PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848098

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848098

United States Energy Bar - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

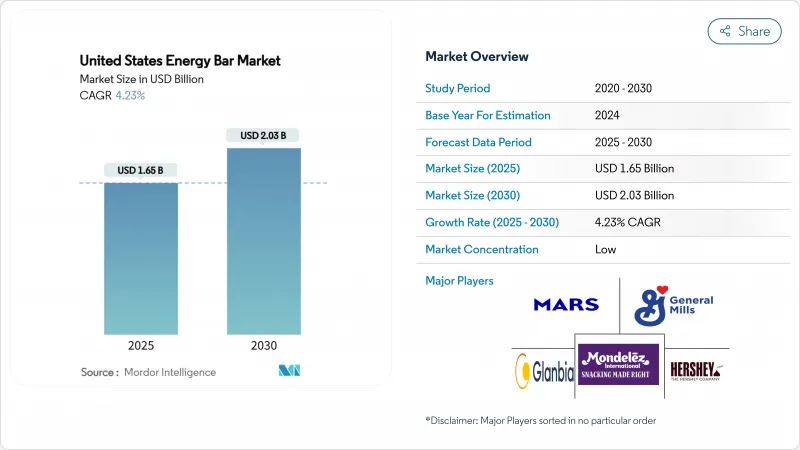

The United States energy bar market size is estimated to be USD 1.65 billion in 2025 to USD 2.03 billion by 2030, achieving a steady CAGR of 4.23% during the forecast period (2025-2030).

This consistent growth trajectory underscores the market's progression toward maturity, driven by several key factors. Increasing consumer demand for convenient and nutritious snack options is a primary driver, as energy bars align with the fast-paced lifestyles of modern consumers. Additionally, the growing awareness of health and wellness, coupled with a shift toward on-the-go consumption, has further fueled the adoption of energy bars. The market is also benefiting from innovations in product formulations, including the incorporation of functional ingredients such as protein, fiber, and superfoods, which cater to specific dietary needs and preferences. Furthermore, the rising popularity of plant-based and clean-label products has encouraged manufacturers to diversify their offerings, appealing to a broader consumer base. The expanding distribution channels, including e-commerce platforms and specialty health stores, are also playing a significant role in enhancing product accessibility and driving market growth.

United States Energy Bar Market Trends and Insights

Innovative Formulations and Clean-Label Ingredients Are Being Favored by Health-Conscious Consumers.

In the US energy bar market, the growing preference for innovative formulations and clean-label ingredients is a significant driver. Consumers are increasingly seeking products that align with their health and wellness goals. Clean-label ingredients, which emphasize transparency and the use of natural, minimally processed components, are gaining traction among health-conscious individuals. These ingredients often exclude artificial additives, preservatives, and synthetic chemicals, which resonate with consumers looking for healthier alternatives. Additionally, innovative formulations that cater to specific dietary needs, such as high-protein, low-sugar, gluten-free, or plant-based options, are becoming more popular. Manufacturers are also incorporating functional ingredients like superfoods, probiotics, and adaptogens to enhance the nutritional profile of energy bars, further appealing to the health-conscious demographic. This trend reflects a broader shift in consumer behavior, where individuals prioritize nutritional value, ingredient quality, and product transparency when selecting energy bars.

Quick Energy-Boosting Snacks Are Driving the Market's Growth

The increasing preference for convenient and nutritious snack options is significantly driving the growth of the United States energy bar market. Consumers are seeking quick energy-boosting snacks that align with their busy lifestyles, offering both portability and nutritional benefits. Energy bars, known for their ability to provide instant energy and essential nutrients, are becoming a popular choice among health-conscious individuals, athletes, and professionals. According to the International Food Information Council, 20% of U.S. consumers followed a high-protein diet in 2024 . This shift toward high-protein diets has further fueled the demand for energy bars, as they are often formulated with high protein content to meet dietary needs. This trend is further supported by the growing awareness of health and wellness, which has led to a surge in demand for functional and on-the-go food products. The market is also benefiting from innovations in flavors, ingredients, and packaging, catering to diverse consumer preferences and dietary requirements. These factors collectively contribute to the robust growth of the energy bar market in the United States.

Sugar Levels and Synthetic Additives Raise Health Alarm Bells

Rising health concerns regarding high sugar content and the presence of synthetic additives in energy bars are acting as significant market restraints in the market. As per the 2024 report from the Centers for Disease Control and Prevention, over 38 million Americans, roughly 1 in 10, are diagnosed with diabetes, with 90% to 95% of these cases being type 2 diabetes . Consumers are increasingly scrutinizing product labels, seeking healthier alternatives with natural ingredients and reduced sugar levels. This shift in consumer preferences is pressuring manufacturers to reformulate their products to align with the growing demand for clean-label and health-conscious options. Failure to address these concerns could hinder market growth, as health-conscious consumers may opt for other snack options perceived as healthier. Additionally, regulatory bodies are imposing stricter guidelines on sugar content and synthetic additives, further challenging manufacturers in this market. Energy bars, often marketed as convenient and nutritious snacks, are facing criticism due to their high sugar content, which can contribute to health issues such as obesity, diabetes, and other metabolic disorders.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Outdoor and Adventure Sports Culture Boosts Demand

- Demand For Convenient and Healthy On-The-Go Snacking

- Allergens Like Nuts and Dairy Restrict Growth for Sensitive Groups

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, weight management and lifestyle energy bars accounted for 46.32% of the United States energy bar market. These bars cater to consumers seeking convenient and nutritious options to support their weight management goals and active lifestyles. The growing awareness of health and wellness, coupled with the increasing demand for on-the-go snacks, has driven the popularity of this segment. Additionally, the rise in dietary trends such as keto, vegan, and gluten-free diets has further boosted the demand for these bars. Manufacturers are focusing on introducing innovative flavors and formulations, such as high-protein, low-sugar, and plant-based options, to meet diverse consumer preferences and dietary needs. The segment also benefits from strategic marketing efforts targeting health-conscious individuals and the increasing availability of these products across various retail channels, including supermarkets, convenience stores, and online platforms.

The sports and endurance nutrition bars segment is projected to grow at a CAGR of 5.05% through 2030. This growth is fueled by the rising participation in sports and fitness activities across the United States, driven by an increasing focus on physical health and wellness. These bars are specifically designed to provide sustained energy and support muscle recovery, making them a preferred choice among athletes and fitness enthusiasts. Companies in this segment are investing in research and development to enhance product efficacy, incorporating ingredients like amino acids, electrolytes, and superfoods to cater to the performance-driven needs of their target audience. Furthermore, the segment is witnessing a surge in demand due to the growing trend of endurance sports, such as marathons and triathlons, and the increasing adoption of fitness routines among the general population. The availability of these products in specialized sports nutrition stores and e-commerce platforms has also contributed to the segment's expansion.

In the United States energy bar market, conventional energy bars continue to dominate, holding a substantial 64.21% market share in 2024. This dominance can be attributed to their well-established distribution networks, where products are often priced competitively, making them an attractive option for cost-conscious consumers. Furthermore, conventional energy bars benefit from decades of market presence, which has helped ensure widespread availability across supermarkets, convenience stores, and online platforms. These are strong brand loyalty and consumer trust. Their ability to cater to a wide range of tastes and dietary preferences through diverse product offerings further solidifies their position as a go-to choice for consumers seeking convenient, affordable, and reliable nutrition solutions.

Conversely, organic energy bars are emerging as a rapidly growing segment, with a projected CAGR of 4.88% through 2030. This growth is primarily driven by a shift in consumer preferences toward products that align with environmental sustainability and health-conscious values. Consumers are increasingly willing to pay premium prices for organic options, perceiving them as healthier and more environmentally friendly alternatives. The segment's growth is further fueled by the rising demand for clean-label products, which emphasize transparency in ingredient sourcing and production processes. Organic energy bars often feature natural, non-GMO, and minimally processed ingredients, appealing to health-focused consumers. Additionally, the increasing awareness of the environmental impact of food production has led to a preference for organic products, which are often associated with sustainable farming practices.

The United States Energy Bar Market Report is Segmented by Product Type (Organic and Conventional), Protein Source (Plant-Based and Animal-Based), Function/Application (Sports and Endurance Nutrition, Meal Replacement, and Weight Management and Lifestyle Energy), and Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Kellanova

- General Mills Inc.

- Mars Incorporated

- Mondelez International Inc.

- Skout Organic LLC

- Ferrero Group

- The Simply Good Foods Company

- BellRing Brands, Inc.

- Nestle S.A.

- Glanbia PLC

- The Hershey Company

- Kate's Real Food

- NuGo Nutrition

- The Hain Celestial Group

- Probar LLC

- 1440 Foods

- Built Brands, LLC.

- Simply Better Brands Corp

- IQBAR, Inc.

- Verb Energy Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Innovative Formulations and Clean-Label Ingredients Are Being Favored by Health-Conscious Consumers.

- 4.2.2 Quick Energy-Boosting Snacks Are Driving the Market's Growth

- 4.2.3 Growth Of Outdoor and Adventure Sports Culture Boosts Demand

- 4.2.4 Demand For Convenient and Healthy On-The-Go Snacking

- 4.2.5 Rising Adoption of Specialized Diets Drives Demand for Niche Bar Formulations

- 4.2.6 Growing Popularity of Plant-Based and Vegan Energy Bar Boosts Demand

- 4.3 Market Restraints

- 4.3.1 Fluctuating Raw Material Prices Disturb Cost Dynamics

- 4.3.2 Sugar Levels and Synthetic Additives Raise Health Alarm Bells

- 4.3.3 Rivalry From Meal Replacement Beverages and Other Snack Bars Stalling Expansion

- 4.3.4 Allergens Like Nuts and Dairy Restricts Growth for Sensitive Groups

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Organic

- 5.1.2 Conventional

- 5.2 By Protein Source

- 5.2.1 Plant-Based

- 5.2.2 Animal-Based

- 5.3 By Function/Application

- 5.3.1 Sports and Endurance Nutrition

- 5.3.2 Meal Replacement

- 5.3.3 Weight Management and Lifestyle Energy

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Convenience Stores

- 5.4.3 Specialty Stores

- 5.4.4 Online Retailers

- 5.4.5 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Funding, New Launches)

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Kellanova

- 6.4.2 General Mills Inc.

- 6.4.3 Mars Incorporated

- 6.4.4 Mondelez International Inc.

- 6.4.5 Skout Organic LLC

- 6.4.6 Ferrero Group

- 6.4.7 The Simply Good Foods Company

- 6.4.8 BellRing Brands, Inc.

- 6.4.9 Nestle S.A.

- 6.4.10 Glanbia PLC

- 6.4.11 The Hershey Company

- 6.4.12 Kate's Real Food

- 6.4.13 NuGo Nutrition

- 6.4.14 The Hain Celestial Group

- 6.4.15 Probar LLC

- 6.4.16 1440 Foods

- 6.4.17 Built Brands, LLC.

- 6.4.18 Simply Better Brands Corp

- 6.4.19 IQBAR, Inc.

- 6.4.20 Verb Energy Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK