PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848116

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848116

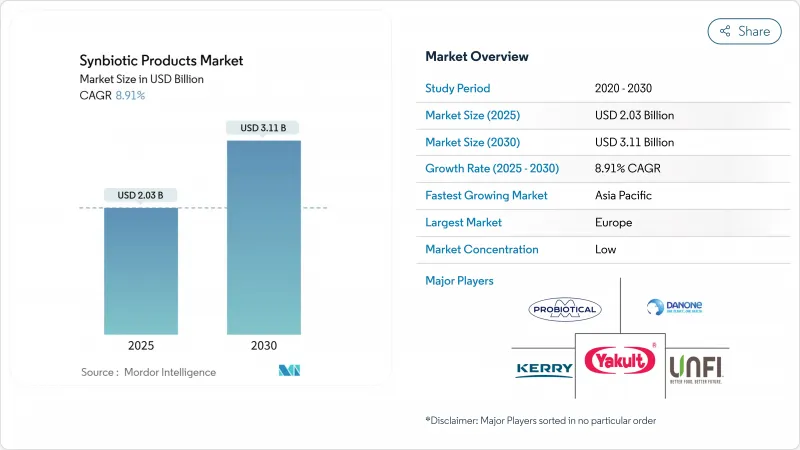

Synbiotic Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The synbiotic products market size is estimated to be USD 2.03 billion in 2025 and is projected to expand to USD 3.11 billion by 2030, representing a CAGR of 8.91%.

This growth trajectory reflects the convergence of consumer health awareness, regulatory clarity, and technological innovations that are reshaping how probiotics and prebiotics are combined for enhanced therapeutic efficacy. Synbiotics products, a combination of prebiotics and probiotics, are a part of functional foods and beverages and are known for improving gut functionality, along with other benefits, including improving mental, digestive, and immune functions and heart health. Furthermore, increased fortification with synbiotics to offer nutritional and health benefits by the leading players in the market has boosted the market's growth. In addition, apart from the food and beverage sector, the growing demand for synbiotic products from the dietary supplements and animal feed sectors is further driving the global market with growth. However, the market is facing challenges such as high manufacturing costs of synbiotic products that are restraining its market space.

Global Synbiotic Products Market Trends and Insights

Rising Health Awareness Among Consumers Boosts Product Consumption Rate

Growing health awareness has expanded from basic nutrition to include gut microbiome health, driving sustained demand for synbiotic products across consumer segments. This shift in consumer understanding influences purchasing patterns, as individuals increasingly opt for products offering multiple health benefits despite higher prices. The market expansion includes younger consumers incorporating synbiotics into their preventive health routines, reflecting a broader demographic adoption of these products. Consumer preferences for personalized nutrition have prompted companies to develop condition-specific formulations, with market research data indicating strong growth potential in targeted synbiotic solutions. The trend demonstrates a fundamental change in how consumers approach their digestive and overall health, leading to increased investment in research and development of advanced synbiotic products.

Supportive Regulatory Frameworks Encourage Synbiotic Market Expansion

Regulatory harmonization efforts are reducing market entry barriers and enabling global product standardization, particularly following EFSA's updated guidelines on microorganism safety assessments. The European Union's Qualified Presumption of Safety list expanded in 2023 to include additional microbial strains, streamlining approval processes for synbiotic products containing these organisms. The FDA's evolving stance on live biotherapeutic products provides clearer pathways for companies developing next-generation probiotics with enhanced therapeutic claims. International Scientific Association for Probiotics and Prebiotics initiatives are fostering global regulatory convergence, reducing compliance costs for multinational companies. These frameworks particularly benefit smaller companies that previously faced prohibitive regulatory expenses. The trend toward science-based regulations rewards companies investing in clinical research, creating competitive advantages for evidence-backed products over generic formulations.

High Production Costs Limit Accessibility In Price-Sensitive Markets

The manufacturing of synbiotics requires specialized fermentation facilities, cold chain infrastructure, and quality control systems, creating significant barriers to market entry. The fermentation facilities must maintain precise temperature controls, pH levels, and sterile conditions throughout the production process. Production costs increase substantially for multi-strain formulations and encapsulated products due to additional processing steps and manufacturing complexity. The complexity stems from maintaining strain viability, preventing cross-contamination, and ensuring consistent product quality. Small companies face higher costs due to limited economies of scale, which creates competitive disadvantages against established manufacturers with integrated production capabilities. In emerging markets, price sensitivity restricts adoption as premium pricing makes products unaffordable for middle-income consumers. The high prices reflect the substantial investments in research, development, and manufacturing infrastructure. While companies develop simplified formulations and alternative production methods to reduce costs, they must maintain product efficacy standards. These standards include ensuring proper strain selection, optimal dosage levels, and stability throughout the product's shelf life.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Prevalence of Digestive Disorders Drives Market Growth Globally

- Surging Popularity of Clean Label Products Enhances Market Demand

- Lack of Consumer Awareness Restricts Market Growth Globally

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Dietary supplements captured 55.24% market share in 2024 while simultaneously driving the fastest growth at 9.45% CAGR through 2030, reflecting regulatory advantages that enable more flexible formulation and health claim positioning compared to food applications. The supplement format allows for higher probiotic concentrations and specialized delivery systems that are difficult to achieve in food matrices without compromising taste or texture. Gummies are emerging as a high-growth subsegment, particularly for pediatric and geriatric populations who prefer chewable formats over traditional pills. As the consumption of supplements is increasing, the demand for synbiotic supplements is also increasing. According to the Statistisches Bundesamt data from 2024, the production volume of food supplements in Germany was 237.02 thousand tons in 2024.

Food and beverage applications face regulatory constraints that limit health claims and require extensive safety testing for novel ingredients, creating slower approval timelines despite strong consumer interest in functional foods. Dairy products remain the primary food vehicle for synbiotics, though plant-based alternatives are gaining traction as companies develop formulations compatible with non-dairy matrices. The segment benefits from less stringent regulatory requirements compared to human applications, enabling faster product development cycles and market entry.

Digestive health maintains dominance with 45.33% market share in 2024, reflecting the foundational role of gut health in synbiotic applications and established consumer understanding of probiotic benefits for gastrointestinal wellness. However, immunity enhancement emerges as the fastest-growing application at 10.44% CAGR, driven by post-pandemic health priorities and scientific evidence linking gut microbiome diversity to immune system function.

Mental health applications represent an emerging opportunity, with research exploring the gut-brain axis and its implications for mood disorders and cognitive function. Women's health applications are gaining momentum, exemplified by Danone's 2024 launch of Almimama, a synbiotic supplement specifically formulated for breastfeeding mothers to reduce mastitis incidence. Metabolic health applications targeting obesity and diabetes are expanding as research demonstrates the role of gut microbiota in glucose metabolism and weight management.

The Synbiotic Products Market is Segmented by Product Type (Food and Beverage, Dietary Supplements, Animal Feed, and Others), Application (Digestive Health, Immunity Enhancement, and More), End User (Adults, Children, and Geriatric Population), Distribution Channel (Pharmacies/Health Stores, Supermarket/Hypermarkets, and More), and by Geography. Market Sizing is Presented in USD Value Terms for all the Abovementioned Segments.

Geography Analysis

Europe holds a dominant 32.05% market share in 2024, supported by established regulations and high consumer acceptance. Germany maintains its position as the leading European market, backed by its pharmaceutical heritage and consumers' focus on preventive healthcare. The region's aging demographic sustains demand for digestive health and immune support products. While Brexit has introduced regulatory challenges for UK companies, market growth persists as businesses adapt to new approval requirements and maintain European supply chain connections.

The Asia-Pacific region demonstrates the highest growth rate at 9.82% CAGR, driven by economic growth, regulatory improvements, and increasing health consciousness. Australia and South Korea are strengthening their domestic manufacturing base to serve growing local demand and reduce dependence on imports. North America represents an established market with comprehensive regulatory structures that support innovation while ensuring consumer safety. The United States leads in advanced probiotic research, with investments in synthetic biology and precision fermentation. The FDA's guidelines for live biotherapeutic products establish standards for pharmaceutical-grade formulations while maintaining safety protocols.

South America and Middle East, and Africa are witnessing significant growth in consumer awareness about gut health and the benefits of synbiotic supplements. Market participants are introducing new products through partnerships, expansions, and strategic collaborations to strengthen their market presence. Companies are investing in research and development to create innovative synbiotic formulations that cater to specific health needs. In October 2023, Clasado Biosciences and Probi AB collaborated to develop two synbiotic combinations targeting gastrointestinal and digestive health, demonstrating the industry's commitment to advancing digestive wellness solutions.

- Danone S.A.

- Yakult Honsha Co., Ltd.

- Probiotical S.p.A.

- Herbalife Nutrition Ltd.

- Sabinsa Corporation

- Seed Health Inc.

- United Natural Foods, Inc.

- Daflorn Ltd.

- Synbalance Srl

- Synbiotik Health LLC

- BioGaia AB

- Synbiotics Limited

- Nature M.D., LLC

- Clasado Biosciences

- Kerry Group plc

- Lifeway Foods, Inc.

- Bio-K Plus International Inc.

- Evonik Industries AG

- Novozymes A/S

- Chobani, LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Health Awareness Among Consumers Boosts Product Consumption Rate

- 4.2.2 Supportive Regulatory Frameworks Encourage Synbiotic Market Expansion

- 4.2.3 Increasing Prevalence Of Digestive Disorders Drives Market Growth Globally

- 4.2.4 Expanding Online Retail Channels Boost Product Accessibility And Sales

- 4.2.5 Surging Popularity Of Clean Label Products Enhances Market Demand

- 4.2.6 Advancements In Probiotic And Prebiotic Technologies Encourage Product Innovation

- 4.3 Market Restraints

- 4.3.1 High Production Costs Limit Accessibility In Price-Sensitive Markets

- 4.3.2 Stringent Regulations Affect Product Approval And Market Entry

- 4.3.3 Lack of Consumer Awareness Restricts Market Growth Globally.

- 4.3.4 Storage And Transportation Challenges Increase Operational Burden Significantly.

- 4.4 Regulatory Landscape

- 4.5 Technology Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Food and Beverage

- 5.1.1.1 Dairy

- 5.1.1.2 Beverages

- 5.1.1.3 Infant Foods

- 5.1.1.4 Others

- 5.1.2 Dietary Supplements

- 5.1.2.1 Capsules

- 5.1.2.2 Tablets

- 5.1.2.3 Powders

- 5.1.2.4 Gummies

- 5.1.2.5 Others

- 5.1.3 Animal Feed

- 5.1.4 Others

- 5.1.1 Food and Beverage

- 5.2 By Application

- 5.2.1 Digestive Health

- 5.2.2 Immunity Enhancement

- 5.2.3 Other Applications

- 5.3 By End-User

- 5.3.1 Adults

- 5.3.2 Children

- 5.3.3 Geriatric Population

- 5.4 By Distribution Channel

- 5.4.1 Pharmacies/Health Stores

- 5.4.2 Supermarkets/Hypermarkets

- 5.4.3 Online Retail Stores

- 5.4.4 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Danone S.A.

- 6.4.2 Yakult Honsha Co., Ltd.

- 6.4.3 Probiotical S.p.A.

- 6.4.4 Herbalife Nutrition Ltd.

- 6.4.5 Sabinsa Corporation

- 6.4.6 Seed Health Inc.

- 6.4.7 United Natural Foods, Inc.

- 6.4.8 Daflorn Ltd.

- 6.4.9 Synbalance Srl

- 6.4.10 Synbiotik Health LLC

- 6.4.11 BioGaia AB

- 6.4.12 Synbiotics Limited

- 6.4.13 Nature M.D., LLC

- 6.4.14 Clasado Biosciences

- 6.4.15 Kerry Group plc

- 6.4.16 Lifeway Foods, Inc.

- 6.4.17 Bio-K Plus International Inc.

- 6.4.18 Evonik Industries AG

- 6.4.19 Novozymes A/S

- 6.4.20 Chobani, LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK