PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848092

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848092

Craniomaxillofacial Fixation Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

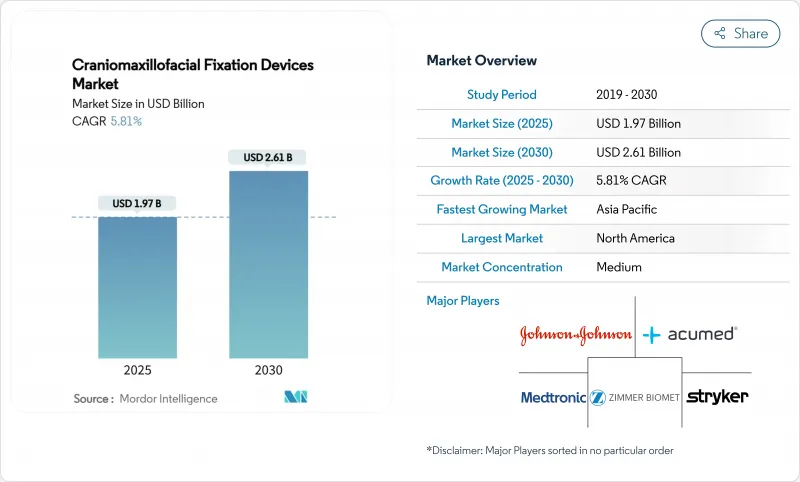

The craniomaxillofacial fixation devices market size stands at USD 1.97 billion in 2025 and is projected to reach USD 2.61 billion by 2030, advancing at a 5.81% CAGR over the forecast period.

Demand remains healthy as rising trauma incidence, steady orthognathic surgery volumes and new bio-resorbable materials widen clinical adoption, while 3D-printed patient-specific solutions create premium price tiers that underpin revenue growth. Integration of additive manufacturing with bio-polymers shifts the competitive focus from commodity titanium sets to customized implants that shorten operating room time and reduce secondary procedures. Regulatory tightening, notably the Quality Management System Regulation that mandates ISO 13485:2016 compliance from February 2026, pushes manufacturers toward harmonized global quality systems and favors firms with robust compliance infrastructure. At the same time, hospital buyers expect evidence of cost savings under value-based care, prompting suppliers to link implant choice to reduced re-operation risk and shorter lengths of stay.

Global Craniomaxillofacial Fixation Devices Market Trends and Insights

Increasing Incidence of Craniofacial Trauma

Urbanization, higher road traffic density and contact-sport participation continue to elevate facial injury rates, making mandibular fractures the most frequent indication for fixation plates. Aging in developed economies adds fall-related injuries, while polytrauma cases demand multi-site fixation, thus requiring broad system portfolios rather than single configurations. Surgeons increasingly adopt modular sets that cover midface, mandible and cranial repairs in one sterile tray, which raises average selling prices. Hospitals value complete kits that shorten turnover time, reinforcing manufacturer preference for players able to bundle screws, plates and resorbables under unified compatibility guarantees. The trend sustains steady baseline procedure volume even in mature regions, protecting the craniomaxillofacial fixation devices market from cyclical capital-equipment swings.

Rising Adoption of Minimally Invasive Surgical Techniques

Intraoral distraction devices and concealed maxillary distractors avoid visible scarring while preserving bone blood supply, improving cosmetic outcomes that matter strongly to pediatric and adult patients alike. Rapid-prototype guide plates generated from CT data enable precise osteotomies, cutting operating room time and reducing radiation exposure from intra-operative imaging. As surgeons gain confidence, minimally invasive protocols become first-line choice rather than alternative, prompting redesigns toward slimmer plate profiles and low-head screws that fit through smaller incisions. Device makers differentiate through ergonomic instrumentation that permits placement without wide exposure, and through color-coded kits that streamline workflow. This shift favors suppliers able to align mechanical strength with smaller footprint hardware.

Unfavorable Reimbursement and Coverage Policies

Medicare fee-cuts of up to 20% on selected CPT codes erode hospital margins, pushing purchasing departments to cap implant spend per procedure. Private insurers request extensive pre-authorization, delaying surgeries and forcing surgeons to document functional necessity beyond aesthetic benefit. In single-payer systems, formularies often prefer generic plates over branded innovations, limiting uptake of premium resorbables despite superior outcomes. Manufacturers respond by publishing cost-utility studies that show savings from avoiding removal surgeries, yet payers demand longitudinal evidence. Near-term, this restraint tempers the craniomaxillofacial fixation devices market growth until value-based data accumulate.

Other drivers and restraints analyzed in the detailed report include:

- Continuous Technological Advancements in Fixation Devices

- Growing Utilization of Patient-Specific and 3D-Printed Implants

- High Procedural Costs and Price Pressure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

CMF distraction devices are forecast to log a 7.65% CAGR through 2030, well above the overall craniomaxillofacial fixation devices market growth rate. The method is now standard for mandibular lengthening in neonates with airway obstruction, achieving 91.3% success in averting tracheostomy according to multicenter data. MF plate & screw fixation remains the workhorse, holding 48.65% market share in 2024 as surgeons rely on its familiarity and immediate load-bearing strength. Technique selection increasingly turns on patient age and defect complexity rather than surgeon preference, with bio-resorbable distraction systems gaining pediatric favor for eliminating secondary hardware removal. The craniomaxillofacial fixation devices market size for distraction systems is projected to reach USD 647 million by 2030, implying a widening revenue gap over cranial flap-only sets.

Surgeons demand hybrid solutions that pair distraction with navigation guidance, creating opportunities for firms that integrate threaded distractors with pre-bent patient-matched guides. External devices lose ground to internal systems that avoid pin-site infections, furthering procedure acceptance among caregivers. Meanwhile, temporomandibular joint replacement grows steadily, supported by custom alloplastic components but remains a smaller share of the craniomaxillofacial fixation devices market. As payers acknowledge long-term airway and facial symmetry benefits, adoption barriers lessen, reinforcing the segment's outperformance.

The Craniomaxillofacial Fixation Devices Market Report is Segmented by Technique (Cranial Flap Fixation, CMF Distraction, TMJ Replacement, and More), Material (Titanium & Titanium Alloys, and More), Application (Neurosurgery & ENT, and More), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 40.56% of global 2024 revenue, anchored by well-reimbursed trauma care and high awareness of pediatric craniofacial conditions. Procedure growth plateaus near population growth, but ASPs remain the highest worldwide thanks to rapid uptake of resorbables and patient-specific implants. Europe follows with subdued but stable expansion; strict MDR documentation raises cost of market entry, tilting competitive balance toward established firms with mature clinical evidence dossiers. Hospitals there increasingly request environmental impact statements, prompting early trials of recyclable instrument trays.

Asia-Pacific exhibits the most momentum at a 6.54% CAGR, led by China's fast build-out of tier-III trauma centers and India's expansion of medical insurance coverage. Domestic companies gain share in standard trauma plates, yet imported bio-resorbables dominate premium pediatric cases. Governments encourage local 3D-printing initiatives, but surgeons still rely on U.S. or German planning software for complex reconstructions, maintaining cross-border supply chains. The craniomaxillofacial fixation devices market size in Asia-Pacific could surpass that of Europe by 2028 if current volume trends hold.

Latin America and the Middle East & Africa grow from a small base, driven mainly by private hospital chains positioning as medical-tourism hubs. Exchange-rate volatility, however, dampens large capital purchases and favors consignment stocking over outright ownership. Vendors must offer flexible payment models such as pay-per-use for patient-specific implants to penetrate these regions. Overall, geographic diversification mitigates exposure to reimbursement cuts in mature markets.

- Stryker

- Johnson & Johnson

- Zimmer Biomet

- Metallos Integra LifeSciences

- Medtronic

- KLS Martin Group

- Medartis

- OsteoMed (Colson Associates)

- B. Braun SE (Aesculap)

- Smith+Nephew Plc

- Acumed

- Orthofix

- MicroPort Scientific Corp.

- Xilloc Medical BV

- Osteopore Ltd.

- Leica Biomaterials AG

- GPC Medical Ltd.

- Cardinal Health (Kanghui CMF)

- Lepu Medical

- HumanTech Surgical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope Of The Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Incidence of Craniofacial Trauma

- 4.2.2 Rising Adoption of Minimally Invasive Surgical Techniques

- 4.2.3 Continuous Technological Advancements in Fixation Devices

- 4.2.4 Growing Utilization of Patient-Specific and 3D-Printed Implants

- 4.2.5 Expansion of Healthcare Infrastructure and Procurement Initiatives in Emerging Markets

- 4.2.6 Integration of Navigation and Augmented Reality Systems

- 4.3 Market Restraints

- 4.3.1 Unfavorable Reimbursement and Coverage Policies

- 4.3.2 High Procedural Costs and Price Pressure

- 4.3.3 Stringent Regulatory Compliance and Certification Requirements

- 4.3.4 Limited Access to Specialized CMF Surgeons in Rural Regions

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat Of New Entrants

- 4.5.2 Bargaining Power Of Buyers

- 4.5.3 Bargaining Power Of Suppliers

- 4.5.4 Threat Of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Technique

- 5.1.1 Cranial Flap Fixation

- 5.1.2 CMF Distraction

- 5.1.3 Temporomandibular Joint (TMJ) Replacement

- 5.1.4 MF Plate & Screw Fixation

- 5.1.5 Bio-Resorbable Fixation

- 5.1.6 Others

- 5.2 By Material

- 5.2.1 Titanium & Titanium Alloys

- 5.2.2 Stainless Steel

- 5.2.3 Bio-Resorbable Polymers (PLA, PGA, PDO)

- 5.2.4 Bio-Ceramics (Hydroxyapatite, Tricalcium Phosphate)

- 5.2.5 Patient-Specific 3-D Printed Composites

- 5.3 By Application

- 5.3.1 Neurosurgery & ENT

- 5.3.2 Orthognathic & Dental Surgery

- 5.3.3 Plastic & Aesthetic Surgery

- 5.3.4 Paediatric Craniosynostosis Repair

- 5.3.5 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Stryker Corporation

- 6.3.2 Johnson and Johnson

- 6.3.3 Zimmer Biomet Holdings Inc.

- 6.3.4 Metallos Integra LifeSciences

- 6.3.5 Medtronic Plc

- 6.3.6 KLS Martin Group

- 6.3.7 Medartis AG

- 6.3.8 OsteoMed (Colson Associates)

- 6.3.9 B. Braun SE (Aesculap)

- 6.3.10 Smith+Nephew Plc

- 6.3.11 Acumed LLC

- 6.3.12 Orthofix Medical Inc.

- 6.3.13 MicroPort Scientific Corp.

- 6.3.14 Xilloc Medical BV

- 6.3.15 Osteopore Ltd.

- 6.3.16 Leica Biomaterials AG

- 6.3.17 GPC Medical Ltd.

- 6.3.18 Cardinal Health (Kanghui CMF)

- 6.3.19 Lepu Medical Technology

- 6.3.20 HumanTech Surgical

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment