PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848162

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848162

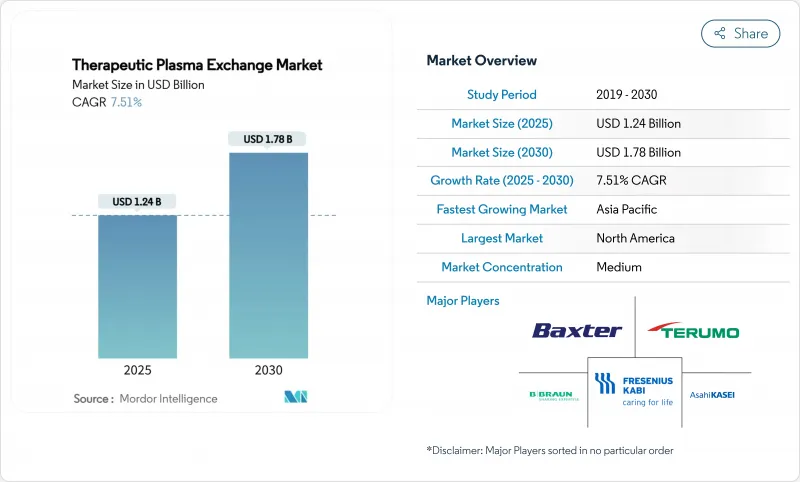

Therapeutic Plasma Exchange - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The therapeutic plasma exchange market size stands at USD 1.24 billion in 2025 and is projected to grow to USD 1.78 billion by 2030, translating into a 7.51% CAGR during the forecast period.

This expansion reflects rising prevalence of severe autoimmune and neurological diseases, growing clinical validation across new indications, and a decisive shift from hospital-centric procedures toward decentralized and home-based care models. Portable apheresis devices shorten treatment times, reduce infection exposure, and align with patients' preference for receiving chronic therapies in familiar environments. Reimbursement upgrades in the United States and Western Europe have removed major financial barriers for frequent procedures, while government-backed localization programs in Asia-Pacific multiply production capacity for both machines and consumables. Technological convergence of membrane filtration with selective adsorption columns is reshaping equipment design as providers demand systems capable of multiplex functionality. At the same time, alternative drug classes such as FcRn inhibitors are intensifying competitive pressure, spurring equipment manufacturers to bundle software, disposables, and service contracts into integrated value propositions.

Global Therapeutic Plasma Exchange Market Trends and Insights

Rising Burden of Autoimmune and Neurological Disorders

Global incidence of chronic autoimmune diseases continues to climb, with Guillain-Barre syndrome and myasthenia gravis patients showing 92% and 81.25% response rates respectively when treated with therapeutic plasma exchange. Healthcare systems increasingly recognize plasma exchange as a rescue therapy for refractory flares, a trend amplified by aging populations in high-income countries where disease severity is greater. Early evidence also suggests plasma exchange may mitigate long-COVID symptoms by removing inflammatory mediators, thereby widening the patient pool. Collectively these epidemiological and clinical factors generate sustained procedure demand and underpin multi-year equipment replacement cycles.

Increasing Clinical Evidence Supporting Expanded Indications

The American Society for Apheresis assigned therapeutic plasma exchange a Category I-III recommendation across 87 diseases in its 2024 guidelines, highlighting broadening indication scope. Randomized studies published in 2025 demonstrated significant reductions in cytokine levels among COVID-19 patients with neurological complications following exchange sessions. Pediatric data from the Egyptian Pediatric Association Gazette confirmed safety outcomes comparable to adults, encouraging earlier intervention in children. Growing evidence base lowers prescriber hesitancy, accelerates hospital protocol integration, and fuels incremental procedural volume across specialties.

High Capital and Consumable Costs of Apheresis Systems

Best-in-class devices exceed USD 100,000 per unit, while single-use kits add USD 1,000-1,200 per procedure, costs that small hospitals in Latin America and Africa struggle to justify. Post-pandemic supply chain shocks elevated resin and membrane prices, inflating column costs by 15% in 2024. Although OEMs offer leasing, pay-per-use, and service bundles, strained health budgets in emerging economies translate into slower replacement cycles and deferred adoption of next-generation platforms.

Other drivers and restraints analyzed in the detailed report include:

- Favorable Reimbursement Policies in Developed Nations

- Growing Adoption of Therapeutic Plasma Exchange in Cardiac Surgery

- Limited Availability of Skilled Apheresis Personnel

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Apheresis machines generated 48.65% of the therapeutic plasma exchange market size in 2024, underscoring their status as the procedural hub across all disease categories. Columns and adsorbers, however, are advancing at a 9.65% CAGR to 2030 as clinicians demand selective pathogen removal with minimal plasma substitution. Integrated devices now combine centrifugal separation with adsorption cartridges, allowing operators to toggle between whole-plasma removal and antibody-specific filtration within the same console. Manufacturers differentiate through sensor-driven anticoagulant titration, closed-system disposables, and cloud-based performance analytics that cut procedure times below 35 minutes.

Recurring consumables revenue remains pivotal: tubing sets, saline, anticoagulants, and replacement fluids contribute nearly 60% of lifetime customer value per installed base. Market incumbents thus bundle hardware leases with long-term consumable contracts, locking in predictable cash flows. Software updates enabling remote troubleshooting and protocol libraries further shift competition from price to platform ecosystem residency, deepening customer dependence and throttling potential displacement by low-cost entrants.

The Therapeutic Plasma Exchange Market Report is Segmented by Product (Apheresis Machines, Filters, Columns & Adsorbers, Disposables, and Software & Services), Indication (Neurological, Cardiovascular, Hematology, Renal, Transplant Rejection, and Other Indications), End-User (Hospitals, and More), and Geography (North America, Europe, Asia-Pacific, MEA, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America dominated with 41.23% of therapeutic plasma exchange market share in 2024, buoyed by robust Medicare and private-payer reimbursement that offsets high consumable costs. FDA clearance of the Aurora Xi plasmapheresis system in 2025 added competition and fostered price moderation among incumbent consoles. Canada's provinces recently harmonized fee schedules with U.S. rates, reducing cross-border procedure leakage and stabilizing domestic demand.

Asia-Pacific is the fastest-growing region at an 8.43% CAGR, propelled by China's Healthy China 2030 plan that funds apheresis infrastructure in 300 county hospitals. Terumo's USD 15 million Hangzhou facility expansion secures local supply of Spectra Optia kits, lowering import tariffs and slashing delivery times by 40%. Japan and South Korea maintain mature installed bases, yet upside remains from demographic aging and transplant program expansions. India's medical tourism growth funnels international patients into private hospitals offering competitive plasma exchange packages.

Europe shows steady but slower expansion. Although universal insurance coverage facilitates access, plasma supply shortages in 2024 forced many EU countries to import 40% of their raw plasma from the United States, prompting the European Blood Alliance to seek two million additional donors. Middle East and Africa markets are nascent but supported by Gulf Cooperation Council investments in tertiary care hubs, while Brazil and Argentina spearhead South American adoption through public-private hospital networks.

- Asahi Kasei Corp.

- Baxter

- B. Braun

- Cerus Corp.

- Fresenius

- Haemonetics Corp.

- HemaCare

- Medica S.p.A.

- Kawasumi Laboratories

- Terumo Corp.

- Kaneka Corp.

- Nikkiso Co.

- MacoPharma

- ImmunoSystems

- Plasauto Biotech

- Sichuan Nigale

- Miltenyi Biotec

- Otsuka Medical Devices

- Biotest

- MediSieve

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Burden of Autoimmune and Neurological Disorders

- 4.2.2 Increasing Clinical Evidence Supporting Expanded Indications

- 4.2.3 Favorable Reimbursement Policies in Developed Nations

- 4.2.4 Growing Adoption of Therapeutic Plasma Exchange in Cardiac Surgery

- 4.2.5 Surge In Adoption of Adsorption Columns in Asian Hospitals

- 4.2.6 Emergence of Portable Apheresis Devices for Out-Of-Hospital Care

- 4.3 Market Restraints

- 4.3.1 High Capital and Consumable Costs of Apheresis Systems

- 4.3.2 Limited Availability of Skilled Apheresis Personnel

- 4.3.3 Vulnerability of Plasma Supply Chain During Global Crises

- 4.3.4 Regulatory Uncertainty Regarding Pediatric Applications

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat Of New Entrants

- 4.5.2 Bargaining Power Of Buyers

- 4.5.3 Bargaining Power Of Suppliers

- 4.5.4 Threat Of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Apheresis Machines

- 5.1.2 Filters

- 5.1.3 Columns & Adsorbers

- 5.1.4 Disposables (Tubing, Kits)

- 5.1.5 Software & Services

- 5.2 By Indication

- 5.2.1 Neurological Disorders

- 5.2.2 Cardiovascular Disorders

- 5.2.3 Hematology Disorders

- 5.2.4 Renal Disorders

- 5.2.5 Transplant Rejection

- 5.2.6 Other Indications

- 5.3 By End-User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Specialty Clinics

- 5.3.4 Home Care Settings

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Asahi Kasei Corp.

- 6.3.2 Baxter International Inc

- 6.3.3 B. Braun Melsungen AG

- 6.3.4 Cerus Corp.

- 6.3.5 Fresenius Kabi AG

- 6.3.6 Haemonetics Corp.

- 6.3.7 HemaCare

- 6.3.8 Medica S.p.A.

- 6.3.9 Kawasumi Laboratories

- 6.3.10 Terumo Corp.

- 6.3.11 Kaneka Corp.

- 6.3.12 Nikkiso Co.

- 6.3.13 Macopharma

- 6.3.14 ImmunoSystems

- 6.3.15 Plasauto Biotech

- 6.3.16 Sichuan Nigale

- 6.3.17 Miltenyi Biotec

- 6.3.18 Otsuka Medical Devices

- 6.3.19 Biotest AG

- 6.3.20 MediSieve

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment