PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848054

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848054

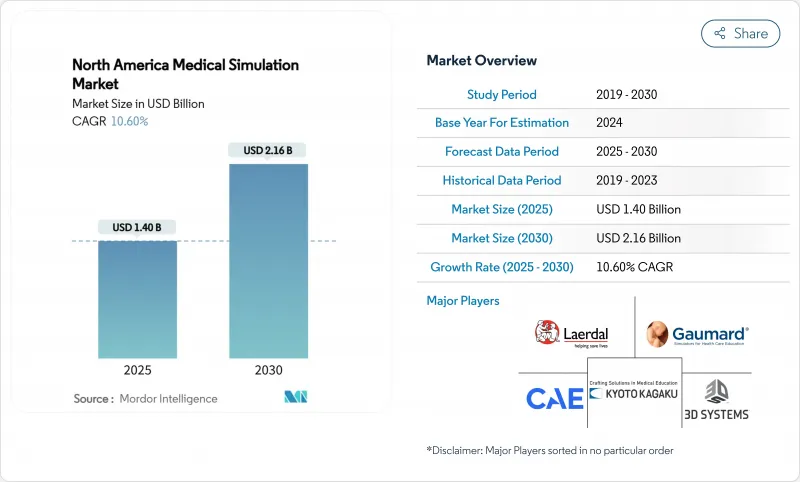

North America Medical Simulation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North American medical simulation market stands at USD 1.14 billion in 2025 and is forecast to climb to USD 2.16 billion by 2030, registering a 13.56% CAGR.

This headline figure represents the current medical simulation market size and highlights the brisk growth trajectory being fueled by faculty shortages, patient-safety mandates, and rapid advances in extended-reality hardware. Demand pressure is strongest where medical schools face limited clerkship slots, regulatory bodies insist on measurable competency proof, and virtual-reality head-mounted displays finally deliver clinical-grade visual fidelity. As a result, the medical simulation market is shifting from discretionary spending toward critical infrastructure investment as educators and hospitals chase scalable, repeatable, and data-rich training models. Regulatory emphasis on computational modeling in FDA submissions, rising adoption of AI-driven adaptive analytics, and cost-effective service contracting all reinforce the market's growth momentum.

North America Medical Simulation Market Trends and Insights

Demand for Minimally-Invasive-Procedure Training

Laparoscopic, robotic, and endoscopic techniques demand psychomotor skills that traditional apprenticeship models cannot deliver at scale. Affordable robotic-surgery interfaces priced near USD 8,400 have widened access to advanced skills practice for resource-constrained schools. Haptic-enabled virtual reality fosters muscle memory and boosts procedural confidence before trainees enter live theaters, and programs using these tools record significant declines in intra-operative error rates. Growth of robotic platforms to offset surgeon shortages further cements simulation as a frontline training modality. The driver adds 2.8 percentage points to forecast CAGR as curricula embed high-repetition, risk-free practice sessions into core learning.

Rising Focus on Patient-Safety & Error-Reduction Mandates

Simulation-based catheter insertion curricula cut 9.95 bloodstream infections per facility each year, saving more than USD 700,000 and delivering a seven-to-one ROI. Such proof reframes simulation from educational overhead to financial imperative. Accrediting bodies like the Joint Commission now require documented competency metrics, which simulation uniquely provides through standardized scenarios and automated scoring. Hospitals leverage these metrics to satisfy value-based reimbursement schemes, shrinking malpractice exposure while elevating care quality.

Shortage of Clinical Faculty Driving Simulation Hours

Eighty-four percent of deans cite clerkship shortages, forcing schools to raise simulation quotas. Modern centers let one instructor oversee multiple learners via adaptive scenarios and analytics dashboards, multiplying teaching reach. The COVID-19 disruption validated simulation's role as curricular backbone rather than ancillary tool. Long-term faculty gaps therefore sustain elevated demand well beyond pandemic pressures.

Other drivers and restraints analyzed in the detailed report include:

- Adoption of VR/AR Hardware Breakthroughs in Simulators

- High Upfront Capital & Maintenance Cost of High-Fidelity Units

- VR-Induced Cybersickness Impacting Learner Acceptance

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Products commanded 53.6% of 2024 revenue as the physical backbone of academic and hospital labs. Within that total, interventional and surgical simulators remain the cornerstone, supplemented by task trainers and physiologic manikins. Yet the services category is expanding at a 13.67% CAGR, propelled by institutions favoring turnkey subscriptions over capital outlay. Cloud licensing, curriculum design, and managed-lab services convert episodic purchases into predictable operating budgets, a pivotal shift for the medical simulation market.

Interventional simulator demand mirrors the growth of robotic and laparoscopic procedures, while patient simulators evolve toward wireless, physiology-rich models that integrate with real monitoring devices. Services momentum is most evident in SaaS ultrasound platforms such as 3B Scientific's e Sono, which illustrates how pay-as-you-go access democratizes advanced training. As recurring revenue rises, the medical simulation industry expands its addressable audience to smaller institutions once priced out of the high-fidelity hardware segment.

Low-fidelity tools hold 47.35% of 2024 spend thanks to affordability and quick deployment. Nevertheless, high-fidelity simulators are logging a 13.99% CAGR as empirical studies tie realism to measurable learning gains. The high-fidelity cohort now includes manikins like Gaumard's HAL S3201 with dynamic lung compliance and drug recognition, bridging the gap between simulation suites and real ICU beds. Institutions justify higher outlays by quantifying error-reduction savings, thereby growing this share of the medical simulation market size.

Medium-fidelity systems remain important for core skills drills, but advanced programs are fast-tracking toward high-immersion experiences that synchronize vitals, imaging, and electronic records. That migration signals a long-run pivot of procurement budgets toward ultra-realism that better prepares clinicians for increasingly complex patient populations.

The North American Medical Simulation Market Report is Segmented by Products & Services (Products, Services & Software), Fidelity (High-Fidelity, Medium-Fidelity, and More), End User (Academic & Research Institutes, Hospitals & Surgical Centers, and More), Delivery Mode (On-Premise Simulation Labs, Cloud-Based), and Geography (United States, Canada, Mexico). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- CAE

- Laerdal Medical AS

- Gaumard Scientific Company, Inc.

- 3D Systems

- Simulab

- Surgical Science Sweden

- Intelligent Ultrasound Group plc

- Mentice

- SimX, Inc.

- VirtaMed

- Operative Experience

- Inovus Medical Ltd.

- Limbs & Things Ltd.

- TruCorp Ltd.

- IngMar Medical, Ltd.

- KavoKerr Group (Dental Simulators)

- VRPatient, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demand for minimally-invasive-procedure training

- 4.2.2 Rising focus on patient-safety & error-reduction mandates

- 4.2.3 Adoption of VR/AR hardware breakthroughs in simulators

- 4.2.4 Shortage of clinical faculty driving simulation hours

- 4.2.5 AI-driven adaptive simulation analytics (under-reported)

- 4.2.6 ESG-linked "zero-harm" corporate training targets (under-reported)

- 4.3 Market Restraints

- 4.3.1 High upfront capital & maintenance cost of high-fidelity units

- 4.3.2 Lack of interoperability standards across simulation platforms

- 4.3.3 Limited faculty training & change-management bandwidth

- 4.3.4 VR-induced cybersickness impacting learner acceptance (under-reported)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Products & Services

- 5.1.1 Products

- 5.1.1.1 Interventional/Surgical Simulators

- 5.1.1.1.1 Laparoscopic

- 5.1.1.1.2 Robotic & Endoscopic

- 5.1.1.1.3 Orthopaedic

- 5.1.1.2 Patient Simulators

- 5.1.1.3 Task Trainers

- 5.1.1.4 Other Products

- 5.1.2 Services & Software

- 5.1.2.1 Web-based Simulation

- 5.1.2.2 Simulation Software Licences

- 5.1.2.3 Training & Consulting Services

- 5.1.1 Products

- 5.2 By Fidelity

- 5.2.1 High-fidelity

- 5.2.2 Medium-fidelity

- 5.2.3 Low-fidelity

- 5.3 By End User

- 5.3.1 Academic & Research Institutes

- 5.3.2 Hospitals & Surgical Centres

- 5.3.3 Military & Defence Organisations

- 5.3.4 Medical-device & Pharma Companies

- 5.4 By Delivery Mode

- 5.4.1 On-premise Simulation Labs

- 5.4.2 Cloud-based /Remote Platforms

- 5.5 By Country

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 CAE Inc.

- 6.3.2 Laerdal Medical AS

- 6.3.3 Gaumard Scientific Company, Inc.

- 6.3.4 3D Systems Corporation

- 6.3.5 Simulab Corporation

- 6.3.6 Surgical Science Sweden AB

- 6.3.7 Intelligent Ultrasound Group plc

- 6.3.8 Mentice AB

- 6.3.9 SimX, Inc.

- 6.3.10 VirtaMed AG

- 6.3.11 Operative Experience, Inc.

- 6.3.12 Inovus Medical Ltd.

- 6.3.13 Limbs & Things Ltd.

- 6.3.14 TruCorp Ltd.

- 6.3.15 IngMar Medical, Ltd.

- 6.3.16 KavoKerr Group (Dental Simulators)

- 6.3.17 VRPatient, Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment