PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848110

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848110

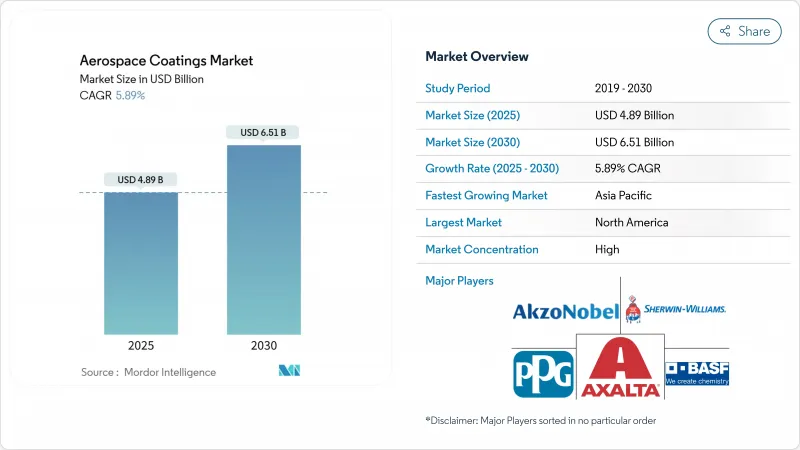

Aerospace Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Aerospace Coatings Market size is estimated at USD 4.89 billion in 2025, and is expected to reach USD 6.51 billion by 2030, at a CAGR of 5.89% during the forecast period (2025-2030).

Commercial aircraft build rates remain the primary growth engine, underpinned by sustained passenger traffic recovery, while composite-intensive airframe designs require new coating chemistries that command premium pricing. Regulatory pressure on volatile organic compounds (VOC) and hexavalent chromium accelerates the shift toward water-borne and chrome-free systems, prompting suppliers to recalibrate R&D portfolios. OEM demand from Airbus, Boeing, and tier-1 integrators anchors baseline volume, yet maintenance, repair, and overhaul (MRO) activity for aging fleets is expanding faster, reshaping product-mix and service requirements. Regionally, North America still generates the largest revenue pool, but Asia-Pacific shows the quickest expansion as supply chains diversify into India, China and Southeast Asia to mitigate geopolitical risk. Overall, the aerospace coatings market exhibits moderate concentration as a handful of qualified suppliers leverage decades of certification know-how to defend share and set the pace of technology adoption.

Global Aerospace Coatings Market Trends and Insights

Rising Production Rates of Commercial Aircraft

Boeing is building 737-series jets at 38 aircraft per month and is seeking Federal Aviation Administration clearance to lift output to 42 units, while Airbus aims to hand over 770 jetliners in 2025 after supply-chain headwinds clipped earlier plans for 800. Each narrow-body requires roughly 150-200 gallons of primer, topcoat, and specialty finishes, so even single-digit rate hikes exert a multiplier effect on coating volume. Builder focus has shifted from cost to delivery reliability, giving qualified coating vendors greater contractual leverage. Fleet modernisation programs centred on fuel-efficient models sustain this momentum, though shortages in engines and cabin interiors can still disrupt paint-shop slots and force suppliers to hold more safety stock.

Increasing Use of Composites in Aircraft Manufacturing

The share of carbon-fibre-reinforced polymer in new aircraft designs has risen annually since 2010. Composites possess a different coefficient of thermal expansion than aluminium, so coatings need higher elasticity and tougher adhesion promoters. Automated lay-up techniques also expose parts to high-temperature cures, compelling vendors to reformulate resins for thermal stability. PPG's chromate-free Aerocron electrocoat primer and AkzoNobel's waterborne epoxy for composites illustrate how sustainability and substrate compatibility are converging in next-generation products.

Concerns of VOC Emissions

The United States Environmental Protection Agency's 2025 aerosol-coating rule tightens reactivity limits, while California's SCAQMD leads the charge with even stricter thresholds. Europe is already phasing out hexavalent chromium under REACH. Compliance forces formulators toward waterborne or high-solids systems, raising application complexity and sometimes sacrificing durability. Suppliers that master low-emission chemistry without performance trade-offs gain a first-mover edge.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Demand for Air Travel

- Accelerating MRO Demand for Aging Fleets

- Lengthy Certification Cycles for New Chemistries

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Epoxy systems held 58.19% share of the aerospace coatings market in 2024 and are forecast to grow at 6.11% CAGR, maintaining primacy because they bond well to both metal and composite substrates. This share translates into the largest aerospace coatings market size contribution, underpinning revenue visibility for formulators. Polyurethanes follow as the topcoat of choice due to superior UV resistance, whereas acrylics find niche use where rapid cure is mandatory.

Certification inertia anchors epoxy's leadership, yet suppliers are investing in chrome-free versions to skirt regulatory bans. Fluoropolymer and silicone blends are carving out high-temperature niches on engine cowlings and exhaust systems. As epoxy maintains volume leadership, specialised resins are expected to secure incremental margin.

Solvent-borne coatings accounted for 54.18% of the aerospace coatings market size in 2024, but their share is slowly slipping as water-borne products expand at 6.09% CAGR. Airlines and MRO shops value the faster dry-to-fly windows solvents provide, keeping them relevant for critical path tasks. Powder and electrocoat technologies, though still small, are winning spots on landing-gear and internal cavities for waste-reduction benefits.

The pivot toward water is driven by pollution levies and health-and-safety mandates. AkzoNobel's latest primer shows that water-borne systems can now meet adhesion and flexibility targets once thought unattainable in humid cure environments. Nevertheless, adoption lags in extreme-climate applications such as desert-based carriers where flash rusting risk remains high.

The Aerospace Coatings Market Report Segments the Industry by Resin Type (Epoxy, Polyurethane, and More), Technology (Solvent-Borne, Water-Borne, and Other Technologies), End User (Original Equipment Manufacturer (OEM), and Maintenance Repair and Operations (MRO)), Aviation Type (Commercial Aviation, Military Aviation, and General Aviation), and Geography (Asia-Pacific, North America, Europe, and More).

Geography Analysis

North America generated 38.92% of global revenue in 2024 on the back of Boeing's ramp-up in Washington and South Carolina, plus Canada's regional aircraft and engine clusters. The region's mature regulatory ecosystem streamlines qualification, giving incumbents an edge. A looming labour shortage, however, could cap output growth and push more finishing work to Mexico, where several OEMs have opened sub-assembly lines. Environmental regulation is also stiffer, accelerating the migration to water-borne topcoats and electrocoat primers across the aerospace coatings market.

Asia-Pacific is the fastest-growing arena, set for a 6.52% CAGR through 2030. India's production offset policies and China's push for domestic large jets relocate paint demand closer to final assembly. Suppliers are erecting regional blending plants to reduce tariffs and improve just-in-time delivery. Southeast Asia's burgeoning MRO hubs in Singapore, Malaysia and the Philippines further widen aftermarket pull. Yet certification capacity and trained applicators remain in short supply, making technology transfer partnerships critical.

Europe retains a stronghold via Airbus facilities in France, Germany and Spain, coupled with tier-1 composite specialists in the United Kingdom and Italy. Stringent REACH rules force early adoption of chrome-free primers, positioning European plants as test beds for sustainability advances that later globalise. Brexit adds customs paperwork but has not materially shifted coating flow thanks to bilateral aviation safety agreements. Eastern European nations are drawing component work through lower labour costs, compelling suppliers to broaden distribution to cover new satellite plants.

- Advanced Deposition & Coating Technologies, Inc.

- Akzo Nobel N.V.

- Axalta Coating Systems, LLC

- BASF SE

- BryCoat Inc.

- Henkel AG & Co. KGaA

- Hentzen Coatings, Inc.

- Ionbond

- Mankiewicz Gebr. & Co.

- PPG Industries, Inc.

- Socomore

- The Sherwin-Williams Company

- Zircotec

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Production Rates of Commercial Aircraft

- 4.2.2 Increasing Use of Composites in Aircraft Manufacturing

- 4.2.3 Increasing Demand for Air Travel

- 4.2.4 Accelerating Mainenance, Reapir and Overhaul Demand for Aging Fleets

- 4.2.5 Increase in Manufacturing of Aircrafts in Emerging Economies

- 4.3 Market Restraints

- 4.3.1 Concerns of VOC emissions

- 4.3.2 Lengthy Certification Cycles for New Chemistries

- 4.3.3 Early Substitution Risk from Next-gen Fluoropolymer Films

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin Type

- 5.1.1 Epoxy

- 5.1.2 Polyurethane

- 5.1.3 Acrylic

- 5.1.4 Other Resin Types (Silicone, Fluoropolymer, etc.)

- 5.2 By Technology

- 5.2.1 Solvent-borne

- 5.2.2 Water-borne

- 5.2.3 Other Technologies (Powder,etc.)

- 5.3 By End User

- 5.3.1 Original Equipment Manufacturer (OEM)

- 5.3.2 Maintenance, Repair and Operations (MRO)

- 5.4 By Aviation Type

- 5.4.1 Commercial Aviation

- 5.4.2 Military Aviation

- 5.4.3 General Aviation

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 France

- 5.5.3.3 United Kingdom

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Advanced Deposition & Coating Technologies, Inc.

- 6.4.2 Akzo Nobel N.V.

- 6.4.3 Axalta Coating Systems, LLC

- 6.4.4 BASF SE

- 6.4.5 BryCoat Inc.

- 6.4.6 Henkel AG & Co. KGaA

- 6.4.7 Hentzen Coatings, Inc.

- 6.4.8 Ionbond

- 6.4.9 Mankiewicz Gebr. & Co.

- 6.4.10 PPG Industries, Inc.

- 6.4.11 Socomore

- 6.4.12 The Sherwin-Williams Company

- 6.4.13 Zircotec

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment