PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848136

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848136

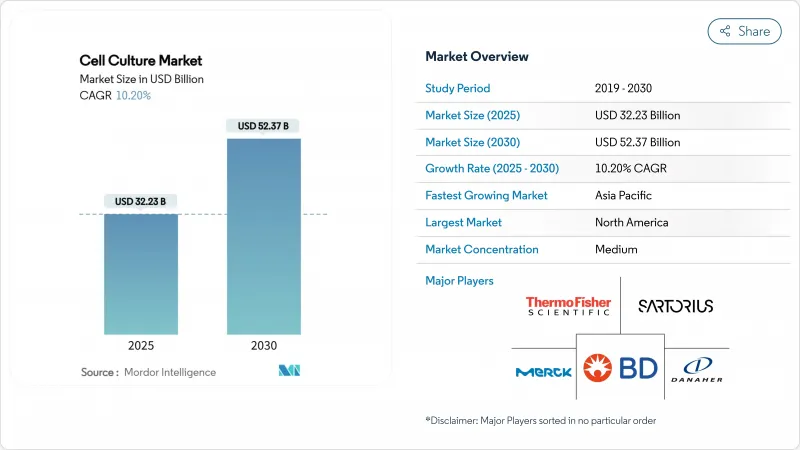

Cell Culture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global cell culture market size is USD 32.23 billion in 2025 and is projected to reach USD 52.37 billion by 2030, advancing at a 10.2% CAGR to the end of the forecast period.

Robust biomanufacturing demand, a surge in stem-cell clinical trials, and tightening regulatory timelines for regenerative medicine are reshaping capital allocation across the cell culture market. Automated single-use bioreactors, serum-free media innovations, and AI-assisted process analytics are lowering per-batch costs while improving reproducibility, allowing developers to scale therapies that once stalled in small-volume research settings. Major life-science vendors now pursue vertical integration-combining equipment, consumables, and contract services-to strengthen supply-chain resilience and shorten technology-transfer cycles. Meanwhile, regional industrial policy in Japan, China, and the United States accelerates facility build-outs that push production closer to patients and reduce cross-border logistics risk. Supply constraints for fetal bovine serum, alongside sustainability mandates, continue to speed the transition toward chemically-defined, animal-component-free systems that simplify regulatory filings and remove ethical bottlenecks.

Global Cell Culture Market Trends and Insights

Rising Global Burden of Chronic Diseases Propelling Biologics Demand

Non-communicable diseases continue to swell biologics pipelines, compelling manufacturers to expand culture capacity that underpins monoclonal antibodies, vaccines, and GLP-1 therapeutics. Sanofi committed EUR 1.3 billion to a vertically integrated insulin facility, highlighting how large-volume chronic disease indications directly translate to cell culture market expansion. Oncology heightens this pressure; more than 60 induced-pluripotent-stem-cell trials are active worldwide, nearly one-third in Japan, where fast-track approvals shorten the path from bench to bedside. The arithmetic is clear: as chronic disease prevalence scales, the cell culture market must supply the therapeutic backbone that keeps populations productive.

Technological Advances in Automated & High-Throughput Cell-Culture Systems

Rapid uptake of closed, single-use bioreactors and AI-orchestrated process control cuts contamination risk and technician hours while doubling batch throughput. An expansion in Copenhagen added eight 2,000 L single-use vessels, enabling 150 extra batches each year and proving that automation can deliver step-change capacity without conventional brick-and-mortar scale-up. Droplet microfluidics further compresses cell-line development timelines, replacing weeks of manual clone picking with minutes of digital selection accuracy. These gains flow straight to the cell culture market P&L, letting sponsors pursue smaller patient sub-groups economically.

High Capital & Operating Costs of Large-Scale cGMP Cell-Culture Facilities

Constructing a compliant biologics plant can cost USD 500-1,400 per square foot, a hurdle that pushes start-ups toward outsourcing models and slows facility deployment in cash-limited geographies. Even deep-pocketed incumbents such as Fujifilm and Lonza accept nine-figure price tags for expansions, underscoring the financial gravity that drags on cell culture market entry.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Government & Private Funding for Cell-Based Research

- Growth in Cell- & Gene-Therapy Clinical Trial Pipeline Worldwide

- Stringent Regulatory & Quality-Compliance Requirements Across Regions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Consumables retained the largest slice of the cell culture market in 2024 at 54.25%, and the segment is forecast to compound at 13.65% through 2030 as developers switch to chemically-defined, animal-free media formulations. This evolution protects operators against the looming FBS crunch and lines up with regulators who prefer traceable ingredients in clinical dossiers. On the equipment side, single-use bioreactors, perfusion platforms, and inline sensors are rewriting facility blueprints, trimming downtime and capital intensity. Thermo Fisher's USD 4.1 billion filtration acquisition underlines how purification hardware has become strategic to robust continuous processing. As automation proliferates, the cell culture market size attributable to equipment will rise faster than in prior cycles-even if consumables keep the larger revenue base.

R&D labs are likewise refreshing microscopes and imaging systems; Yokogawa's CQ3000 captures live 3D images that feed downstream AI analytics, shortening assay development. Disposable tubing, filters, and sampling ports complete the single-use ecosystem, locking in predictable consumables demand with every new bioreactor install. Together, these shifts cement a feedback loop where equipment innovation unlocks new consumables SKUs, and vice versa, enriching the cell culture market value chain.

Mammalian platforms generated 62.32% of the cell culture market share in 2024, in large part because CHO lines remain the workhorse for monoclonal antibodies. Yet stem cells post the fastest rise, tracking an 11.85% CAGR as global trials hit 115 at the end of 2024. Japan's regulatory accelerators and public funding have pulled induced-pluripotent-stem-cell therapies to the cusp of commercial approval, signaling a demand inflection for GMP-grade stem-cell media, matrices, and closed harvesting systems.

Within mammalian lines, primary cells win research relevance while immortalized lines supply reliable production titles. Microbial and insect cell systems address niche protein targets and vaccine antigens that mammalian lines fail to express efficiently, preserving a diversified demand pattern inside the broader cell culture market.

The Cell Culture Market Report is Segmented by Product (Equipment and Consumables), Cell Type (Mammalian Cells, and More), Technology (2-D Cell Culture and 3-D Cell Culture), Application (Biopharmaceutical Production, Drug Discovery & Development, and More), End-User (Pharmaceutical & Biotechnology Companies, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 38.52% of global revenue in 2024, supported by landmark expansions such as Merck's USD 1 billion Gardasil ingredient facility and AstraZeneca's USD 300 million cell-therapy plant in Maryland. The U.S. regulatory climate, forecasting 20 annual advanced-therapy approvals from 2025 onward, guarantees utilization of newly added GMP suites. Canada bolsters the region with tax credits that entice CDMOs, and Mexico offers fill-finish and component-molding capacities that support continental supply chains. Federal ambitions to meet 30% of U.S. chemical demand with sustainable biomanufacturing by 2040 provide an enduring policy tailwind for the cell culture market.

Europe presents strong catch-up momentum. German biotech financing rocketed to EUR 1.9 billion in 2024, and the United Kingdom unveiled a GBP 450 million vaccine hub to hedge pandemic risk. EU efforts to harmonize GMP annex updates streamline cross-border product release and favor pan-European service networks. Furthermore, collaborations such as Bayer's gene- and cell-therapy center in Berlin pull industrial partners into public-science ecosystems.

Asia-Pacific registers the fastest climb, clocking a 12.8% CAGR. Japan's USD 760 million regenerative-medicine program spawns more than 60 iPSC trials and primes domestic demand for defined media, closed bioreactors, and downstream purification skids. China scales both upstream antibody plants and emergent mRNA lines, while India monetizes cost advantages to capture contract formulation and analytics. South Korea and Australia round out the regional mosaic with advanced stem-cell manufacturing and supportive reimbursement regimes, respectively. Collectively, APAC's demographic profile-aging populations and growing chronic disease incidence-cements a demand runway for the cell culture market that stretches beyond the forecast period.

- Thermo Fisher Scientific

- Merck

- Sartorius

- Danaher

- Corning

- Lonza Group Ltd.

- Eppendorf

- Beckton Dickinson

- Agilent Technologies

- Bio-Rad Laboratories

- PromoCell

- Tecan Group

- CellGenix

- FUJIFILM Irvine Scientific Inc.

- Greiner Bio One International

- Hi-Media Laboratories Pvt Ltd.

- Biospherix Ltd.

- XenoTech

- Miltenyi Biotec B.V. & Co. KG

- Advanced Instrumentations

- Stem Cell Technologies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Global Burden of Chronic Diseases Propelling Biologics Demand

- 4.2.2 Technological Advances in Automated & High-Throughput Cell-Culture Systems

- 4.2.3 Expanding Government & Private Funding for Cell-Based Research

- 4.2.4 Growth in Cell- & Gene-Therapy Clinical Trial Pipeline Worldwide

- 4.2.5 Increasing Adoption of Cell-Based Assays in Drug Discovery & Toxicity Testing

- 4.2.6 Shift Toward Animal-Component-Free and Sustainable Biomanufacturing Practices

- 4.3 Market Restraints

- 4.3.1 High Capital & Operating Costs of Large-Scale cGMP Cell-Culture Facilities

- 4.3.2 Stringent Regulatory & Quality-Compliance Requirements Across Regions

- 4.3.3 Contamination Risk and Batch-Failure Impact on Production Economics

- 4.3.4 Supply-Chain Vulnerabilities for Critical Media, Plastics, and Reagents

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Buyers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Equipment

- 5.1.1.1 Biosafety Cabinets

- 5.1.1.2 Centrifuges

- 5.1.1.3 Cryostorage Equipment

- 5.1.1.4 Culture Systems / Bioreactors

- 5.1.1.5 Incubators

- 5.1.1.6 Pipetting Instruments

- 5.1.1.7 Microscopes & Imaging Systems

- 5.1.1.8 Cell Counters & Analyzers

- 5.1.1.9 Filtration Systems

- 5.1.1.10 Accessories (Tubing, Connectors, Fittings)

- 5.1.2 Consumables

- 5.1.2.1 Media

- 5.1.2.2 Serum-Free Media

- 5.1.2.3 Sera (FBS & Alternatives)

- 5.1.2.4 Reagents

- 5.1.2.5 Buffers & Salts

- 5.1.2.6 Supplements & Growth Factors

- 5.1.2.7 Cryoprotective Agents

- 5.1.2.8 Plasticware (Flasks, Plates, Dishes)

- 5.1.1 Equipment

- 5.2 By Cell Type

- 5.2.1 Mammalian Cells

- 5.2.1.1 Primary Cells

- 5.2.1.2 Continuous Cell Lines

- 5.2.2 Stem Cells

- 5.2.2.1 Embryonic Stem Cells

- 5.2.2.2 Adult Stem Cells

- 5.2.2.3 Induced Pluripotent Stem Cells

- 5.2.3 Microbial Cells

- 5.2.3.1 Bacterial

- 5.2.3.2 Yeast & Fungal

- 5.2.4 Insect Cells

- 5.2.1 Mammalian Cells

- 5.3 By Technology

- 5.3.1 2-D Cell Culture

- 5.3.2 3-D Cell Culture

- 5.3.2.1 Scaffold-Based

- 5.3.2.2 Scaffold-Free

- 5.4 By Application

- 5.4.1 Biopharmaceutical Production

- 5.4.2 Drug Discovery & Development

- 5.4.3 Gene & Cell Therapy Manufacturing

- 5.4.4 Vaccine Production

- 5.4.5 Tissue Engineering & Regenerative Medicine

- 5.4.6 Cancer Research

- 5.4.7 Diagnostics & Assay Development

- 5.4.8 Toxicity Testing & Safety Assessment

- 5.5 By End-User

- 5.5.1 Pharmaceutical & Biotechnology Companies

- 5.5.2 Academic & Research Institutes

- 5.5.3 CROs & CDMOs

- 5.5.4 Hospitals & Diagnostic Laboratories

- 5.5.5 Cell Banks & Biobanks

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Thermo Fisher Scientific Inc.

- 6.3.2 Merck KGaA

- 6.3.3 Sartorius AG

- 6.3.4 Danaher Corporation

- 6.3.5 Corning Incorporated

- 6.3.6 Lonza Group Ltd.

- 6.3.7 Eppendorf SE

- 6.3.8 Becton, Dickinson and Company

- 6.3.9 Agilent Technologies Inc.

- 6.3.10 Bio-Rad Laboratories Inc.

- 6.3.11 Promocell GmbH

- 6.3.12 Tecan Group Ltd.

- 6.3.13 CellGenix GmbH

- 6.3.14 FUJIFILM Irvine Scientific Inc.

- 6.3.15 Greiner Bio-One International GmbH

- 6.3.16 Hi-Media Laboratories Pvt Ltd.

- 6.3.17 Biospherix Ltd.

- 6.3.18 Sekisui XenoTech LLC

- 6.3.19 Miltenyi Biotec B.V. & Co. KG

- 6.3.20 Advanced Instruments LLC

- 6.3.21 STEMCELL Technologies Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment