PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848147

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848147

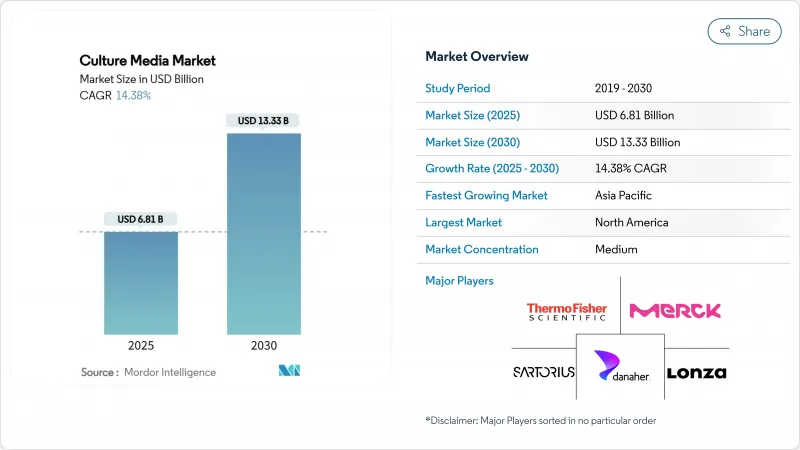

Culture Media - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The culture media market size stood at USD 6.81 billion in 2025 and is projected to reach USD 13.33 billion by 2030, reflecting a sturdy 14.38% CAGR.

Intensifying demand for next-generation bioprocessing inputs, the scaling-up of mRNA vaccine lines, and accelerating biosimilar commercialization are the principal forces widening adoption. Dehydrated formulations preserve dominance because of supply-chain economy, yet the popularity of chromogenic formats signals laboratories' steady shift to automation-ready consumables. Regional demand tilts toward North America thanks to its established regulatory environment and venture funding pipeline, while Asia-Pacific's policy-backed facility build-out positions the region for the quickest unit expansion. Competitive pressure is rising as full-service suppliers integrate raw-material sourcing, single-use hardware, and in-house analytics to capture end-to-end workflow spending. Fiscal incentives that favor domestic bioprocessing, coupled with automated media-preparation platforms, are unlocking fresh opportunities in a market that remains sensitive to raw-material inflation and logistics risk.

Global Culture Media Market Trends and Insights

Shift from Serum-based to Animal-component-free Media

Regulators now favor media free from animal components, prompting manufacturers to retire serum inputs and increase reliance on chemically-defined alternatives. Serum-free variants already control 36.32% share and continue gaining as FDA guidance heightens scrutiny of adventitious agents. Stem-cell media, expanding at 15.85% CAGR, underscores the premium that regenerative-medicine producers place on defined chemistries. Merck KGaA's EUR 300 million research center for antibody and mRNA development exemplifies capital flowing into component-free platforms. Heightened lot-to-lot consistency, simpler downstream purification, and lower contamination risk anchor the commercial justification for animal-component-free solutions, making the transition a core structural tailwind for the culture media market.

Rapid, Large-scale mRNA / Viral-vector Vaccine Capacity Expansions

Production assets erected during the pandemic have pivoted toward cancer vaccines, gene therapies, and mpox prophylaxis, locking in recurrent demand for specialized viral-vector media. Bavarian Nordic's plan to deliver 10 million mpox doses by end-2025 reflects the sustained use of these green-field facilities. Media optimized for high-yield mRNA transcription and viral infectivity is pivotal for platform manufacturers that run multiple programs through the same suites. By supporting cross-product standardization, culture media suppliers are edging closer to partnerships that include process-control analytics and single-use hardware bundles. Given the sector's urgency, purchase commitments frequently span multi-year horizons, improving revenue visibility for media vendors operating in this high-growth corner of the culture media market.

Pharmaceutical-grade Raw-material Inflation & Supply-chain Fragility

Surging prices for amino acids, growth factors, and high-purity water, compounded by transportation bottlenecks, continue to squeeze margins. COVID-19-era disruptions exposed the vulnerability of lengthy supply chains, prompting companies to hedge with larger safety stocks, thereby increasing working-capital needs. While dual-sourcing strategies alleviate some exposure, they raise qualification costs and place smaller laboratories at a disadvantage. Consequently, although policy incentives are encouraging domestic production, near-term growth in the culture media market is dampened by cost pass-through fatigue among end users who must preserve budget flexibility for validation and capital projects.

Other drivers and restraints analyzed in the detailed report include:

- Biosimilar Manufacturing Boom Creating Bulk-Media Demand

- Adoption of Fully-Automated Media-Preparation Systems in CDMOs & Big Pharma

- Batch-to-batch Variability Hampers Regulatory Approvals for Complex Media

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Dehydrated formulations accounted for 51.25% of culture media market share in 2024, anchored by long shelf life and economical freight profiles. Chromogenic alternatives, however, are accelerating at a 15.65% CAGR as automated plate-streaking systems proliferate in clinical and food-testing settings. This expansion signals laboratories' preference for pre-differentiated, color-changing substrates that shorten readout times and reduce human error. Over the forecast window, chromogenic solutions are projected to erode dehydrated incumbency, particularly in high-throughput hospital labs. Still, price sensitivity in emerging economies preserves a sizable base for dehydrated products, ensuring they remain a cornerstone of the culture media market.

Automation-friendly characteristics make chromogenic media the logical companion to total laboratory automation suites, where bar-coded plate tracking and robotic incubation demand uniform physical properties. Vendors able to supply ready-stacked, automation-compliant formats are accordingly capturing disproportionate share. Dehydrated formulations remain favored for bulk shipment into regional blending centers, allowing buyers to scale volumes without paying for hydrated weight. The contrasting value propositions sustain a mixed portfolio approach for leading suppliers that balance legacy dehydrated strengths with high-margin chromogenic innovations.

Serum-free products represented 36.32% of revenue in 2024, reflecting the regulatory push toward defined ingredients and away from bovine serum risks. Stem-cell media, the fastest-rising subset, benefits from the sector's pivot toward autologous and allogeneic therapies that require feeder-free conditions. Growth forecasts show stem-cell media climbing 15.85% CAGR through 2030 on the back of regenerative medicine trials entering late-phase studies.

The adoption of chemically defined blends in large-scale antibody and mRNA manufacturing is likewise intensifying, owing to their traceability and consistent performance. Vendor collaborations with cell-line development specialists are producing custom recipes that accelerate titer optimization, assuring deeper customer lock-in. Meanwhile, specialty and custom media tailored for unique metabolic needs of CAR-T, oncolytic viruses, or organoid cultures are commanding premium price points, widening the revenue mix inside the culture media market.

The Culture Media Market Report is Segmented by Media Type (Chromogenic Culture Media, and More), Formulation (Serum-Based Media, and More), Physical State (Liquid Media, and More), End User (Academic & Research Institutes, and More), Preparation Automation (Manual Media Preparation, and Automated Media-Preparation Systems), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 39.25% share of the culture media market in 2024 and is projected to expand at a 13.8% CAGR through 2030. The United States anchors regional momentum by repurposing pandemic-funded mRNA infrastructure for oncology and rare-disease pipelines, while the FDA's clear guidance on media validation sustains industry confidence. Capital deployment such as Merck KGaA's USD 290 million biosafety testing facility in Maryland and BD's syringe-capacity expansion further entrenches supplier ecosystems. Venture funding gravitates toward cell-therapy start-ups, reinforcing steady demand for high-performance, animal-component-free formulations.

Asia-Pacific is set to log the swiftest expansion at 16.45% CAGR, buoyed by national programs that treat biotechnology as a strategic sector. China's normalization of laboratory ordering patterns after COVID-19, South Korea's incentives for biosimilar production, and India's duty exemptions on bioprocessing imports all raise regional media volumes. MilliporeSigma's EUR 300 million Korean facility demonstrates multinationals' commitment to localized supply. Australian and Japanese markets, built on strong research bases and harmonized GMP frameworks, adopt high-spec stem-cell media at above-average run rates.

Europe captured 28.5% of 2024 revenue and aims for a 12.9% CAGR by 2030, with Germany, the United Kingdom, and France comprising the leading triad. Germany's Advanced Research Center in Darmstadt amplifies regional R&D in antibodies and mRNA, while the UK benefits from vaccine-cluster legacies and MHRA regulatory capacity. French initiatives for biologics innovation maintain demand continuity for serum-free and chemically defined inputs. EMA guidance that harmonizes documentation and quality requirements across member states lowers authorization hurdles for suppliers, positioning Europe as a stable yet competitive export market for culture media.

- Thermo Fisher Scientific

- Merck KGaA (MilliporeSigma)

- Sartorius

- Danaher Corp. (Cytiva)

- Lonza Group Ltd.

- Beckton Dickinson

- Corning

- Bio-Rad Laboratories

- FUJIFILM Holdings (Irvine Scientific)

- Avantor Inc.

- HiMedia Laboratories Pvt. Ltd.

- GE Healthcare

- Ajinomoto Co. Inc.

- Caisson Laboratories

- PAN-Biotech GmbH

- MP Biomedicals LLC

- KOHJIN Bio Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift from Serum-based to Animal-component-free Media

- 4.2.2 Rapid, Large-scale mRNA / Viral-vector Vaccine Capacity Expansions

- 4.2.3 Biosimilar Manufacturing Boom Creating Bulk-Media Demand

- 4.2.4 Adoption of Fully-Automated Media-Preparation Systems in CDMOs & Big Pharma

- 4.2.5 Fiscal Incentives for On-shore Bioprocessing

- 4.3 Market Restraints

- 4.3.1 Pharmaceutical-grade Raw-material Inflation & Supply-chain Fragility

- 4.3.2 Batch-to-batch Variability Hampers Regulatory Approvals for Complex Media

- 4.3.3 Global Shortage of Skilled Media-optimization Scientists

- 4.4 Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Media Type

- 5.1.1 Chromogenic Culture Media

- 5.1.2 Dehydrated Culture Media

- 5.1.3 Prepared / Ready-to-use Culture Media

- 5.2 By Formulation

- 5.2.1 Serum-based Media

- 5.2.2 Serum-free Media

- 5.2.3 Chemically-defined Media

- 5.2.4 Stem-cell Culture Media

- 5.2.5 Specialty / Custom Media

- 5.3 By Physical State

- 5.3.1 Liquid Media

- 5.3.2 Powdered Media

- 5.3.3 Semi-solid / Gel Media

- 5.4 By End User

- 5.4.1 Pharmaceutical & Biotechnology Companies

- 5.4.2 Contract Development & Manufacturing Organizations (CDMOs)

- 5.4.3 Academic & Research Institutes

- 5.4.4 Clinical & Diagnostic Laboratories

- 5.4.5 Food & Beverage Testing Laboratories

- 5.5 By Preparation Automation

- 5.5.1 Manual Media Preparation

- 5.5.2 Automated Media-Preparation Systems

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Company Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market-level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Thermo Fisher Scientific Inc.

- 6.3.2 Merck KGaA (MilliporeSigma)

- 6.3.3 Sartorius AG

- 6.3.4 Danaher Corp. (Cytiva)

- 6.3.5 Lonza Group Ltd.

- 6.3.6 Becton, Dickinson and Company

- 6.3.7 Corning Incorporated

- 6.3.8 Bio-Rad Laboratories Inc.

- 6.3.9 FUJIFILM Holdings (Irvine Scientific)

- 6.3.10 Avantor Inc.

- 6.3.11 HiMedia Laboratories Pvt. Ltd.

- 6.3.12 GE HealthCare

- 6.3.13 Ajinomoto Co. Inc.

- 6.3.14 Caisson Laboratories Inc.

- 6.3.15 PAN-Biotech GmbH

- 6.3.16 MP Biomedicals LLC

- 6.3.17 KOHJIN Bio Co. Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment