PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848096

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848096

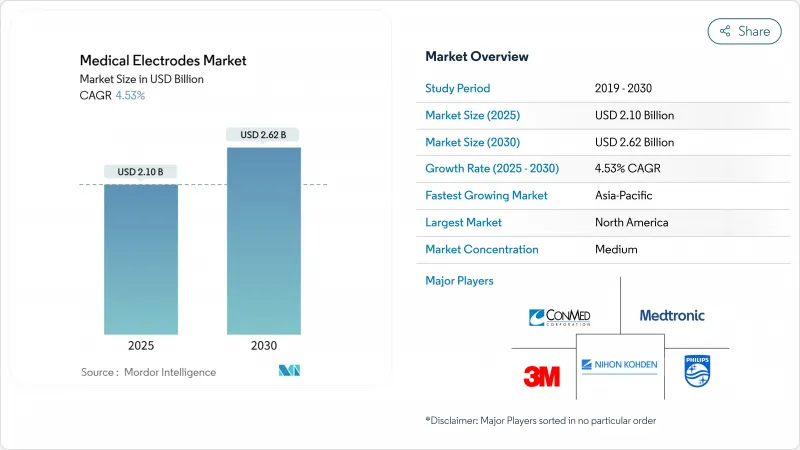

Medical Electrodes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The medical electrodes market size reached USD 2.10 billion in 2025 and is projected to advance to USD 2.62 billion by 2030, reflecting a 4.53% CAGR.

Demand progression stems from the sector's shift beyond basic bio-signal capture toward connected, AI-enabled diagnostic and therapeutic ecosystems. Home-based care expansion, ageing populations, and heightened chronic-disease prevalence sustain year-round purchasing cycles for advanced, comfortable electrodes. Supply-chain resilience now sits on the C-suite agenda, as shipping, labor, and raw-material inflation have driven logistics outlays to as high as 20% of revenue, prompting leading device makers to earmark 3-5% of annual sales for supply-chain risk services. North America continues to lead adoption on the back of robust reimbursement frameworks, while Asia-Pacific shows the fastest growth trajectory, buoyed by strong domestic manufacturing capacity and pro-innovation policies in China, Japan, and South Korea.

Global Medical Electrodes Market Trends and Insights

Rising Incidence of Cardiovascular and Neurological Diseases

Surging chronic-disease prevalence underpins steady demand for precision electrodes that capture high-fidelity bio-signals during lengthy monitoring windows. Medtronic's 2025 FDA-cleared BrainSense Adaptive DBS platform illustrates how electrodes now enable closed-loop neuromodulation by adjusting therapy in real time based on brain-activity feedback. AI-enhanced analytics layer predictive insights atop raw ECG or EEG feeds, paving the way for earlier clinical intervention. Health providers increasingly justify premium pricing where electrode performance directly elevates diagnostic confidence and therapeutic outcomes. The trend secures multiyear purchasing visibility for vendors able to balance signal quality with wearer comfort and skin safety.

Continuous Innovations in Dry, Hydrogel, and Flexible Electrode Materials

Dry polymer matrices, semi-dry antibacterial hydrogels, and kirigami-patterned films are redefining comfort standards. Datwyler's SoftPulse polymer product eliminates gel yet maintains low impedance for multiday ECG capture. Hydrogel sheets incorporating silver nanoparticles deliver 12-hour EEG with suppressed bacterial proliferation. Textile electrodes knitted from silver-coated polyamide yarn have recorded 98.7% signal-classification accuracy during exercise while remaining breathable. These material gains minimise skin irritation, reduce motion artefacts, and simplify application workflows, thereby lifting overall utilisation rates.

Stringent Multiregional Regulatory and Quality-Compliance Requirements

The FDA's 2024 revision of ISO 10993-1 guidance obliges deeper chemical-characterisation studies, adding 6-12 months to approval timelines for skin-contact devices. Europe's Medical Device Regulation further increases audit frequency and post-market surveillance duties, lifting compliance costs to as much as 5% of sales for mid-size manufacturers. China's volume-based procurement drives list-price compression while local registration rules evolve in parallel, straining global launch calendars. Cyber-security plans are now mandatory for U.S. submissions, compelling electrode developers to budget for secure firmware and over-the-air update capabilities.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Volume of Minimally Invasive and Ambulatory Surgeries

- Emergence of Textile and Printable Electrodes for Wearable Health Applications

- Persistent Biocompatibility and Skin-Irritation Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Surface electrodes dominated the medical electrodes market with 46.45% revenue in 2024. Long-standing use in ECG, sleep studies, and routine neuro-diagnostics, coupled with straightforward application, secures their volume edge. Advanced pressure-sensitive hydrogels now cut motion artefacts, reinforcing hospital preference. The medical electrodes market size tied to surface variants is forecast to advance steadily alongside cardiac and sleep screening programs. Needle electrodes, conversely, are projected to post a 6.43% CAGR to 2030. Demand originates from intraoperative neuromonitoring, botulinum toxin guidance, and sophisticated DBS mapping. Recent acquisitions such as Nihon Kohden's Ad-Tech buyout underline industry commitment to deeper brain-interface innovation.

Hybrid micro-needle patches blur categorical lines by letting clinicians sample intracellular signals without full penetration. Early prototypes from MIT can coil around neurons, presaging sub-cellular diagnostic opportunities. Vendors now differentiate through proprietary alloys that enable sharper tips yet minimise tissue trauma. Continued miniaturisation and robotic surgical adoption should keep needle solutions on an elevated growth arc.

Disposable formats held 68.34% of the medical electrodes market share in 2024 as infection-control protocols, heightened by the pandemic, favoured single-use consumables. Hospitals appreciate the time-saving convenience of peel-and-stick packs that bypass sterilisation workflows. Nevertheless, reusable electrodes are forecast to climb at a 7.32% CAGR as health-system sustainability charters tighten landfill-reduction targets. Self-healing conductive elastomers that regain 80% functionality within 10 seconds address historic durability gaps.

Several manufacturers now market hybrid kits where the cable harness and snap assembly are resterilisable, while the adhesive sensing pad is replaceable. Total-cost-of-ownership models show break-even within six procedural cycles, prompting large academic centres to trial reusable fleets. Policy signals, such as European tenders awarding points for circular-economy conformity, are expected to accelerate transitions.

The Medical Electrodes Market Report is Segmented by Product Type (Surface Electrodes and Needle Electrodes), Usability (Disposable Electrodes and Reusable Electrodes), Technology (Wet (Gel-Based), Dry, and More), Modality (Electrocardiography (ECG), and More), Application (Cardiology, and More), End-User (Hospitals, and More), Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 38.75% revenue in 2024, underpinned by established reimbursement for remote cardiac telemetry and the FDA's active yet innovation-friendly oversight fda.gov. Regional conglomerates such as Medtronic, Boston Scientific, and Solventum integrate R&D and manufacturing, fostering rapid prototype-to-market cycles. The surge in Hospital-at-Home programs draws electrodes into living rooms, further consolidating North America's consumption base.

Asia-Pacific is positioned for a 5.45% CAGR to 2030 as China's medical-device spending climbs toward USD 210 billion in 2025. Government schemes like Healthy China 2030 prioritise domestic innovation, driving state grants toward flexible electrode startups. Japan's precision-manufacturing heritage and South Korea's 5G health-cloud rollouts complement China's scale, jointly lifting regional output capacity. Supply-chain localisation strategies also reduce lead times for export markets.

Europe maintains steady expansion under stringent MDR quality benchmarks that favour premium, reusable electrode offerings. Sustainability mandates cajole hospitals into life-cycle-cost audits, nudging procurement toward longer-lasting designs. Middle East & Africa and South America trail in market penetration but register rising tender volumes as universal-health-coverage schemes widen device access. Cost-optimised yet clinically validated electrodes gain traction where budget constraints are acute.

- 3M

- Ambu

- Medtronic

- Nihon Kohden

- Koninklijke Philips

- Cardinal Health

- Conmed

- Natus Medical

- Ad-Tech Medical Instrument

- Cognionics

- DCC Healthcare (Leonhard Lang)

- The Cooper Companies

- Dymedix

- Zoll Medical

- Zynex Inc.

- Dynatronics

- Rhythmlink International

- Biosemi

- Neuroone Medical Technologies

- Shimmer Research

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Incidence of Cardiovascular and Neurological Diseases

- 4.2.2 Growing Adoption of Home and Remote Patient Monitoring Technologies

- 4.2.3 Continuous Innovations in Dry, Hydrogel, and Flexible Electrode Materials

- 4.2.4 Increasing Volume of Minimally Invasive and Ambulatory Surgeries

- 4.2.5 Emergence of Textile And Printable Electrodes for Wearable Health Applications

- 4.2.6 Government Shift Toward Preventive Care and Early Diagnosis Reimbursement Models

- 4.3 Market Restraints

- 4.3.1 Stringent Multiregional Regulatory and Quality Compliance Requirements

- 4.3.2 Persistent Biocompatibility and Skin-Irritation Concerns

- 4.3.3 Volatile Supply And Pricing of Silver/Silver Chloride Raw Materials

- 4.3.4 Data Privacy and Signal Integrity Challenges in Connected Electrode Platforms

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat Of New Entrants

- 4.5.2 Bargaining Power Of Buyers

- 4.5.3 Bargaining Power Of Suppliers

- 4.5.4 Threat Of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Surface Electrodes

- 5.1.2 Needle Electrodes

- 5.2 By Usability

- 5.2.1 Disposable Electrodes

- 5.2.2 Reusable Electrodes

- 5.3 By Technology

- 5.3.1 Wet (Gel-Based)

- 5.3.2 Dry

- 5.3.3 Semidry / Hydrogel

- 5.3.4 Textile / Printable

- 5.3.5 Needle

- 5.4 By Modality

- 5.4.1 Electrocardiography (ECG)

- 5.4.2 Electroencephalography (EEG)

- 5.4.3 Electromyography (EMG)

- 5.4.4 Brainstem Auditory Evoked Potentials (BAEPs)

- 5.4.5 Other Modalities

- 5.5 By Application

- 5.5.1 Cardiology

- 5.5.2 Neurophysiology

- 5.5.3 Sleep Disorders

- 5.5.4 Intraoperative Monitoring

- 5.5.5 Other Applications

- 5.6 By End User

- 5.6.1 Hospitals

- 5.6.2 Diagnostic Centers

- 5.6.3 Ambulatory Surgical Centers

- 5.6.4 Home-Care Settings

- 5.7 Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 Australia

- 5.7.3.5 South Korea

- 5.7.3.6 Rest of Asia-Pacific

- 5.7.4 Middle East & Africa

- 5.7.4.1 GCC

- 5.7.4.2 South Africa

- 5.7.4.3 Rest of Middle East & Africa

- 5.7.5 South America

- 5.7.5.1 Brazil

- 5.7.5.2 Argentina

- 5.7.5.3 Rest of South America

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 3M

- 6.3.2 Ambu A/S

- 6.3.3 Medtronic Plc

- 6.3.4 Nihon Kohden Corporation

- 6.3.5 Koninklijke Philips N.V.

- 6.3.6 Cardinal Health

- 6.3.7 CONMED Corporation

- 6.3.8 Natus Medical Incorporated

- 6.3.9 Ad-Tech Medical Instrument

- 6.3.10 Cognionics Inc.

- 6.3.11 DCC Healthcare (Leonhard Lang)

- 6.3.12 Coopersurgical Inc.

- 6.3.13 Dymedix

- 6.3.14 Zoll Medical Corporation

- 6.3.15 Zynex Inc.

- 6.3.16 Dynatronics Corporation

- 6.3.17 Rhythmlink International

- 6.3.18 Biosemi

- 6.3.19 Neuroone Medical Technologies

- 6.3.20 Shimmer Research

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment