PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848084

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848084

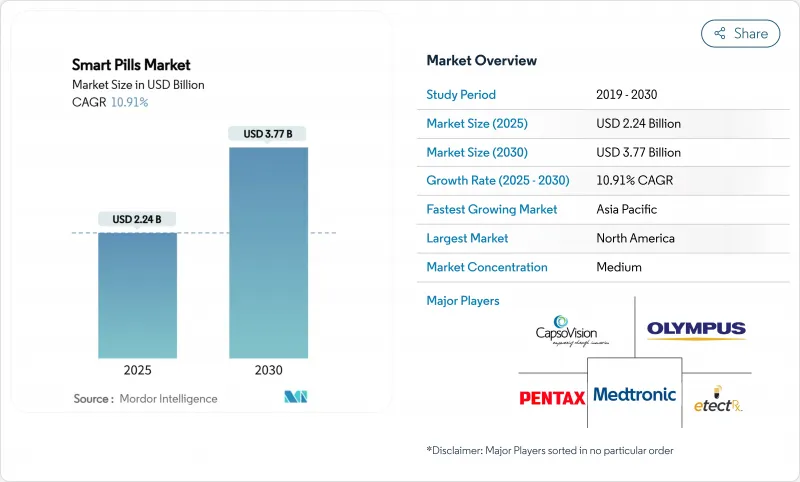

Smart Pills - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Smart Pills Market size is estimated at USD 2.24 billion in 2025, and is expected to reach USD 3.77 billion by 2030, at a CAGR of 10.91% during the forecast period (2025-2030).

Advancing semiconductor miniaturization, accelerating adoption of remote monitoring after the pandemic, and aging-driven demand for less invasive gastrointestinal (GI) procedures collectively anchor this growth. Hospitals continue to drive procedure volumes, yet home-based diagnostics are scaling quickly as 5G connectivity and artificial intelligence (AI) enable real-time image transmission. Regulatory alignment across major economies further lowers commercialization risk, while safety-enhanced designs are widening the eligible patient pool. Competitive focus is shifting from basic imaging capsules toward multifunctional platforms that diagnose, monitor, and precisely deliver therapeutics.

Global Smart Pills Market Trends and Insights

Rising Preference for Minimally Invasive Diagnostics

Heightened patient comfort and streamlined clinical workflows position capsule-based imaging as a superior alternative to scope-based procedures. Smart pills remove sedation, air insufflation, and recovery delays, aligning with health-system mandates to improve throughput and lower procedural costs. The Centers for Disease Control and Prevention reports that 60-70 million Americans experience GI disorders yearly, underscoring the volume of procedures that could migrate to noninvasive capsules. Post-pandemic reliance on remote care has embedded digital monitoring into standard care pathways. Diagnostic accuracy now rivals conventional endoscopy, with AI-enabled capsules showing 87.17% sensitivity and 98.77% specificity in lesion detection. As image quality converges, the remaining adoption barrier of diagnostic reliability is effectively neutralized.

Growing Burden of Gastrointestinal Disorders

Rising life expectancy is exposing larger cohorts to chronic GI diseases such as Crohn's and celiac disease. Frequent visual assessment of mucosal status is central to disease control, but elderly or comorbid patients poorly tolerate repeated endoscopy. Smart pills provide longitudinal insight without procedure-related stress, supporting treat-to-target strategies. They also harvest microbiome samples, enabling researchers to link microbial signatures with systemic conditions, including neurodegenerative disease progression. This expanded clinical utility enlarges the addressable patient base and encourages multi-disciplinary adoption beyond gastroenterology.

High Device Cost & Uneven Reimbursement

Single-use capsules cost USD 500-2,000, a price point that constrains routine utilization in lower-income settings. Payer coverage is patchy; U.S. Medicare limits reimbursement to specific indications, and many private insurers still require prior authorization. Emerging economies contend with added customs duties and exchange-rate volatility, further inflating costs. Capital requirements also encompass reading stations and clinician training. Manufacturers are pursuing scale economies and automated AI reporting to compress per-procedure outlays, yet widespread affordability remains two to four years away.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Advances in Capsule Imaging & Miniaturized Sensors

- Aging Population with Poor Tolerance to Conventional Endoscopy

- Capsule Retention / Adverse Events Risk

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Capsule endoscopy dominated procedure volume in 2024, accounting for 54.38% of the smart pills market share, largely due to its established role in obscure GI bleeding evaluation. Drug Delivery, however, is forecast for a 17.93% CAGR as pharmaceutical companies leverage programmable release mechanisms to overcome pH-mediated degradation and enhance biologic bioavailability. Strong clinical trial pipelines indicate a transition from diagnostic single-use capsules toward dual-function platforms that both identify and treat pathology.

Convergence of device and drug regulation favors incumbents with combined expertise, yet smaller entrants are carving niches by partnering with contract manufacturing organizations for rapid iteration. Patient Monitoring capsules that measure pH, temperature, and pressure are gaining traction within telehealth packages targeted at chronic disease management, ensuring diversified revenue streams beyond imaging reimbursements. The overall smart pills market size tied to application innovation is expected to widen as multi-sensor payloads validate new use cases.

Occult GI bleeding held 25.93% share of the smart pills market size in 2024 as guidelines endorse capsule imaging when colonoscopy and upper endoscopy fail to identify bleeding sources. Celiac Disease applications are poised to rise at 16.19% CAGR, driven by gluten-sensing capsules that provide immediate dietary feedback and reduce the need for repeat biopsy. The link between gut microbiota and neurological disorders is opening cross-specialty collaboration, exemplified by pilot studies associating microbial metabolites with Parkinson's symptom severity.

Small-bowel tumor detection continues as a high-value niche, commanding premium reimbursement because of limited alternative diagnostics. Meanwhile, Crohn's Disease surveillance is transitioning to serial capsule studies that track mucosal healing and predict flare-ups, reducing corticosteroid exposure and hospitalization rates. As personalized therapy expands, disease-specific capsules with targeted sensors will anchor long-term revenue expansion for the smart pills industry.

The Smart Pills Market Report is Segmented by Application Area (Capsule Endoscopy, Drug Delivery, Patient Monitoring), Disease Indication (Occult GI Bleeding, Crohn's Disease, and More), Target Area (Esophagus, Stomach, and More), End User (Hospitals, Diagnostic Centers, and More), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 44.36% of the smart pills market size in 2024, anchored by comprehensive insurance coverage for capsule endoscopy and a streamlined U.S. Food and Drug Administration breakthrough-device pathway that accelerates approvals. Regional growth remains solid as updated Quality System Regulation amendments harmonize U.S. standards with international guidance, lowering compliance burdens. Favorable procurement budgets among integrated delivery networks continue to support adoption, even as payers pressure providers to demonstrate cost-effectiveness.

Asia Pacific is the fastest-growing region, projected for 18.89% CAGR, supported by national digital-health strategies and aging demographics that prioritize noninvasive diagnostics. In China, smart hospital initiatives finance tele-endoscopy pilots in tier-2 cities, while Japan's rapidly expanding over-75 age segment demands minimally invasive monitoring. India's private hospital chains are introducing capsule imaging packages bundled with mobile follow-up consultations, pairing affordability with accessibility.

Europe's harmonized Medical Device Regulation enables simultaneous multi-country launches, fostering competition that restrains price escalation and promotes evidence generation. Germany's Digital Healthcare Act reimburses digital therapeutics, offering a template that may extend to AI-enhanced capsule reading software. Scandinavia is piloting remote colon capsule screening for rural populations, demonstrating scalability in low-density regions.

Emerging markets in Latin America and the Middle East are investing in flagship tertiary centers that incorporate capsule platforms to attract medical tourism. Multilateral financing and public-private partnerships are easing import costs, though reimbursement frameworks remain fragmented. Over time, proven reductions in invasive procedure volumes should motivate broader payer adoption, reinforcing geographic expansion of the smart pills market.

- Medtronic

- Olympus

- CapsoVision

- Jinshan Science & Technology

- Check-Cap Ltd

- Koninklijke Philips

- Novartis

- Intromedic Co. Ltd

- etectRx

- Otsuka

- Pentax Medical

- Fujifilm Holdings Corp.

- Boston Scientific

- RF Co. Ltd

- Proteus Digital Health

- Pixie Scientific

- HQ

- Aerpio Pharmaceuticals

- Bio-Images Research Ltd

- Acurable Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Preference for Minimally Invasive Diagnostics

- 4.2.2 Growing Burden of Gastrointestinal (GI) Disorders

- 4.2.3 Rapid Advances in Capsule Imaging & Miniaturised Sensors

- 4.2.4 Ageing Population with Poor Tolerance to Conventional Endoscopy

- 4.2.5 Emerging Microbiome-Sampling & Personalised-Nutrition Capsules

- 4.2.6 Space-Medicine & Defence Adoption for In-Situ GI Monitoring

- 4.3 Market Restraints

- 4.3.1 High Device Cost & Uneven Reimbursement

- 4.3.2 Capsule Retention / Adverse Events Risk

- 4.3.3 Data-Privacy & Cybersecurity Concerns with Ingestible Sensors

- 4.3.4 AI-Interpretability & Liability Hurdles Delaying Approvals

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Application

- 5.1.1 Capsule Endoscopy

- 5.1.1.1 Small Bowel Video Capsule Endoscopy

- 5.1.1.2 Colon Capsule Endoscopy

- 5.1.2 Drug Delivery

- 5.1.3 Patient Monitoring

- 5.1.1 Capsule Endoscopy

- 5.2 By Disease Indication

- 5.2.1 Occult GI Bleeding

- 5.2.2 Crohn's Disease

- 5.2.3 Small-Bowel Tumors

- 5.2.4 Celiac Disease

- 5.2.5 Inherited Polyposis Syndromes

- 5.2.6 Neurological Disorders

- 5.2.7 Other Indications

- 5.3 By Target Area

- 5.3.1 Esophagus

- 5.3.2 Stomach

- 5.3.3 Small Intestine

- 5.3.4 Large Intestine

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Diagnostic Centers

- 5.4.3 Home Healthcare

- 5.4.4 Research Institutes

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Medtronic

- 6.3.2 Olympus Corporation

- 6.3.3 CapsoVision Inc.

- 6.3.4 Jinshan Science & Technology

- 6.3.5 Check-Cap Ltd

- 6.3.6 Koninklijke Philips NV (Medimetrics)

- 6.3.7 Novartis AG

- 6.3.8 Intromedic Co. Ltd

- 6.3.9 etectRx Inc.

- 6.3.10 Otsuka Pharmaceutical Co. Ltd

- 6.3.11 Pentax Medical (Hoya)

- 6.3.12 Fujifilm Holdings Corp.

- 6.3.13 Boston Scientific Corp.

- 6.3.14 RF Co. Ltd

- 6.3.15 Proteus Digital Health

- 6.3.16 Pixie Scientific

- 6.3.17 HQ Inc.

- 6.3.18 Aerpio Pharmaceuticals

- 6.3.19 Bio-Images Research Ltd

- 6.3.20 Acurable Ltd

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment