PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848122

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848122

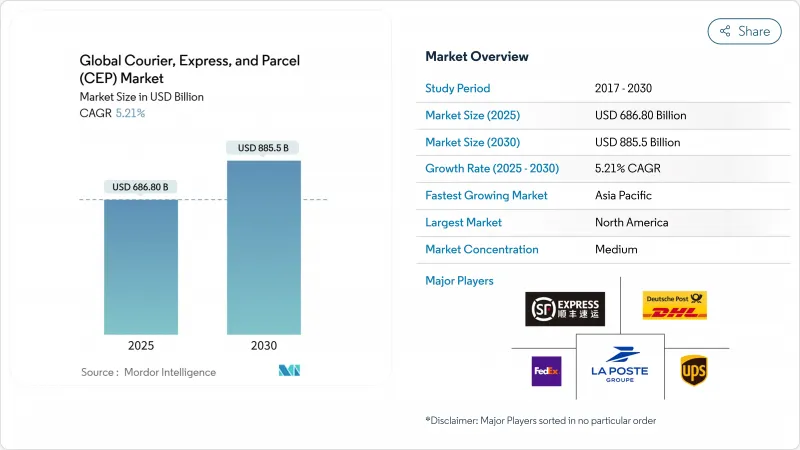

Courier, Express, And Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The courier express parcel market size is valued at USD 686.8 billion in 2025 and is forecast to reach USD 885.5 billion by 2030, advancing at a 5.21% CAGR between 2025-2030.

This outlook signals a transition from the pandemic-era surge toward steadier expansion led by premium services, network automation, and selective capacity additions. E-commerce remains the core volume engine, yet operators now emphasize margin protection through dynamic pricing, technology-enabled routing, and value-added verticals such as healthcare logistics. Cross-border flows are expanding as more small and medium exporters rely on digital marketplaces, while domestic volumes plateau in mature regions. Capital continues gravitating to digital-first networks able to integrate air capacity, regional road fleets, and out-of-home delivery points to optimize cost and speed. Consolidation, highlighted by DSV's purchase of DB Schenker, underlines the strategic value of scale as labor shortages, fuel-neutral fleets, and air-freight constraints raise operating thresholds.

Global Courier, Express, And Parcel (CEP) Market Trends and Insights

E-commerce Penetration Driving B2C Parcel Volumes in Emerging Asia-Pacific Region

Smartphone-led shopping now drives parcel demand as 57% of online buyers purchase via mobile devices. Cross-border volumes climb in tandem with social-commerce sales, projected at USD 8.5 trillion by 2030. China's cross-border parcel flows grew alongside a RMB 21.4 trillion (USD 3.01 trillion) digital-retail sector in 2025, prompting operators to deploy flexible hubs that manage varied package profiles. Network investments across Southeast Asia target wider rural reach and delivery-time certainty, ensuring service parity with urban markets.

Cross-Border SME Exports Leveraging Digital Marketplaces in Europe Region

European SMEs increasingly ship direct to global customers through online marketplaces, intensifying demand for harmonized customs clearance. Negotiations among 90 WTO members seek common e-commerce rules to reduce procedural friction. Automated declarations and blockchain-backed documents can cut average trade costs by 11%. Standardized cross-border services enable operators to pool volumes, lower unit costs, and enlarge the courier express parcel market.

Air-Capacity Constraints on the Trans-Pacific Lanes

Freighter supply rose 8% in 2024, yet demand from China is set to climb 20% in 2025, tightening space and lifting spot rates 15% year-on-year. Limited new-aircraft deliveries cap future growth near 4.4%. Operators prioritize high-value goods and explore secondary hubs, but elevated costs weigh on the courier express parcel market CAGR.

Other drivers and restraints analyzed in the detailed report include:

- Same-Day Delivery Premiumization in Urban North America

- Government Push for Postal Network Modernization in GCC Countries

- Chronic Driver Shortage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Healthcare recorded the fastest 5.75% CAGR between 2025-2030 as aging populations lift demand for temperature-controlled deliveries. DHL and UPS aim to grow healthcare revenues to USD 10.8 billion and USD 20 billion, respectively, underscoring strategic focus. Real-time data loggers ensure compliance, justifying premium fees embedded within the overall courier express parcel market pricing.

E-commerce still represented 36.94% of 2024 revenue but shows a gradual deceleration in mature regions. Manufacturing and wholesale trade offer steady B2B flows, while financial services shipments decline as digitization reduces physical document exchange.

International parcels are projected to expand at a 5.57% CAGR between 2025-2030. The courier express parcel market size tied to cross-border flows is set to widen as trade agreements and electronic customs procedures simplify clearance. Domestic deliveries keep a 69.09% share in 2024, but mature e-commerce penetration caps growth.

Technology-enabled services such as BEST Inc.'s CNY 7 (USD 0.98) per-kilogram offering connect Southeast Asian shoppers to Chinese merchants, illustrating cost reductions through consolidated exports. WTO digital-trade frameworks and RCEP customs harmonization further encourage SMEs to ship internationally, expanding high-margin lanes for established integrators.

The Global Courier, Express, and Parcel (CEP) Market Report is Segmented by Destination (Domestic and International), by Speed of Delivery (Express and More), by Model (Business-To-Business and More), by Shipment Weight (Heavy Weight Shipments and More), Mode of Transport (Air and More), by End User Industry (E-Commerce and More), and by Geography (Asia-Pacific and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 36.76% of 2024 revenue, anchored by consumer expectations for two-day delivery and developed last-mile assets. Persistent driver shortages magnify operating costs, prompting automation pilots and the acquisition of healthcare specialists such as UPS-Andlauer to secure growth niches. Urban micro-fulfillment centers and same-day offerings support premium-rate stability even as volume growth moderates.

Asia-Pacific is the fastest-growing region at 6.77% CAGR between 2025-2030, propelled by cross-border e-commerce and rising consumer incomes. China's RMB 21.4 trillion (USD 3.01 trillion) digital retail base drives parcel density, while RCEP customs alignment lowers friction. Yamato Holdings targets JPY 2-2.4 trillion (USD 0.28-0.33 trillion) revenue by FY2027, embedding carbon-neutral pledges to align with regional sustainability mandates. Europe combines legacy postal infrastructure with aggressive decarbonization policies. The ban on new combustion vans by 2035 accelerates fleet electrification; PostNL plans 100% emission-free Benelux delivery by 2030. DHL's merger with Evri pools international and domestic strengths to handle more than 1 billion UK parcels per year.

Middle East and Africa benefit from GCC diversification programs. Saudi Arabia's automated hub exemplifies investments positioning the region as an intercontinental transit bridge. Security risks on central corridors and fragmented infrastructure still temper growth, favoring partnerships with national postal operators that bring local expertise. South America remains smaller but developing customs reforms, such as Brazil's Remessa Conforme program, improve data quality and compliance, encouraging global platforms to expand cross-border offerings. Currency volatility and patchy road networks require flexible, country-specific approaches.

- Aramex

- Australian Postal Corporation

- Canada Post Corporation (Including Purolator, Inc.)

- China Post

- CJ Logistics

- Deppon Logistics Co., Ltd.

- DHL Group

- Empresa Brasileira de Correios e Telegrafos

- FedEx

- InPost Sp. z o.o.

- International Distribution Services PLC

- JD.com, Inc. (Including JD Logistics, Inc.)

- La Poste Group (Including DPD Group)

- LX International Corp. (Including LX Pantos Co., Ltd.)

- Osterreichische Post AG (Austrian Post)

- Poste Italiane

- PostNL N.V.

- PostNord AB

- SF Express (KEX-SF)

- SG Holdings Co., Ltd.

- STO Express Co., Ltd. (Shentong Express)

- Swiss Post, Ltd.

- United Parcel Service of America, Inc. (UPS)

- Yamato Holdings Co., Ltd.

- ZTO Express (Cayman), Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Demographics

- 4.3 GDP Distribution by Economic Activity

- 4.4 GDP Growth by Economic Activity

- 4.5 Inflation

- 4.6 Economic Performance and Profile

- 4.6.1 Trends in E-Commerce Industry

- 4.6.2 Trends in Manufacturing Industry

- 4.7 Transport and Storage Sector GDP

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Price

- 4.11 Logistics Performance

- 4.12 Infrastructure

- 4.13 Regulatory Framework

- 4.14 Value Chain and Distribution Channel Analysis

- 4.15 Market Drivers

- 4.15.1 E-commerce Penetration Driving B2C Parcel Volumes in Emerging Asia-Pacific Region

- 4.15.2 Cross-Border SME Exports Leveraging Digital Marketplaces in Europe Region

- 4.15.3 Same-Day Delivery Premiumization in Urban North America

- 4.15.4 Government Push for Postal Network Modernization in GCC Countries

- 4.15.5 Adoption of Out-of-Home PUDO Networks in Nordics

- 4.15.6 Cold-Chain Compliance Requirements for Healthcare CEP in Japan

- 4.16 Market Restraints

- 4.16.1 Air Capacity Constraints Witnessed on the Trans-Pacific Lanes

- 4.16.2 Chronic Driver Shortage Impacting Last-Mile Costs in the US and UK

- 4.16.3 Regulatory Caps Implementation on Delivery Fleet Emissions in EU27

- 4.16.4 Rising Security Risks on Africa's Central Corridor Routes

- 4.17 Technology Innovations in the Market

- 4.18 Porter's Five Forces Analysis

- 4.18.1 Competitive Rivalry

- 4.18.2 Threat of New Entrants

- 4.18.3 Bargaining Power of Suppliers

- 4.18.4 Bargaining Power of Buyers

- 4.18.5 Threat of Substitutes

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 Speed of Delivery

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Shipment Weight

- 5.4.1 Heavy Weight Shipments

- 5.4.2 Light Weight Shipments

- 5.4.3 Medium Weight Shipments

- 5.5 Mode of Transport

- 5.5.1 Air

- 5.5.2 Road

- 5.5.3 Others

- 5.6 End User Industry

- 5.6.1 E-Commerce

- 5.6.2 Financial Services (BFSI)

- 5.6.3 Healthcare

- 5.6.4 Manufacturing

- 5.6.5 Primary Industry

- 5.6.6 Wholesale and Retail Trade (Offline)

- 5.6.7 Others

- 5.7 Geography

- 5.7.1 Asia-Pacific

- 5.7.1.1 Australia

- 5.7.1.2 China

- 5.7.1.3 India

- 5.7.1.4 Indonesia

- 5.7.1.5 Japan

- 5.7.1.6 Malaysia

- 5.7.1.7 Pakistan

- 5.7.1.8 Philippines

- 5.7.1.9 Thailand

- 5.7.1.10 Vietnam

- 5.7.1.11 Rest of Asia-Pacific

- 5.7.2 Europe

- 5.7.2.1 Albania

- 5.7.2.2 Bulgaria

- 5.7.2.3 Croatia

- 5.7.2.4 Czech Republic

- 5.7.2.5 Denmark

- 5.7.2.6 Estonia

- 5.7.2.7 Finland

- 5.7.2.8 France

- 5.7.2.9 Germany

- 5.7.2.10 Hungary

- 5.7.2.11 Iceland

- 5.7.2.12 Italy

- 5.7.2.13 Latvia

- 5.7.2.14 Lithuania

- 5.7.2.15 Netherlands

- 5.7.2.16 Norway

- 5.7.2.17 Poland

- 5.7.2.18 Romania

- 5.7.2.19 Russia

- 5.7.2.20 Slovak Republic

- 5.7.2.21 Slovenia

- 5.7.2.22 Spain

- 5.7.2.23 Sweden

- 5.7.2.24 Switzerland

- 5.7.2.25 United Kingdom

- 5.7.2.26 Rest of Europe

- 5.7.3 Middle East and Africa

- 5.7.3.1 Qatar

- 5.7.3.2 Saudi Arabia

- 5.7.3.3 UAE

- 5.7.3.4 Egypt

- 5.7.3.5 Nigeria

- 5.7.3.6 South Africa

- 5.7.3.7 Rest of Middle East and Africa

- 5.7.4 North America

- 5.7.4.1 Canada

- 5.7.4.2 Mexico

- 5.7.4.3 United States

- 5.7.4.4 Rest of North America

- 5.7.5 South America

- 5.7.5.1 Argentina

- 5.7.5.2 Brazil

- 5.7.5.3 Chile

- 5.7.5.4 Rest of South America

- 5.7.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Aramex

- 6.4.2 Australian Postal Corporation

- 6.4.3 Canada Post Corporation (Including Purolator, Inc.)

- 6.4.4 China Post

- 6.4.5 CJ Logistics

- 6.4.6 Deppon Logistics Co., Ltd.

- 6.4.7 DHL Group

- 6.4.8 Empresa Brasileira de Correios e Telegrafos

- 6.4.9 FedEx

- 6.4.10 InPost Sp. z o.o.

- 6.4.11 International Distribution Services PLC

- 6.4.12 JD.com, Inc. (Including JD Logistics, Inc.)

- 6.4.13 La Poste Group (Including DPD Group)

- 6.4.14 LX International Corp. (Including LX Pantos Co., Ltd.)

- 6.4.15 Osterreichische Post AG (Austrian Post)

- 6.4.16 Poste Italiane

- 6.4.17 PostNL N.V.

- 6.4.18 PostNord AB

- 6.4.19 SF Express (KEX-SF)

- 6.4.20 SG Holdings Co., Ltd.

- 6.4.21 STO Express Co., Ltd. (Shentong Express)

- 6.4.22 Swiss Post, Ltd.

- 6.4.23 United Parcel Service of America, Inc. (UPS)

- 6.4.24 Yamato Holdings Co., Ltd.

- 6.4.25 ZTO Express (Cayman), Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment