PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848105

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848105

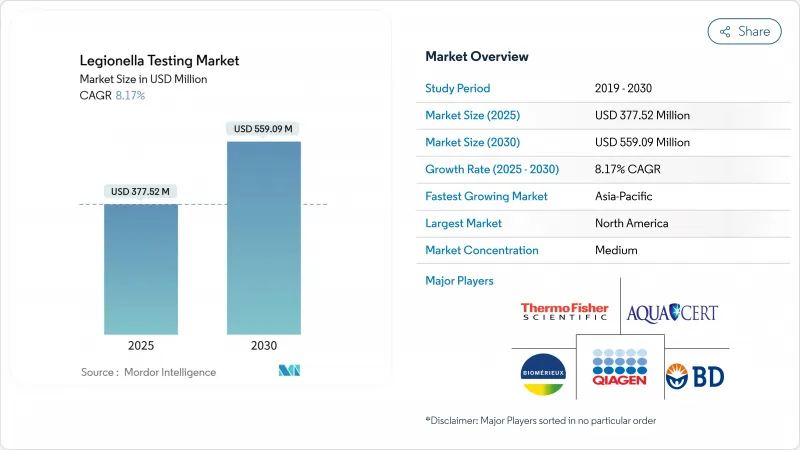

Legionella Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The legionella testing market size was valued at USD 377.52 million in 2025 and is forecast to reach USD 559.09 million by 2030, advancing at an 8.17% CAGR.

Stricter building-water regulations, heightened post-pandemic vigilance, and rapid advances in molecular diagnostics are sustaining double-digit demand growth. Mandatory CMS rules that link Medicare funding to implementation of ASHRAE-compliant water management programs keep hospitals and long-term-care facilities on a continuous testing cycle. Rising legal liability and insurance stipulations have extended this compliance mindset to hotels, commercial real estate, and manufacturing plants. Technology migration toward PCR platforms has shortened result turnaround from 7-14 days to under 48 hours, enabling early intervention protocols that limit outbreak scale.

Global Legionella Testing Market Trends and Insights

Rising Incidence of Pneumonia and Legionella-Linked Illness

Reported U.S. Legionnaires' disease cases tripled from 2000-2011 and have continued climbing through 2024, a pattern mirrored in several OECD countries. Melbourne's 2024 outbreak produced 77 cases, 75 hospitalizations, and 2 deaths, underscoring how rapidly contaminated aerosols can infect dense urban populations. With mortality in severe cases ranging from 20-40%, health systems recognize that routine surveillance lowers overall treatment costs. Employers also see productivity savings when preventive testing keeps staff from illness. Consequently, sustained epidemiological pressure is translating into baseline demand for both clinical and environmental testing.

Increasing Demand for Rapid and Advanced Diagnostics

Clinicians seek actionable results within 24 hours; culture's 7-14-day lag is now viewed as clinically unacceptable for severe pneumonia management. PCR platforms provide same-day answers with 99.95% negative predictive value at clinically relevant thresholds. Post-COVID facility re-openings exposed stagnant pipes that intensified bacterial growth, accelerating adoption of rapid molecular panels. Environmental managers likewise favor quick tests so they can adjust disinfection protocols before bacteria levels cross regulatory limits. The push for turnaround times under 48 hours therefore remains a defining feature of the Legionella testing market.

Sub-Optimal Sensitivity and Specificity of Legacy Tests

Culture yields 70-90% sensitivity depending on sample type and requires repeat sampling when non-Legionella flora overgrow plates. Urinary antigen assays detect only L. pneumophila serogroup 1, missing the 8-30% of cases caused by other serogroups. Each missed detection invites continued exposure and potential litigation, yet budget-limited facilities still opt for these older methods. Widespread reliance on legacy tests therefore slows universal migration to faster, broader-spectrum diagnostics.

Other drivers and restraints analyzed in the detailed report include:

- Technological Innovations in Molecular and IMS Methods

- Stricter Building-Water Regulations and ASHRAE-188 Adoption

- High Cost of PCR/qPCR and ddPCR Panels

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

PCR/qPCR/ddPCR platforms captured 42.76% Legionella testing market share in 2024 because hospitals value 24-hour turnaround when treating severe pneumonia. Within the USD 377.52 million Legionella testing market size logged in 2025, PCR assays generated the largest revenue slice by combining high sensitivity with broad serotype coverage. Laboratories also rely on molecular methods to validate water treatment efficacy faster than culture. Culture remains essential for viability confirmation and antimicrobial susceptibility, but its use is shifting toward confirmatory rather than frontline testing. Direct fluorescent antibody staining fills immediate visualization niches yet accounts for a modest revenue contribution. Urinary antigen tests lead growth at a 10.56% CAGR by offering 15-minute point-of-care results that support emergency-department triage decisions. Technology refinements have pushed UAT sensitivity past 95%, and multiplex versions now detect several Legionella species in a single cartridge. As reagent costs fall, UAT kits are penetrating occupational health programs and cruise-ship medical units. Market participants therefore maintain balanced portfolios that cover both rapid molecular and decentralized antigen formats to maximize reach across diverse end-user budgets.

Second-generation ddPCR instruments are expected to erode culture share further by identifying sub-detectable colony counts in large plumbing systems. Field technicians equipped with portable LAMP-lateral-flow kits can now screen spa water during routine maintenance visits, creating new revenue lines for HVAC and water-treatment contractors. Although reagent pricing remains higher than agar media, volume purchasing and reagent rental contracts are narrowing the gap, especially for regional reference labs processing thousands of samples weekly. Over the forecast period, technology convergence will likely see labs combine ddPCR quantification with culture confirmation in a single workflow, cementing molecular dominance across the Legionella testing market.

The Legionella Testing Market Report is Segmented by Test Type (Culture Method, Urinary Antigen Test (UAT), Direct Fluorescent Antibody (DFA), Polymerase Chain Reaction (PCR/QPCR/DdPCR), and More), End-User (Hospitals & Clinics, Diagnostic Laboratories, and Other End Users), Geography (North America, Europe, Asia-Pacific, The Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 43.43% of global revenue in 2024, underpinned by a robust regulatory network that spans CMS rules for healthcare, OSHA guidelines for workplaces, and insurer-driven audits for commercial property owners. Large diagnostic firms headquartered in the United States supply most PCR reagents, while hundreds of accredited laboratories offer same-day test logistics. Canada's public-health agencies have mirrored U.S. standards, and Mexico's private hospital expansions are aligning procurement policies accordingly. High litigation exposure also keeps routine testing budgets intact, even during broader healthcare cost pressures.

Asia-Pacific is the fastest-growing region at a 9.34% CAGR, propelled by urbanization and infrastructure investment. Japan's Expo 2025 detected Legionella counts 50-times above safety limits, prompting nationwide awareness campaigns and stricter municipal codes. China's hospital-building boom and India's PPP hospital projects necessitate comprehensive water-safety plans that incorporate quarterly testing. Hong Kong's cooling-tower surveillance, which analyzed 115 samples in July 2024 alone, showcases government-led vigilance. Australia's state health departments continue to enforce monthly cooling-tower checks, setting a compliance example for Southeast Asian neighbors.

Europe presents a fragmented picture shaped by differing national laws and energy-conservation goals. Germany's high legionellosis incidence has moved laboratories toward the IDEXX Legiolert method, regarded as more sensitive than ISO plates. France continues to subsidize UAT kits for nursing homes, whereas the United Kingdom mandates quarterly risk assessments under HSE guidance. Green-building initiatives sometimes reduce hot-water storage temperatures, requiring sophisticated control strategies that maintain energy efficiency without fostering bacterial growth. Testing providers capable of navigating multiple regulatory frameworks enjoy a competitive edge across the European Union.

- Albagaia Ltd

- Aquacert

- Becton Dickinson & Co

- bioMerieux

- Merck

- Evoqua Water Tech

- Danaher (Pall Corp)

- Phigenics

- QIAGEN

- Thermo Fisher Scientific

- IDEXX

- EMSL Analytical

- Pathcon Labs

- AquaPhoenix Sci

- IDEXX Water

- PathogenDx

- Idex Legiolert OEMs

- Hydrosense Ltd

- SGS

- Eurofins

- Intertek Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Incidence of Pneumonia & Legionella-Linked Illness

- 4.2.2 Increasing Demand for Rapid & Advanced Diagnostics

- 4.2.3 Technological Innovations in Molecular & IMS Methods

- 4.2.4 Stricter Building-Water Regulations & ASHRAE-188 Adoption

- 4.2.5 Post-COVID Re-Occupancy of Buildings Elevating Risk

- 4.2.6 Insurance Carriers Mandating Legionella Risk Audits

- 4.3 Market Restraints

- 4.3.1 Sub-Optimal Sensitivity/Specificity of Legacy Tests

- 4.3.2 High Cost Of PCR/Qpcr & Ddpcr Panels

- 4.3.3 Fragmented Global Compliance Standards Increase Burden

- 4.3.4 Litigation Risk from PCR False Positives Hindering Uptake

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD million)

- 5.1 By Test Type

- 5.1.1 Culture Method

- 5.1.2 Urinary Antigen Test (UAT)

- 5.1.3 Direct Fluorescent Antibody (DFA)

- 5.1.4 Polymerase Chain Reaction (PCR/qPCR/ddPCR)

- 5.1.5 Other Test Types

- 5.2 By End User

- 5.2.1 Hospitals & Clinics

- 5.2.2 Diagnostic Laboratories

- 5.2.3 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East & Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East & Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Albagaia Ltd

- 6.3.2 Aquacert Ltd

- 6.3.3 Becton Dickinson & Co

- 6.3.4 bioMrieux SA

- 6.3.5 Merck KGaA

- 6.3.6 Evoqua Water Tech

- 6.3.7 Danaher (Pall Corp)

- 6.3.8 Phigenics LLC

- 6.3.9 Qiagen NV

- 6.3.10 Thermo Fisher Scientific

- 6.3.11 IDEXX Laboratories

- 6.3.12 EMSL Analytical

- 6.3.13 Pathcon Labs

- 6.3.14 AquaPhoenix Sci

- 6.3.15 IDEXX Water

- 6.3.16 PathogenDx

- 6.3.17 Idex Legiolert OEMs

- 6.3.18 Hydrosense Ltd

- 6.3.19 SGS SA

- 6.3.20 Eurofins Scientific

- 6.3.21 Intertek Group

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment