-Brexit certification divergence escalating compliance costs

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Machinery Type

- 5.1.1 Tractor

- 5.1.1.1 Less than 50 HP

- 5.1.1.2 50 to 100 HP

- 5.1.1.3 100 to 150 HP

- 5.1.1.4 Above 150 HP

- 5.1.2 Equipment

- 5.1.2.1 Plows

- 5.1.2.2 Harrows

- 5.1.2.3 Cultivators and Tillers

- 5.1.2.4 Other Equipment (Seed Drills, Rollers, etc.)

- 5.1.3 Irrigation Machinery

- 5.1.3.1 Sprinkler Irrigation

- 5.1.3.2 Drip Irrigation

- 5.1.3.3 Other Irrigation Machinery (Center Pivot Systems, Micro Sprinklers, etc.)

- 5.1.4 Harvesting Machinery

- 5.1.4.1 Combine Harvesters

- 5.1.4.2 Forage Harvesters

- 5.1.4.3 Other Harvesting Machinery (Potato Harvesters, Beet Harvesters, etc.)

- 5.1.5 Haying and Forage Machinery

- 5.1.5.1 Mowers and Conditioners

- 5.1.5.2 Balers

- 5.1.5.3 Other Haying and Forage Machinery (Rakes, Tedders)

- 5.1.6 Other Machinery Types

- 5.1.1 Tractor

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Deere & Company

- 6.4.2 CNH Industrial N.V.

- 6.4.3 AGCO Corporation

- 6.4.4 Kubota Corporation

- 6.4.5 Claas KGaA mbH

- 6.4.6 J.C. Bamford Excavators Ltd.

- 6.4.7 Kuhn Group (Bucher Industries AG)

- 6.4.8 SDF Group S.p.A.

- 6.4.9 Bernard Krone Holding SE & Co. KG

- 6.4.10 Horsch Maschinen GmbH

- 6.4.11 Amazone-Werke H. Dreyer SE & Co. KG

- 6.4.12 GRIMME Landmaschinenfabrik GmbH & Co. KG

- 6.4.13 LEMKEN GmbH & Co. KG

- 6.4.14 Vaderstad Group

7 Market Opportunities and Future Outlook