PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848037

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848037

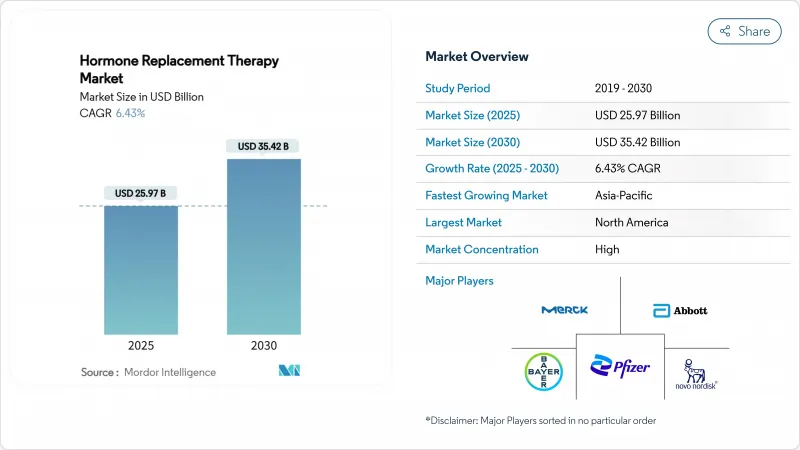

Hormone Replacement Therapy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global hormone replacement therapy market size reached USD 25.97 billion in 2025 and is forecast to rise to USD 35.42 billion by 2030, translating to a 6.43% CAGR.

Demand grows in line with an aging demographic-women over 50 are projected to exceed 1.2 billion by 2030. Follow-up findings from the Women's Health Initiative now distinguish risks across individual formulations, restoring physician confidence and widening candidate pools for treatment. Rapid telehealth adoption removes geographic barriers, while direct-to-consumer platforms deliver up to 90% cost savings and accelerate first-time user adoption. Reimbursement pathways keep expanding, as seen in Medicare coverage for medically necessary transgender regimens, which establishes precedents for broader hormonal care reimbursement models. Innovation attention has shifted toward non-hormonal neurokinin antagonists and tissue-selective modulators, positioning the hormone replacement therapy market for sustained mid-single-digit growth despite periodic safety debates and upcoming patent cliffs.

Global Hormone Replacement Therapy Market Trends and Insights

Surging Post-Menopausal Population & Life-Expectancy Gains

Demographic momentum is enlarging the potential treatment pool as women now spend roughly one-third of their lives post-menopause. Workforce productivity losses, such as Japan's USD 12 billion annual burden tied to unmanaged menopausal symptoms, nudge healthcare payers and employers toward proactive hormone care programs. Integrated longevity initiatives in public health strategies are creating sustained demand that moves beyond symptom relief toward long-term preventive regimens.

Rapid Adoption of Bio-Identical Hormone Formulations

Clinical evidence shows micronized progesterone and estradiol combinations exhibit lower cardiometabolic and oncologic risk than earlier conjugated equine estrogens, enabling 20-30% premium pricing and faster uptake among health-conscious mid-life women. TherapeuticsMD's BIJUVA approval set a regulatory benchmark and, with patent protection to 2032, provides a defensible niche for innovators. Capacity expansion through acquisitions, exemplified by Biote's purchase of 503B compounding facilities, secures supply while standardizing quality.

Cancer-Risk Perception After WHI & Follow-Up Studies

Though 21-year follow-up data indicate estrogen-only regimens reduce breast cancer incidence by 23% and mortality by 40%, the original 2002 WHI headlines still shape public opinion. Recent FDA boxed warnings, such as that applied to non-hormonal fezolinetant, keep safety debates visible and complicate physician messaging. Professional societies have updated positions to allow therapy beyond age 65 with individualized counseling, yet broad adoption hinges on continuous educational outreach.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Tele-Health BHRT Subscription Models

- Pipeline of Micro-Dosed & Tissue-Selective SERMs/SARMs

- High Lifetime Therapy Cost & Lack of Generic Bio-Identicals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Estrogen products retained 42.56% of 2024 revenue, underlining their central position in the hormone replacement therapy market. The parathyroid segment, however, is charting an 8.51% CAGR through 2030 as newer indications surface, pushing the hormone replacement therapy market size toward diversified growth corridors. Specialized products such as YORVIPATH for chronic hypoparathyroidism command premium pricing and underscore the shift from broad symptom control to targeted organ support.

Precision-oriented pipelines pair micro-dosed estrogens with tissue-selective modulators to serve nuanced patient profiles. Companies with multi-hormone portfolios are well positioned, whereas single-product players risk share attrition. Testosterone demand is dampened by heightened cardiovascular labeling while growth hormone continues steady uptake among longevity-focused consumers.

Oral regimens held 40.34% share in 2024 and remain widely prescribed owing to convenience. Transdermal patches and gels, buoyed by a 7.92% forecast CAGR, offer consistent plasma levels without first-pass metabolism, helping the hormone replacement therapy market transition toward personalized dosing. Novartis's Estradot micro-patch illustrates how miniaturized systems elevate compliance.

Long-acting injectables such as MIT's SLIM microcrystal technology hint at quarterly or semi-annual dosing horizons. Vaginal and intrauterine devices continue to address local genitourinary symptoms with minimal systemic exposure, adding breadth to delivery choices.

The Hormone Replacement Therapy Market Report is Segmented by Therapy (Estrogen, Growth Hormone, Thyroid, and More), Route of Administration (Oral, Parenteral, Transdermal, Vaginal/Intra-uterine, and More), Indication (Menopause, Hypothyroidism, and More), Distribution Channel (Hospital Pharmacy, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America sustained 38.63% share in 2024 owing to strong reimbursement frameworks, FDA guidance clarity, and an ecosystem that supports rapid telehealth scaling. Medicare's precedent on gender-affirming coverage signals how policy can unlock new segments. Generic estradiol gel approvals improve affordability, though upcoming patent expiries may pressure established brands.

Asia-Pacific is projected to grow at 7.41% CAGR through 2030. Rising urban incomes, aging populations, and shifting cultural perceptions on women's health underpin uptake, while corporate Japan quantifies menopause-related absenteeism at USD 12 billion annually, spurring employer-financed wellness offerings. Regulatory pilots in China for gender-affirming therapies and increasing Indian middle-class purchasing power collectively expand the hormone replacement therapy market footprint across the region.

Europe shows steady, guideline-driven demand yet faces cost-effectiveness scrutiny by health technology assessment bodies. Tough environmental rules on endocrine-active emissions influence production costs, with the European Medicines Agency mandating statewide monitoring ema. Emerging regions across the Middle East, Africa, and South America present growth runways but require localization strategies that align with diverse cultural and regulatory landscapes.

- Abbott Laboratories

- Bayer

- Eli Lilly and Company

- Roche

- Merck

- Mylan Viatris

- Novartis

- Novo Nordisk

- Pfizer

- Amgen

- Abbvie

- Hisamitsu Pharma

- Endo International

- TherapeuticsMD

- BioTE Medical

- Viatris

- Ascend Therapeutics

- Acerus Pharma

- Johnson & Johnson

- Teva Pharmaceutical Industries

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Post-Menopausal Population & Life-Expectancy Gains

- 4.2.2 Rapid Adoption of Bio-Identical Hormone Formulations

- 4.2.3 Expanding Tele-Health BHRT Subscription Models

- 4.2.4 Insurance Reimbursement Expansion for Transgender HRT

- 4.2.5 Pipeline Of Micro-Dosed & Tissue-Selective Serms / Sarms

- 4.2.6 Wearable Transdermal Patch Innovations & Long-Acting Injectables

- 4.3 Market Restraints

- 4.3.1 Cancer-Risk Perception After WHI & Follow-Up Studies

- 4.3.2 High Lifetime Therapy Cost & Lack of Generic Bio-Identicals

- 4.3.3 Patent-Cliff & Pricing Pressure on Legacy Estrogen Brands

- 4.3.4 Tightening Environmental Rules on Endocrine-Active Emissions

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Therapy

- 5.1.1 Estrogen

- 5.1.2 Growth Hormone

- 5.1.3 Thyroid

- 5.1.4 Testosterone

- 5.1.5 Parathyroid

- 5.2 By Route of Administration

- 5.2.1 Oral

- 5.2.2 Parenteral

- 5.2.3 Transdermal

- 5.2.4 Vaginal/Intra-uterine

- 5.2.5 Implantable Pellets

- 5.3 By Indication

- 5.3.1 Menopause

- 5.3.2 Hypothyroidism

- 5.3.3 Growth Hormone Deficiency

- 5.3.4 Other Indications

- 5.4 By Distribution Channel

- 5.4.1 Hospital Pharmacy

- 5.4.2 Retail Pharmacy

- 5.4.3 Online/Direct-to-Consumer Clinics

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 Bayer AG

- 6.3.3 Eli Lilly and Company

- 6.3.4 F. Hoffmann-La Roche

- 6.3.5 Merck KGaA

- 6.3.6 Mylan Viatris

- 6.3.7 Novartis AG

- 6.3.8 Novo Nordisk A/S

- 6.3.9 Pfizer Inc.

- 6.3.10 Amgen Inc.

- 6.3.11 AbbVie Inc.

- 6.3.12 Hisamitsu Pharma

- 6.3.13 Endo International

- 6.3.14 TherapeuticsMD

- 6.3.15 BioTE Medical

- 6.3.16 Viatris Inc.

- 6.3.17 Ascend Therapeutics

- 6.3.18 Acerus Pharma

- 6.3.19 Johnson & Johnson (Janssen)

- 6.3.20 Teva Pharmaceuticals

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment