PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848117

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848117

South America Fermented Ingredients - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

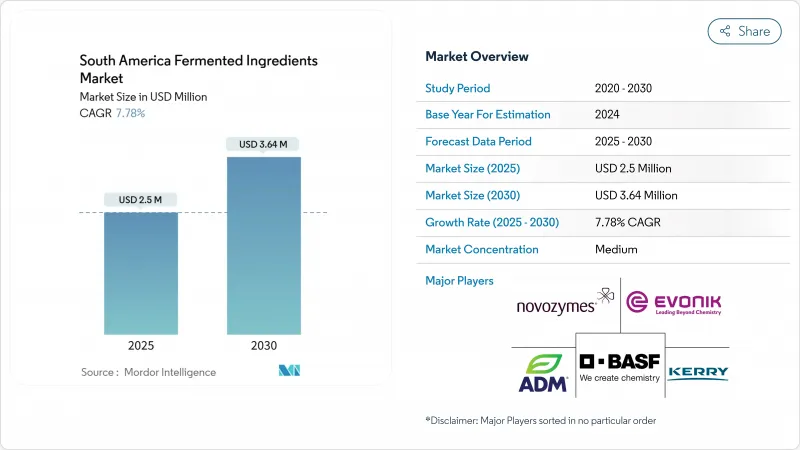

The South American fermented ingredients market size is estimated at USD 2.50 million in 2025 and is forecast to reach USD 3.64 million by 2030, advancing at a 7.78% CAGR.

Expansion rests on the region's plentiful crop feedstocks, improving bio-inputs legislation, and manufacturers' pivot toward bio-based solutions in food, feed, and industrial uses. Livestock growth in Brazil and Argentina sustains steady demand for amino-acid feed additives, while national bioeconomy programs funnel public funds into fermentation capacity. Multinational players add scale through green-field factories, yet local start-ups remain agile in specialty niches that leverage indigenous fermentation know-how. Supply-chain resilience is improving as ethanol and sugar co-products are valorized into substrates, but cost parity with petrochemical substitutes remains elusive in capital-intensive polymers and specialty proteins.

South America Fermented Ingredients Market Trends and Insights

Booming Animal-Protein Exports Fuelling Demand for Feed-Grade Amino Acids

South America's livestock sector expansion creates cascading demand for fermented feed additives, particularly as the region consolidates its position as the world's protein supplier. This protein boom drives amino acid demand beyond traditional lysine and methionine toward specialized fermentation-derived compounds like threonine and tryptophan, essential for optimizing feed conversion ratios in intensive production systems. Brazil's position as the world's largest beef exporter and second-largest poultry producer creates structural demand for fermentation-derived feed additives, particularly as environmental regulations push producers toward bio-based alternatives to synthetic growth promoters. The sector's projected growth to 43.7 billion liters of ethanol demand by 2033 also generates substantial co-product streams suitable for fermentation substrate applications, according to the International Energy Agency data. Argentina's recent reduction in export tariffs on soybean products enhances the region's competitiveness in global protein markets, further amplifying demand for feed-grade fermentation products as producers seek margin optimization through improved feed efficiency.

Rising Clean-Label Trend in Food and Beverages Driving Switch to Bio-Based Additives

Brazil's food-processing sector generated USD 209 billion in 2022, and updated supplement rules under Normative Instruction 284/2028 clarify the use of enzymes and probiotics in finished products, according to the ANVISA data. Brand owners respond by replacing synthetic preservatives with fermentation-derived lactic and citric acids that deliver recognizable labels and acidic impact. Consumer surveys in major Brazilian and Chilean cities show a willingness to pay premiums for naturally sourced texturizers, spurring uptake of fermented gums and cultures in snacks and dairy lines. Retailers amplify demand by expanding "free-from" aisles, nudging processors toward short-ingredient panels rooted in bio-derived components. Together, regulatory clarity and purchasing shifts translate into sustained, margin-accretive growth for clean-label solutions within the South American fermented ingredients market.

Price Competition from Synthetic Petrochemical-Based Ingredients

Global synthetic amino acids and organic acids benefit from decades-long optimization and large-scale Asian plants that deliver low cost per kilogram. Latin America currently lacks extensive food-grade fermentation infrastructure, forcing many users to import at higher landed costs. Until regional biofactories reach similar economies of scale, price-sensitive feed and industrial buyers will gravitate toward petrochemical alternatives, trimming addressable volumes for the South American fermented ingredients market. Currency volatility in Argentina and local financing costs compound the challenge by inflating capital expenditure for new fermentation lines. Producers mitigate risk through waste-to-substrate programs and regional purchasing agreements, yet cost parity remains a near-term hurdle.

Other drivers and restraints analyzed in the detailed report include:

- National Bio-Inputs Programs in Brazil and Argentina Subsidising Fermentation Capacity

- Cultural Affinity for Fermented Foods Supporting Traditional Fermentation Ingredients

- Limited Research and Development and Technical Expertise

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Amino acids accounted for 44.51% of the South American fermented ingredients market revenue in 2024. The segment's growth stems from feed optimization requirements in the region's livestock sector. Manufacturers utilize the region's corn and soybean resources to produce lysine, methionine, and threonine, which improve feed-conversion efficiency in poultry and swine production. Brazil's dual role as a protein exporter and ethanol producer provides co-products that reduce glucose production costs, enabling competitive amino acid pricing. The polymer segment is expected to grow at a 9.42% CAGR, driven by new plastic waste regulations that encourage biodegradable packaging adoption. Government purchasing policies in Chile and Colombia favor compostable materials, increasing market opportunities for fermentation-based polyhydroxyalkanoates.

Organic acids and vitamins maintain consistent demand in food and beverage production as natural preservatives and fortification ingredients. Industrial enzymes secure contracts with biofuel and brewing facilities that need specific catalytic properties. While antibiotics represent a smaller market share due to regional restrictions on medicated feed, they maintain steady sales in veterinary applications. Brazil's Center-West region continues to expand amino acid production, with integrated soy processing facilities utilizing fermentation by-products for energy generation. Polymer production attracts investment for pilot facilities that use sugarcane bagasse hydrolysate to reduce raw material costs. Organic acid manufacturers collaborate with fruit processors to utilize peel waste, supporting circular economy initiatives. The vitamin segment faces challenges from global price fluctuations but benefits from domestic blending operations that reduce import costs.

The South America Fermented Ingredient Market Report is Segmented by Type (Amino Acids, Organic Acids, Polymers, Vitamins, Industrial Enzymes, and Antibiotics), Form (Dry and Liquid), Application (Food and Beverages, Feed, Pharmaceutical, Industrial Application, and Other Application), and Geography (Brazil, Argentina, Chile, Colombia, and Rest of South America). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Evonik Industries AG

- Novozymes A/S

- BASF SE

- Kerry Group plc

- Dohler Group SE

- Lonza Group

- Manuchar Group

- Archer Daniels Midland Company

- Corbion N.V.

- International Flavors and Frangrance Inc

- DSM-Firmenich

- ABF Ingredients

- Ajinomoto Co., Inc.

- Cargill Incorporated

- Givaudan SA

- Tate & Lyle PLC

- Lallemand Inc.

- Lesaffre Group (Bio Springer)

- Ingredion Incorporated

- Tereos S.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Booming animal-protein exports fuelling demand for feed-grade amino acids

- 4.2.2 Rising clean-label trend in Food and Beverages driving switch to bio-based additives

- 4.2.3 National bio-inputs programs in Brazil and Argentina subsidising fermentation capacity

- 4.2.4 Cultural Affinity for Fermented Foods Supporting Traditional Fermentation Ingredients

- 4.2.5 Rising consumer awareness and demand for natural, healthy foods

- 4.2.6 Advancements in Biotechnology Supporting Scalable Fermentation Processes

- 4.3 Market Restraints

- 4.3.1 Price Competition from Synthetic Petrochemical-Based Ingredients

- 4.3.2 Limited Research and Developemnt and Technical Expertise

- 4.3.3 Economic and Geopolitical Uncertainties

- 4.3.4 Dependence on Imported Raw Materials for Fermentation Processes

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Amino Acids

- 5.1.1.1 Lysine

- 5.1.1.2 Methionine

- 5.1.1.3 Threonine

- 5.1.1.4 Other Amino Acid

- 5.1.2 Organic Acids

- 5.1.2.1 Lactic Acid

- 5.1.2.2 Citric Acid

- 5.1.2.3 Others

- 5.1.3 Polymers

- 5.1.4 Vitamins

- 5.1.5 Industrial Enzymes

- 5.1.5.1 Proteases

- 5.1.5.2 Amylases

- 5.1.5.3 Other Industrial Enzymes

- 5.1.6 Antibiotics

- 5.1.1 Amino Acids

- 5.2 By Form

- 5.2.1 Dry

- 5.2.2 Liquid

- 5.3 By Application

- 5.3.1 Food and Beverages

- 5.3.1.1 Dairy

- 5.3.1.2 Bakery and Confectionery

- 5.3.1.3 Beverages

- 5.3.1.4 Meat and Seafood Products

- 5.3.1.5 Functional and Fortified Foods

- 5.3.1.6 Other Food and Beverage Applications

- 5.3.2 Feed

- 5.3.3 Pharmaceutical

- 5.3.4 Industrial Application

- 5.3.5 Other Applications

- 5.3.1 Food and Beverages

- 5.4 By Geography

- 5.4.1 Brazil

- 5.4.2 Argentina

- 5.4.3 Chile

- 5.4.4 Colombia

- 5.4.5 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Evonik Industries AG

- 6.4.2 Novozymes A/S

- 6.4.3 BASF SE

- 6.4.4 Kerry Group plc

- 6.4.5 Dohler Group SE

- 6.4.6 Lonza Group

- 6.4.7 Manuchar Group

- 6.4.8 Archer Daniels Midland Company

- 6.4.9 Corbion N.V.

- 6.4.10 International Flavors and Frangrance Inc

- 6.4.11 DSM-Firmenich

- 6.4.12 ABF Ingredients

- 6.4.13 Ajinomoto Co., Inc.

- 6.4.14 Cargill Incorporated

- 6.4.15 Givaudan SA

- 6.4.16 Tate & Lyle PLC

- 6.4.17 Lallemand Inc.

- 6.4.18 Lesaffre Group (Bio Springer)

- 6.4.19 Ingredion Incorporated

- 6.4.20 Tereos S.A.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK