PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848153

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848153

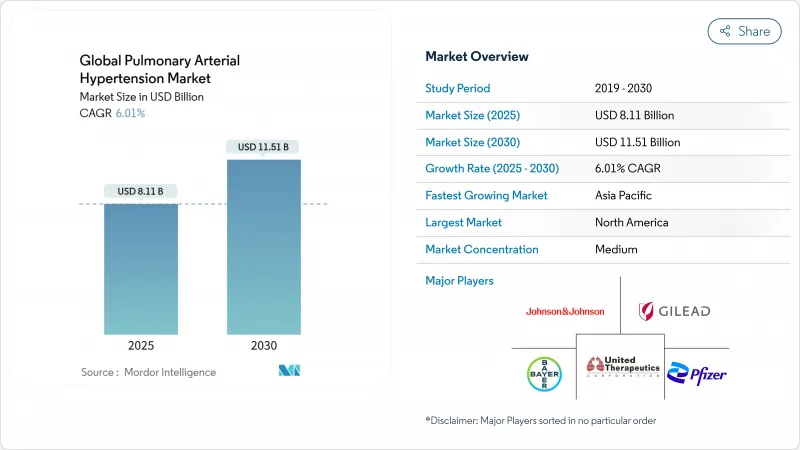

Pulmonary Arterial Hypertension - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The pulmonary arterial hypertension therapeutics market size is valued at USD 8.11 billion in 2025 and is forecast to reach USD 11.51 billion by 2030, advancing at a 6.01% CAGR.

Accelerated uptake of disease-modifying agents, notably activin-signaling inhibitors such as sotatercept, is widening treatment choices and tempering pricing pressure. North America leads demand on the back of generous reimbursement and early adoption of dual and triple oral regimens, while Asia Pacific is poised for rapid growth thanks to AI-enabled echocardiography that shortens time to diagnosis. Endothelin receptor antagonists (ERAs) still anchor most first-line prescriptions, but novel Smad-signaling modulators are beginning to reshape late-stage pipelines. Oral formulations dominate because convenience drives adherence, yet inhaled dry-powder prostacyclin products are gaining share as they combine targeted delivery with simplified dosing. Competitive intensity is rising as large pharmas secure pipeline assets through acquisitions and alliances to defend their positions in the pulmonary arterial hypertension therapeutics market.

Global Pulmonary Arterial Hypertension Market Trends and Insights

Rising Prevalence of PAH Linked to CHD-Survivor Cohort Expansion

Clinical advances in congenital heart disease (CHD) surgery and care have extended survival, creating a larger reservoir of patients who later develop PAH. Prevalence reaches 25.0% in children with trisomy 21 and rises to 45.0% when CHD co-exists, reshaping the patient pool and driving demand for tailored therapies. Eisenmenger syndrome patients in the REHAP registry show poorer outcomes, underscoring the need for specialized drug regimens that control vascular remodeling and manage high pulmonary resistance. As clinicians emphasize early hemodynamic assessment before corrective procedures, the pulmonary arterial hypertension therapeutics market sees sustained growth from this evolving demographic. Long-term monitoring needs are also expanding ancillary service opportunities such as remote hemodynamic surveillance.

Rapid Label Expansions & Earlier-Line Combination Therapy Adoption in US & EU5

Guidelines from the 7th World Symposium recommend dual or triple oral therapy upfront for non-high-risk patients, accelerating demand for fixed-dose combinations. Johnson & Johnson's single-tablet Opsynvi improved pulmonary vascular resistance versus monotherapies in the A DUE study, giving prescribers an easy path to initiate combination treatment. Early addition of selexipag cut disease-progression risk by 52.0% when layered onto ERA + PDE-5i backbones. These data validate multi-pathway suppression and stimulate payers to expand coverage, which amplifies volume-driven growth in the pulmonary arterial hypertension therapeutics market.

Serious Adverse Events & Infection Risk with Parenteral Prostacyclin Pumps Deter Uptake in Elderly

Continuous intravenous prostacyclin carries risks of hypotension, nausea, and catheter-related bloodstream infections that discourage early use, especially in older patients with multiple comorbidities. A real-world survey found intermediate-risk patients often do not receive guideline-recommended parenteral therapy because clinicians weigh infection hazards against benefit. This safety profile drags on uptake and shifts demand toward oral and inhaled alternatives in the pulmonary arterial hypertension therapeutics market.

Other drivers and restraints analyzed in the detailed report include:

- Commercialization of Oral Prostacyclin & Non-Prostanoid IP-Receptor Agonists Enhancing Adherence

- FDA Breakthrough Approvals of Novel Smad-Signaling Modulators Driving Pipeline Momentum

- Constrained Reimbursement Budgets Limiting Triple Therapy Access in South America & Africa

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Endothelin receptor antagonists generated 42.0% of revenue in 2024 as macitentan and ambrisentan remain foundational across disease severities. This segment benefits from fixed-dose combinations such as Opsynvi that simplify multipathway blockade. The pulmonary arterial hypertension therapeutics market size for ERAs is projected to grow modestly through 2030 as competition from disease-modifying agents intensifies.

Smad-signaling modulators headline the "Other" segment and are forecast to post a 9.5% CAGR through 2030, reflecting clinical enthusiasm for sotatercept's robust mortality benefit. PDE-5 inhibitors stay relevant for their favorable safety profile, while prostacyclin analogs retain utility in advanced disease. The pulmonary arterial hypertension therapeutics industry is likely to see increased experimentation with dual-action molecules such as sparsentan that integrate endothelin blockade with additional pathways to raise efficacy.

Oral drugs accounted for 66.0% of sales in 2024 and remain the preferred first-line modality thanks to convenience and the push for early combination therapy. Inhaled formulations, led by Tyvaso DPI, are projected to be the fastest-growing subsegment at an 8.7% CAGR because they deliver prostacyclin directly to the pulmonary bed without invasive hardware.

Subcutaneous and intravenous routes remain indispensable for decompensated patients, and innovations such as RemunityPRO pumps seek to reduce infection risk and boost quality of life. Nonetheless, the pulmonary arterial hypertension therapeutics market will keep migrating to less invasive modalities as efficacy gaps narrow.

The Pulmonary Arterial Hypertension Market Report is Segmented by Drug Class (Prostacyclin and Prostacyclin Analogs, and More), Route of Administration (Oral, Intravenous, Subcutaneous, and More), Drug Type (Branded and Generic), Distribution Channel (Hospital Pharmacies, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 45.0% of global revenue in 2024, supported by premium pricing and dense networks of accredited PAH centers. Sotatercept's launch at USD 238,000 annually exemplifies the region's willingness to fund high-cost orphan drugs, propelling Merck's product to USD 419 million in first-year sales. Uptake of single-tablet combinations further consolidates the region's share in the pulmonary arterial hypertension therapeutics market.

Europe remains a vital revenue base thanks to coordinated registries and harmonized guidelines that speed incorporation of new evidence. National health systems negotiate steep discounts yet enable broad access to breakthrough drugs when survival benefits are compelling. Treatment-pattern surveys show higher combination-therapy use in Germany than in the United States, illustrating how reimbursement structures shape practice.

Asia Pacific is forecast to post a 7.2% CAGR through 2030 as AI-enhanced echocardiography tools such as US2.AI improve early detection accuracy, registering an AUC of 0.88 for pulmonary hypertension. Vision-language models like MePH further reduce mean pulmonary arterial pressure estimation error by nearly 50%. These diagnostic gains, along with rising healthcare spend, accelerate therapy adoption in the pulmonary arterial hypertension therapeutics market.

Middle East & Africa and South America witness slower uptake due to reimbursement gaps. Access challenges limit triple-therapy penetration, yet pilot risk-sharing agreements and patient-assistance programs could unlock latent demand over the forecast horizon.

- United Therapeutics

- Johnson & Johnson (Actelion Pharmaceuticals Ltd.)

- Bayer

- Gilead Sciences

- Merck

- Pfizer

- Novartis

- Bristol-Myers Squibb

- GlaxoSmithKline

- Arena Pharmaceuticals

- PhaseBio Pharmaceuticals Inc.

- Liquidia Corporation

- Gossamer Bio Inc.

- Aerami Therapeutics

- Acceleron Pharma Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of PAH Linked to CHD-Survivor Cohort Expansion

- 4.2.2 Rapid Label Expansions & Earlier-Line Combination Therapy Adoption in US & EU5

- 4.2.3 Commercialization of Oral Prostacyclin & Non-Prostanoid IP-Receptor Agonists Enhancing Adherence

- 4.2.4 FDA Breakthrough Approvals of Novel Smad-Signaling Modulators (e.g., Sotatercept) Driving Pipeline Momentum

- 4.2.5 Orphan-Drug Incentives & Premium Pricing Sustain High Revenue per Patient in Developed Markets

- 4.2.6 AI-Enabled Echocardiography Screening Programs Boost Early Diagnosis in High-Burden Asian Countries

- 4.3 Market Restraints

- 4.3.1 Serious Adverse Events & Infection Risk with Parenteral Prostacyclin Pumps Deter Uptake in Elderly

- 4.3.2 Constrained Reimbursement Budgets Limiting Triple-Therapy Access in South America & Africa

- 4.3.3 Persistent Diagnostic Delays > 24 Months in Rural Asia-Pacific Reducing Treatable Patient Pool

- 4.3.4 2026-28 Patent Cliff for ERA & PDE-5 Agents Triggering Generic Price Erosion

- 4.4 Regulatory Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Drug Class

- 5.1.1 Prostacyclin and Prostacyclin Analogs

- 5.1.2 Calcium Channel Blockers

- 5.1.3 Phosphodiesterase 5 (PDE-5)

- 5.1.4 Endothelin Receptor Antagonists (ERA)

- 5.1.5 Other Drug Class

- 5.2 By Route of Administration

- 5.2.1 Oral

- 5.2.2 Intravenous

- 5.2.3 Subcutaneous

- 5.2.4 Inhalation

- 5.3 By Drug Type

- 5.3.1 Branded

- 5.3.2 Generic

- 5.4 By Distribution Channel

- 5.4.1 Hospital Pharmacies

- 5.4.2 Retail Pharmacies

- 5.4.3 Online Pharmacies

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 United Therapeutics Corporation

- 6.3.2 Johnson & Johnson (Actelion Pharmaceuticals Ltd.)

- 6.3.3 Bayer AG

- 6.3.4 Gilead Sciences Inc.

- 6.3.5 Merck & Co. Inc.

- 6.3.6 Pfizer Inc.

- 6.3.7 Novartis AG

- 6.3.8 Bristol-Myers Squibb Company

- 6.3.9 GlaxoSmithKline plc

- 6.3.10 Arena Pharmaceuticals

- 6.3.11 PhaseBio Pharmaceuticals Inc.

- 6.3.12 Liquidia Corporation

- 6.3.13 Gossamer Bio Inc.

- 6.3.14 Aerami Therapeutics

- 6.3.15 Acceleron Pharma Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment