PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848126

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848126

Automated Parcel Delivery Terminals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

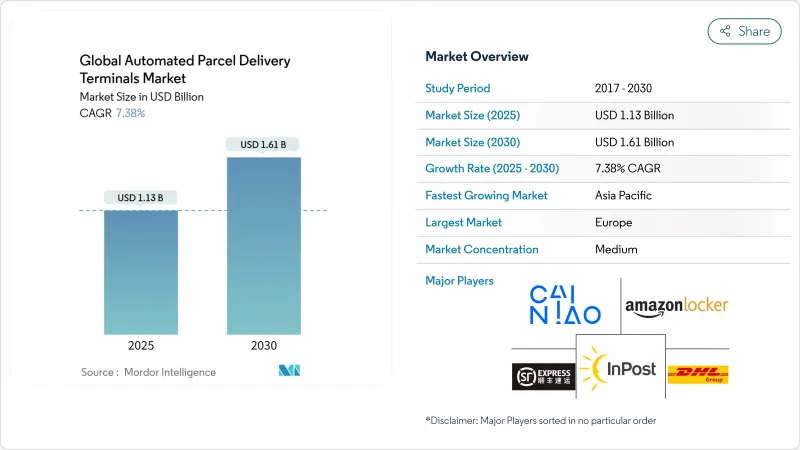

The automated parcel delivery terminals market size is valued at USD 1.13 billion in 2025 and is projected to reach USD 1.61 billion by 2030, advancing at a 7.38% CAGR between 2025-2030.

Rising urban density, e-commerce scale, and postal operators' shift to carrier-agnostic infrastructure underpin the expansion, while AI-enabled routing reduces costly failed first-attempt deliveries, strengthening the business case. Regulatory pressure for carbon-neutral last-mile services, hardware innovations that allow off-grid outdoor units, and retail investments in click-and-collect banks further accelerate network roll-outs. At the same time, security threats and fragmented U.S. permitting rules temper growth, prompting operators to prioritize indoor deployment and advanced surveillance. Competitive intensity is heightening as logistics firms, e-commerce giants, and hardware specialists all race to control customer touchpoints and delivery data.

Global Automated Parcel Delivery Terminals Market Trends and Insights

Rapid Urban E-commerce Fulfilment Needs

China processed more than 130 billion parcels in 2024, and megacities such as Shanghai see densities topping 50 parcels /km2 daily, a scale that makes door-to-door models unsustainable. Smart lockers in residential towers cut last-mile costs by up to 40%, while SingPost's USD 22.72 million capacity upgrade quadruples parcel throughput and signals how operators are scaling to meet volume spikes. High utilization rates improve payback periods, reinforcing the automated parcel delivery terminals market as core urban infrastructure rather than a convenience feature.

Consolidation of Carrier-Agnostic Locker Networks

Deutsche Post DHL plans to double German Pack stations to 30,000 by 2030, investing EUR 500 million (USD 551.82 million) to harvest multi-carrier flows and lower per-parcel costs. Royal Mail, bpost, and Poste Italiane are following suit through joint ventures and retailer partnerships that densify networks without proportionate capex outlays. Consolidation erects entry barriers and positions incumbents as platform orchestrators, shifting competitive dynamics in the automated parcel delivery terminals market.

Ongoing Vandalism and Security Breaches

Package theft in the UK totals GBP 376 million (USD 478.65 million) annually, and USPS recorded over 1,200 mail theft arrests in 2024, forcing operators to invest in hardened enclosures and video analytics that add 15-20% to operating costs. Elevated risk weighs on deployment economics, particularly for outdoor banks situated in high-crime districts.

Other drivers and restraints analyzed in the detailed report include:

- AI-Enabled Dynamic Locker Routing

- Temperature-Controlled Grocery Lockers

- Fragmented Regulatory Approvals in U.S. Cities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Retail and e-commerce sectors commanded a 56.93% share in 2024, leveraging lockers to cut in-store handling and attract omnichannel shopper footfall. Residential and mixed-use complexes deliver the fastest growth at 8.94% CAGR (2025-2030), with developers installing lobby banks that eliminate concierge burden and differentiate property amenities. Case studies show 52% CO2 savings and 60-hour monthly labor reductions per building after smart-box adoption Citibox.

For logistics providers, residential deployments unlock consolidated drop-off routes that shrink stop counts. The automated parcel delivery terminals market, therefore, straddles commercial and living spaces, embedding itself in daily routines and urban design codes.

Indoor sites accounted for 64.77% of 2024 revenue, a dominance underpinned by lower vandalism exposure and climate control that extends hardware life. This share equals USD 0.72 billion of the automated parcel delivery terminals market size in 2025, with retail foyers and mixed-use lobbies offering constant footfall and minimal permitting friction. Insurance premiums fall as much as 30% compared with outdoor banks, reinforcing indoor preference. On the flip side, the outdoor sites' growth of 8.58% CAGR (2025-2030) reflects battery- and solar-powered designs that bypass grid constraints. CTT's solar lockers in Lisbon and Cleveron's battery modules allow operators to fill suburban and rural coverage gaps. As security technology matures, outdoor nodes will form the mesh that complements dense indoor clusters, expanding geographic reach without duplicating legacy branch networks.

Second-order effects include data monetization: indoor units provide anonymized shopper traffic insights that retailers leverage for in-aisle promotions. Outdoor units gather environmental telemetry valuable to municipal planners optimizing curbside use. Consequently, deployment decisions now balance direct parcel revenue with adjacent data-service potential, broadening the return profile for investors in the automated parcel delivery terminals market.

The Global Automated Parcel Delivery Terminals Market Report is Segmented by Deployment (Indoor and More), Shipment Speed (Express and More), by Model (Business-To-Business and More), by Ownership (E-Commerce and More), by Locker Configuration (Modular Parcel Lockers and More), by End-User Industry (Retail and E-Commerce and More), and by Geography (North America and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe accounts for 33.43% of global revenue in 2024, reaching USD 0.38 billion of the automated parcel delivery terminals market size in 2025. Dense postal networks, stringent emission targets, and widespread consumer familiarity drive high utilization. Investments such as Deutsche Post DHL's Packstation expansion and the DHL-Poste Italiane joint venture mark a decisive push toward 100% carrier-agnostic coverage, reinforcing Europe's structural lead.

Asia-Pacific is the growth pacesetter at an 8.12% CAGR between 2025-2030, supported by unparalleled parcel volumes and government backing for smart-city logistics. Cainiao's infrastructure build-out in Southeast Asia and sustained locker infill in Tier 1 Chinese cities exemplify the region's scale potential. Local hardware makers tailor ruggedized units for monsoon climates, and municipal authorities fast-track approvals to mitigate traffic congestion linked to doorstep deliveries. These factors create a virtuous cycle that solidifies the region's long-term contribution to the automated parcel delivery terminals market.

North America maintains steady double-digit locker additions, though fragmented zoning rules prolong rollout timelines. Retailers spearhead uptake via click-and-collect hubs that merge parcel pick-up with curb-side grocery, while USPS pilots indicate federal momentum toward nationwide coverage. Emerging Latin American and Middle-East markets show nascent but accelerating adoption, often through public-private partnerships that leverage postal real estate to bridge infrastructural gaps.

- Amazon (Amazon Lockers)

- Aramex (Aramex Lockers)

- Australia Post (MyPost Lockers)

- bpost (Belgian Post SmartLockers)

- Cainiao Network (Alibaba - Cainiao Smart Lockers)

- Correos (CityPaq Lockers)

- CTT Expresso (Locky)

- Deutsche Post DHL Group (DHL Packstation)

- InPost S.A. (InPost Parcel Lockers)

- La Poste (Evri Parcel Lockers

- Colissimo Pickup Stations)

- Poste Italiane (Punto Poste Lockers)

- PostNL (PostNL Parcel Machine - PakkettenAutomaat)

- PostNord (PostNord Parcel Lockers)

- SF Express (SF Lockers)

- SingPost (Pick Own Parcel Station - POP Lockers)

- Yamato Transport Co., Ltd. (TA-Q-BIN Lockers)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Demographics

- 4.3 GDP Distribution by Economic Activity

- 4.4 GDP Growth by Economic Activity

- 4.5 Inflation

- 4.6 Economic Performance and Profile

- 4.6.1 Trends in E-Commerce Industry

- 4.6.2 Trends in Manufacturing Industry

- 4.7 Transport and Storage Sector GDP

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Price

- 4.11 Logistics Performance

- 4.12 Infrastructure

- 4.13 Regulatory Framework

- 4.14 Value Chain and Distribution Channel Analysis

- 4.15 Market Drivers

- 4.15.1 Rapid Urban E-commerce Fulfilment Needs in Densely Populated Asian Cities

- 4.15.2 Consolidation of Carrier-Agnostic Locker Networks by European Postal Operators

- 4.15.3 Retailer Investments in Store-Front Click-and-Collect Banks Across North America

- 4.15.4 Carbon-Neutral Last-mile Mandates Accelerating Locker Roll-Outs in the Nordics

- 4.15.5 AI-Enabled Dynamic Locker Routing Reducing Failed First-Attempt Deliveries

- 4.15.6 Temperature-Controlled Grocery Locker Pilots Driving Fresh-Food Use-Cases

- 4.16 Market Restraints

- 4.16.1 Ongoing Vandalism and Security Breach Incidents in Public-Access Locker Sites

- 4.16.2 Limited Grid-Power Access for Rural and Suburban Outdoor Banks

- 4.16.3 Fragmented Regulatory Approvals for Curb-Side Installations in U.S. Cities

- 4.16.4 High Retrofit Costs to Integrate Legacy Postal Infrastructure

- 4.17 Value / Supply-Chain Analysis

- 4.18 Technology Innovations in the Market

- 4.19 Porter's Five Forces Analysis

- 4.19.1 Threat of New Entrants

- 4.19.2 Bargaining Power of Buyers

- 4.19.3 Bargaining Power of Suppliers

- 4.19.4 Threat of Substitutes

- 4.19.5 Intensity of Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 Deployment

- 5.1.1 Indoor

- 5.1.2 Outdoor

- 5.2 Shipment Speed

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Ownership

- 5.4.1 E-commerce (Online Retailers and Marketplaces)

- 5.4.2 Courier/Logistics Companies

- 5.4.3 Government Organizations

- 5.4.4 Postal Operators

- 5.4.5 Independent Third-Party Providers

- 5.4.6 Others

- 5.5 Locker Configuration

- 5.5.1 Modular Parcel Lockers

- 5.5.2 Cooling (Fresh-Food Lockers)

- 5.5.3 Postal (Mailroom Lockers )

- 5.5.4 Laundry and Service-Based Lockers

- 5.5.5 Others

- 5.6 End-User Industry

- 5.6.1 Retail and E-commerce

- 5.6.2 Logistics/Supply-Chain Service Providers

- 5.6.3 Residential and Mixed-Use Complexes

- 5.6.4 Others (Public Services, Institutions, Government and Public Sector Among Others)

- 5.7 Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.1.4 Rest of North America

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Spain

- 5.7.3.5 Italy

- 5.7.3.6 Netherlands

- 5.7.3.7 Nordics

- 5.7.3.8 Central and Eastern Europe (CEE)

- 5.7.3.9 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 Japan

- 5.7.4.3 India

- 5.7.4.4 Australia

- 5.7.4.5 ASEAN

- 5.7.4.6 Rest of Asia-Pacific

- 5.7.5 Middle East And Africa

- 5.7.5.1 United Arab Emirates

- 5.7.5.2 Saudi Arabia

- 5.7.5.3 Rest of Middle East and Africa

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis (Ranking of Key Network Operators and Key Suppliers)

- 6.4 Company Profiles of Network Operators and Logistics Players - These Companies Own and Operate Parcel-Locker Networks as Part of Their Delivery/CEP Services. (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Amazon (Amazon Lockers)

- 6.4.2 Aramex (Aramex Lockers)

- 6.4.3 Australia Post (MyPost Lockers)

- 6.4.4 bpost (Belgian Post SmartLockers)

- 6.4.5 Cainiao Network (Alibaba - Cainiao Smart Lockers)

- 6.4.6 Correos (CityPaq Lockers)

- 6.4.7 CTT Expresso (Locky)

- 6.4.8 Deutsche Post DHL Group (DHL Packstation)

- 6.4.9 InPost S.A. (InPost Parcel Lockers)

- 6.4.10 La Poste (Evri Parcel Lockers; Colissimo Pickup Stations)

- 6.4.11 Poste Italiane (Punto Poste Lockers)

- 6.4.12 PostNL (PostNL Parcel Machine - PakkettenAutomaat)

- 6.4.13 PostNord (PostNord Parcel Lockers)

- 6.4.14 SF Express (SF Lockers)

- 6.4.15 SingPost (Pick Own Parcel Station - POP Lockers)

- 6.4.16 Yamato Transport Co., Ltd. (TA-Q-BIN Lockers)

7 Overview of Hardware and Software Suppliers (OEMs / Platform Vendors) - Includes Overview and Insights on the Companies that Design, Manufacture or License the Locker Hardware and/or Control Software, but Do Not Themselves Run Large-Scale Last-Mile Networks.

- 7.1 Cleveron AS

- 7.2 Parcel Pending LLC (Quadient SA)

- 7.3 KEBA

- 7.4 Bell and Howell LLC

- 7.5 Thinventory Holdings, Ltd. (ByBox Holdings, Ltd.)

- 7.6 Smartbox Ecommerce Solutions Pvt., Ltd.

- 7.7 TZ, Ltd.

- 7.8 Winnsen Industry Co., Ltd.

- 7.9 Luxer One

- 7.10 LockTec GmbH

- 7.11 Shenzhen Zhilai Sci and Tech Co., Ltd.

- 7.12 KernTerminal

- 7.13 Renz Group (MyRENZbox)

- 7.14 Parcel Hive

8 Market Opportunities and Future Outlook

- 8.1 White-Space and Unmet-Need Assessment