PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848151

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848151

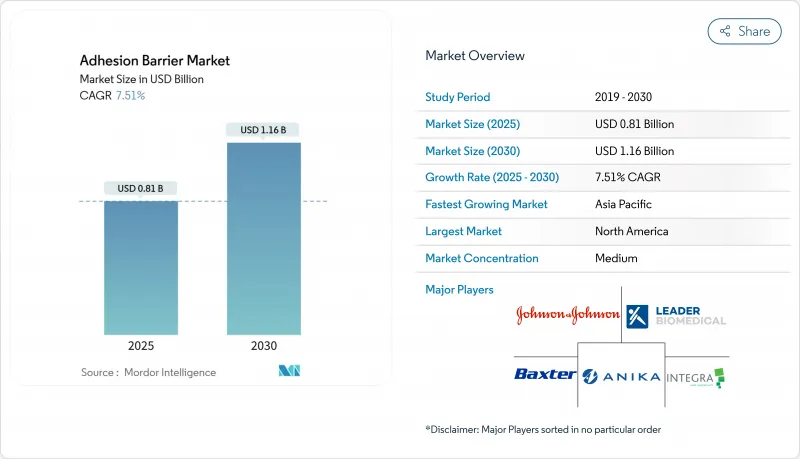

Adhesion Barrier - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The adhesion barrier market size is USD 0.81 billion in 2025 and is forecast to reach USD 1.16 billion by 2030, translating into a 7.51% CAGR for the period.

Rising surgical volumes in abdominal, gynecological, orthopedic, and cardiovascular specialties underpin daily consumption, while value-based care frameworks reward hospitals that document lower adhesion-related readmissions under bundled payment contracts. In North America, widespread uptake of minimally invasive techniques and hospital protocols that classify adhesion prevention as a peri-operative quality indicator keep utilization high. Asia-Pacific is gaining momentum as public hospital modernization programs and national reimbursement schedules emphasize evidence-backed consumables that reduce downstream costs. Across regions, procurement teams prefer multi-functional barrier-sealants that combine sealing, hemostasis, and anti-adhesion properties, enabling premium pricing even as standalone film barriers face commoditization pressures.

Global Adhesion Barrier Market Trends and Insights

Shift To Value-Based Payment Incentives

Hospitals paid under bundled or capitated contracts treat adhesiolysis as an avoidable cost, so barrier use is now embedded in quality dashboards that track surgical readmissions. Facilities that document fewer returns to theatre receive higher composite scores, unlocking bonus pools and reinforcing recurring purchases in the adhesion barrier market. Federal programs such as the Hospital Readmissions Reduction Program supply the framework for continuous reporting, essentially converting barriers from discretionary supplies to mandated inventory items. Suppliers respond by publishing health-economic dossiers showing reduced length of stay, which strengthens formulary positions and preserves premium price tiers in the adhesion barrier market.

Rise in Minimally Invasive Procedure Volumes

Outpatient laparoscopic and robotic cases outpace open surgeries in many abdominal and pelvic indications, and small trocar ports require barriers that deliver through narrow lumens without impairing visualization. Sprayable polyethylene glycol hydrogels meet this ergonomic need and minimize peritoneal drying time, reducing operating-room minutes. Value committees standardize on brands that show consistent deployment in simulation labs, creating repeat orders across integrated delivery networks. The sustained rise in minimally invasive caseloads guarantees long-run demand headroom for consumables within the adhesion barrier market.

DRG Reimbursement Caps

Diagnosis-Related Group ceilings do not include a dedicated code for adhesion barriers, so premium products must fit within fixed payments. Hospitals under budget pressure often substitute lower-cost synthetic sheets for high-priced biologic films, compressing margins and fuelling price competition in the adhesion barrier market. Unless separate coding emerges, suppliers of premium formats will need stronger health-economic data to sustain higher prices.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Robotic Surgery Platforms

- Hospital "Zero-Adhesion" Protocols

- Batch-To-Batch Variability in Natural Collagen Barriers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Synthetic products held 62.11% revenue share in the adhesion barrier market in 2024. Shelf-stable hyaluronate-carboxymethylcellulose films fit hospital lean-inventory goals, while predictable degradation schedules match standardized surgical checklists. Suppliers refine molecular weight to tailor absorption times, extending life cycles without triggering fresh pre-market submissions, which safeguards their dominant position across the adhesion barrier market.

Natural barriers-collagen, chitosan, human amnion-are posting an 8.21% CAGR off a smaller baseline. Peer-reviewed studies funded by the National Institutes of Health show lower inflammatory markers in amniotic membrane grafts compared with synthetic films, boosting adoption in fertility-preserving myomectomies. Ethical sourcing resonates with patient-centric hospitals, although accreditation audits increase overhead. If purification upgrades for collagen pass FDA review and stabilize lot performance, natural products could expand share in the adhesion barrier industry.

Film barriers accounted for 47.12% of the adhesion barrier market size in 2024. Long familiarity in open abdominal and gynecological surgeries secures baseline orders, and hybrids that fuse mesh reinforcement for hernia repair illustrate how films remain adaptable to evolving clinical needs. Procurement committees, however, now screen for laparoscopic deployability, steering vendors toward foldable or fan-shaped designs that navigate port sites.

Gel and spray systems are growing at an 8.81% CAGR, reflecting the broader migration to minimally invasive techniques. Sprayable PEG hydrogels spread evenly over irregular anatomy, conserve theatre minutes, and allow exact dosing, making them popular in robotic suites. Liquid barriers remain niche but innovative prototypes with visible-light-activated stiffening-funded by the U.S. Department of Defense for field surgery kits-hint at future diversification.

The Adhesion Barrier Market Report is Segmented by Product (Synthetic Adhesion Barriers and Natural Adhesion Barriers), Formulation (Film/Mesh, Liquid, and Gel/Spray), Application (General/Abdominal Surgeries, and More), End-User (Hospitals, and More), Geography (North America, Europe, Asia-Pacific, The Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 45% of global revenue in 2024. United States hospitals document USD 2.3 billion in annual adhesiolysis costs, creating strong incentives for preventive consumables. Robotic platforms further raise per-procedure barrier spend, and the Medicare Hospital Outpatient Prospective Payment System counts barrier use as a quality adjustment factor in select DRG bundles. Canadian provincial formularies-managed by governmental health ministries-rely on HTA reports from CADTH; once a barrier gains listing, national uptake accelerates, with recent interest tilting toward biologic amnion products.

Asia-Pacific is advancing at an 8.5% CAGR. China's National Medical Products Administration shortened review timelines for Class III wound-closure devices, fast-tracking synthetic spray approvals and intensifying price competition. Tropical climates in parts of India and Southeast Asia favour heat-stable synthetic powders over gelatin liquids that require cold chain, steering procurement choices. Japanese and Australian fellowship programs integrate adhesion-prevention modules, anchoring long-term demand.

Europe maintains steady growth as national payers embed adhesion-avoidance metrics into Diagnosis Related Group contracts. The European Medicines Agency's centralized registration route smooths market entry for next-generation barrier-sealants, while public tenders in Germany and France emphasise clinical dossier strength. In the Middle East and Africa, Gulf Cooperation Council oncology centres procure premium barriers for tertiary cases, creating reference installations that influence surrounding markets, although wider adoption is tempered by logistics hurdles. South American private networks rely on import licences issued by ANVISA in Brazil and INVIMA in Colombia; companies offering staggered payment terms mitigate currency risk, supporting incremental penetration of the adhesion barrier market.

- Johnson & Johnson

- Baxter

- Sanofi

- Integra LifeSciences Holdings Corp.

- Anika Therapeutics

- FzioMed Inc.

- Betatech Medical

- Leader Biomedical Group

- MAST Biosurgery AG

- GUNZE Limited

- TAICEND Technology Co., Ltd.

- Wuhan Sitaili Medical Apparatus Dev.

- Medtronic

- B. Braun

- CryoLife

- Advanced Medical Solutions Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Uptake of Bio-resorbable Synthetic Barriers in Complex Cardiovascular Procedures

- 4.2.2 Government-funded Bundled Payments Driving Adoption in Outpatient Gynecologic Laparoscopy

- 4.2.3 Hospital System 'Zero-Adhesion' Protocols Triggering Bulk Purchasing of Film Barriers

- 4.2.4 Orthopedic Robotics Boom Increasing Demand for Sprayable PEG Barriers

- 4.2.5 Surge in Bariatric Surgeries Creating Niche for Large-format HA Meshes

- 4.2.6 Med-Tech Consolidation Accelerating Barrier/Sealant Combination Products

- 4.3 Market Restraints

- 4.3.1 Reimbursement Caps on Anti-adhesion Consumables in DRG Systems

- 4.3.2 Batch-to-Batch Variability in Collagen Barriers Causing Surgeon Reluctance

- 4.3.3 Cold-chain Logistics for Fibrin-based Liquids Limiting Penetration in Sub-Saharan Africa

- 4.3.4 Heightened FDA PMA Scrutiny After Recent Seprafilm Recalls

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Synthetic Adhesion Barriers

- 5.1.1.1 Hyaluronic Acid

- 5.1.1.2 Regenerated Cellulose

- 5.1.1.3 Polyethylene Glycol

- 5.1.1.4 Other Synthetic Adhesion Barriers

- 5.1.2 Natural Adhesion Barriers

- 5.1.2.1 Collagen

- 5.1.2.2 Fibrin

- 5.1.1 Synthetic Adhesion Barriers

- 5.2 By Formulation

- 5.2.1 Film / Mesh

- 5.2.2 Liquid

- 5.2.3 Gel / Spray

- 5.3 By Application

- 5.3.1 General / Abdominal Surgeries

- 5.3.2 Gynecological Surgeries

- 5.3.3 Cardiovascular Surgeries

- 5.3.4 Orthopedic Surgeries

- 5.3.5 Neurological Surgeries

- 5.3.6 Other Applications

- 5.4 By End-User

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgical Centers

- 5.4.3 Other End-Users

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Johnson & Johnson

- 6.3.2 Baxter International Inc.

- 6.3.3 Sanofi S.A.

- 6.3.4 Integra LifeSciences Holdings Corp.

- 6.3.5 Anika Therapeutics Inc.

- 6.3.6 FzioMed Inc.

- 6.3.7 Betatech Medical

- 6.3.8 Leader Biomedical Group

- 6.3.9 MAST Biosurgery AG

- 6.3.10 GUNZE Limited

- 6.3.11 TAICEND Technology Co., Ltd.

- 6.3.12 Wuhan Sitaili Medical Apparatus Dev.

- 6.3.13 Medtronic plc

- 6.3.14 B. Braun Melsungen AG

- 6.3.15 CryoLife Inc.

- 6.3.16 Advanced Medical Solutions Group

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment