PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848080

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848080

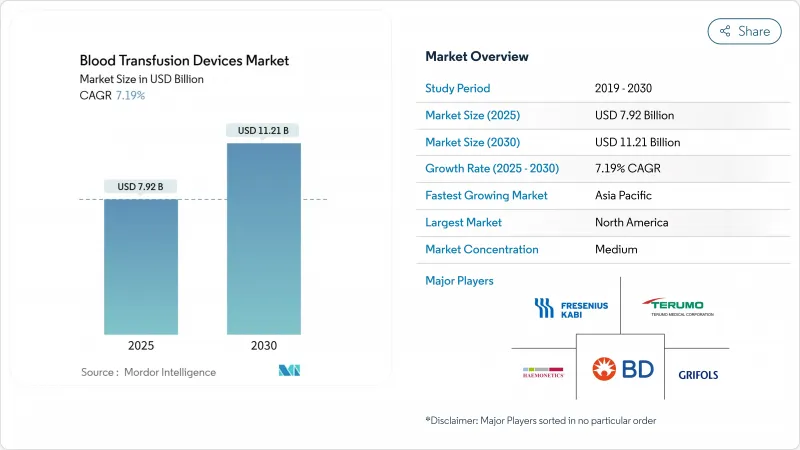

Blood Transfusion Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The blood transfusion devices market size generated USD 7.92 billion in 2025 and is expected to reach USD 11.21 billion by 2030, reflecting a 7.19% CAGR.

Steady demand arises from higher surgical procedure volumes, a growing burden of hematological disorders, and rapid uptake of pathogen-reduction systems that neutralize emerging pathogens. Digital inventory analytics are lowering wastage, and government-backed blood-safety programs are expanding in emerging economies. Automation is rising as healthcare providers seek labor savings, while patient blood-management initiatives encourage optimized transfusion practices that, in turn, spur equipment upgrades. Although stringent regulations and cold-chain expenses weigh on profitability, industry stakeholders continue launching integrated solutions that enhance safety, efficiency, and traceability across the transfusion workflow.

Global Blood Transfusion Devices Market Trends and Insights

Rising Surgical Procedure Volumes Worldwide

Global surgical demand continues to climb, with the World Health Organization projecting a 25% increase by 2030. Cardiovascular, orthopedic, and oncologic procedures consume the most blood components, making automated processing equipment essential in high-volume hospitals. Terumo's Reveos system cuts manual steps by 65% and improves component consistency, illustrating how efficiency gains align with rising case loads. Stable procedure growth underpins equipment replacement cycles, though strained donor pools still challenge overall supply chains.

Growing Prevalence of Hematological Disorders

Greater life expectancy and better diagnostics reveal more cases of sickle cell disease, thalassemia, and hematologic cancers. Regular transfusions remain standard therapy, sustaining predictable equipment demand. Novel gene therapies temporarily lift transfusion requirements during pre-conditioning regimens, pushing apheresis device usage upward. Safety concerns for immunocompromised patients further accelerate pathogen-reduction adoption.

Stringent Regulatory and Quality Compliance Requirements

The FDA's 2025 agenda lists five new blood-component guidances, while Europe's SoHO rule revamps compliance reporting. The pivot away from DEHP introduces costly material validation cycles. Smaller OEMs face submission expenses topping USD 2 million for complex devices, extending development timelines by up to five years and tilting competitive advantage toward firms with deep regulatory resources.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Technological Advancements in Transfusion Equipment

- Expanding Government Support for Blood-Safety Initiatives in Emerging Markets

- High Operational Costs of Blood Collection and Cold Chain

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Blood Bags & Accessories led the segment with 38.65% blood transfusion devices market share in 2024, supported by universal demand across collection sites. The blood transfusion devices market size for Blood Bags & Accessories is expected to advance steadily through 2030 as procedure volumes increase. Pathogen-Reduction Systems, posting the quickest 9.34% CAGR, align with regulatory pushes for proactive safety and have now reached over 100 global blood centers.

The segment's second growth driver involves automated component separators that enhance platelet quality while trimming processing time. Leukoreduction filters are now mandated in most developed markets, creating incremental replacement demand. Blood-warming devices focus on microprocessor accuracy and electronic health-record interoperability, while consumable kits face margin compression due to group-purchasing contracts.

Manual/Conventional platforms retained 54.76% share of the blood transfusion devices market in 2024, reflecting affordability for low-resource settings. Yet Automated/Integrated systems are gaining ground at 8.86% CAGR. The blood transfusion devices market size for Automated/Integrated solutions is rising as labor constraints and error-reduction targets encourage adoption. Terumo's Reveos illustrates ROI: one device cuts platelet processing steps from 26 to 9 and yields more platelets per donation.

Artificial-intelligence modules embedded in automation suites enable predictive maintenance and quality analytics, reducing downtime. Interfaces that connect with hospital information systems improve traceability reporting and compliance. As funding models evolve, manual devices are expected to persist in lower-volume centers, while automation becomes standard in regional hubs.

The Blood Transfusion Devices Market Report is Segmented by Product (Blood Bags & Accessories, Blood Mixer, and More), Technology (Manual/Conventional, Automated/Integrated, and More), Application (Collection, Processing & Separation, and More), End-User (Hospitals, and More), Geography (North America, Europe, Asia-Pacific, The Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 40.67% of global revenue in 2024 thanks to stringent oversight, early pathogen-reduction adoption, and high per-patient spending. The FDA's active guidance pipeline shapes global best practice, and suppliers benefit from predictable reimbursement. Yet donor shortages remain acute: the American Red Cross cites a 40% decline over two decades, and extreme weather led to 19,000 canceled drives in 2024 alone. Investment in automated processing and recruitment campaigns aims to stabilize supply.

Asia-Pacific is the fastest-growing region at an 8.66% CAGR through 2030. China's localization strategy encourages domestic production of advanced systems, while Japan's artificial-blood trials position the region at the innovation frontier. Rising surgical volumes, expanding insurance coverage, and government-subsidized safety upgrades underpin sustained equipment demand from India to Southeast Asia.

Europe sustains a sizable install base and will implement the SoHO framework by 2027, harmonizing standards and stimulating uptake of DEHP-free bags and pathogen-reduction across member states. Middle East & Africa and South America trail in total revenue but exhibit strong demand fundamentals tied to urbanization and non-communicable disease treatment expansion.

- Beckton Dickinson

- B. Braun

- Terumo

- Grifols

- Fresenius

- Haemonetics

- MacoPharma

- Ecomed Solutions

- Polymedicure Ltd.

- Baxter

- Smiths Group

- Stryker

- Asahi Kasei

- Immucor

- Roche

- Thermo Fisher Scientific

- Werfen (Instrumentation Laboratory)

- HemoCue AB

- Medtronic

- Kawasumi Laboratories

- Nipro

- Kawamoto Corporation

- Mitra Industries

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Surgical Procedure Volumes Worldwide

- 4.2.2 Growing Prevalence of Hematological Disorders

- 4.2.3 Rapid Technological Advancements in Transfusion Equipment

- 4.2.4 Expanding Government Support for Blood Safety Initiatives in Emerging Markets

- 4.2.5 Increasing Deployment of Patient Blood Management Programs

- 4.2.6 Integration of Digital Inventory Analytics to Reduce Wastage

- 4.3 Market Restraints

- 4.3.1 Stringent Regulatory and Quality Compliance Requirements

- 4.3.2 High Operational Costs of Blood Collection and Cold Chain

- 4.3.3 Sustainability Pressures on PVC-Based Blood Bag Materials

- 4.3.4 Shrinking Eligible Donor Base Due to Demographic Shifts

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Blood Bags & Accessories

- 5.1.2 Blood Mixer

- 5.1.3 Blood Filters

- 5.1.4 Blood Component Separator

- 5.1.5 Apheresis Device

- 5.1.6 Pathogen Reduction System

- 5.1.7 Blood & Fluid Warmer

- 5.1.8 Blood Collection & Processing Consumables

- 5.1.9 Other Products

- 5.2 By Technology

- 5.2.1 Manual / Conventional

- 5.2.2 Automated / Integrated

- 5.3 By Application

- 5.3.1 Collection

- 5.3.2 Processing & Separation

- 5.3.3 Storage & Preservation

- 5.3.4 Transfusion & Administration

- 5.4 By End-user

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgical Centres

- 5.4.3 Blood Banks

- 5.4.4 Other End-users

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Becton Dickinson and Company

- 6.3.2 B. Braun Melsungen AG

- 6.3.3 Terumo Corporation

- 6.3.4 Grifols SA

- 6.3.5 Fresenius Kabi AG

- 6.3.6 Haemonetics Corporation

- 6.3.7 Macopharma SA

- 6.3.8 Ecomed Solutions, LLC.

- 6.3.9 Polymedicure Ltd.

- 6.3.10 Baxter International Inc.

- 6.3.11 Smiths Medical (ICU Medical)

- 6.3.12 Stryker Corporation

- 6.3.13 Asahi Kasei Medical Co., Ltd.

- 6.3.14 Immucor, Inc.

- 6.3.15 Roche Diagnostics

- 6.3.16 Thermo Fisher Scientific Inc.

- 6.3.17 Werfen (Instrumentation Laboratory)

- 6.3.18 HemoCue AB

- 6.3.19 Medtronic plc

- 6.3.20 Kawasumi Laboratories

- 6.3.21 Nipro Corporation

- 6.3.22 Kawamoto Corporation

- 6.3.23 Mitra Industries

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment