PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848049

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848049

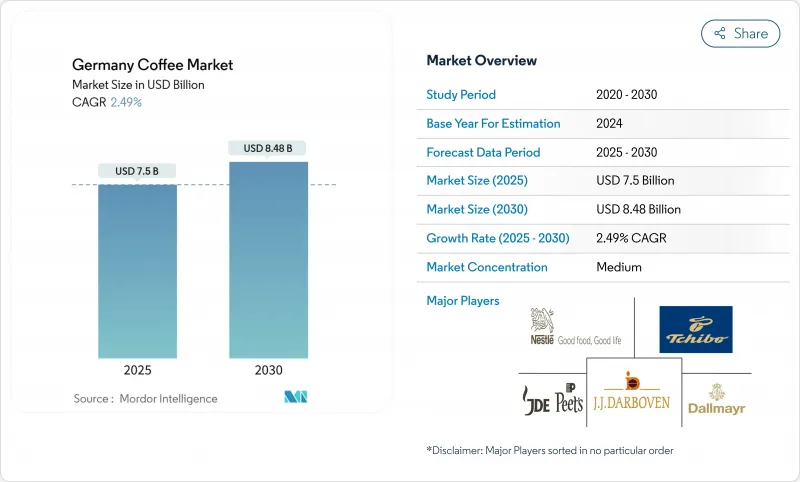

Germany Coffee - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The German coffee market size, valued at USD 7.50 billion in 2025, is projected to reach USD 8.48 billion by 2030, growing at a CAGR of 2.49%.

The market is characterized by a strong presence of both domestic and international players, with growth driven by multiple factors, including the rising home-barista trend, specialty coffee shops, and increasing demand for premium coffee varieties. German consumers are increasingly prioritizing quality, origin, and sustainability in their purchasing decisions, leading to higher sales of certified organic and fair-trade coffee products. While traditional coffee remains popular, the market has adapted to include newer brewing methods and formats, particularly coffee pods and capsules. The e-commerce channel has strengthened its position in coffee sales, supported by changing consumer shopping patterns. The out-of-home consumption segment has demonstrated notable recovery in cafes and restaurants across major German cities, complemented by increased investment in coffee roasting facilities and distribution networks. With these diverse market dynamics and evolving consumer preferences, the German coffee market is well-positioned for sustained growth and innovation in the coming years.

Germany Coffee Market Trends and Insights

Premiumization and Third-Wave Coffee Boom

The rising trend of premiumization and third-wave coffee culture in Germany, particularly in urban areas, is transforming coffee consumption patterns. German consumers are increasingly seeking high-quality, specialty coffee beans and artisanal brewing methods, moving away from traditional mass-market products. This shift is evident in the proliferation of specialty coffee shops, micro-roasteries, and coffee bars across major cities like Berlin, Hamburg, and Munich. This consumer behavior is supported by rising disposable income and sophisticated taste preferences, with emphasis on coffee origin, sustainable sourcing, and precise brewing methods. The trend is further reinforced by the growing availability of specialty coffee equipment and beans through both physical and online retail channels. Urban consumers demonstrate a strong willingness to pay premium prices for high-quality coffee experiences, with 78% of German coffee drinkers preferring to pay more for organic options, according to the European Ministry of Foreign Affairs. In response, major retailers are expanding their specialty offerings, while established companies like Tchibo and Dallmayr are repositioning their premium lines to capture this growing market segment.

Growth of Home-Barista Equipment Boosting Whole-Bean Sales

The increasing popularity of home-brewing equipment, such as espresso machines, grinders, and pour-over devices, has evolved into a sustained trend, with German consumers investing in sophisticated brewing equipment that rivals cafe quality. This home-barista movement directly drives the growth in whole bean coffee sales as consumers seek fresher, more flavorful brews. Coffee enthusiasts increasingly view brewing as a craft to be mastered rather than a convenience to be outsourced, leading to increased consumer knowledge about coffee brewing techniques and bean quality. The rise in remote work arrangements has further solidified this trend, with consumers prioritizing premium coffee experiences within their homes. Manufacturers are responding with innovations targeting this segment, exemplified by Gruppo Illy's launch of the new X-CAPS capsule system in April 2025. Additionally, the cost savings associated with home brewing compared to daily cafe purchases motivate consumers to invest in quality brewing equipment and whole beans. Coffee enthusiasts also appreciate the flexibility to adjust grind sizes for different brewing methods, contributing to the growing demand for whole bean coffee in the retail segment.

German Coffee Tax and Import Tariff Volatility

Germany's unique coffee tax (Kaffeesteuer) creates significant cost pressures in the market, with levies of EUR 2.19/kg on roasted coffee and EUR 4.78/kg on instant coffee, alongside EU import tariffs of 7.5% on roasted coffee. This tax structure, unparalleled in other EU nations, combined with volatile international coffee prices and varying import duties, poses substantial challenges for market participants. Small and medium-sized businesses are particularly affected, as they have limited capacity to absorb cost fluctuations and manage complex tax compliance requirements. These financial pressures often force companies to choose between reducing profit margins or increasing consumer prices, potentially impacting market growth and consumption patterns. While green coffee beans remain exempt from import duties, the overall tax and regulatory framework continues to influence market dynamics and business operations in Germany's coffee industry.

Other drivers and restraints analyzed in the detailed report include:

- Rising Demand for Roasted Coffee

- Innovation in Coffee Brewing Methods

- Climate-Induced Supply Shocks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ground coffee dominates with a 49.40% market share in 2024, driven by convenience and established consumer preferences. Whole bean coffee demonstrates strong growth potential with a projected CAGR of 3.70% during 2025-2030, exceeding the market's overall growth rate of 2.49%. This trend indicates German consumers' increasing preference for quality coffee experiences, supported by investments in home grinding equipment. The growing popularity of specialty coffee shops has influenced consumers to replicate cafe-quality beverages at home, further strengthening ground coffee's market position. Additionally, the availability of diverse flavor profiles and origins in ground coffee formats continues to attract consumers seeking authentic coffee experiences.

While instant coffee maintains its presence among convenience-focused consumers, it faces competition from ready-to-drink formats and single-serve options. The coffee pods and capsules segment remains stable, with developments like Nespresso's introduction of 100% biodegradable capsules highlighting the importance of sustainable solutions. The market continues to evolve as consumers seek products that balance convenience with quality. German retailers have expanded their instant coffee selections to include premium varieties and organic options, addressing changing consumer preferences. The emergence of specialized instant coffee brands targeting younger consumers with innovative flavors and sustainable packaging has also contributed to market dynamics.

The conventional coffee segment dominates the German market with an 84.87% share in 2024, providing consistent quality at accessible price points. However, the specialty coffee segment is experiencing explosive growth at 8.93% CAGR (2025-2030), more than three times the overall market rate. This growth is driven by increasing consumer knowledge about coffee origins, processing methods, and flavor profiles. The specialty segment is characterized by direct trade relationships, transparency in sourcing, and emphasis on unique sensory experiences. Digital marketplaces are enhancing connections between producers and roasters, while e-commerce is facilitating consumer access to specialty offerings.

The specialty coffee boom is reshaping competitive dynamics, with multinational companies acquiring specialty brands to capitalize on this trend. Simultaneously, small independent roasters are gaining market share by emphasizing craftsmanship and sustainability. The specialty segment's influence extends beyond its market share, as its emphasis on quality and ethics increasingly informs conventional coffee positioning. Julius Meinl's introduction of specialty coffees in 2024 from Costa Rica and Burundi exemplifies how established players are expanding their premium offerings to meet evolving consumer preferences. This segment's continued growth suggests a fundamental shift in how German consumers perceive and value coffee, with implications for pricing strategies and product development across the market.

The Germany Coffee Market Report is Segmented by Product Type (Whole Bean, Ground Coffee, Instant Coffee, and More), Type (Conventional Coffee and Specialty Coffee), Packaging Format (Flexible, Rigid, and Single-Serve), Distribution Channel (On Trade and Off Trade), and Region (Northern Germany, Western Germany, Central Germany, Southern Germany, and Eastern Germany). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- JAB Holding Company

- JJ Darboven GmbH & Co. KG

- Tchibo GmbH

- Nestle SA

- JDE Peet's N.V.

- Starbucks Corporation

- J.M.Smucker Co

- Alois Dallmayr OHG

- Lavazza SpA

- Movenpick Holding AG

- The Illy Group

- The Kraft Heinz Compan

- Aktiebolaget Anders LOFberg

- Kruger GmbH & Co KG

- Deutsche Extrakt Kaffee GmbH

- W. Machwitz GmbH

- Circle Products GmbH

- Balzac's Coffee Roasters

- Massimo Zanetti Beverage Group

- Strauss Group Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Premiumization and Third-Wave Coffee Boom

- 4.2.2 Growth of Home-Barista Equipment Boosting Whole-Bean Sales

- 4.2.3 Rising Demand for Roasted Coffee

- 4.2.4 Innovativation in Coffee Brewing Methods

- 4.2.5 Urbanization and a Fast-Paced Lifestyle

- 4.2.6 Growing demand for Functional Coffee

- 4.3 Market Restraints

- 4.3.1 German Coffee Tax and Import Tariff Volatility

- 4.3.2 Climate-Induced Supply Shocks

- 4.3.3 Health-Driven Shift toward Lower-Caffeine Drinks

- 4.3.4 Environmental and Sustainability Concerns

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Consumer Behaviour Analysis

- 4.8 Import and Export Analysis

- 4.9 Specialized Certifications by Coffee Producers and Manufactuers

- 4.10 Porter's Five Forces

- 4.10.1 Threat of New Entrants

- 4.10.2 Bargaining Power of Buyers

- 4.10.3 Bargaining Power of Suppliers

- 4.10.4 Threat of Substitutes

- 4.10.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Whole Bean

- 5.1.2 Ground Coffee

- 5.1.3 Instant Coffee

- 5.1.4 Coffee Pods and Capsules

- 5.2 By Type

- 5.2.1 Conventional Coffee

- 5.2.2 Specialty Coffee

- 5.3 By Packaging Format

- 5.3.1 Flexible (Bags, Pouches)

- 5.3.2 Rigid (Cans, Jars)

- 5.3.3 Single-Serve (Capsules, Pods, Sachets)

- 5.4 By Distribution Channel

- 5.4.1 On-Trade

- 5.4.2 Off-Trade

- 5.4.2.1 Supermarkets/Hypermarkets

- 5.4.2.2 Convenience/Grocery Stores

- 5.4.2.3 Online Retail

- 5.4.2.4 Other Off-Trade Channels

- 5.5 By Region

- 5.5.1 Northern Germany

- 5.5.2 Western Germany

- 5.5.3 Central Germany

- 5.5.4 Sothern Germany

- 5.5.5 Eastern Germany

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 JAB Holding Company

- 6.4.2 JJ Darboven GmbH & Co. KG

- 6.4.3 Tchibo GmbH

- 6.4.4 Nestle SA

- 6.4.5 JDE Peet's N.V.

- 6.4.6 Starbucks Corporation

- 6.4.7 J.M.Smucker Co

- 6.4.8 Alois Dallmayr OHG

- 6.4.9 Lavazza SpA

- 6.4.10 Movenpick Holding AG

- 6.4.11 The Illy Group

- 6.4.12 The Kraft Heinz Compan

- 6.4.13 Aktiebolaget Anders LOFberg

- 6.4.14 Kruger GmbH & Co KG

- 6.4.15 Deutsche Extrakt Kaffee GmbH

- 6.4.16 W. Machwitz GmbH

- 6.4.17 Circle Products GmbH

- 6.4.18 Balzac's Coffee Roasters

- 6.4.19 Massimo Zanetti Beverage Group

- 6.4.20 Strauss Group Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK