PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848043

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848043

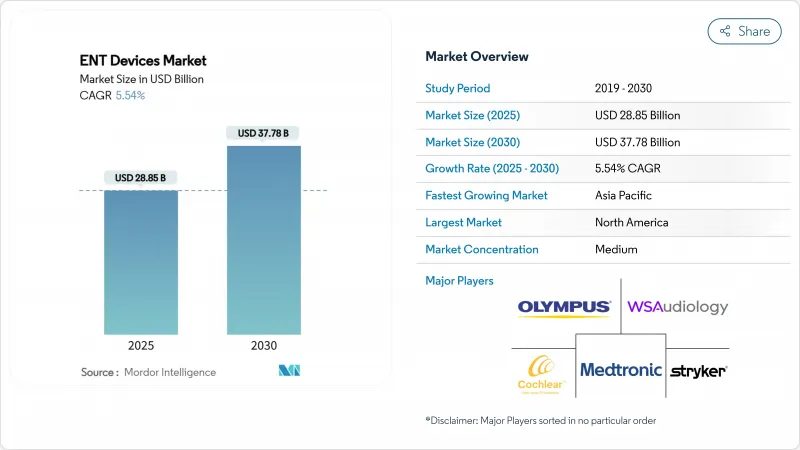

ENT Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The ENT devices market size reached USD 28.85 billion in 2025 and is forecast to climb to USD 37.78 billion by 2030, reflecting a 5.54% CAGR.

Robust demand stems from the expanding pool of age-related auditory and sinonasal disorders, steady procedure volumes across hospitals and ambulatory centers, and the rapid infusion of artificial intelligence into routine ENT tools. AI-enabled hearing aids that adjust to real-world listening environments, hyperspectral endoscopes that reveal tissue microstructures, and balloon sinus dilation kits that speed post-operative recovery collectively raise clinical expectations and spur replacement purchases. Parallel gains in home-based care, exemplified by smartphone-linked devices that permit remote programming, widen patient access and support recurring revenue models inside the ENT devices market. Volume growth is further anchored by Asia-Pacific's infrastructure build-out, North America's reimbursements that now cover over-the-counter aids, and surgically focused innovations that shorten operating-room time.

Global ENT Devices Market Trends and Insights

Rising Prevalence of ENT Disorders

Aging populations and deteriorating urban air quality have raised the incidence of chronic rhinosinusitis, otitis media, and sensorineural hearing loss. Hospital registries confirm earlier presentation in metropolitan clinics, while rural patients still arrive with advanced pathologies that often require more invasive interventions. Across the ENT devices market, this epidemiology sustains baseline demand for imaging scopes, balloon dilation kits, and programmable hearing aids. Public health agencies therefore prioritize early screening, which in turn elevates diagnostic instrument placements and stimulates follow-on sales of consumables.

Technological Advancements in ENT Devices

Digital signal processors, narrow-beam microphones, and 4D motion sensors now embed inside premium hearing aids, allowing real-time environmental classification and noise suppression that improve speech recognition. In operating theaters, rigid endoscopes capable of hyperspectral imaging distinguish perfused mucosa from malignancies, enhancing resection margins while limiting bleeding. These breakthroughs reinforce the ENT devices market as a technology-driven arena: manufacturers differentiate through software updates, cloud-based fitting portals, and module-ready components that clip into existing surgical stacks.

High Cost of Devices

Fully implanted cochlear systems often list above USD 25,000, a figure beyond the reach of many uninsured adults. Even in countries with national health plans, wait lists persist when reimbursement caps lag inflation. Consequently, only a fraction of clinically eligible patients receive implants, dampening volume expansion inside the ENT devices market. Legislative proposals to reclassify active middle-ear devices as prosthetics aim to unlock Medicare funding and could gradually narrow affordability gaps.

Other drivers and restraints analyzed in the detailed report include:

- Rising Adoption of Minimally Invasive Procedures

- Rising Awareness Campaigns and Health Programs

- Device Sterilization and Maintenance Challenges

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The hearing-aid segment generated the largest slice of the ENT devices market size with 32% revenue in 2024. Cloud-linked firmware updates, lithium-ion rechargeable batteries, and AI-guided scene detection keep replacement cycles near four years, supporting steady unit demand. At the premium tier, integrated health sensors track cardiac rhythm and step counts, expanding device value beyond amplification. Sales also benefit from consumer electronics entrants who position self-fit models next to smartphones, an approach that widens channel exposure without cannibalizing clinic-fitted premium lines.

Implantable devices accounted for a smaller base yet posted the highest forward momentum with a 9.2% CAGR outlook. Innovations such as totally implanted cochlear systems remove external processors, boosting cosmetic appeal and swimming convenience. Surgeons appreciate magnet-guided electrode arrays that reduce cochlear trauma and shorten programming sessions. Favorable long-term outcomes foster payer acceptance, propelling multi-year growth inside the ENT devices market. Diagnostic instruments retain significant share; portable optical-coherence-tomography otoscopes now reveal middle-ear effusions at primary-care desks, broadening early intervention. Surgical device uptake follows the minimally invasive trend, especially balloon sinus kits that occupy ambulatory centers seeking rapid turnover.

The ENT Devices Market Report is Segmented by Product (Diagnostic Devices, Surgical Devices, Hearing Aids, Implantable Devices, Image-Guided Surgery Navigation Systems, and More), Age Group (Pediatric, Adult, and Geriatric), End User (Hospitals, ENT Clinics, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the ENT devices market with 38% revenue share in 2024. Extensive insurance coverage, veteran tele-audiology networks, and a vibrant research ecosystem accelerate adoption cycles. FDA authorization of consumer earbuds equipped with hearing-aid software underscores regulatory agility and primes retailers for expanded audiology aisles. Hospital groups invest in spectral-imaging endoscopes and revision-ready implant suites to retain referral flows, reinforcing regional spending momentum.

Europe remains a substantive contributor. Public payer systems reimburse most implant costs, though stringent evidence requirements slow initial roll-outs of novel technologies. Regional manufacturers emphasize miniaturization and eco-friendly packaging to align with environmental directives. Cross-border clinical consortia pool data, refining surgical guidelines and informing device redesigns that travel globally through the ENT devices market.

Asia-Pacific represents the fastest-growing arena with a 7.2% CAGR outlook. Government-backed insurance in China now covers bone-anchored hearing solutions, while India's Ayushman Bharat program subsidizes sinus surgeries at district hospitals. Domestic suppliers scale mid-tier offerings that balance durability with affordability, narrowing urban-rural access gaps. Start-ups in Korea and Singapore leverage robotics to navigate narrow nasal cavities, exporting intellectual property through licensing deals. Middle East and Africa move gradually yet benefit from teaching-hospital frameworks in Gulf states that import advanced suites and train regional surgeons. South America shows mixed progress as Brazil modernizes otology centers while neighboring countries grapple with funding constraints.

- Cochlear

- Sonova

- Demant

- GN Store Nord

- WS Audiology

- Medtronic

- Stryker

- Smith+Nephew PLC

- Olympus

- Fujifilm Holdings Corp.

- Starkey Laboratories

- Coloplast (Atos Medical AB)

- InHealth Technologies

- Richard Wolf

- Nurotron Biotechnology

- Baxter International (Hill-Rom)

- Acclarent Inc. (J&J)

- Boston Scientific

- Smiths Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of ENT Disorders

- 4.2.2 Technological Advancements in the ENT Devices

- 4.2.3 Rising Adoption of Minimally Invasive Procedures

- 4.2.4 Rising Awareness Campaigns and Health Programs

- 4.2.5 Rising Adoption of Telemedicine

- 4.3 Market Restraints

- 4.3.1 High Cost of Devices

- 4.3.2 Device Sterilization and Maintenance Challenges

- 4.3.3 Social Stigma Around Hearing-Aid Use in Emerging Markets

- 4.4 Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Diagnostic Devices

- 5.1.1.1 Endoscopes (Rigid, Flexible)

- 5.1.1.2 Hearing Screening Devices (OAE, Tympanometry)

- 5.1.2 Surgical Devices

- 5.1.2.1 Powered Surgical Instruments

- 5.1.2.2 Balloon Sinus Dilation Systems

- 5.1.2.3 CO? & Diode Lasers

- 5.1.2.4 ENT Supplies & Consumables (Stents, Ear Tubes)

- 5.1.3 Hearing Aids

- 5.1.3.1 Behind-the-Ear (BTE)

- 5.1.3.2 In-the-Ear / In-the-Canal (ITE/ITC)

- 5.1.3.3 Receiver-in-Canal (RIC)

- 5.1.3.4 Over-the-Counter (OTC) Hearing Aids

- 5.1.4 Implantable Devices

- 5.1.4.1 Cochlear Implants

- 5.1.4.2 Bone-Anchored Hearing Aids (BAHA)

- 5.1.5 Image-Guided Surgery Navigation Systems

- 5.1.6 Other Products

- 5.1.1 Diagnostic Devices

- 5.2 By Age Group

- 5.2.1 Pediatric (0-17 Years)

- 5.2.2 Adult (18-64 Years)

- 5.2.3 Geriatric (65+ Years)

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 ENT Clinics

- 5.3.3 Ambulatory Surgical Centers (ASCs)

- 5.3.4 Home-care

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Cochlear Ltd.

- 6.3.2 Sonova Holding AG

- 6.3.3 Demant A/S

- 6.3.4 GN Store Nord A/S

- 6.3.5 WS Audiology

- 6.3.6 Medtronic PLC

- 6.3.7 Stryker Corporation

- 6.3.8 Smith+Nephew PLC

- 6.3.9 Olympus Corporation

- 6.3.10 Fujifilm Holdings Corp.

- 6.3.11 Starkey Laboratories Inc.

- 6.3.12 Coloplast (Atos Medical AB)

- 6.3.13 InHealth Technologies

- 6.3.14 Richard Wolf GmbH

- 6.3.15 Nurotron Biotechnology Co. Ltd.

- 6.3.16 Baxter International (Hill-Rom)

- 6.3.17 Acclarent Inc. (J&J)

- 6.3.18 Boston Scientific Corp.

- 6.3.19 Smiths Medical

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment