PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848138

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848138

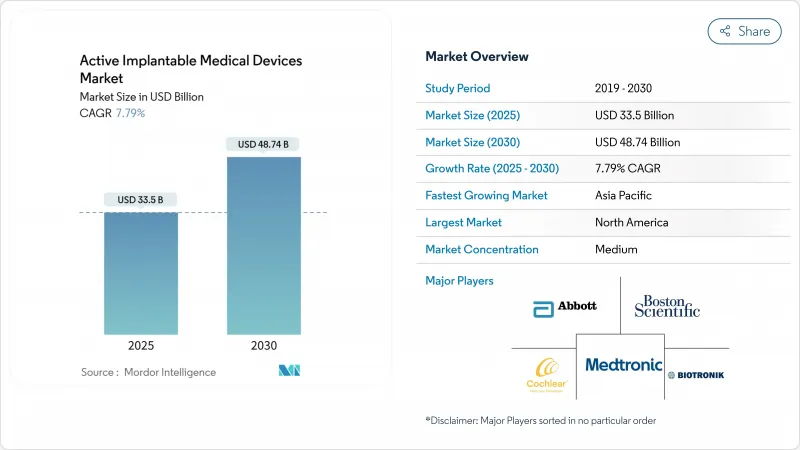

Active Implantable Medical Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The active implantable medical devices market size generated USD 33.50 billion in 2025 and is projected to reach USD 48.74 billion by 2030, translating to a 7.79% CAGR.

Rising life expectancy, rapid miniaturization of electronics, and expanding reimbursement frameworks are widening patient eligibility while shortening technology-adoption cycles. The uptake of AI-enabled remote monitoring has cut false cardiac alerts by up to 85%, easing clinician workload and increasing confidence in long-term device use. In parallel, the EU Medical Device Regulation (MDR) has extended transition deadlines to December 2027 for Class III implants, channeling demand toward manufacturers with strong quality systems. Stabilization of the semiconductor supply chain after 2024 shortages is restoring production of sub-centimeter components essential for leadless and wireless architectures. Together, these dynamics reinforce a steady scale-up trajectory for the Active implantable medical devices market through 2030.

Global Active Implantable Medical Devices Market Trends and Insights

Rising Prevalence of Cardio-, Neuro- & Otologic Disorders

Heart failure impacts more than 64 million people worldwide and atrial fibrillation is expected to reach 17.9 million cases in developed markets by 2030, intensifying demand for implantable cardioverter-defibrillators and resynchronization devices. Parkinson's disease affects around 10 million patients globally, spurring adoption of adaptive deep-brain stimulation systems that modulate therapy in real time. WHO forecasts that hearing loss will affect 700 million people by 2050, a trend accelerating cochlear-implant usage as fully implantable designs erase cosmetic barriers. Co-morbid disease profiles are also becoming more common, prompting multi-device implantation and underpinning sustained growth in the Active implantable medical devices market.

Rapid Miniaturization & MRI-Safe Leadless Design Innovations

Leadless pacemakers have shrunk to volumes below 1 cm3 while retaining 10-year battery life, and devices like Abbott's AVEIR dual-chamber system synchronize atrioventricular pacing without transvenous leads. MRI protocols have progressed from conditional to fully unrestricted scanning at 3 Tesla, removing long-standing imaging barriers for device patients. Precision Neuroscience's Layer 7 cortical interface, hosting 1,024 hair-thin electrodes, exemplifies the fine-scale fabrication now achievable. Bio-resorbable pacemakers that dissolve after therapy completion have completed first-in-human feasibility trials, hinting at a future where explant surgery becomes unnecessary. These advances lower infection risks, simplify procedures, and widen patient selection, strengthening momentum in the Active implantable medical devices market.

High Device & Procedure Cost in Emerging Markets

In many low- and middle-income regions, implant prices still exceed annual household income, limiting penetration to wealthy urban populations. Only 19% of residents in these economies have access even to basic diagnostics, highlighting systemic care gaps. Currency depreciation further inflates import costs for devices priced in hard currencies, while fragmented insurance coverage pushes most payments out of pocket. Local manufacturing policies in India and Brazil offer tax incentives, yet high-risk implant categories require specialized cleanroom production and intellectual property portfolios that few domestic firms possess. Training deficits compound the barrier, as implant procedures demand electrophysiologists and otologic surgeons who remain concentrated in flagship hospitals. Until financing models mature, cost will continue to cap the Active implantable medical devices market in numerous emerging territories.

Other drivers and restraints analyzed in the detailed report include:

- Ageing Population Expanding Implant-Eligible Pool

- Favourable Reimbursement Expansion in OECD & China

- Stringent Cybersecurity & Regulatory Hurdles Lengthen Approvals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Implantable cardioverter-defibrillators captured a 31.23% slice of the Active implantable medical devices market size in 2024 thanks to their life-saving role in sudden-cardiac-death prevention among roughly 6 million US heart-failure patients. Subcutaneous and leadless formats reduce infection risk and enable MRI access, sustaining steady replacement cycles. Pacemakers stay relevant because dual-chamber leadless designs now correct complex arrhythmias without transvenous leads. Ventricular assist devices profit from magnetically levitated pumps that cut thrombosis, doubling two-year survival compared with previous generations.

Implantable hearing devices post the fastest trajectory at a 9.43% CAGR through 2030 as totally implantable cochlear implants enter pivotal trials and promise round-the-clock sound without external processors. Early data from MED-EL's TICI feasibility study showed speech-recognition parity with standard models and higher patient satisfaction. Neurostimulators also benefit from closed-loop capabilities that cut overstimulation by 89%, while insertable loop recorders and drug-infusion pumps gain from personalized chronic-disease management. These dynamics collectively deepen product diversity and future-proof the Active implantable medical devices market.

Cardiovascular disorders retained 55.34% of the Active implantable medical devices market size in 2024 driven by escalating heart-failure prevalence and broadening indications for conduction-system pacing and resynchronization. Abbott's TriClip device reduced moderate-or-greater tricuspid regurgitation by 84% and improved Kansas City Cardiomyopathy Questionnaire scores, highlighting structural-heart opportunities. Neurological applications remain steady because adaptive deep-brain stimulation widens clinical benefit to previously refractory Parkinson's subtypes.

Hearing-loss treatment is growing at a 10.67% CAGR to 2030 as WHO projects 700 million affected individuals, and fully implantable solutions erase long-standing stigma. Chronic pain management sees rising adoption of AI-driven spinal cord stimulators that auto-calibrate dosing, reducing opioid reliance. Endocrine use cases, such as closed-loop insulin delivery, represent an emerging adjacency that could inject fresh volume into the Active implantable medical devices market.

The Active Implantable Medical Devices Market Report is Segmented by Product Type (Pacemakers, Implantable Cardioverter-Defibrillators (ICD), and More), Application (Cardiovascular Disorders, Neurological Disorders, and More), Technology (Conventional Devices, and More), (end User (Hospitals, and More), Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 38.54% of 2024 sales, fueled by Medicare coverage of breakthrough devices and a dense ecosystem linking academia, industry, and venture capital. The FDA Breakthrough Device pathway has compressed cardiac and neuro device approvals to under 150 days on average, allowing rapid clinician adoption. Robust reimbursement and established referral networks support high procedural volumes for leadless pacing and adaptive DBS systems. Yet value-based payment initiatives are pressuring suppliers to evidence longitudinal cost offsets, ushering in risk-sharing contracts that could reshape the Active implantable medical devices market's pricing structure.

Asia-Pacific is set to grow at 8.76% CAGR between 2025 and 2030 thanks to China's VoBP cost resets and accelerated National Medical Products Administration approvals of 270 innovative implants since 2017. Japan's super-aged society fuels demand for small, long-life devices, while South Korea's advanced fabrication capacity positions it as a leading export hub. India's Production Linked Incentive scheme is drawing global OEMs to set up local final assembly, trimming logistics costs and supporting broader regional access. These shifts elevate Asia-Pacific's weighting in the Active implantable medical devices market and create scale efficiencies for global suppliers.

Europe is navigating MDR transition bottlenecks that delay certification yet ultimately harmonize evidence standards. Germany remains a powerhouse in electrophysiology, and France's digital-health reimbursement framework incentivizes AI-linked implants. Brexit adds a parallel UK approval pathway, raising planning complexity for dual-region launches. Nonetheless, the continent's ageing demographic and universal coverage still assure steady device demand. Once notified-body capacity normalises, pent-up approvals could yield a release of new products and reinforce Europe's place within the Active implantable medical devices market.

- Medtronic

- Abbott Laboratories

- Boston Scientific

- Cochlear

- BIOTRONIK

- LivaNova

- Nevro

- Axonics Inc.

- Inspire Medical Systems

- Sonova (Advanced Bionics)

- MED-EL

- MicroPort CRM

- Terumo

- Abiomed

- Jarvik Heart

- Biotronik Neuro

- BlueWind Medical

- CVRx Inc.

- Mindray

- Lepu Medical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Cardio-, Neuro- & Otologic Disorders

- 4.2.2 Rapid Miniaturisation & MRI-Safe/Lead-Less Design Innovations

- 4.2.3 Ageing Population Expanding Implant-Eligible Pool

- 4.2.4 Favourable Reimbursement Expansion in OECD & China

- 4.2.5 AI-Enabled Remote Monitoring Algorithms Improving Real-World Outcomes

- 4.2.6 Breakthrough Bio-Resorbable Electronics Eliminating Explant Surgeries

- 4.3 Market Restraints

- 4.3.1 High Device & Procedure Cost in Emerging Markets

- 4.3.2 Stringent Cyber-Security / Regulatory Hurdles Lengthen Approvals

- 4.3.3 Semiconductor Supply Bottlenecks for Ultra-Miniature Components

- 4.3.4 Battery-Material Sustainability Pressures on Lithium-Iodine Chemistry

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Pacemakers

- 5.1.2 Implantable Cardioverter-Defibrillators (ICD)

- 5.1.3 Ventricular Assist Devices (VAD)

- 5.1.4 Neurostimulators

- 5.1.4.1 Spinal Cord Stimulators

- 5.1.4.2 Deep Brain Stimulators

- 5.1.4.3 Vagus Nerve Stimulators

- 5.1.4.4 Sacral Nerve Stimulators

- 5.1.5 Implantable Hearing Devices

- 5.1.5.1 Cochlear Implants

- 5.1.5.2 Bone-Anchored Hearing Systems

- 5.1.6 Insertable Loop Recorders

- 5.1.7 Implantable Drug-Infusion Pumps

- 5.2 By Application

- 5.2.1 Cardiovascular Disorders

- 5.2.2 Neurological Disorders

- 5.2.3 Hearing Loss

- 5.2.4 Chronic Pain Management

- 5.2.5 Endocrine & Metabolic (e.g., Diabetes)

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgery Centres

- 5.3.3 Specialty & ENT Clinics

- 5.3.4 Home-Care Settings

- 5.4 By Technology

- 5.4.1 MRI-Compatible Devices

- 5.4.2 Conventional Devices

- 5.4.3 Leadless / Wireless Implants

- 5.4.4 Rechargeable / Bio-resorbable Power Systems

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Medtronic plc

- 6.3.2 Abbott Laboratories

- 6.3.3 Boston Scientific Corporation

- 6.3.4 Cochlear Limited

- 6.3.5 BIOTRONIK SE & Co. KG

- 6.3.6 LivaNova PLC

- 6.3.7 Nevro Corp

- 6.3.8 Axonics Inc.

- 6.3.9 Inspire Medical Systems

- 6.3.10 Sonova (Advanced Bionics)

- 6.3.11 MED-EL

- 6.3.12 MicroPort CRM

- 6.3.13 Terumo

- 6.3.14 Abiomed

- 6.3.15 Jarvik Heart Inc.

- 6.3.16 Biotronik Neuro

- 6.3.17 BlueWind Medical

- 6.3.18 CVRx Inc.

- 6.3.19 Shenzhen Mindray

- 6.3.20 Lepu Medical

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment