PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848053

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848053

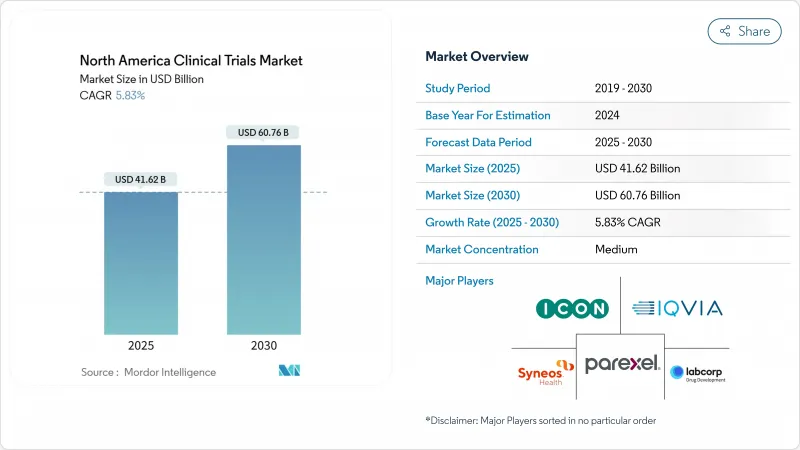

North America Clinical Trials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North America clinical trials market size stands at USD 41.62 billion in 2025 and is forecast to expand to USD 60.76 billion by 2030, reflecting a 5.83% CAGR.

This sustained trajectory is rooted in North America's position as the global epicenter for pharmaceutical innovation, reinforced by sophisticated regulatory pathways, mature contract-research infrastructure, and strong investor confidence that collectively underpin more than three-quarters of FDA approvals. Intensifying adoption of AI-enabled data analytics, a rising chronic-disease burden, and health-authority endorsement of decentralized and adaptive designs have markedly lifted study volumes, even as Phase III trial costs reached USD 36.58 million in 2024. Consolidation among leading CROs, exemplified by ICON's USD 12 billion acquisition of PRA Health Sciences, is yielding end-to-end service platforms that challenge traditional outsourcing models.

North America Clinical Trials Market Trends and Insights

Robust Life-Sciences Investment & Innovation Ecosystem

Record R&D spending of USD 161 billion by major pharmaceutical firms in 2023 fueled an influx of Phase II and Phase III programs that now anchor the North America clinical trials market. Private-equity momentum-highlighted by Kohlberg's investment in Worldwide Clinical Trials-has scaled dedicated site networks that shorten study start-up timelines and deepen therapeutic specialization. Venture funding into biotech rebounded to USD 3 billion in 2024 and is increasingly tied to AI-driven platform companies that demand rapid proof-of-concept readouts. Strategic alliances such as Parexel-Palantir integrate advanced analytics directly into trial operations, improving protocol feasibility and accelerating interim decisions. These converging capital flows reinforce a virtuous cycle where investment begets infrastructure upgrades that, in turn, attract further sponsor activity across the North America clinical trials market.

High Chronic- & Rare-Disease Burden Generating Trial Demand

An aging population and escalating prevalence of cardiometabolic and neurodegenerative disorders sustain a robust pipeline of development programs. North America accounts for a disproportionate share of Alzheimer's research, with the regional pipeline feeding an Alzheimer's therapeutics market expected to reach USD 30.8 billion by 2033. Parallel growth in diabetes and obesity studies further elevates site utilization as GLP-1 receptor agonists dominate the metabolic drug landscape. Moreover, oncology precision-medicine protocols now comprise 30% of global oncology trials and expand fastest in the United States, intensifying demand for biomarker-enabled laboratories. Regulatory flexibility toward adaptive designs enables swift protocol amendments that align trial resources with shifting disease-biology insights, reinforcing upside for the North America clinical trials market.

Complex Multi-Jurisdictional Regulatory Landscape Prolonging Approvals

Divergent country requirements frequently delay regional study launches: Mexico's COFEPRIS averages three months for approvals, triple Health Canada's default timeline, forcing staggered start-up strategies that complicate data harmonization. Separate ethics-committee mandates across jurisdictions further extend timelines and inflate costs as sponsors must secure sequential green-lights before enrollment begins. Forthcoming ICH E6(R3) revisions in 2025 will tighten metadata standards, necessitating new digital traceability systems at sites and CROs. Combined, these factors temper the otherwise strong growth curve of the North America clinical trials market by adding compliance complexity and administrative overhead.

Other drivers and restraints analyzed in the detailed report include:

- Mature CRO/Site Infrastructure Supporting Large-Scale Outsourcing

- Supportive FDA & Health Canada Initiatives for Decentralized and Adaptive Designs

- Shortage of Skilled Investigators, Coordinators and Site Staff

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Phase III programs commanded 49.12% of the North America clinical trials market in 2024, an outsized footprint that reflects regulatory reliance on large pivotal studies for approval decisions. Average Phase III spending climbed to USD 36.58 million in 2024 as biomarker testing, imaging endpoints, and patient-reported outcomes layered complexity onto traditional efficacy measures, yet sponsors continue to funnel resources into these late-stage trials to secure first-in-class or best-in-class labels. Concurrently, the North America clinical trials market size for Phase II programs is projected to expand at a 7.80% CAGR through 2030 as companies prioritize well-characterized proof-of-concept designs that mitigate downstream attrition.

A growing share of Phase II studies leverage adaptive features-futility analyses, sample-size re-estimation, and dose-finding algorithms-that enable early termination or cohort expansion based on interim reads, sharpening commercial decision-making and conserving capital. Phase I trials maintain steady momentum as immuno-oncology and gene-therapy modalities demand rigorous safety exploration, while Phase IV post-marketing studies rise in prominence amid payer insistence on real-world evidence. Such diversification across phases ensures that the wider North America clinical trials industry retains balanced growth vectors even under budget scrutiny.

Interventional designs held 72.36% share in 2024, underscoring regulatory preference for randomized controlled environments when evaluating investigational therapies. Robust oversight frameworks and well-established statistical conventions solidify interventional studies as the gold standard for primary efficacy claims within the North America clinical trials market. Yet adaptive trials are gaining velocity, forecast to post an 8.68% CAGR as sponsors capture efficiencies by prospectively planning design modifications that respond to interim outcomes data.

The growing repository of FDA guidance on adaptive methods has alleviated historical concerns regarding type-I error inflation, prompting oncology and rare-disease portfolios to incorporate seamless Phase II/III protocols that compress development timelines. Observational and expanded-access studies round out the design mix, supplying complementary real-world data that inform payer value dossiers. With regulatory authorities increasingly receptive to master protocols and platform trials, the North America clinical trials market size for adaptive designs is set to widen, enhancing flexibility in heterogeneous patient populations.

The North America Clinical Trials Market Report is Segmented by Phase (Phase I, and More), Study Design (Interventional/Treatment Studies, and More), Service Type (Protocol Design & Feasibility, and More), Sponsor Type (Pharmaceutical and Biopharmaceutical Companies, and More), Therapeutic Area (Oncology, and More), Geography (United States, Canada, and Mexico). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- IQVIA

- Laboratory Corp of America (Covance)

- Parexel International

- ICON

- Syneos Health

- Charles River

- Medpace Holdings

- WuXi App Tec

- PRA Health Sciences

- Clinipace

- Pharmaceutical Product Development (PPD)

- Thermo Fisher Scientific

- Catalent Pharma Solutions

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Robust Life-Sciences Investment & Innovation Ecosystem

- 4.2.2 High Chronic- & Rare-Disease Burden Generating Trial Demand

- 4.2.3 Mature CRO/Site Infrastructure Supporting Large-Scale Outsourcing

- 4.2.4 Supportive FDA & Health Canada Initiatives for Decentralized and Adaptive Designs

- 4.2.5 Advanced Data-Sharing & Digital-Health Backbone Enabling Hybrid Trials

- 4.2.6 Favorable IP Protection & Reimbursement Outlook Attracting Sponsor Capital

- 4.3 Market Restraints

- 4.3.1 Complex Multi-Jurisdictional Regulatory Landscape Prolonging Approvals

- 4.3.2 Shortage Of Skilled Investigators, Coordinators and Site Staff

- 4.3.3 Inflation-Driven Escalation Of Site Operating and Participant-Recruitment Costs

- 4.3.4 Intensifying Competition For Diverse Patient Cohorts Slowing Enrollment

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Phase

- 5.1.1 Phase I

- 5.1.2 Phase II

- 5.1.3 Phase III

- 5.1.4 Phase IV

- 5.2 By Study Design

- 5.2.1 Interventional / Treatment Studies

- 5.2.2 Observational Studies

- 5.2.3 Expanded Access Studies

- 5.3 By Service Type

- 5.3.1 Protocol Design & Feasibility

- 5.3.2 Site Identification & Start-up

- 5.3.3 Regulatory Submission & Approval

- 5.3.4 Clinical Trial Monitoring

- 5.3.5 Data Management & Biostatistics

- 5.3.6 Medical Writing

- 5.3.7 Other Service Types

- 5.4 By Therapeutic Area

- 5.4.1 Oncology

- 5.4.2 Cardiovascular

- 5.4.3 Neurology

- 5.4.4 Infectious Diseases

- 5.4.5 Metabolic Disorders (Diabetes, Obesity)

- 5.4.6 Immunology / Autoimmune

- 5.4.7 Other Therapeutic Areas

- 5.5 By Sponsor Type

- 5.5.1 Pharmaceutical & Biopharmaceutical Companies

- 5.5.2 Medical Device Companies

- 5.5.3 Academic & Research Institutes

- 5.5.4 Government & Non-profit Organizations

- 5.6 Geography

- 5.6.1 United States

- 5.6.2 Canada

- 5.6.3 Mexico

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 IQVIA

- 6.3.2 Laboratory Corp of America (Covance)

- 6.3.3 Parexel International

- 6.3.4 ICON plc

- 6.3.5 Syneos Health

- 6.3.6 Charles River Laboratories

- 6.3.7 Medpace Holdings

- 6.3.8 Wuxi AppTec

- 6.3.9 PRA Health Sciences

- 6.3.10 Clinipace

- 6.3.11 Pharmaceutical Product Development (PPD)

- 6.3.12 Thermo Fisher Scientific

- 6.3.13 Catalent Pharma Solutions

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment