PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848108

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848108

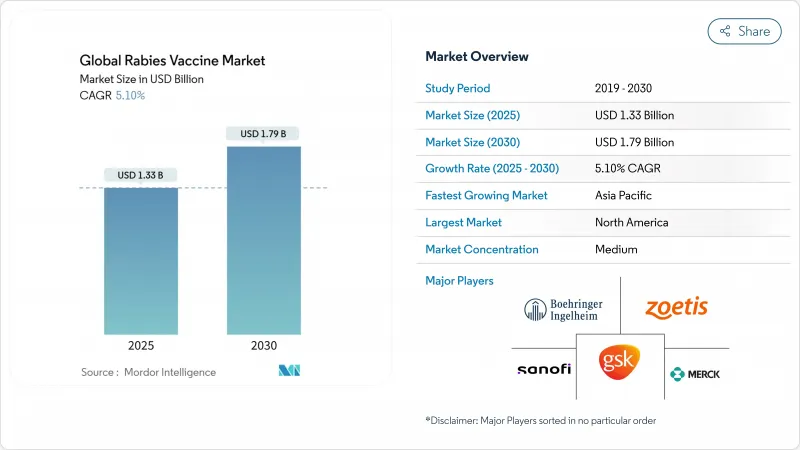

Rabies Vaccine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The rabies vaccine market size is valued at USD1.33 billion in 2025 and is forecast to reach USD1.79 billion by 2030, registering a 5.1% CAGR.

Growth rests on multilateral funding unlocked by the WHO-led "Zero by 30" campaign and on technology shifts from nerve-tissue to advanced cell-culture and mRNA platforms, which together lift production efficiency and improve safety profiles. Gavi's 2024 decision to finance human post-exposure prophylaxis (PEP) across more than 50 eligible countries sharply widens demand by lowering affordability barriers in the highest-burden regions[1]. Meanwhile, rising stray-dog density in Asia and Africa sustains reactive vaccination needs, even as companion-animal ownership in North America and Europe drives preventive uptake. Supply shortages persist because of limited fill-finish capacity and fragile cold-chain networks, creating space for cost-efficient Asian entrants. Sanofi's late-stage mRNA candidate SP0087, slated for US and EU filings in 2H 2025, could accelerate the premium segment and stimulate competitive responses.

Global Rabies Vaccine Market Trends and Insights

Global "Zero by 30" Rabies Elimination Initiative Boosting Multilateral Funding

The WHO-led goal of ending dog-mediated human rabies deaths by 2030 has unlocked unprecedented multilateral funding streams that guarantee long-term vaccine demand. Gavi now finances post-exposure prophylaxis in more than 50 eligible countries, removing the biggest affordability hurdle in low-income settings. Bulk tenders created under this framework give manufacturers better visibility into future volumes, encouraging capacity expansions. Integrated Bite Case Management tools rolled out with the program improve surveillance, which sharpens demand forecasts and cuts wastage. Together, these elements convert previously unpredictable humanitarian purchases into a stable commercial pipeline.

Shift from Nerve-Tissue to Advanced Cell-Culture & mRNA Platforms Enhancing Safety and Uptake

Manufacturers are phasing out nerve-tissue vaccines in favor of Vero, BHK, and mRNA technologies that deliver higher efficacy and better safety records. mRNA candidates show full protection in animal models with just two doses, which improves patient compliance and lowers program costs. Serum-free production under review in China eliminates animal serum risks and supports premium pricing in quality-sensitive markets. Higher yields from suspension cultures reduce per-dose cost, making advanced platforms attractive even for public tenders. These shifts collectively expand supply, enhance trust, and open doors to dose-sparing schedules.

Limited Cold-Chain & Healthcare Infrastructure Restricting Rural Distribution in Endemic Regions

The absence of reliable electricity means that up to 30% of vaccines spoil before reaching remote clinics in several African and South Asian countries, wiping out scarce public-health budgets. WHO's Vaccine Innovation Prioritisation Strategy now places thermostable rabies formulations in its top tier of needed technologies, signalling future tender preference for products that tolerate 40 °C excursions for at least three days. Pilot field studies with deep-cold borosilicate vials introduced in 2024 cut breakage rates by 70% during last-mile transport on motorcycles over unpaved roads. Even where storage exists, clinics often lack calibrated temperature monitoring, leading to batch-by-batch quality uncertainty that erodes clinician confidence and depresses demand. Thermostable human rabies immune globulin (HRIG) now in late-stage development could further ease logistics by eliminating strict 2-8 °C handling requirements, but commercial launch is not expected before 2027.

Other drivers and restraints analyzed in the detailed report include:

- Expanded Government Procurement & Donor Support Mechanisms Improving Vaccine Accessibility

- Robust R&D Pipeline in Novel Modalities (mRNA, Monoclonal Antibodies) Broadening Addressable Market

- High Total Cost of Full PEP Regimen Creating Affordability Barriers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Vero Cell segment holds 55.0% of the rabies vaccine market share in 2024. Robust antigen recovery and 99.99% host-DNA removal deliver reliable safety benchmarks, while serum-free suspension culture pushes yields to 5.2 X 10^7 FFU/mL. As emerging mRNA and BHK products grow at 10% CAGR, manufacturers hedge portfolios to retain relevance. Continuous process intensification positions Vero Cell plants to defend volumes even as niche premium segments accelerate.

Other product types form the quickest-growing cluster. mRNA candidates promise two-dose schedules, smaller batch sizes, and rapid scalability during shortages, aligning with future tender criteria. AIM Vaccine filed the first serum-free human rabies vaccine with regulators in 2025, signalling wider competition in upper-middle-income markets. These innovations are likely to lift the rabies vaccine market size for non-Vero formats above USD400 million by 2030.

PEP accounts for 78.0% of the rabies vaccine market in 2024. WHO's 1-week intradermal protocol lifts compliance: 87% of recipients maintain protective antibody titres after 1 year. Monoclonal antibody combinations now entering practice cut adverse reactions and standardize potency, strengthening PEP's clinical edge.

PrEP grows at 6.8% CAGR as travel rebounds and occupational guidelines shift. CDC now endorses a 2-dose PrEP series, lowering cost and clinic visits. With longer booster intervals, the rabies vaccine industry sees new opportunities in employer-funded schemes for veterinarians, laboratory staff, and adventure tourists.

The Rabies Vaccine Market Report is Segmented by Product Type (Baby Hamster Kidney (BHK) Vaccine, and More), Vaccination Type (Pre-Exposure Vaccination (PrEP/PEV) and Post-Exposure Prophylaxis (PEP)), End-User (Humans and Animals), Distribution Channel (Public Health Procurement & Mass Immunization Programs, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retains 41% share of the rabies vaccine market in 2024, propelled by airtight regulatory oversight and widespread insurance coverage. Canada's Immunization Guide mandates risk-based regimens for veterinarians and laboratory workers, promoting steady baseline uptake. Community programs such as Brownsville's free 2025 clinic reinforce equitable access.

Asia Pacific records the fastest regional CAGR at 6.5%. India and China now deliver more than 1 billion vaccine doses annually and self-supply over 85% of regional demand. China's rabies vaccine market size is forecast to surpass RMB14.8 billion (USD 2.06 billion) by 2030 on the back of rising urban pet ownership and local innovation pipelines. Serum-free and combination formulations are expected to be early adopters in this environment.

Europe, Middle East & Africa, and South America form a diversified opportunity set. In Europe, Bavarian Nordic's Rabipur/RabAvert exceeded sales expectations in 2024, highlighting resilient premium demand. African Union initiatives such as PAVM aim to grow local manufacturing through finance and technology transfer, signalling long-run supply-side changes. South America showcases sustained progress: dog-transmitted human cases dropped 98% since 1983, yet governments still prioritize canine campaigns to maintain >=80% coverage.

- Sanofi

- GlaxoSmithKline

- Merck

- Zoetis

- Boehringer Ingelheim

- Pfizer

- Elanco

- Virbac

- Bharat Biotech

- AIM Vaccine Co., Ltd.

- Chengdu Institute of Biological Products

- Indian Immunologicals

- Kamada Ltd.

- Kedrion Biopharma

- CSL Behring

- Grifols

- Liaoning Cheng Da Co., Ltd.

- Shuanglin Bio-Pharmaceutical Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Global 'Zero by 30' Rabies Elimination Initiative Boosting Multilateral Funding

- 4.2.2 Shift from Nerve-Tissue to Advanced Cell-Culture & mRNA Platforms Enhancing Safety and Uptake

- 4.2.3 Escalating Animal-Bite Incidence & Stray-Dog Density in Emerging Economies Sustaining Demand

- 4.2.4 Rising Companion-Animal Ownership and Preventive Vet-Care Expenditure Worldwide

- 4.2.5 Expanded Government Procurement & Donor Support Mechanisms Improving Vaccine Accessibility

- 4.2.6 Robust R&D Pipeline in Novel Modalities (mRNA, Monoclonal Antibodies) Broadening Addressable Market

- 4.3 Market Restraints

- 4.3.1 Limited Cold-Chain & Healthcare Infrastructure Restricting Rural Distribution in Endemic Regions

- 4.3.2 High Total Cost of Full PEP Regimen Creating Affordability Barriers

- 4.3.3 Intermittent Supply Shortages & Manufacturing Capacity Constraints Impacting Global Availability

- 4.3.4 Complex, Price-Sensitive Tender and Regulatory Processes Delaying New Vaccine Market Entry

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Baby Hamster Kidney (BHK) Vaccine

- 5.1.2 Purified Chick Embryo Cell Rabies Vaccine

- 5.1.3 Vero Cell Rabies Vaccine

- 5.1.4 Other Product Types

- 5.2 By Vaccination Type

- 5.2.1 Pre-Exposure Vaccination (PrEP/PEV)

- 5.2.2 Post-Exposure Prophylaxis (PEP)

- 5.3 By End-User

- 5.3.1 Humans

- 5.3.2 Animals

- 5.4 By Distribution Channel

- 5.4.1 Public Health Procurement & Mass Immunization Programs

- 5.4.2 Hospitals & Travel Clinics

- 5.4.3 Veterinary Clinics

- 5.4.4 Retail & Online Pharmacies

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 Sanofi SA

- 6.4.2 GlaxoSmithKline plc

- 6.4.3 Merck & Co., Inc.

- 6.4.4 Zoetis Inc.

- 6.4.5 Boehringer Ingelheim International GmbH

- 6.4.6 Pfizer Inc.

- 6.4.7 Elanco Animal Health

- 6.4.8 Virbac SA

- 6.4.9 Bharat Biotech

- 6.4.10 AIM Vaccine Co., Ltd.

- 6.4.11 Chengdu Institute of Biological Products

- 6.4.12 Indian Immunologicals Ltd.

- 6.4.13 Kamada Ltd.

- 6.4.14 Kedrion Biopharma Inc.

- 6.4.15 CSL Behring

- 6.4.16 Grifols SA

- 6.4.17 Liaoning Cheng Da Co., Ltd.

- 6.4.18 Shuanglin Bio-Pharmaceutical Co., Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment