PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848064

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848064

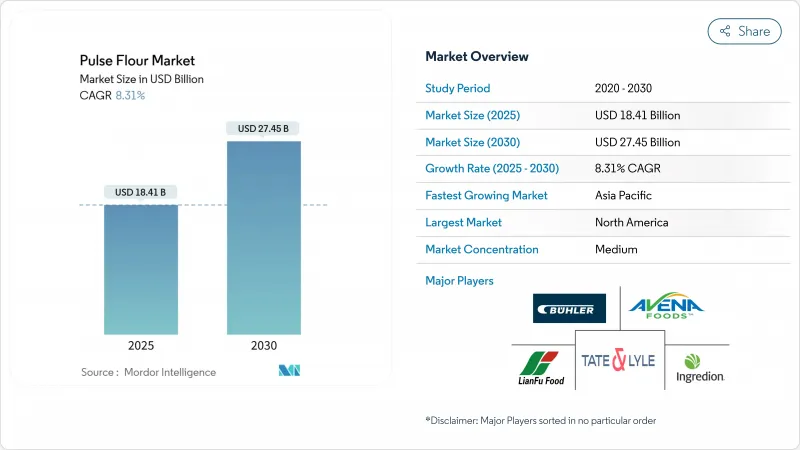

Pulse Flour - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The pulse flour market size is estimated to be USD 18.41 billion in 2025 and is projected to reach USD 27.45 billion by 2030, registering a CAGR of 8.31% during the forecast period.

This robust expansion reflects the convergence of health-conscious consumer behavior, technological processing advancements, and regulatory support for plant-based protein alternatives across major food systems. Macro forces driving this growth trajectory include the escalating prevalence of celiac disease and gluten intolerance, which has intensified the demand for gluten-free alternatives beyond traditional wheat-based products. The clean-label movement has simultaneously elevated pulse flour as a minimally processed ingredient that delivers both nutritional density and functional versatility. Supply chain dynamics present both opportunities and constraints, with weather-dependent crop yields creating price volatility that processors must navigate through strategic sourcing and inventory management . The resilient expansion reflects consumers' shift to plant-based proteins, new dry-fractionation and wet-milling methods that improve functionality, and supportive labeling regulations.

Global Pulse Flour Market Trends and Insights

Heightened Awareness and Adoption of Gluten-Free and Plant-Based Diets

Consumer dietary preferences have fundamentally shifted toward plant-based proteins, with pulse flour emerging as a cornerstone ingredient in this transformation. The gluten-free market expansion has created unprecedented demand for functional alternatives that maintain textural integrity in baked goods and processed foods. Pulse flours deliver superior protein content ranging from 16-30% compared to traditional wheat flour, while providing essential amino acids that complement plant-based dietary patterns .This nutritional advantage has prompted food manufacturers to reformulate existing products and develop new categories specifically targeting flexitarian and vegetarian consumers. The trend extends beyond individual health choices to encompass environmental sustainability concerns, as pulse cultivation requires significantly less water and generates lower carbon emissions than animal protein production. Regulatory bodies have responded by establishing clearer labeling standards for plant-based products, reducing market entry barriers for pulse flour applications.

Increasing Incidence of Celiac Disease and Gluten Intolerance

Medical diagnosis rates for celiac disease and non-celiac gluten sensitivity continue escalating across developed markets, creating a medically-driven demand base that transcends lifestyle preferences. Healthcare providers increasingly recommend pulse-based alternatives as nutritionally superior substitutes that address both gluten avoidance and protein adequacy requirements. The demographic expansion of diagnosed cases has shifted from predominantly adult populations to include pediatric patients, broadening the market scope to include specialized infant and child nutrition products. Food service establishments have responded by incorporating pulse flour into menu items to accommodate medical dietary restrictions while maintaining operational efficiency. This medical necessity creates price-inelastic demand that provides revenue stability for pulse flour processors during commodity price fluctuations. The trend has also stimulated research into pulse flour processing techniques that eliminate cross-contamination risks, leading to dedicated production facilities and certification programs.

Inconsistent Supply of Raw Materials Due to Weather-Dependent Crop Yields

Agricultural production volatility presents the most significant operational challenge for pulse flour processors, with weather patterns increasingly unpredictable due to climate change impacts. Drought conditions in major pulse-producing regions can reduce crop yields, creating supply shortages that force processors to source from alternative regions at premium prices. The concentration of pulse production in specific geographic areas amplifies this vulnerability, as adverse weather events can simultaneously impact multiple suppliers within the same region. Processing facilities must maintain larger inventory buffers to ensure consistent production schedules, increasing working capital requirements and storage costs. The supply inconsistency also affects product quality standardization, as different growing regions produce pulses with varying protein content, moisture levels, and functional characteristics. Long-term contracts with growers provide some stability but limit processors' ability to capitalize on favorable spot market conditions during abundant harvest periods.

Other drivers and restraints analyzed in the detailed report include:

- Growing Demand for Clean-Label, Natural, and Minimally Processed Ingredients

- Rising Consumption of Protein-Rich and Ready-to-Eat (RTE) Foods

- Price Volatility of Raw Pulse Crops

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Conventional pulse flour maintains market leadership with 71.33% share in 2024, reflecting established supply chains and cost-competitive positioning across mainstream food applications. However, the organic segment demonstrates exceptional growth momentum at 10.82% CAGR through 2030, driven by premium positioning and sustainability-focused procurement strategies. The organic certification process requires dedicated processing facilities and supply chain segregation, creating barriers to entry that protect margins for established organic processors according to the World of Organic Agriculture. Conventional pulse flour benefits from economies of scale and established distribution networks, making it the preferred choice for large-volume applications in commercial bakery and food service sectors.

The organic segment's growth trajectory reflects consumer willingness to pay premium prices for certified organic ingredients, with price premiums ranging above conventional alternatives. Processing innovations have reduced the cost differential between organic and conventional pulse flour production, making organic options more accessible to mid-market food manufacturers. The regulatory environment supports organic growth through clear certification standards and labeling requirements that enable premium positioning. Organic pulse flour processors increasingly focus on direct relationships with certified organic farmers to ensure supply security and quality consistency, creating vertically integrated supply chains that enhance profitability.

The Pulse Flour Market is Segmented by Nature (Organic and Conventional), Pulse Type (Bean, Chickpea, Lentil, Pea, and Others), Application (Food and Beverages, Animal Feed and Other Applications), and Geography (North America, Europe, Asia-Pacific, South America, and the Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commands 32.83% market share in 2024, leveraging established agricultural infrastructure and consumer familiarity with plant-based proteins to maintain regional leadership. The United States and Canada benefit from concentrated pulse production in the northern Great Plains, providing processors with reliable raw material access and reduced transportation costs that enhance competitiveness in global markets. Processing facilities in this region have invested heavily in advanced milling and fractionation technologies that produce high-purity protein concentrates and specialized flour grades for premium applications. The regulatory environment supports market growth through clear labeling standards and food safety protocols that facilitate product development and market entry.

Asia-Pacific emerges as the fastest-growing region with 9.41% CAGR through 2030, driven by expanding food processing industries and increasing protein consumption in developing markets. India's food processing sector is projected to rise, creating substantial demand for protein-rich ingredients like pulse flour in packaged foods and ready-to-eat products. China's growing middle class and urbanization trends drive demand for convenient, protein-enhanced foods that incorporate pulse flour as a functional ingredient. The region benefits from government initiatives promoting food processing infrastructure development and nutritional enhancement programs that support pulse flour adoption.

Europe represents a mature market characterized by premium positioning and organic product focus, with steady growth driven by sustainability concerns and clean-label preferences. The European Union's agricultural policies aim to boost local pulse production and reduce import dependence, potentially affecting supply chain dynamics and pricing structures for pulse flour processors. Germany, France, and the United Kingdom lead regional consumption, with established distribution networks and consumer acceptance of plant-based proteins supporting market stability. The region's stringent food safety and labeling requirements create barriers to entry but also protect established players from low-cost competition. Recent acquisitions like DSM's purchase of Vestkorn Milling for EUR 65 million (USD 70 million) in November 2021 demonstrate continued consolidation and investment in pulse-based protein capabilities

- Xinghua Lianfu Food Co.,Ltd

- Tate & Lyle PLC

- Ingredion Inc.

- Buhler Holding AG

- Avena Foods Limited

- Essantis

- Ardent Mills.

- Limagrain Ingredients

- Ardent Mills LLC

- Cargill, Incorporated.

- Samasta Foods

- Ebro Foods S.A.

- Leipnik-Lundenburger Invest Beteilungs AG (GoodMills Innovation GmbH)

- Yesraj Enterprises

- Samrudhi Besan

- Aakash Food Products Pvt. Ltd.

- Pulse Canada.

- ProviNord Group (Alsiano A/S)

- Marigot Group (Deltagen UK Ltd)

- DACSA Group (Molendum Ingredients)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Heightened Awareness and Adoption of Gluten-Free and Plant-Based Diets

- 4.2.2 Increasing Incidence of Celiac Disease and Gluten Intolerance

- 4.2.3 Growing Demand for Clean-Label, Natural, And Minimally Processed Ingredients

- 4.2.4 Rising Consumption of Protein-Rich and Ready-To-Eat (RTE) Foods

- 4.2.5 Widening Adoption of Pulse Flour in Bakery and Snack Products

- 4.2.6 Expanding Applications in Food Fortification and Nutritional Enhancement

- 4.3 Market Restraints

- 4.3.1 Inconsistent Supply of Raw Materials Due To Weather-Dependent Crop Yields

- 4.3.2 Price Volatility of Raw Pulse Crops

- 4.3.3 Taste And Texture Differences Affecting Consumer Acceptance

- 4.3.4 Allergenic Concerns Associated with Certain Pulse Varieties

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Nature

- 5.1.1 Organic

- 5.1.2 Conventional

- 5.2 By Pulse Type

- 5.2.1 Chickpea

- 5.2.2 Peas

- 5.2.3 Lentil

- 5.2.4 Bean

- 5.2.5 Others

- 5.3 By Application

- 5.3.1 Food and Beverages

- 5.3.1.1 Bakery Products

- 5.3.1.2 Extruded Snacks

- 5.3.1.3 Breakfast Cereals

- 5.3.1.4 Pasta and Noodles

- 5.3.1.5 Meat and Meat Analogs

- 5.3.1.6 Others

- 5.3.2 Animal Feed

- 5.3.3 Others

- 5.3.1 Food and Beverages

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Xinghua Lianfu Food Co.,Ltd

- 6.4.2 Tate & Lyle PLC

- 6.4.3 Ingredion Inc.

- 6.4.4 Buhler Holding AG

- 6.4.5 Avena Foods Limited

- 6.4.6 Essantis

- 6.4.7 Ardent Mills.

- 6.4.8 Limagrain Ingredients

- 6.4.9 Ardent Mills LLC

- 6.4.10 Cargill, Incorporated.

- 6.4.11 Samasta Foods

- 6.4.12 Ebro Foods S.A.

- 6.4.13 Leipnik-Lundenburger Invest Beteilungs AG (GoodMills Innovation GmbH)

- 6.4.14 Yesraj Enterprises

- 6.4.15 Samrudhi Besan

- 6.4.16 Aakash Food Products Pvt. Ltd.

- 6.4.17 Pulse Canada.

- 6.4.18 ProviNord Group (Alsiano A/S)

- 6.4.19 Marigot Group (Deltagen UK Ltd)

- 6.4.20 DACSA Group (Molendum Ingredients)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK