PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848104

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848104

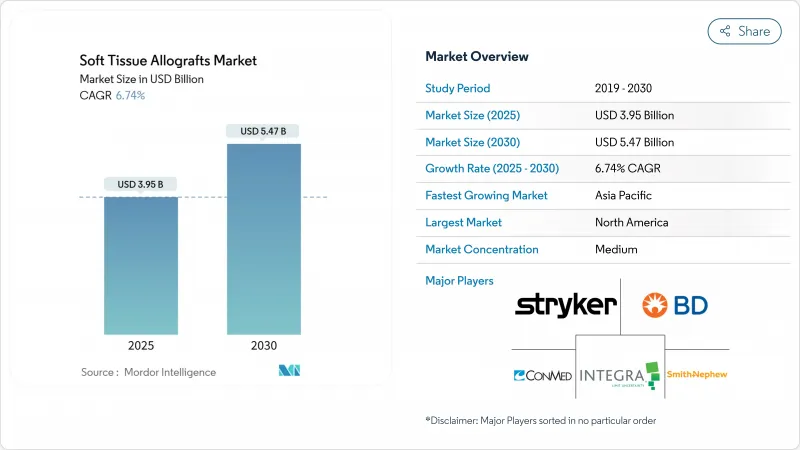

Soft Tissue Allografts - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The soft tissue allografts market size is valued at USD3.95billion in2025 and is forecast to reach USD5.47billion by2030, advancing at a6.74% CAGR.

Demand grows steadily as allografts move from experimental use to routine surgical materials in orthopedics, dentistry, wound care, and vascular repair. Adoption is reinforced by improved processing technologies that extend shelf life, lower immunogenicity, and offer better biomechanical performance. At the same time, an aging population and climbing sports-injury volumes expand the surgical candidate pool, while new reimbursement pathways reduce financial barriers. Heightened regulatory scrutiny-particularly six USFDA guidance documents released inJanuary2025-raises compliance costs yet standardizes quality, favoring processors with robust quality systems. In addition, mergers such as ZimmerBiomet's USD1.1billion deal for Paragon28 illustrate a race to secure graft supply and distribution channels across diverse specialties.

Global Soft Tissue Allografts Market Trends and Insights

Rising Prevalence of Musculoskeletal Disorders

Musculoskeletal conditions have shifted the soft tissue allografts market toward predictable, elective procedures instead of sporadic trauma-driven interventions. Chronic knee, shoulder, and spinal pathologies require planned reconstruction, enabling tissue banks to forecast demand, match donor characteristics to recipient needs, and reduce wastage. Aging demographics magnify this trend because degenerative tissue loss in seniors often rules out autografts. Surgeons therefore turn to pre-processed allografts that shorten operating times and avoid donor-site morbidity, producing clinical outcomes that compare favorably with autografts in elderly cohorts. The result is a durable demand curve that allows processors to optimize inventory and drives revenue visibility across the soft tissue allografts market.

Expanding Geriatric Population Base

Older patients exhibit limited healing capacity and insufficient autograft sites. Allografts thus become first-line options in complex foot, ankle, and spine surgeries. The FDA's December2024 approval of Symvess, an acellular tissue-engineered vessel, illustrates a regulatory embrace of advanced allografts for vascular reconstruction in fragile patient groups. Hospitals now prioritize shorter anesthesia times and fewer complications, favoring off-the-shelf grafts despite higher prices. Consequently, the geriatric demographic strengthens long-term growth for the soft tissue allografts market.

High Treatment and Graft Costs

Insurance payers compare allograft charges with autograft alternatives, triggering pre-authorization hurdles that slow adoption, particularly for elective digital nerve repair where median hospital billing reaches USD35,295, exceeding autograft procedures by USD11,224. Providers must now supply clinical data linking graft use to superior function or lower revision rates. Moreover, allografts require validated cold-chain logistics and traceability systems, inflating overhead for hospitals and ASCs. These factors temporarily temper uptake in price-sensitive regions but are unlikely to derail the long-range expansion of the soft tissue allografts market.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Sports and Recreation Injuries

- Rapid Advances in Tissue Engineering Technologies

- Stringent and Fragmented Regulatory Landscape

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Tendon allografts accounted for34.56% of2024 revenue, cementing their role in ACL and rotator cuff reconstruction. This segment's entrenched surgeon familiarity and strong biomechanical performance anchor the soft tissue allografts market. Dental/periodontal grafts, however, register an8.65% CAGR, rising on the back of implant dentistry and ridge augmentation. Dentsply Sirona's Symbios portfolio underscores how rigorous donor screening and a Sterility Assurance Level of10-6 resonate with periodontists. Cartilage and meniscus grafts cater to niche joint-surface defects, while ligament grafts contend with autografts in active young adults. Adipose-derived matrices and specialty connective tissues mark early-stage niches but hint at broader reconstructive potential. Competitive emphasis in this graft-type landscape shows processors diversifying lines to de-risk reliance on a single clinical domain, thereby sustaining demand across the soft tissue allografts market.

Surgeons now weigh graft selection against patient age, activity, and healing profile. For example, meniscus allografts appeal to younger athletes needing shock-absorbing properties unavailable in synthetics. Across categories, continuous documentation of long-term outcomes bolsters payer confidence and streamlines reimbursement, feeding back into sustained use throughout the soft tissue allografts market.

Fresh-frozen grafts held42.55% share in2024, benefiting from decades of clinical data and broad operating-room familiarity, positioning them as a staple in the soft tissue allografts market. Nonetheless, decellularized and acellular grafts accelerate at an8.44% CAGR because surgeons prioritize reduced rejection and improved integration. Cryopreservation maintains viable cells for orthopedic cartilage plugs, while lyophilization offers multi-year shelf life ideal for battlefield or rural care. Gamma irradiation remains a sterilization mainstay, though high doses may degrade collagen. In bone repair, demineralized bone matrix bridges classic allografts with synthetic substitutes, preserving osteoinductive proteins.

Selection criteria increasingly pivot on regenerative potential rather than simple availability. High-fidelity decellularization preserves biomechanical integrity and extracellular signaling, facilitating vascular invasion once implanted. Consequently, premium pricing aligns with outcome-focused purchasing, and processors finance R&D to compress processing time, guard growth factors, and scale manufacture. This technological arms race shapes competitive hierarchies inside the soft tissue allografts market.

The Soft Tissue Allografts Market Report is Segmented by Graft Type (Cartilage Allograft, Tendon Allograft, and More), Processing & Preservation Method (Fresh-Frozen, Cryopreserved, and More), Application (Orthopedic Reconstruction, Sports Medicine, and More), End User (Hospitals, and More), Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled45.67% of2024 revenue, reflecting mature tissue banks, sophisticated reimbursement, and a robust clinical research ecosystem. The presence of large processors such as LifeNet Health and MTF Biologics, together with integrated procurement organizations, ensures reliable donor pools and steady throughput. Despite dominance, value-based care initiatives urge surgeons to prove clinical superiority and cost offsets before selecting premium grafts. Upcoming federal compliance deadlines in2025 also press smaller US banks to merge or close, subtly reshaping regional supply dynamics and reinforcing the centrality of the soft tissue allografts market.

Asia-Pacific is the fastest riser, growing at7.56% CAGR through2030. Japan spearheads regenerative medicine with over60 iPS clinical trials, many intersecting with scaffold technologies that could dovetail with decellularized allografts. China's regulatory green light for Artivion's BioGlue in2024 signals openness to complex biologics, while urban hospitals modernize operating suites and cryogenic storage. Elsewhere, India and Southeast Asia benefit from expanding middle-class incomes and health insurance penetration, yet still grapple with fragmented regulations that slow cross-border tissue flow. Nonetheless, regional growth broadens the global footprint of the soft tissue allografts market.

Europe offers stable uptake, underpinned by harmonized directives under the European Union Tissues and Cells legislation that streamline supply across borders. National health systems favor quality-accredited grafts, and many surgeons participate in registries documenting long-term outcomes, strengthening evidence-based procurement. Mid-tier markets like the Middle East, Africa, and South America currently lag because of limited cold-chain infrastructure and higher out-of-pocket costs, yet represent long-range opportunities as private specialty hospitals proliferate. Consequently, strategic expansion plans increasingly balance the mature North American base with Asia-Pacific momentum, while nurturing footholds in emerging geographies to secure future share in the soft tissue allografts market.

- AbbVie (Allergan Aesthetics)

- Conmed

- Xtant Medical Holdings

- Bone Bank Allografts

- Smiths Group

- Beckton Dickinson

- Integra LifeSciences

- Stryker

- Zimmer Biomet

- Arthrex

- Medtronic

- Johnson & Johnson

- LifeNet Health

- Organogenesis Holdings

- AlloSource

- CryoLife (Artivion)

- Tissue Regenix Group

- MiMedx Group

- Axogen Inc.

- MTF Biologics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Musculoskeletal Disorders

- 4.2.2 Expanding Geriatric Population Base

- 4.2.3 Increasing Sports and Recreation Injuries

- 4.2.4 Rapid Advances in Tissue Engineering Technologies

- 4.2.5 Growing Healthcare Expenditure in Emerging Economies

- 4.2.6 Favorable Reimbursement and Policy Support

- 4.3 Market Restraints

- 4.3.1 High Treatment and Graft Costs

- 4.3.2 Stringent and Fragmented Regulatory Landscape

- 4.3.3 Limited Availability of Donor Tissue

- 4.3.4 Potential Risk of Disease Transmission

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Graft Type

- 5.1.1 Cartilage Allograft

- 5.1.2 Tendon Allograft

- 5.1.3 Meniscus Allograft

- 5.1.4 Ligament Allograft

- 5.1.5 Dental/Periodontal Allograft

- 5.1.6 Other Graft Types

- 5.2 By Processing & Preservation Method

- 5.2.1 Fresh-Frozen

- 5.2.2 Cryopreserved

- 5.2.3 Lyophilized

- 5.2.4 Gamma-Irradiated Sterilized

- 5.2.5 Decellularized & Acellular

- 5.2.6 Demineralized Bone Matrix (DBM)

- 5.3 By Application

- 5.3.1 Orthopedic Reconstruction

- 5.3.2 Sports Medicine

- 5.3.3 Dentistry & Periodontics

- 5.3.4 Wound & Burn Management

- 5.3.5 Cosmetic & Plastic Surgery

- 5.3.6 Other Applications

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgical Centers

- 5.4.3 Orthopedic Specialty Clinics

- 5.4.4 Other End Users

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 AbbVie (Allergan Aesthetics)

- 6.3.2 CONMED Corporation

- 6.3.3 Xtant Medical Holdings

- 6.3.4 Bone Bank Allografts

- 6.3.5 Smith & Nephew (Osiris Therapeutics Inc.)

- 6.3.6 BD (Becton Dickinson and Company)

- 6.3.7 Integra LifeSciences Corporation

- 6.3.8 Stryker Corporation

- 6.3.9 Zimmer Biomet

- 6.3.10 Arthrex

- 6.3.11 Medtronic

- 6.3.12 Johnson & Johnson (DePuy Synthes)

- 6.3.13 LifeNet Health

- 6.3.14 Organogenesis Holdings

- 6.3.15 AlloSource

- 6.3.16 CryoLife (Artivion)

- 6.3.17 Tissue Regenix Group

- 6.3.18 MiMedx Group

- 6.3.19 Axogen Inc.

- 6.3.20 MTF Biologics

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment