PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848145

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848145

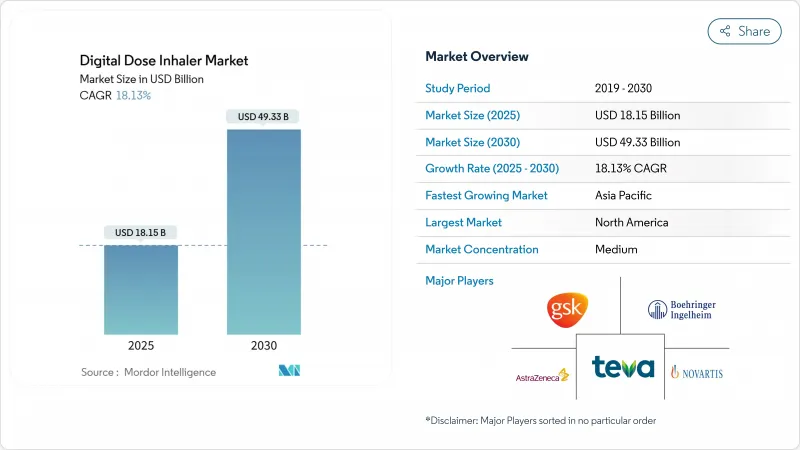

Digital Dose Inhaler - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The digital dose inhaler market size is valued at USD 18.15 billion in 2025 and is projected to reach USD 49.33 billion by 2030, reflecting an 18.13% CAGR.

Robust growth is linked to rising respiratory disease prevalence, rapid uptake of connected therapeutics, and stringent environmental regulations that are forcing propellant innovation. Real-time data capture from Internet of Things-enabled inhalers is giving physicians objective adherence evidence, while artificial intelligence is beginning to predict exacerbations before they occur. Capital inflows into digital respiratory care start-ups continue to climb, strengthening the competitive landscape and expanding patient access to sensor-equipped devices. Environmental legislation in Europe is accelerating the switch to low-GWP propellants, prompting major suppliers to overhaul meter-dose inhaler portfolios well ahead of 2030 compliance deadlines.

Global Digital Dose Inhaler Market Trends and Insights

Escalating Global Respiratory Disease Burden

Chronic respiratory diseases affected 213.39 million people in 2021, sustaining demand for connected inhalers that objectively record adherence. Studies show 44% adherence improvement among COPD patients using behavior-change programs linked to smart devices. Integration of artificial intelligence is enabling early exacerbation alerts, moving digital devices from passive trackers to proactive disease-management tools.

Expanding Geriatric Patient Pool

The geriatric cohort is the fastest-growing user group at an 18.67% CAGR through 2030 as age-related dexterity limitations make intuitive breath-activated devices attractive. Simplified interfaces and larger displays improve usability, while Medicare payment pilots are experimenting with sensor reimbursement, although national coverage remains uneven.

Premium Pricing of Connected Inhaler Devices

Smart inhalers cost substantially more than conventional units, and total ownership expenses include data plans and software subscriptions. Economic evaluations find clinical benefits but question cost-effectiveness when pharmacy margins are narrow. Tiered pricing and payer partnerships are evolving, yet the lack of consistent reimbursement, especially in public systems, limits penetration in developing regions.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advancements in Smart Inhaler Platforms

- Transition Toward Digital Therapeutics and Remote Monitoring

- Complex Regulatory and Reimbursement Pathways

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Metered dose inhalers retained 48.54% of digital dose inhaler market share in 2024, underscoring user familiarity and mature manufacturing economics. The digital dose inhaler market size for this segment is projected to rise at a 14.2% CAGR as companies transition to ultra-low-GWP propellants. Environmental mandates are accelerating formulation re-engineering, with AstraZeneca's HFO-1234ze(E) rollout reducing broad environmental impact by 99.9%.

Soft-mist inhalers provide higher lung deposition and need no propellant, fueling a 20.34% CAGR that outpaces the broader digital dose inhaler market. Device miniaturization and embedded sensors allow real-time flow measurement, appealing to providers seeking precise dose verification. Dry-powder inhalers remain relevant in regions with cooler climates and robust inspiratory flow among adult users, yet high humidity limits uptake in tropical geographies.

Asthma accounted for 41.48% of revenue in 2024, buoyed by large pediatric and young-adult cohorts and plentiful clinical evidence supporting connected adherence solutions. The digital dose inhaler market size for COPD is expanding faster at 18.9% CAGR as aging populations lengthen disease duration and payers seek cost offsets through fewer hospitalizations. HealthPrize RespiPoints documented a 44% adherence increase among tiotropium users, translating to material cost savings.

Cystic fibrosis growth at 19.45% CAGR demonstrates willingness of caregivers to invest in premium monitoring to optimize high-value medication regimens. AI algorithms now differentiate disease-specific inhalation patterns, personalizing coaching for each indication and raising the clinical relevance of connected platforms.

The Digital Dose Inhaler Market Report is Segmented by Product (Dry Powder Inhalers, and More), Indication (COPD, and More), Type (Branded and Generic), Patient Age Group (Pediatric, and More), Distribution Channel (Hospital Pharmacies, and More), Geography (North America, Europe, Asia-Pacific, The Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 43.45% of revenue in 2024 on the back of sophisticated payer systems, high COPD prevalence, and early FDA approvals of digital therapeutics. GSK and Propeller Health broadened their collaboration to ship sensor-enabled Ellipta inhalers nationwide, demonstrating the commercial viability of integrated prescription-tech bundles. Canada benefits from single-payer purchasing leverage, while Provincial formularies are piloting outcome-based procurement tied to adherence reports. Mexico's growing middle class and digital-health incentives open gateways for mid-priced devices.

Asia-Pacific is the fastest-growing region at 19.45% CAGR through 2030 as urban air pollution and smoking contribute to rising COPD cases. China's population-level burden pressures policymakers to adopt preventive tools; public hospitals are trialling cloud dashboards that integrate inhaler data with electronic medical records. India's expanding 4G coverage and revised telemedicine guidelines underpin online pharmacy distribution of sensor kits, yet affordability gaps persist. Japan couples rapidly aging demographics with a mature technology culture, making it a fertile market for premium soft-mist inhalers bundled with AI coaching.

Europe remains a mature but innovative market where environmental regulation sets global precedents. The F-Gas Regulation 2024/573 bans new HFC-filled inhalers outside of quota allocations from 2025, accelerating low-GWP adoption schedules. Germany's DiGA framework reimburses certified digital health apps, positioning inhaler companion software for rapid uptake. The United Kingdom maintains a pragmatic stance, reimbursing devices that demonstrate hospital-admission avoidance. Middle East & Africa and South America are nascent yet promising, limited by infrastructure, clinician training, and consumer purchasing power. Donation programs and tiered pricing models aim to bridge these gaps.

- Teva Pharmaceutical Industries

- GlaxoSmithKline

- AstraZeneca

- Boehringer Ingelheim

- Novartis

- Glenmark Pharmaceuticals

- Koninklijke Philips

- Propeller Health

- AptarGroup Inc.

- H&T Presspart Manufacturing Ltd.

- Trudell Medical Group

- Adherium Ltd.

- Resmed

- Vectura Group plc

- Mundipharma International

- 3M Drug Delivery Systems

- Cipla

- Opko Health Inc.

- Amiko Digital Health

- Pneuma Respiratory

- Findair

- Cohero Health

- BreatheSuite

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating Global Respiratory Disease Burden

- 4.2.2 Expanding Geriatric Patient Pool

- 4.2.3 Technological Advancements in Smart Inhaler Platforms

- 4.2.4 Transition Toward Digital Therapeutics and Remote Monitoring

- 4.2.5 Integration of Data Analytics And Value-Based Care Models

- 4.2.6 Environmental Compliance and Low-Gwp Propellant Adoption

- 4.3 Market Restraints

- 4.3.1 Premium Pricing of Connected Inhaler Devices

- 4.3.2 Complex Regulatory and Reimbursement Pathways

- 4.3.3 Stringent Data Privacy and Cybersecurity Requirements

- 4.3.4 Semiconductor Supply Chain Constraints

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Dry Powder Inhalers

- 5.1.2 Metered Dose Inhalers

- 5.1.3 Soft-Mist Inhalers

- 5.2 By Indication

- 5.2.1 COPD

- 5.2.2 Asthma

- 5.2.3 Cystic Fibrosis

- 5.2.4 Other Respiratory Disorders

- 5.3 By Type

- 5.3.1 Branded

- 5.3.2 Generic

- 5.4 By Patient Age Group

- 5.4.1 Pediatric

- 5.4.2 Adult

- 5.4.3 Geriatric

- 5.5 By Distribution Channel

- 5.5.1 Hospital Pharmacies

- 5.5.2 Retail Pharmacies

- 5.5.3 Online Pharmacies

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East & Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East & Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Teva Pharmaceutical Industries

- 6.3.2 GlaxoSmithKline plc

- 6.3.3 AstraZeneca plc

- 6.3.4 Boehringer Ingelheim

- 6.3.5 Novartis AG

- 6.3.6 Glenmark Pharmaceuticals

- 6.3.7 Koninklijke Philips N.V.

- 6.3.8 Propeller Health

- 6.3.9 AptarGroup Inc.

- 6.3.10 H&T Presspart Manufacturing Ltd.

- 6.3.11 Trudell Medical Group

- 6.3.12 Adherium Ltd.

- 6.3.13 ResMed Inc.

- 6.3.14 Vectura Group plc

- 6.3.15 Mundipharma International

- 6.3.16 3M Drug Delivery Systems

- 6.3.17 Cipla Ltd.

- 6.3.18 Opko Health Inc.

- 6.3.19 Amiko Digital Health

- 6.3.20 Pneuma Respiratory

- 6.3.21 FindAir

- 6.3.22 Cohero Health

- 6.3.23 BreatheSuite Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment