PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848076

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848076

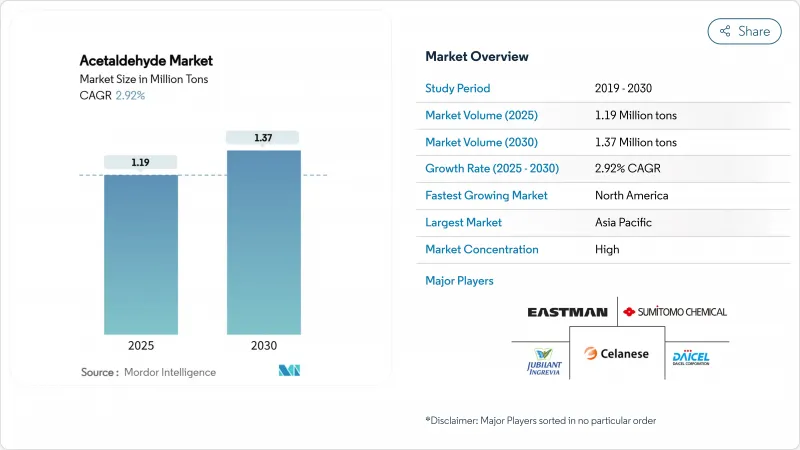

Acetaldehyde - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Acetaldehyde Market size is estimated at 1.19 million tons in 2025 and is expected to reach 1.37 million tons by 2030, at a CAGR of 2.92% during the forecast period (2025-2030).

This expansion reflects the chemical's entrenched role as an intermediate for high-value derivatives such as acetic acid, pyridine bases, pentaerythritol, and acetate esters that enable low-VOC solvent systems, sustainable coatings, and circular PET recycling solutions. Asia-Pacific's integrated petrochemical networks continue to shape price discovery, while North American producers gain momentum by leveraging shale-derived ethane and breakthrough ethane-to-acetaldehyde catalysis. Competitive positioning is shifting toward players that can secure feedstock flexibility, achieve superior purity grades for pharmaceutical syntheses, and offer specialized scavenging additives for advanced PET recycling. Over the forecast horizon, technology adoption, regulatory pressure, and sustainability credentials will determine value capture across the acetaldehyde market.

Global Acetaldehyde Market Trends and Insights

Rising Demand for Pyridine and Pyridine-Base Derivatives

Pharmaceutical manufacturing is scaling rapidly, and complex drug molecules increasingly rely on acetaldehyde-derived pyridine intermediates. The 3.94% CAGR to 2030 underscores the derivative's strategic relevance for oncology and neurology therapies, where acetaldehyde purity improvements deliver higher reaction yields and regulatory compliance with FDA cGMP requirements. Asian generic producers are expanding multi-purpose active-pharmaceutical-ingredient lines, which lifts regional consumption of high-purity acetaldehyde grades. The personalized-medicine shift calls for specialized building blocks, ensuring robust volume growth for pyridine chains. Producers that can certify low residual impurities win premium contracts, reinforcing a virtuous cycle of quality-driven demand in the acetaldehyde market.

Expanding Pentaerythritol Use in Alkyd and UV-Curable Resins

Coatings formulators pivot toward bio-based alkyd and fast-curing UV systems, and pentaerythritol, synthesized from acetaldehyde and formaldehyde, has become indispensable. North American and European suppliers report accelerating off-takes as automakers adopt UV-curable clear coats that shorten production cycles and cut energy consumption. Recent research showed bio-alkyds featuring pentaerythritol achieve 70% biodegradability in 90 days versus 34.7% for conventional resins, a sustainability edge that supports price premiums. The coatings industry's low-VOC imperative boosts acetate-ester co-solvents, reinforcing derivative synergies along the acetaldehyde value chain. Consequently, pentaerythritol draws incremental capacity additions, anchoring stable demand in the acetaldehyde market.

Shift to Methanol Carbonylation for Acetic-Acid Production

More than 85% of global acetic-acid capacity now employs methanol carbonylation, obviating acetaldehyde intermediacy and eroding a legacy demand pillar. The Rh- and Ir-catalyzed route delivers superior selectivity and energy efficiency, depressing new investments in acetaldehyde-based acetic acid. Incremental expansions by East-Asian giants accentuate the swing, removing 0.4 percentage points from the acetaldehyde CAGR forecast. To offset this secular decline, producers push into higher-value pyridine, pentaerythritol, and PET-recycling additives, redefining portfolio priorities within the acetaldehyde market.

Other drivers and restraints analyzed in the detailed report include:

- Growing Acetate-Ester Demand in Low-VOC Solvent Blends

- Breakthrough Ethane-to-Acetaldehyde PdO Catalysis

- Carcinogenic Re-Classification and Tighter Workplace Exposure Limits

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Acetic acid retained a 28.39% slice of the acetaldehyde market share in 2024, but its volume growth remains muted amid structural substitution by methanol carbonylation. Conversely, pyridine and pyridine bases are set to register a robust 3.94% CAGR through 2030, propelled by surging pharmaceutical output in Asia-Pacific. The paints sector's appetite for pentaerythritol drives incremental additions, while acetate esters underpin compliant low-VOC systems. Collectively, specialty derivatives insulate the acetaldehyde market size against stagnation in the mature acetic-acid pool.

The migration to high-value niches heightens purity requirements, inviting capital investments in purification columns, molecular sieves, and continuous distillation control. Producers that master in-process analytics secure contract premiums, while laggards risk relegation to commodity pools. Butylene glycol, chloral, and peracetic acid remain niche outlets, yet continued demand from cosmetics, pharmaceuticals, and water treatment keeps asset utilization healthy. This tiered derivative portfolio balances commodity volume with specialty margins, defining long-run resilience for the acetaldehyde market.

The Acetaldehyde Report is Segmented by Derivative (Pyridine and Pyridine Bases, Pentaerythritol, Acetic Acid, Acetate Esters, and More), End-User Industry (Adhesives, Food and Beverage, Paints and Coatings, Pharmaceuticals, and Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific commanded 57.81% of global demand in 2024, anchored by China's world-scale petrochemical complexes and integrated aromatics-to-acetyl chains. Japan's Daicel Corporation augments technological sophistication, while India's Godavari Biorefineries bridges petrochemical and bio-based streams.

North America is poised for a 3.18% CAGR through 2030, underpinned by ethane-to-acetaldehyde catalysts and clear regulatory tailwinds for circular chemistry. Celanese's Clear Lake platform and regional PET-recycling build-outs exemplify the pivot to low-carbon, high-purity production.

Europe's sustainability ethos sustains niche demand for high-performance derivatives, while South America and Middle-East and Africa gradually scale capacity via ethanol upgrading and feedstock-advantaged petrochemical hubs. This regional mosaic balances mature bulk markets with frontier growth, reinforcing global dispersion of the acetaldehyde market.

- Celanese Corporation

- Daicel Corporation

- Eastman Chemical Company

- Jubilant Ingrevia Limited

- Laxmi Organic Industries Ltd.

- LCY

- Lonza

- Merck KGaA

- Resonac Corporation

- Sekab

- Sumitomo Chemical Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Pyridine and Pyridine-Base Derivatives

- 4.2.2 Expanding Pentaerythritol Use in Alkyd And UV-Curable Resins

- 4.2.3 Growing Acetate-Ester Demand in Low-VOC Solvent Blends

- 4.2.4 Breakthrough Ethane-To-Acetaldehyde PdO Catalysis

- 4.2.5 Circular PET De-Aldehyde Upgrades Raising Bottle-Grade Quality Bar

- 4.3 Market Restraints

- 4.3.1 Shift to Methanol Carbonylation for Acetic-Acid Production

- 4.3.2 Carcinogenic Re-Classification and Tighter Workplace Exposure Limits

- 4.3.3 Ethylene Price Volatility Squeezing Wacker-Process Margins

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Derivative

- 5.1.1 Pyridine and Pyridine Bases

- 5.1.2 Pentaerythritol

- 5.1.3 Acetic Acid

- 5.1.4 Acetate Esters

- 5.1.5 Butylene Glycol

- 5.1.6 Other Derivatives (Chloral, Peracetic Acid, etc.)

- 5.2 By End-User Industry

- 5.2.1 Adhesives

- 5.2.2 Food and Beverage

- 5.2.3 Paints and Coatings

- 5.2.4 Pharmaceuticals

- 5.2.5 Other End-user Industries (Water Treatment, Plastics, Rubber, Fuel Additives, etc.)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 NORDIC

- 5.3.3.8 Turkey

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Celanese Corporation

- 6.4.2 Daicel Corporation

- 6.4.3 Eastman Chemical Company

- 6.4.4 Jubilant Ingrevia Limited

- 6.4.5 Laxmi Organic Industries Ltd.

- 6.4.6 LCY

- 6.4.7 Lonza

- 6.4.8 Merck KGaA

- 6.4.9 Resonac Corporation

- 6.4.10 Sekab

- 6.4.11 Sumitomo Chemical Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment